BUSINESS BUDGET TRACKING Track budgets in real time for unparalleled visibility and control

Get complete oversight of all your spend against budgets in a single place with easy-to-manage budgets from Payhawk.

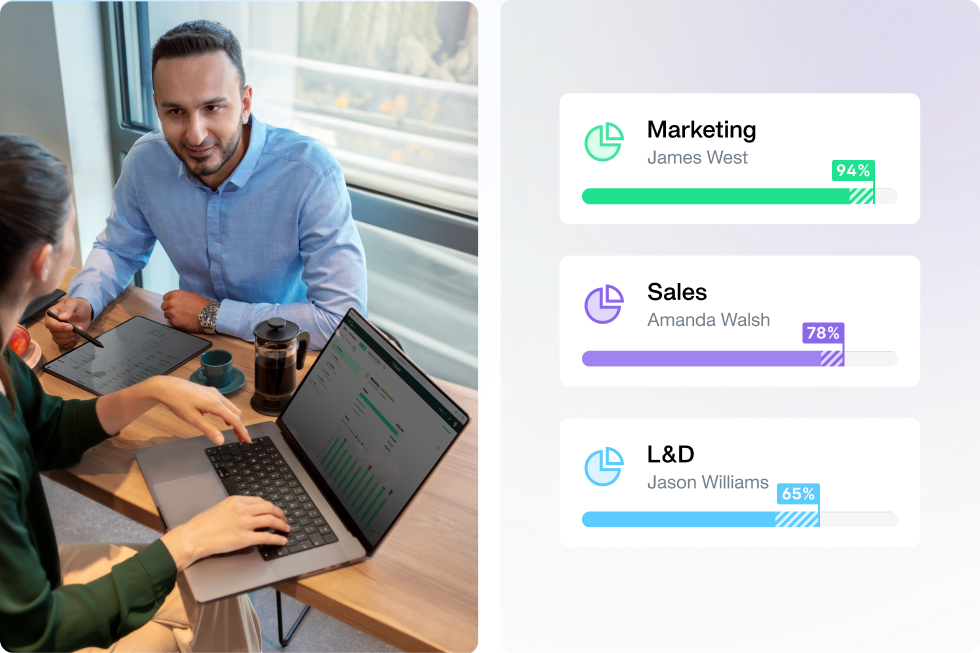

Cut the noise and empower every budget owner

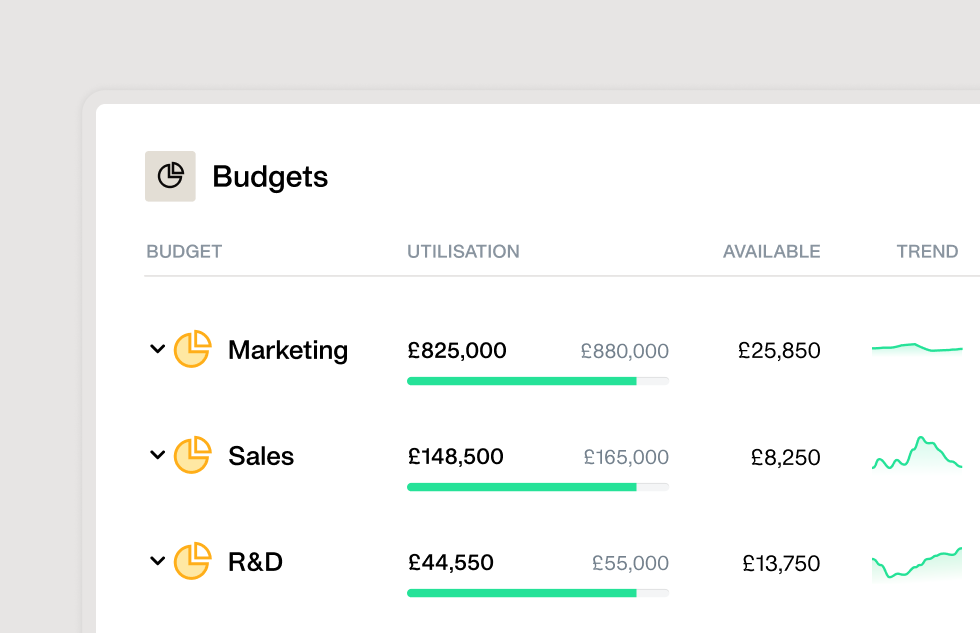

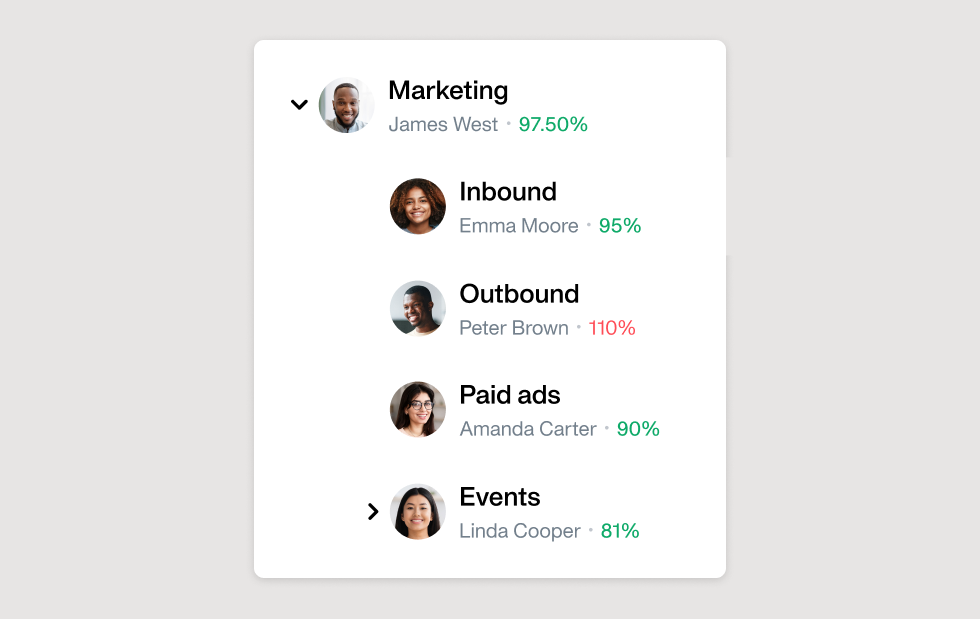

Get real-time insights into budget usage, with no need to wait for month-end. Explore detailed dashboards to see spending by department, category, period, employee, and much more to make smart decisions — fast.

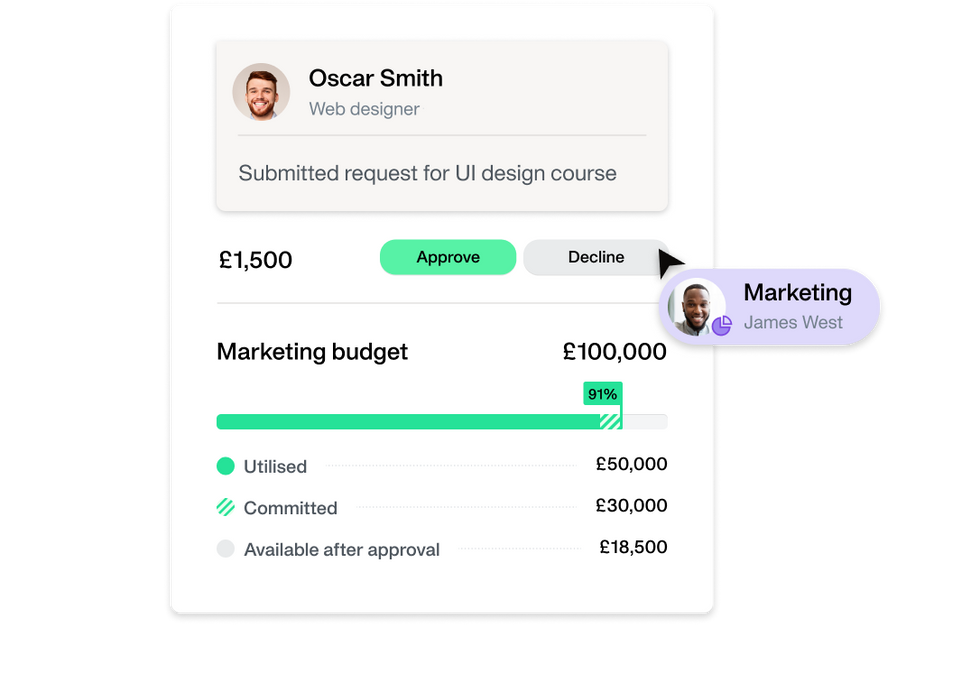

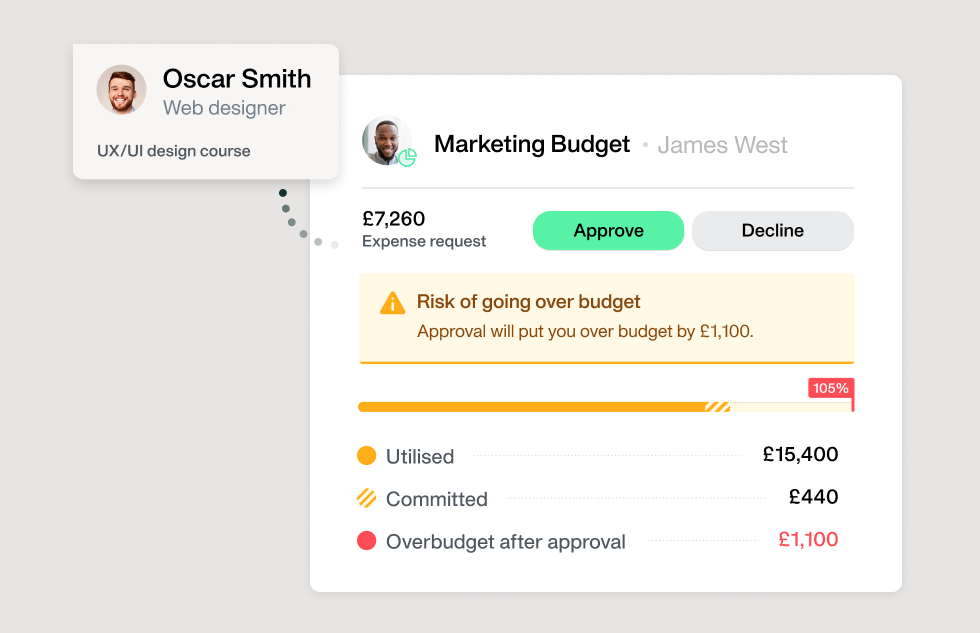

Make it easy for budget owners to see how any expense they approve will impact their budget — all that in real time and with an amazing user experience.

Empower budget owners to track spending effortlessly with real-time budget visibility and insights into the impact on expenses. Reduce team reliance on your finance team and say goodbye to spreadsheets to focus on strategic priorities instead.

Keep every type of spend on budget

Automatically track card payments, reimbursements, purchase orders, and supplier invoices in real time, all against your budgets. Enjoy a true all-in-one spend management solution that tracks all your spending, and more.

Business budget tracking, but better

Discover extensive customisation options, support for multiple forecasts, and built-in accruals. Tailored to the growing needs of mid-market and enterprise companies, our budget tracking provides advanced capabilities to simplify even the most complex financial management.

Simplify budget tracking for everyone

Finance teams

Enhance financial health and empower informed spending decisions aligned with company strategy.

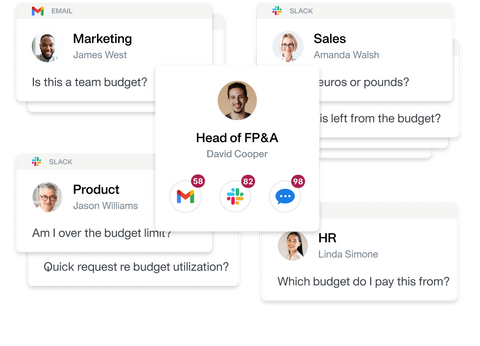

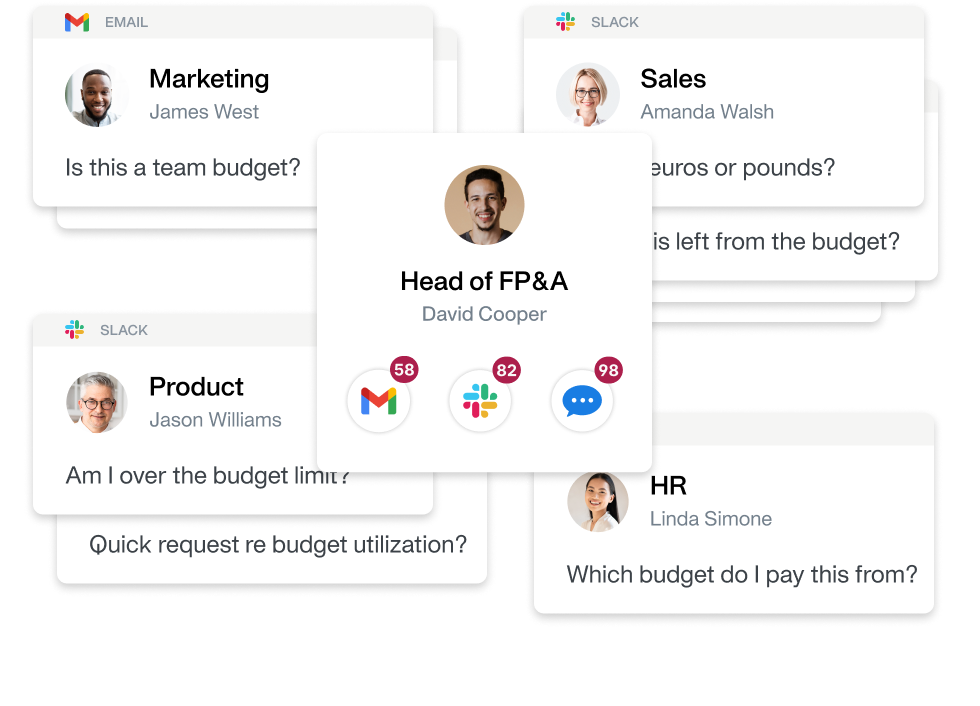

FP&A/Business partners

Save time from your busy day by enabling others to track their budgets autonomously.

Budget owners

Make fast, well-informed decisions and understand the budget impact before spend happens.

Finance teams

Enhance financial health and empower informed spending decisions aligned with company strategy.

FP&A/Business partners

Save time from your busy day by enabling others to track their budgets autonomously.

Budget owners

Make fast, well-informed decisions and understand the budget impact before spend happens.

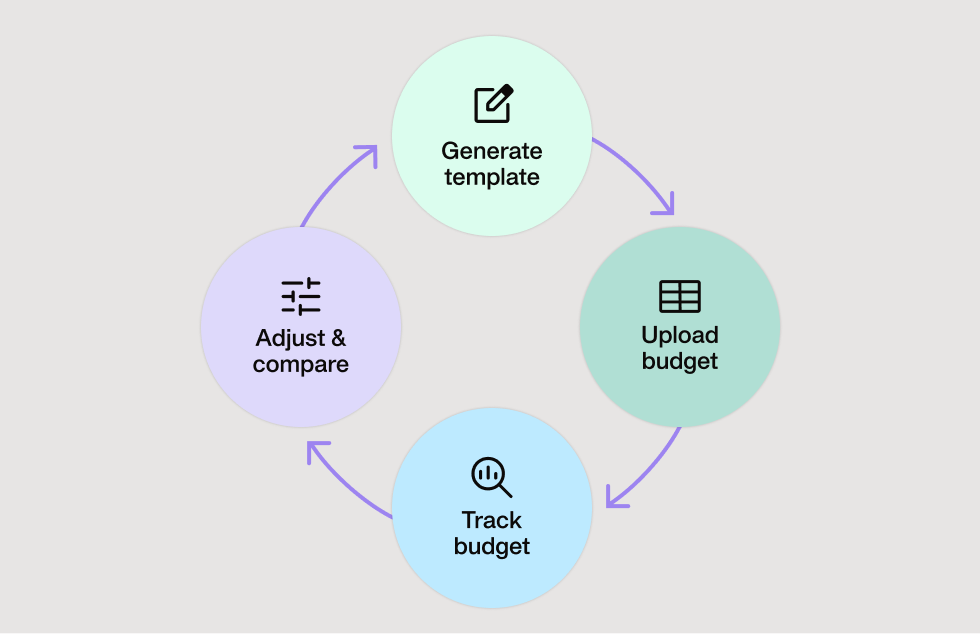

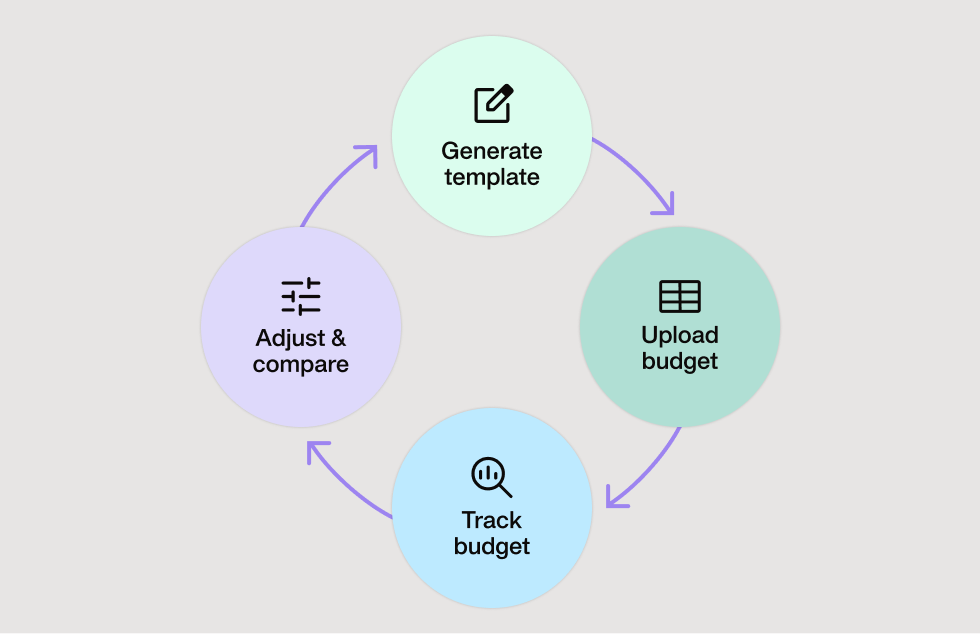

Our budget tracking processes at a glance

Quickly create your custom budget template by selecting the budget dimensions you need, such as employee, supplier, entity, category, custom fields, and more. Set the start of your fiscal year and you're ready to go.

Fill out the Excel template provided with all the relevant budget information. Establish parent-child relationships, determine budget currency, assign owners, and define dimensions. Upload everything into Payhawk in seconds.

Monitor all operating expenses, including card spend, reimbursements, invoices, purchase orders, subscriptions, and fund requests. Get clear visibility into Committed spend versus Utilised spend.

Easily update and communicate budget changes by uploading new forecasts as needed. Download your template to see current and past periods' actual spend, adjust future periods, and upload the new forecast without deleting previous ones.

Quickly create your custom budget template by selecting the budget dimensions you need, such as employee, supplier, entity, category, custom fields, and more. Set the start of your fiscal year and you're ready to go.

Fill out the Excel template provided with all the relevant budget information. Establish parent-child relationships, determine budget currency, assign owners, and define dimensions. Upload everything into Payhawk in seconds.

Monitor all operating expenses, including card spend, reimbursements, invoices, purchase orders, subscriptions, and fund requests. Get clear visibility into Committed spend versus Utilised spend.

Easily update and communicate budget changes by uploading new forecasts as needed. Download your template to see current and past periods' actual spend, adjust future periods, and upload the new forecast without deleting previous ones.

All the features you need to take your budget management to the next level

Enable the most detailed data breakdown by categories, teams, suppliers, or any custom field.

Replicate your exact budget hierarchy through a custom import directly in the platform.

Import all your budgets with a single click thanks to a simple Excel template.

Improve global visibility as each budget can be set up in a different currency, independently of your Payhawk accounts.

Breakdown budget spend by supplier, team, employee, project, or any other field to analyse your biggest spenders.

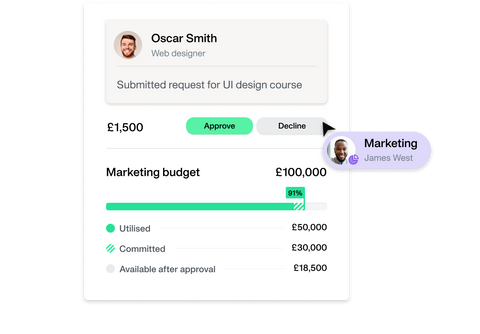

Ensure all budget owners can view the budget utilisation progress bar (included in the request for any budgets impacted).

Create Group budgets and enter entities as dimensions if you're based at a company with multiple entities.

Leverage accurate budget utilisation calculated considering the amortisation period, service period, or document date.

Let admins easily upload new forecasts and keep them all on the platform for greater visibility.

FAQs

Business budgeting represents a detailed financial plan that outlines an organisation's expected revenues, expenses, and capital expenditures over a specific period, typically a fiscal year. More importantly, corporate budgeting is not only about how much the company should spend, but also how/on what; it is the most important strategic tool for helping companies achieve their goals.

Business budgeting is the process of forecasting how much your company plans to spend over a certain period of time. Budget tracking is consistently monitoring business spend and aligning it with the initial budget, making sure that the company is staying within its bounds.

Financial planning and analytics (FP&A) tools are the gold standard for calculating the budget of mid-market and enterprise companies. FP&A software is typically used solely by finance teams to create their budgets and various financial reports. FP&A tools are typically not meant to be accessed by non-finance employees as the data in those tools is extremely sensitive.

Therefore, when finance teams want to share these budgets with the rest of the organisation, like heads of departments and other budget owners, they can use Payhawk Budgets. Payhawk Budgets provides budget owners with real-time access and visibility over budget utilisation and how it is impacted by all types of spend - cards, reimbursements, fund requests, subscriptions, tech spend, purchase orders, and invoice payments.

Typically finance teams will create business budgets in an FP&A tool, their ERP, or even a spreadsheet. Regardless of their preferred tool for budgeting and forecasting, finance teams often end up sharing these budgets with the wider organisation using complex spreadsheets with multiple formulas and, most importantly, static information on spend which quickly becomes out-of-date.

Payhawk Budgets provides finance teams with an alternative means to track spending and communicate budgets internally instead of the classic spreadsheet, which is extremely easy to break and requires constant manual updating. Payhawk tracks all corporate spending in real time and provides valuable insights into budget utilisation so that budget owners have a user-friendly format to view their budgets and make better decisions.

Yes, and it only takes a minute. You can generate a custom budget template through the Payhawk platform and select all dimensions on which your budgets are based: team/department, location, category, or any custom requirement. The other parameter you have to define is the start month of your fiscal year. This is enough to generate your custom template.

In the template, you can enter all your budgets and determine the owner of each budget, the currency (yes, each budget can have a different currency from the rest), and each of the dimensions it is determined by. Our template also enables you to easily establish a hierarchical structure and identify sub-budgets within a budget.

Payhawk Budgets are made for the sophisticated needs of finance teams in mid-market and enterprise companies. We have taken into account their requirements and delivered a solution that ticks all the boxes:

- Budgets can be created in any currency

- Budgets can have endless dimensions and support any hierarchy

- Budget utilisation is based on all types of spend, not just card or invoices - it considers purchase requests, subscriptions, fund requests, reimbursements, invoices

- You can upload all your budgets with just a few clicks, saving yourself lots of valuable time

- Payhawk lets you maintain a view of multiple forecasts of the same year, so you don't lose sight of your budget's past iterations

- You can create multiple fiscal years ahead so you are not constrained to having just one forecast.

Absolutely! Not only can you edit budgets, but you can also save your previous forecasts and create as many new forecasts as needed, such as after closing each month or quarter. Payhawk allows you to keep track of all previous iterations without deleting or overriding them (unless you choose to), giving you unparalleled visibility and control over your budgeting process.

Payhawk is a solution geared towards mid-market and enterprise companies which use accrual accounting. Our Budgets feature also works using the accruals principle: budget utilisation takes into account amortisation scheduling, service period, and document dates instead of using the payment date.

The purpose of Payhawk budgets is to provide better visibility on budget utilisation and to enable budget owners to make informed decisions by having them review the potential impact on their budget before they approve an expense or a request. Our solution does not restrict or limit spend based on your budget; budget owners are empowered to demonstrate financial discipline and agility when making well-informed decisions.

Yes, you can upload multiple budget forecasts and keep track of all of them on the platform. You can keep all previous iterations without deleting or overriding them (unless you choose to), so you have unparalleled visibility and control.

A budget owner in Payhawk is someone who is responsible for one or more budgets. They can view their budget and sub-budgets, analyse and filter spend by a variety of dimensions (suppliers, employees, categories, etc), and approve or decline any expense requests. Payhawk will automatically detect if an expense of any type (card, bank transfer, subscription or even a purchase request) affects one or multiple budgets and will include the respective budget owners as approvers.

A budget owner will be asked to review this expense and will be shown how this approval would impact the respective budget. The budget owner can therefore approve it or deny the request.

Responsible budget discipline with real-time insights

Get started with Payhawk!