Breakdown of Apple Card strategy and 10 predictions for its future

Apple is widely recognised for its innovative design and super strong brand and values. The company has a large global following and is one of the most valuable brands in the world. Its most infamous hardware products include the iPhone, iPad, Mac, Apple Watch, and Apple TV.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Apple Card, Tim Cook, strong Apple style statement and boom… the biggest card innovation in 50 years. And while some see the currency of the future to be the battery of your mobile phone, one should look further than the marketing blah to understand what Apple is up to.

When you are building a Fintech company and manage to get it on the market for less than 6 months, it’s inevitable to have a row of people asking you about Apple Card. So here is a short blog post on the subject along with my bold predictions for its future.

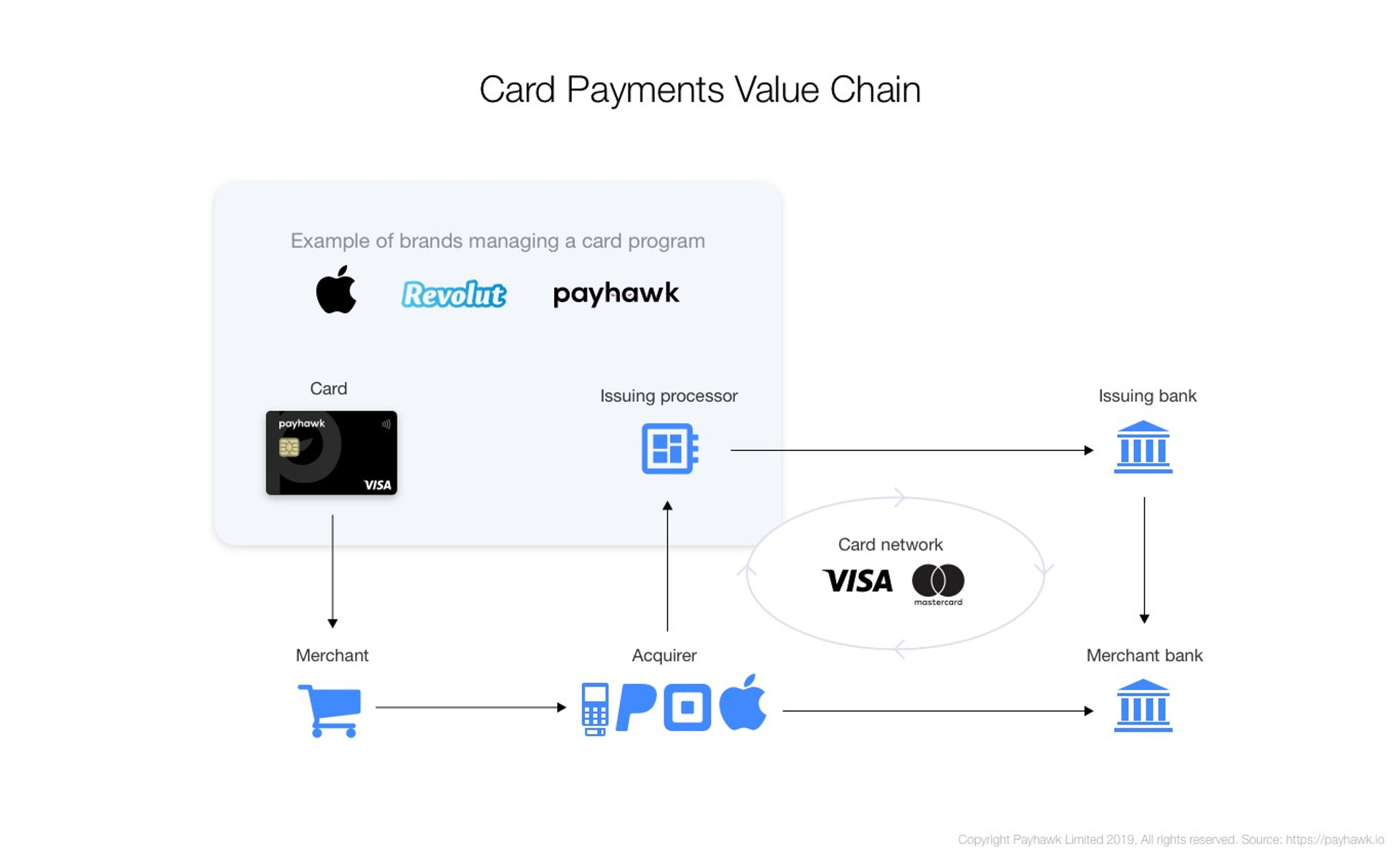

Who are the players, their roles and what’s in it for whom?

Before you can breakdown Apple’s strategy, you have to answer the question of why the most valuable brand in the world needs partners? The payment services market is one of the most fragmented and heavily regulated markets. And for Apple’s regret, they have to rely on the existing infrastructure to be able to provide their services.

Why does Apple need Mastercard?

Because of infrastructure. The role of the card networks (Mastercard, Visa, Union Pay etc.) is to handle the actual payment processing. They are facilitating the process of moving money from your bank to the merchant’s bank when you pay with your card. The card networks are the ones providing the necessary platform for communication between all the players. They have built a massive infrastructure for processing transactions. In 2018, Visa processed 182 billion transactions with a total volume of $11 trillion.

The card networking industry is a very exclusive place to be in. The considerably low operational costs make it a very appealing business, however, the established players have developed strategic partnerships and fundamental technologies, which makes the entry of new companies rather impossible.

Why does Apple need Goldman Sachs?

Because of risk management. The role of the Issuing Bank (Goldman Sachs) is to bear the risk of the credit cards and provide the risk management know-how necessary to assess the creditworthiness of individuals. Further, the Goldman Sachs Bank is licensed by Mastercard to issue cards and manage the associated funds across the Mastercard network.

Why does Apple need Apple card?

Because of control. There is a growing number of Fintech startups and neobanks that challenge existing banks with 100% digital services available on mobile phones. Many brands issue cards with additional value-added services and Apple wants to put itself in the center of the growing eco-system.

Also, the adoption of contactless payment technologies thanks to Near-field communication (NFC) protocols position mobile devices as a viable alternative to plastic cards. And in a truly Apple-style approach, Apple prefers to quickly burst the air out of the growing market, and develop it in its own pace and (rules). And to do so, it needs to have a stake in the payment initiation side of the equation. The revolution won’t be Apple Card, but the surrounding set of services that includes P2P transfers, NFC payments and faster and safer checkouts with already stored cards on the devices.

For Apple, the currency of the future is likely to be the battery of your device.

The unit economics — What’s in for whom?

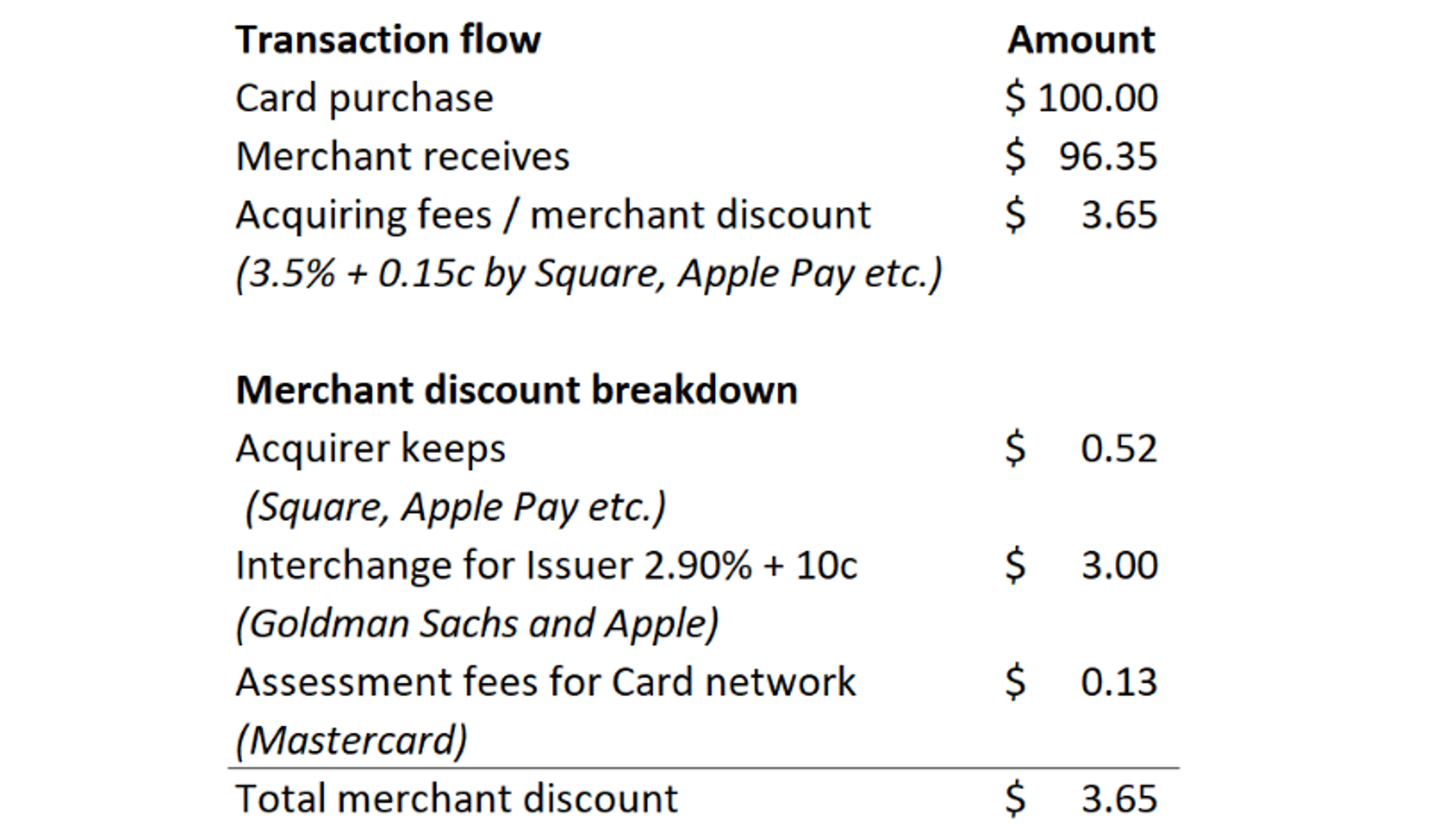

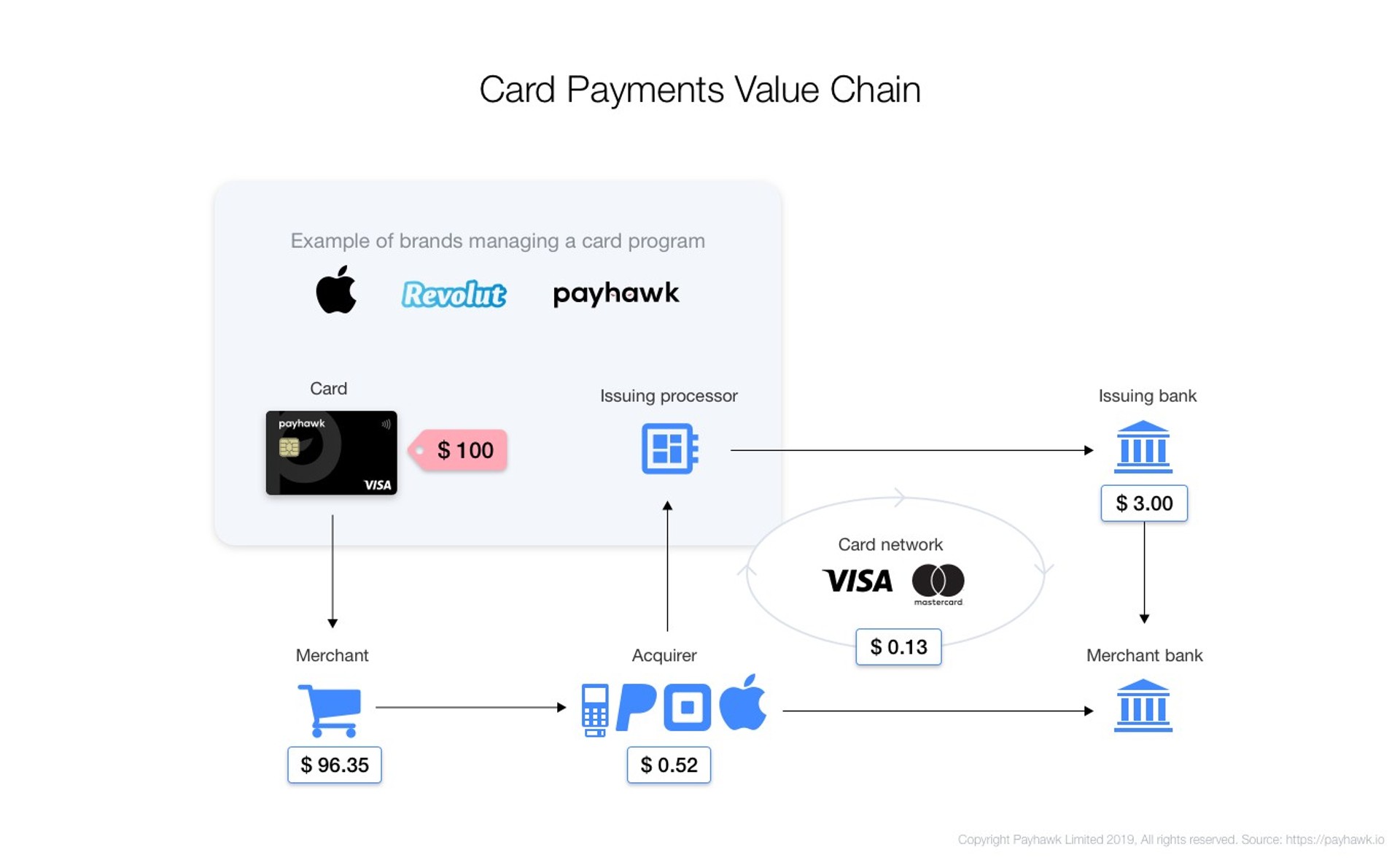

Тhere ain’t no such thing as a free lunch and the card networks naturally charge fees for their efforts. For example, Mastercard receives fees from issuing and acquiring financial institutions. They make money on a portion of the total transaction volume (around 0.13% called assessment fees). There is also a fixed fee which is charged from the merchant called merchant discount. The merchant is the one selling you stuff. This is him/her paying for using the services of the card networks. This fee is distributed among all players in a card transaction.

Build a finance function that drives business strategy and growth

To best illustrate this, let’s look at what happens when you swipe your card to pay $100 to a merchant that accepts card payments. The POS terminal, provided by an Acquiring bank (also called the Merchant’s bank) is linked to the Card network. As soon as you swipe your card, the Acquirer sends a request to the Issuer of your card over the Card Network. Every card Issuer has a Processor in place that, among other things, checks whether you have sufficient funds, spending limit and whether a specific merchant can be accepted. Once the transaction is evaluated by the Processor, a message is sent back to the Acquirer authorizing or declining the funds. The whole process must complete in less than 9 seconds or the transaction will timeout and your card will be declined. That is why your card can get declined sometimes even if you have available funds in your account. If you have enough funds and our transaction is successful, here is who gets what:

Additionally Apple and Goldman Sachs make money from the interest rate. The average Annual Credit Card Interest Rate in the US is 17.67% and Apple gives you a rate between 13.24% to 24.24% based on your creditworthiness if you read the fine print is here.

*You can find the complete list of interchange rates for the US market on the Mastercard website *here*.

And these are just the standard scheme fees and distribution. Apple and Goldman Sachs have decided not to make money from a few standard fees that are usually collected from the cardholder.

No annual fees. No cash‑advance fees. No international fees. No over‑the‑limit or returned‑payment fees. And best of all, no hidden fees.

No annual fees. A yearly service charge for owning a card.

No international fees. Percent markup (usually %1.5 to 2.0%) on top of the spot exchange rate when there are currency conversations.

No over‑the‑limit. This is an extinct fee that is very uncommon on the market today.

Returned‑payment fees. These are usually refunds and they are charged to protect from currency fluctuations. Since these card will have zero international fees, it makes sense to have this at 0.

ATM withdrawal fees. It’s still not clear whether Apple will charge cash withdrawal fees.

So at the end of the day, Apple can play with the math and decide how to make money that isn’t directly obvious to the consumer. Today, their strategy is mostly to gather money from the merchant discount in the form of interchange rates, and make the card as attractive as possible with no charges for consumers.

10 predictions for its future

Now that you know the high-level components of the card payment value chain, let’s look at the most likely strategy for Apple Pay.

1. Focus on the US market only for at least 3 years

It will be unlikely to see the product outside of the US market in the next 3 years. Even if we assume that Apple will be using the global presence of Goldman Sachs outside the US, Apple needs to start handling multi-currency wallets and expand beyond US dollars. Especially given the volatility of some strong currencies in the Forex markets during the time of Brexit and the Trump administration.

2. Unlikely to become a business card in the next 5 years

The value proposition of Apple Card might make sense to existing consumers who spend a lot on Apple product and/or purchase at stores or websites that accept Apple Pay. But outside the consumer specific benefits, Apple will need to develop a new value proposition focused around solving specific business problems.

3. There will be privacy concerns, because .. oh wait, risk scoring is about your data in the past

Apple promises that “All of the spending tracking and other information is stored directly on the device, not Apple’s servers. And Goldman Sachs will never sell your data to third parties for marketing and advertising” Great. The company is fast to tackle the privacy question upfront and focus on new data that you are about to generate with Apple. But nobody tells you how you will get scored for a credit card. The credit card market is all about existing data to evaluate your creditworthiness. Guess who has a lot of data for you... Makes sense?

4. You will pay

The production of a metal card carved with your name and bearing a premium Mastercard logo, shipped to your address will come at a price. If you are paying today $9.00 for the audio jack adapter on the left, my guess is that you will pay at least $19 per year for a plastic card, and $29 per year for a metal card. And a super premium golden card at $39. The virtual credit card stored in your Apple Wallet should come at $0.

5. It’s going to be great but without a contactless chip

Contactless chip is a pretty standard feature that works with NFC to make payments without requiring you to present your card. But Apple Card doesn’t come with a contactless chip. You will be forced to use your iPhone or Apple Watch that comes with NFC to make a payment. And if you are out of battery, well… you will be “using it wrong”.

6. The life of Fintech startups as we know it today will change

The recent revelations from Spotify and it’s controversial experience with Apple brings a lot of questions on the table. There are hundreds of startups that allow personal finances, card management, and other card relation operations outside the Apple Pay wallet. The temptation of changing the App Store policies for rivals will be just a whim away.

7. More restrictions for other cards to be in Apple Pay

If you want to scan your existing card and make it work with Apple Pay, you have to make sure that your bank is participating in Apple Pay. There is a strict process and fees associated with participation in this program for banks, and it’s likely that restrictions won’t be relaxed for new banks to enter. Here is a comprehensive list of banks working with Apple Pay today.

8. The innovation won’t be on the card itself

The card is a viable product but that is pretty much it. Cashback, no fees, no name cards, personal spending planning and tracker, expense management software — all of these are already existing on the market. And if you are working with an external Issuer and its processor, there isn’t much room for innovation. You should try to innovate on the value-added activities complementing the card.

9. Apple will handle authorization processing within 2 years

The authorization or not decision of Goldman Sachs will most likely be a binary choice as simple as “Is your credit limit reached or not?” The real innovation can come if Apple starts to handle the actual authorization requests and adds an intelligence layer on top of it. This way Apple will be able to apply business logic and make a card that follows your rules like Hey Siri, don’t allow Merchant X to charge my card anymore.

10. Cashback is not a long-term strategy

Apple will give you 3% cashback on Apple products, 2% cash back if you pay with Apple Pay and 1% cashback for merchants that don’t accept Apple Pay. Apple Card will get traction given the scale of its Apple-lovers community. But cashback is more of a marketing gimmick rather than a long-term strategy. The main source of the cashback is coming from the interchange received through the Card network from the merchant discount fees. Why? If a product costs $100 at retail and given a 3% merchant discount rate charged by the Acquirer for collecting the payments, the merchant will only receive $97. If cashback starts to become the norm in the industry, the market will easily inflate prices to cover for the additional costs and burden on top of the business. It’s a zero-sum game.

If you want to hear more internal stories from the Payhawk team, remember the ABC of blogging — Always Be Clapping.

Hristo is the compass guiding Payhawk's journey. With a rich background in engineering аnd product management he is a stalwart advocate for our products and customers, bringing a mix of innovation and user-centricity to everything we do. Outside the office, you'll catch him enjoying camper and sailing trips, shredding slopes on his snowboard, or simply soaking up precious moments with his family.

Related Articles

Top ways to streamline expense management across transport and logistics