EXCLUSIVE PROGRAM FOR SMALL BUSINESSESSave 85%* and gain full control over your business spend

Payhawk's Growth Program offers small businesses an enterprise-ready solution to control spending at a fraction of the regular price.

*Compared to a regular plan with a similar list of features on the Growth Program.

Big savings for small businesses

We recommend Payhawk's Growth program to our portfolio of seed-stage companies. It's a very cost-effective way to easily manage and control spending as a small business, which will also scale with you in the future. With the Growth program you get the power of a market-leading spend management solution for a fraction of the usual cost.

Designed for small businesses

You are not an existing Payhawk customer.

You have fewer than 10 employees*.

Your company is registered in the EEA or UK.

*Payhawk's services in the UK are not available for micro-enterprises or small charities as defined in the UK Consumer Duty Regulations. A micro-enterprise employs less than 10 people and has a turnover or annual balance sheet of less than €2 million.

Get Payhawk's complete product suite at a fraction of the usual cost

Payhawk's Growth program empowers your small business with an enterprise-ready spend management solution, giving you access to everything you need to efficiently control spending at a fraction of the cost.

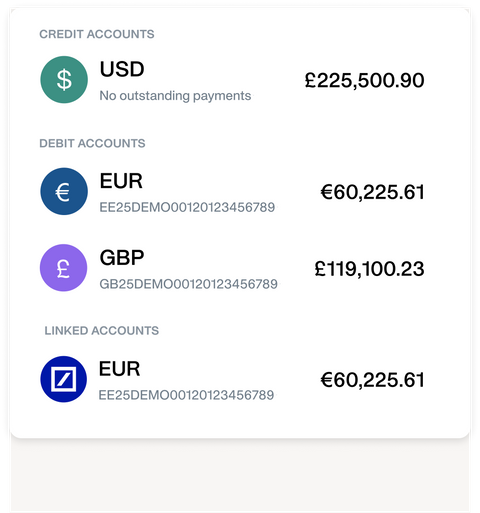

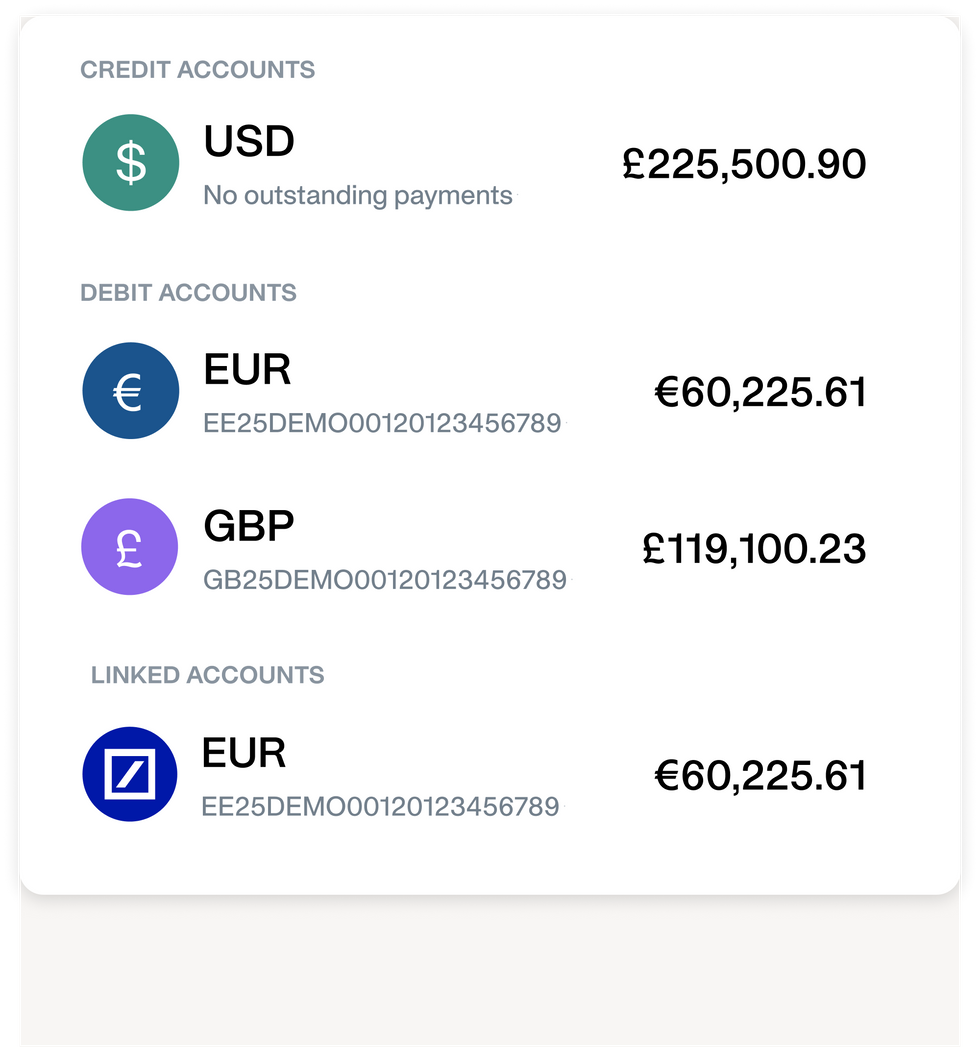

Dedicated IBANs in multiple currencies, safeguarding of funds in line with PSD2, and seamless linking to your existing bank accounts.

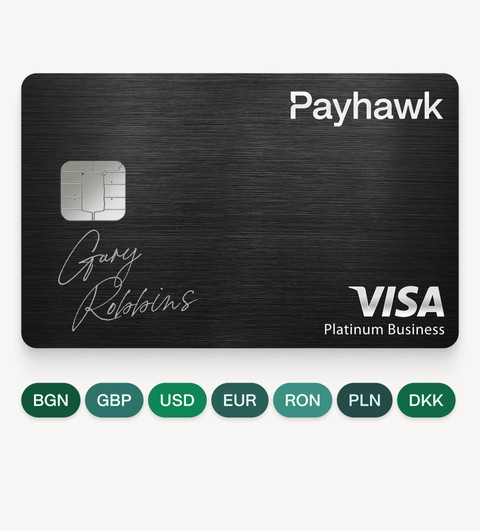

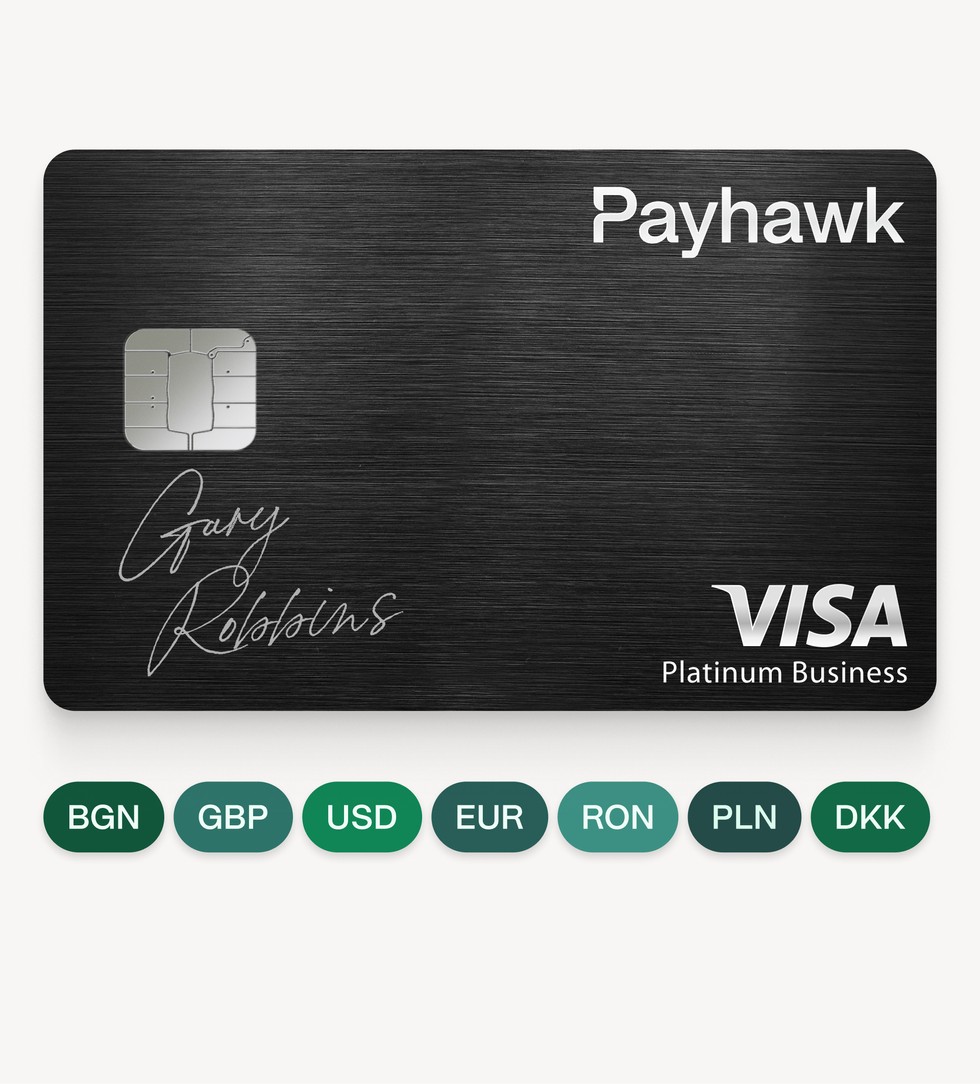

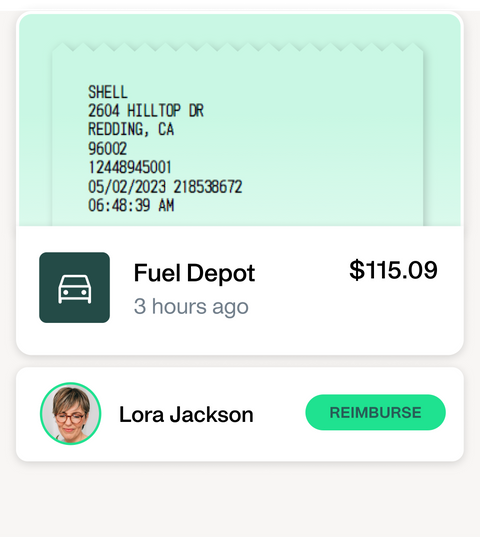

Corporate Visa debit cards in 7 currencies across 32+ countries with proactive spend controls, automated receipt collection, and real-time spend reports.

Fully digitized employee reimbursements and travel expenses with advanced approval flows and direct reimbursement to employee bank accounts.

End-to-end accounts payable software including invoice management, suppliers, approval workflows, as well as free domestic payments.

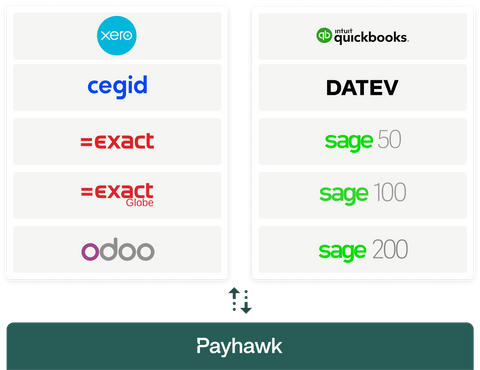

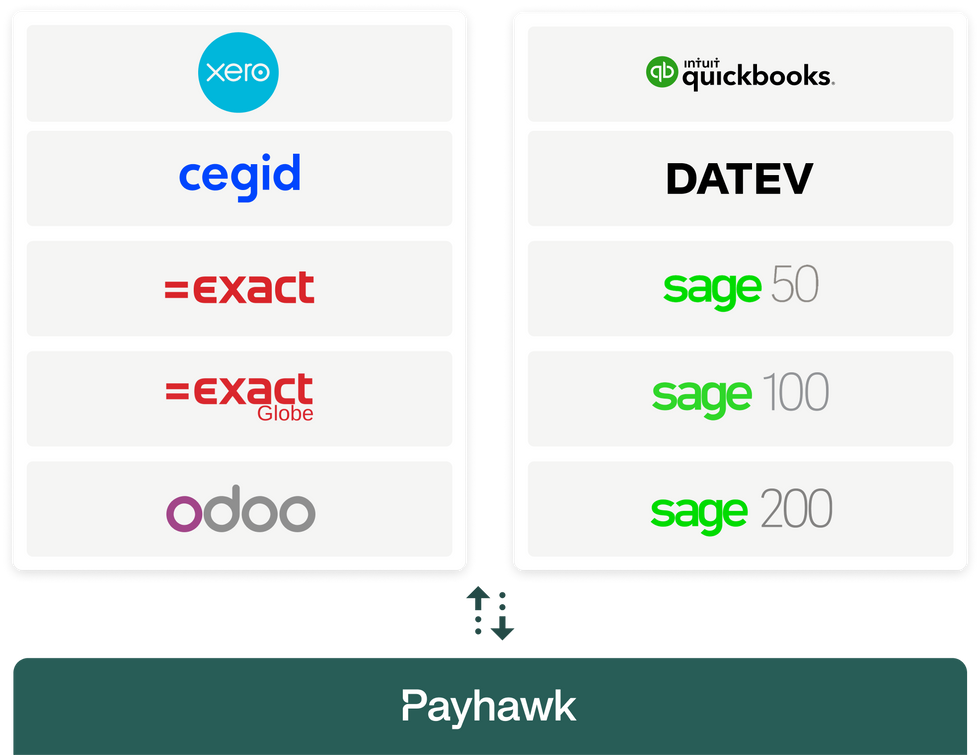

Market-leading integrations with your accounting software, plus a robust RESTful API and real-time webhooks.

Getting started is quick, easy, and commitment free

Provide some basic details about your company so we can check your eligibility. Most applications are approved instantly and once approved you'll be able to create your account and start exploring Payhawk.

After creating your account, you get free access to Payhawk for 7 days. Download the mobile app, add up to 10 users, connect your accounting software using our intuitive connection wizard, start submitting expenses and more.

During the 7-day exploration period, we ask you to provide a few more details so we can complete legally required compliance checks. This grants you access to payment functionalities, and you can start using Payhawk to optimize all your business spend.

Provide some basic details about your company so we can check your eligibility. Most applications are approved instantly and once approved you'll be able to create your account and start exploring Payhawk.

After creating your account, you get free access to Payhawk for 7 days. Download the mobile app, add up to 10 users, connect your accounting software using our intuitive connection wizard, start submitting expenses and more.

During the 7-day exploration period, we ask you to provide a few more details so we can complete legally required compliance checks. This grants you access to payment functionalities, and you can start using Payhawk to optimize all your business spend.

Join many other small businesses already using Payhawk

“If you are looking to scale your expensing with your team, you are also getting to the point that you’d be stupid if you didn’t take the elegant and simple solution.“

"The team loves the Payhawk App! It's straightforward for everyone to use. We've also seen fewer mistakes now that the built-in OCR tech captures all the receipt data once someone uploads a receipt. So, all they need to do is choose the right category, etc."

"Saving time with Payhawk is a game changer; we've even been able to allocate resources to revenue-impacting teams — we now have a finance employee who spends 50 % of her time supporting as an SDR."

Level up your small business with a highly-trusted spend management platform

FAQs

The Growth program unlocks the full suite of Payhawk features, including card management, expense tracking and reimbursements, accounts payable with invoice handling, and global supplier payments. Enjoy seamless integrations with accounting systems and extensive customization options for approval workflows and spending controls.

While tailored for small and growing businesses, certain enterprise functionalities such as purchase orders, multi-entity management, budget tracking, HR and ERP integrations, credit cards, cashback, and dedicated implementation support are not included.

As part of the Growth program, you have the option to buy a one-time add-on for an extra 10 cards. If your needs exceed 20 cards, upgrading to one of our standard plans is the next step. See our pricing page for details or reach out to us for a personalized quote that matches your organization's requirements and budget.

If you need more seats, you can add up to 10 additional employee seats for €99/month or purchase extra admin/accountant seats for €19 per seat. The total number of seats is capped at 20. If your needs exceed this limit, upgrading to one of our standard plans is the next step. See our pricing page for details or reach out to us for a personalized quote that matches your organization's requirements and budget.

If you need to review more than 15 reimbursements or invoices per month, you will need to upgrade to one of our regular plans. See our pricing page for more information or contact us to tailor a personalised quote.

You can use the Growth program for 2 years, providing you meet the eligibility criteria and stay within the defined card, user, and monthly invoice and reimbursements limits.

You will need to use one of our regular plans. See our pricing page for more information or contact us to tailor a personalised quote.

If your business is part of a group and you only want to onboard one of your entities, our Growth Program is suitable for you, provided you are not applying as the parent entity. However, if you are looking to onboard your entire group and require a solution that supports complex company structures, our regular plans would be more appropriate. These regular plans are designed to cater to the needs of parent companies with multiple subsidiaries, providing a comprehensive spend management solution for the entire group.

If you need to add more users or cards or review more invoices and reimbursements, you can upgrade to any of our regular plans at any time. Not only that, but being part of the Growth program gives you a 50% discount on regular pricing when you upgrade in your first year, or a 25% discount when you upgrade in your second year.

Start smart now, save big later!

Save 85% and gain full control over your business spend.

Looking for a robust solution for your mid-market or enterprise business?

Payhawk has a plan suitable for businesses at every stage. Contact our sales team for a customised quote based on your needs.