A smarter spend control and visibility solution

Stay in control of all your business expenses, including invoices, reimbursements, cards, and more — all in one place.

Take control of card spend

Help your colleagues do business while you stay in control of spend with corporate cards supported by smart expense management software.

Issue debit or credit cards individually or in bulk, and create team cards and budgets. No need to wait weeks for bank issuance; virtual Payhawk cards can be used in seconds.

Set up stand alone or company-wide card spend limits, with no need to manage card by card. Adjust easily and set up a low funds alert to warn you when the balance is drying up.

Issue cards with zero balance and ask users to perform simple fund requests via the app. Auto-approve requests or link to pre-set approval workflows based on the amount.

Halt card spending in a couple of clicks in case of employee misuse or suspicious activity. Problem solved? Unfreeze cards in seconds to resume agreed use.

Easily delete cards according to staff turnover. Simply close the card via the portal, with no effort or expectation from the departing employee.

Save time implementing card controls by doing it in bulk. Manage multiple cards and set different policies by staff cardholder seniority level.

Get complete spend management and transparency, from policy-setting with advanced card controls to real-time reconciliation and seamless ERP integrations.

Track your subscriptions with smart recurring spend management features. Never miss an expense, make duplicate payments, or pay for unused tools again.

Create and implement robust spend management policy (and increase adoption) with approval workflows, advanced card controls, a user-friendly app, and more.

Support your spend policies

Leverage compliance-boosting software to put your expense policies at your cardholders

fingertips via approval workflows, spend rules, and clever automation.

Increase adoption and compliance

Say goodbye to dusty, neglected expense policies and encourage compliance with in-built customisable rules, and limits, and an app that employees love.

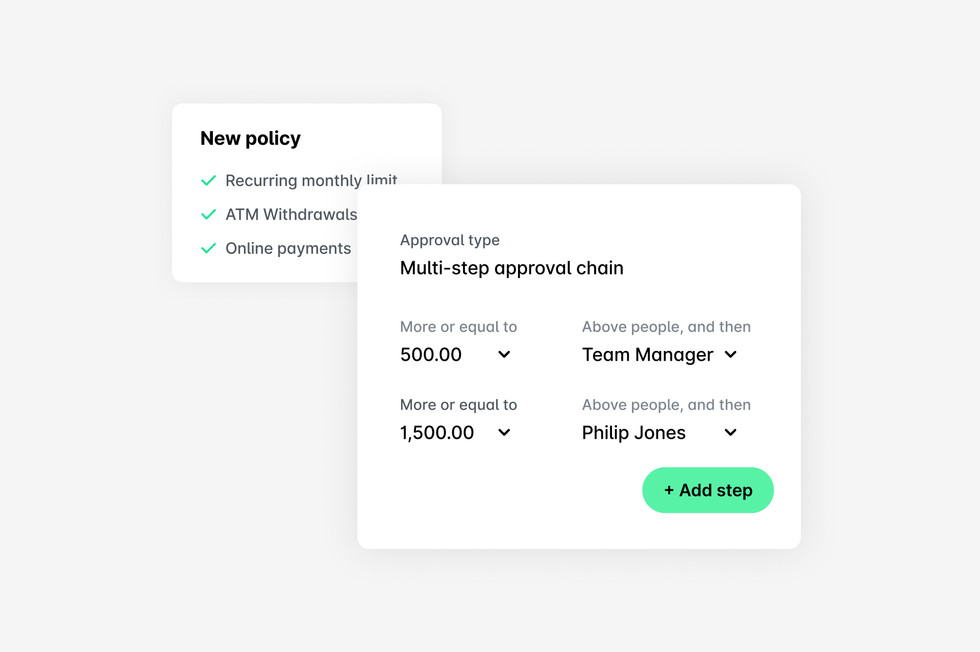

Customise spend rules

Set and update card rules individually or in bulk around single transactions, daily limits, hierarchies, and expense types to roll out your spend policy and update it as required.

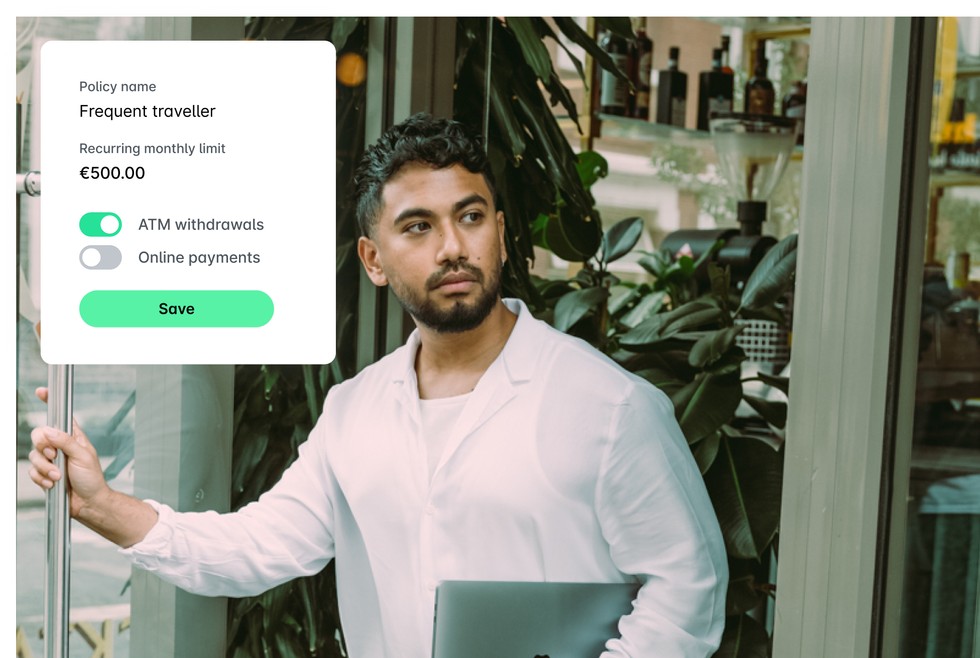

Block offline spend

Choose whether to allow online payments or not. If your business uses cards predominantly for travel for example, then you can easily select to disallow online payments.

Set ATM withdrawals

Decide if colleagues can use their cards in ATMs or not. Admins and accountants can simply toggle individual or bulk cards ATM use on and off as they need.

See what our cards can do

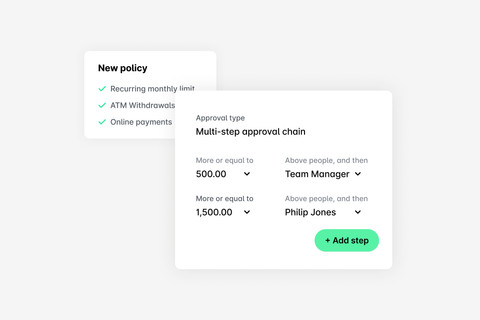

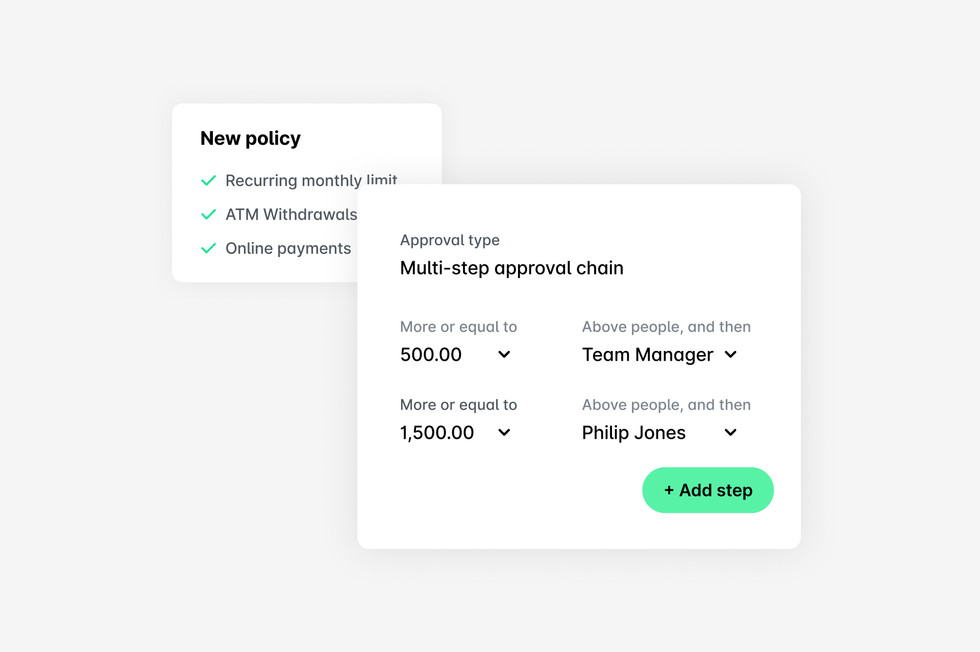

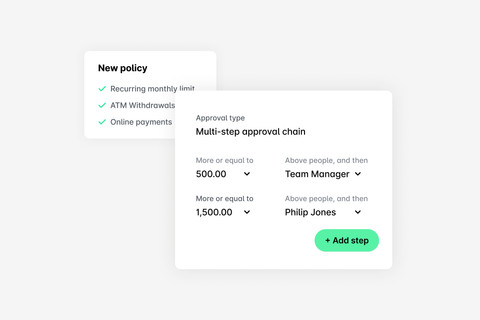

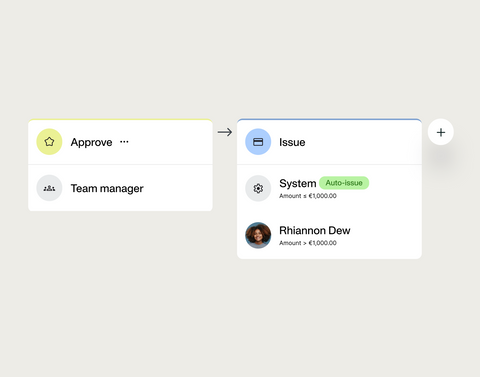

Save time with custom spend approval workflows

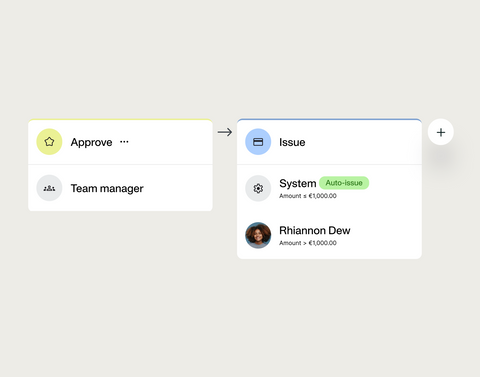

Save time and reduce risk with automated funding approvals and secure

step-by-step verifications.

Create secure approval flows

Set fund request approval steps to approve (or reject), review, and pay. Give your budget owners and finance team oversight and expand the flow as you need.

Assign multi-step approvals

Add additional approval levels as per your company’s policy easily and in bulk. Set approvals and automate who will be alerted based on the amount spent or funds requested.

Set approvals by expense type

Create different approval workflows according to the expense type, including card payments, bank transfers, reimbursements, company cash, and mileage.

Get seamless integrations for complete spend visibility

Leverage compliance-boosting software to put your expense policies at your cardholders

fingertips via approval workflows, spend rules, and clever automation.

Ensure the most up-to-date relevant data is at your fingertips at all times. Sync the spend data that powers your business with direct ERP integrations for full visibility and control.

Enjoy a complete real-time overview of spend across your entire business via the multi-entity management dashboard. Make smart decisions based on real-time info and insight.

Stay on top of cash flow management and avoid delays with automated notifications when accounts run low. Plus auto-chase your employees if they don't submit their receipts.

Avoid overspending on duplicate or unused recurring payments with our subscription management feature. Track prices, discrepancies, and duplicates to find savings opportunities.

Ensure the most up-to-date relevant data is at your fingertips at all times. Sync the spend data that powers your business with direct ERP integrations for full visibility and control.

Enjoy a complete real-time overview of spend across your entire business via the multi-entity management dashboard. Make smart decisions based on real-time info and insight.

Stay on top of cash flow management and avoid delays with automated notifications when accounts run low. Plus auto-chase your employees if they don't submit their receipts.

Avoid overspending on duplicate or unused recurring payments with our subscription management feature. Track prices, discrepancies, and duplicates to find savings opportunities.

“Before Payhawk, we had just one level of approval, and that wasn’t enough for me to keep control. As a CFO, I like that with Payhawk; we’re in control of who can approve what. In summary, Payhawk gives us a combination of efficiency and additional spend control, and that’s exactly what we need in finance.”

FAQs

Business spend control refers to the processes and procedures of managing, monitoring, and regulating company expenditures. A broad goal of spend control is to optimise how a business uses financial resources to align spending with the organisation's financial objectives and goals. Spend management and control includes budgeting, purchasing, invoicing, payment processing, and expense reporting.

At a more granular level, spend control includes specific features like card controls, ATM withdrawal blocks, spend limits, and more.

Broadly, spend control has several benefits for a business, including:

- Improved financial management: Businesses can make informed decisions by seeing and controlling spend.

- Increased profit margins: By reducing unnecessary expenses, you can improve your business's bottom line and increase profits.

- Better budgeting: Spend control can help you design budgets that support your business's financial goals, avoid overspending, and perform more accurate forecasting.

- Reduced waste: By monitoring your spending and cutting back on unnecessary expenses, you can reduce waste and improve the efficiency of your business operations.

- Improved cash flow: By controlling spend and reducing waste, you can improve your business's cash flow and encourage financial stability and growth.

At a more granular level, business spend controls like company card controls, and workflows can help your business roll out proactive and reactive expense policies and keep a firm grip over company spend.

For a full rundown of our card controls and their benefits, check out the main Spend control and visibility page.

Card controls include:

- Individual cards and team cards with assigned budgets

- Card spend limits

- Risk-free, zero balance cards

- Cards blocks

- Card freezes

- Card deletions

- Bulk card management

- Blocks for online spend

- Blocks for ATM withdrawals

- And more

Payhawk helps you reduce the risk involved with giving out corporate cards in a number of clear ways:

- Establish clear guidelines and use spend management software like Payhawk to implement the policies through in-built card control features like daily limits, ATM withdrawal freezes, and per diems

- Monitor transactions: Your cards are connected directly to your software so you can see who is spending what and where in real time - giving you the insight you need to adjust and update policies or even reach out to employees or teams directly

- Set spending limits: Set spend limits for each card or in bulk to reduce the risk of overspending

- Use workflows: Create approval workflows within the tool to approve spending. You can even give out cards with zero funds and ask cardholders to request funds each time they spend. Then, depending on the amount requested, the approval can be automated or go through a series of desired approvers

- Implement fraud detection and prevention measures: Use fraud detection and prevention tools and leverage card controls like card freezes and blocks

- Be user friendly: Give your cardholders cards and tools they love. Payhawk cardholders find it easy to stay compliant as they love using the cards and expense management tool (meaning there are instances of out-of-policy spend)

- Implement reconciliation processes: Payhawk automatically pulls data from your receipts, helps you categorise it, and seamlessly syncs with your accounting software which makes reconciliation easy and effective