FROM STARTUPS TO ENTERPRISEThe most efficient corporate credit cards for businesses

- Issue Physical and virtual Visa business credit cards

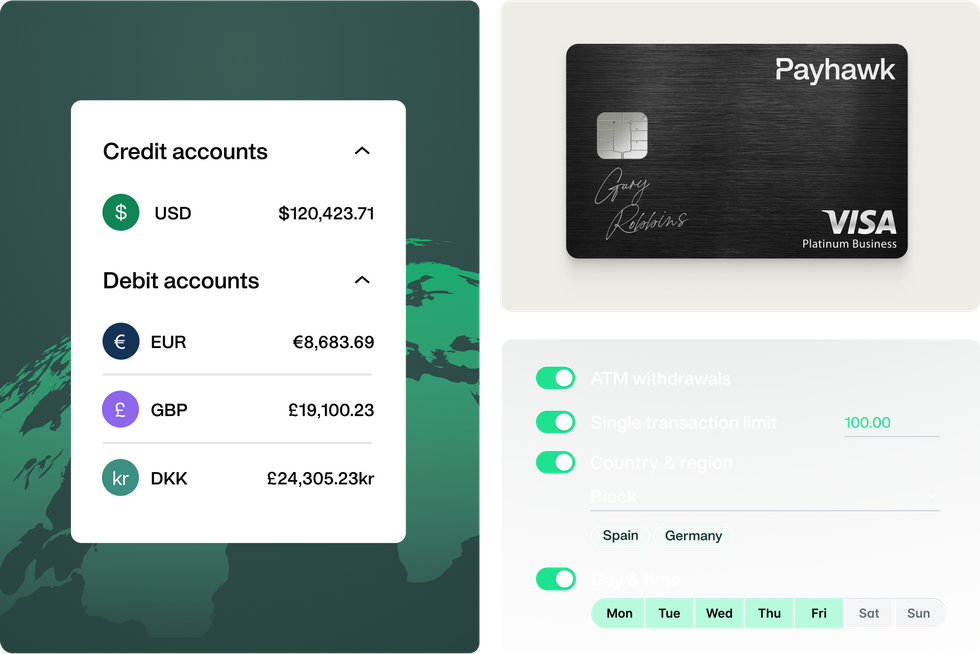

- Create custom controls and limits tailored to your business

- Automate receipt collection & reconciliation

- Streamline travel expenses and employee reimbursements

- Integrate directly with accounting and ERP system

Get corporate credit cards that save you time and money

**The VAT savings metrics are from real Payhawk clients but your exact savings will depend on your business size, type, spend volumes, and your local VAT reclaim legislation. The non-compliant spend savings metric is a six-months average across all Payhawk customers and for illustrative purposes only. Cashback amounts vary. *

Traditional bank cards | ||

|---|---|---|

| Card Issuing | ||

Instantly available virtual cards | ||

Credit cards | ||

One issuer in 32 countries | ||

Instant and paperless issuing of cards | ||

Issue in bulk | ||

| Spend controls | ||

Daily spend limits | Depending on the bank | |

Transactional limits | Depending on the bank | |

Merchant spend controls | ||

Merchant category spend controls | ||

Day & Time spend controls | ||

Country & Region spend controls | ||

Custom card spend policies | ||

Instant fund requests | ||

Instant card freeze | ||

Automated on and off-boarding | ||

Card auto-blocking triggered by custom rules | ||

| Perks | ||

Cashback | ||

FX fees | 1.99% | 1.00-3.00% |

Carbon footprint tracking | ||

| Other capabilities | ||

3D Secure card payments | ||

Business bank account | ||

Funds safeguarding | ||

Automated receipt collection | ||

Mobile app available for iOS, Android and HarmonyOS | Depending on the Bank | |

Compatible with Apple Pay and Google Pay | Depending on the Bank | |

Real human customer support with response time in minutes | ||

Scale sustainably with a single global corporate card provider

Improve financial governance and manage cash flow your way with direct access to your funds through dedicated bank accounts and debit and credit cards.

- Access up to £500k, €500K, or $1M based on assessment

- Improve cash flow with a 38-day repayment period

- Access credit without personal guarantees

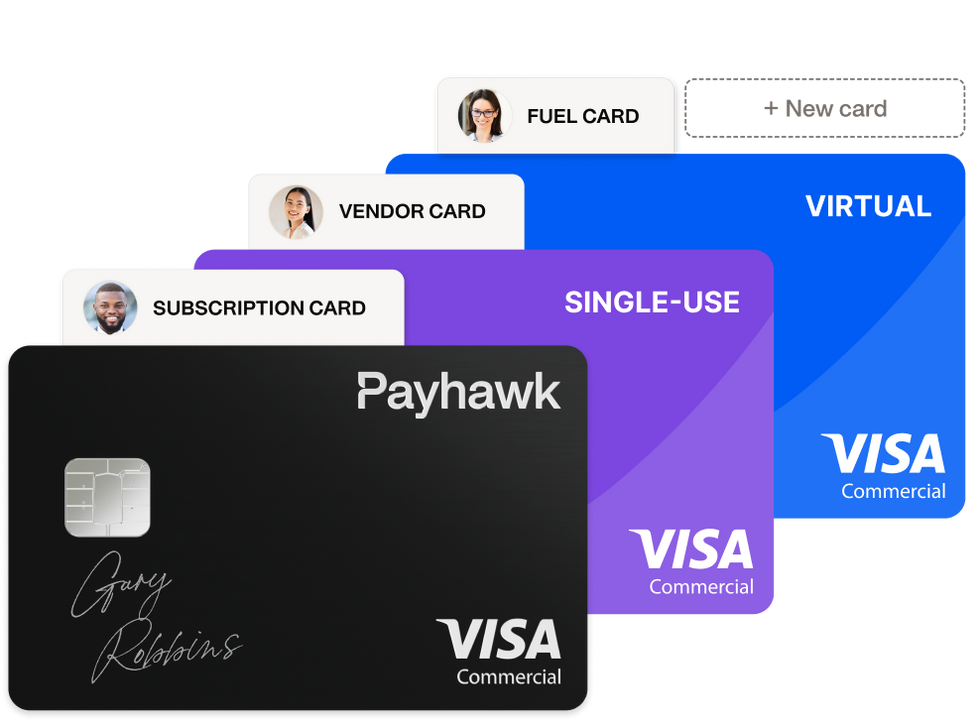

Ensure compliance across all your business entities and eliminate out-of-policy spend with cards that fit any use case. Thanks to our powerful controls, flexible limit settings and spend policies, you can easily create a card for every purpose - individually or in bulk.

- Single-use cards

- Procurement cards

- T&E cards

- Fuel cards, and more

Support global spend with a mix of physical and virtual cards in 32 countries and manage spend permissions for individuals or at scale so that every team is equipped to spend. Enjoy a leading worldwide acceptance rate with 0% FX in seven currencies and 1.99% FX for all others.

Online purchases

We follow globally-established best practices and employ leading technology to verify transactions. All online purchases are protected with 3DS password.

Secure transactions

Every transaction made with Payhawk Visa cards goes through real-time risk assessment and risk scoring.

Behavioural monitoring

Our team utilises advanced AI algorithms to get to know your spending habits and quickly detect unusual transactions, ensuring fraud prevention by flagging anomalies for your approval.

Activate automated CO2 emissions tracking for every transaction with just a click, simplifying sustainability and ESG reporting. Better support your sustainability efforts with valuable insights into your Scope 3 emissions.

Get real-time visibility and control on all card spend

You don't need to compromise control over the convenience of using corporate cards.

Keep all spend compliant

Nurture an environment of trust and transparency with 100% spend policy compliance across all locations. Tailor spend rules with powerful card controls to set transaction times, and approve or block specific merchants, categories, countries, regions, and more.

Track spend in real time

Stay on top of every penny with real-time tracking for informed decisions. Payhawk's intuitive platform offers live expense monitoring, ensuring transparency and accountability. Streamline financial processes and empower your team with a centralized hub for all card transactions.

Save time with built-in automation every step of the way

Submit expenses and track, approve, and review company spend – all from a single platform.

Capture receipts effortlessly

Make it easy for your teams to submit their expenses and receipts on time with our highly-rated iOS, Android, and Huawei app. Forward any receipts you get per email to our smart receipts mailbox.

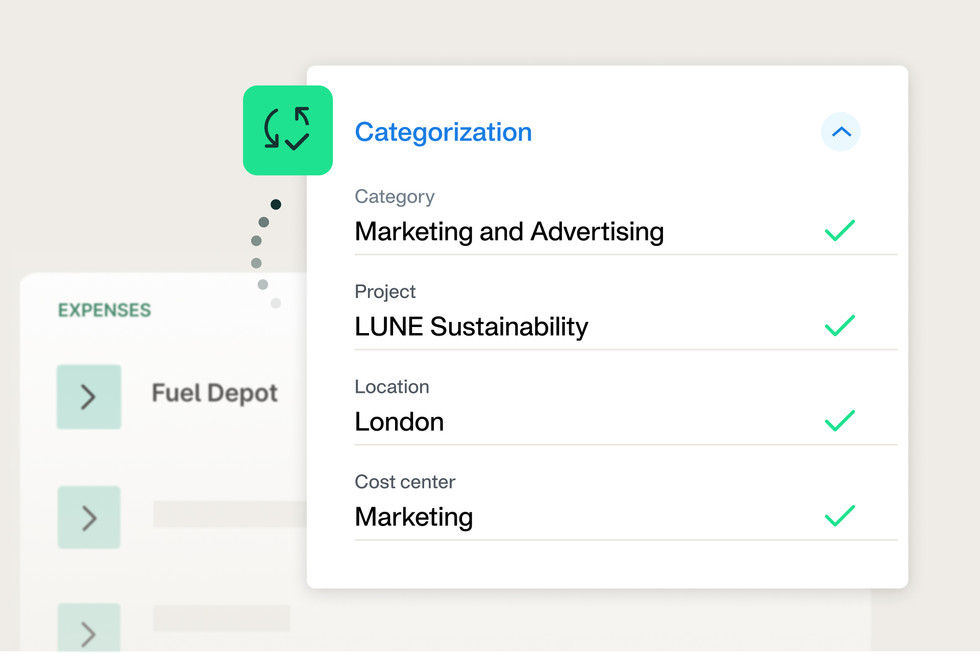

Automate preparatory accounting

Save time and prevent errors by automating data entry with market-leading OCR, predefined expense categorisation, and AI-powered expense field suggestions that get smarter with every use.

Automatically reconcile card payments

Have all your data flow seamlessly between Payhawk and your ERP systems without the need for manual uploads. See transactions exported in real-time once settled and expenses upon review.

Employee corporate cards suitable for everyone

Easily translate spend policies into proactive card limits and controls. Once you’ve created the spend policy in Payhawk, assign cards to employees or make changes to rules in bulk to comply with the correct spend policy.

Make processing, reconciling, and reporting on company spend easier than ever for Accounting teams. Track all data on one platform in real time and shave hours off your month-end with automations, bulk-review tools, and smart receipt capture.

Equip your managers to respond to urgent requests for funds from their direct reports. Managers can keep an eye on team spend, approve requests on the go, and even freeze the employee’s card instantly through the mobile app.

Support worry-free spending that's always in policy, say goodbye to clawbacks. Automate receipt collection and expense reports to save your team and yourself precious time.

Learn how businesses like yours save time, money, and resources

0

"The international aspect of Payhawk is super important to us, particularly the ability to flick through the different dashboards to find out exactly when and where a transaction happened. Plus, we pay per platform rather than per transaction, which is vital to us as a hospitality business."

FAQ

With Payhawk, you have the option to choose between debit and credit corporate expense cards, which can be issued as virtual, plastic, or metal cards. This flexibility allows you to select the card type that best suits your preferences and requirements.

On top of that, our powerful limit settings and controls enable you to customise your card to fit any use case: you can issue subscription cards, vendor cards, single-use cards, travel & entertainment cards, procurement cards, fuel cards, benefit cards for employee allowances, and many more.

Debit cards are linked directly to your Payhawk funds account, while credit cards allow you to borrow funds up to a specified limit and repay them later. At Payhawk, we provide both debit and credit card options to our customers. With our credit card offering, you can enjoy interest-free purchases for up to 38 days.

At Payhawk, our cards offer several advantages over traditional corporate cards. Firstly, we provide a seamless and intuitive digital experience, allowing for paperless card issuance, easy expense management, real-time monitoring, and automated reconciliation. Additionally, the Payhawk solution features customisable spend limits and controls that align with your specific policies, as well as smart receipt capture to optimise expense management. Furthermore, Payhawk cards are typically more flexible, with transparent pricing and no hidden fees. Lastly, we prioritise customer service and support, ensuring businesses receive personalised assistance whenever needed.

Payhawk cards stand out from other spend management provider card solutions in several key ways. Firstly, we offer unparalleled levels of spend control and granularity, allowing precise management of card expenditures. With our detailed controls and limit settings, you can issue any type of card you need: single-use, temporary project, subscription, and more. Secondly, our cards provide extensive global coverage, making them ideal for multinational companies looking to issue cards across Europe, the UK, and the US. Additionally, we offer flexibility with both debit and credit options, available in virtual, plastic, or metal formats. These features make our cards the perfect solution for global businesses seeking comprehensive spend management capabilities.

Payhawk cards are very secure. As an EEA and UK EMI licensed provider and Visa principal member, we adhere to strict security standards. We employ advanced technology, including 3DS password protection for online purchases and real-time risk assessment. Our AI algorithms detect suspicious transactions, and we analyse spending behaviour to flag anomalies, ensuring peace of mind and fraud prevention.

Each plan includes a set number of cards, with the option to add more as needed. For precise pricing tailored to your business needs, reach out to us for a personalised quote.

No, purchasing Payhawk cards without the full spend management software isn't possible. The software is integral to harnessing the full potential and benefits of the cards. It provides essential features like expense tracking, real-time insights, and comprehensive controls over spending. Without the software, you would miss out on these critical functionalities that ensure efficient expense management and financial oversight for your business.

Yes, Payhawk cards can be used for ATM withdrawals. Additionally, our platform offers advanced controls, allowing you to customise ATM usage preferences. You can choose to permit withdrawals, block them entirely, or enable employees to request ATM access for approval by managers. This flexibility ensures optimal control over your company's finances and spending habits.

Yes, you can use Payhawk cards to pay in foreign countries. Our Visa cards offer excellent global acceptance, with Visa accepted in approximately 200 countries and at over 44 million vendors/merchants worldwide. This ensures convenient and seamless transactions wherever your business takes you.