5 tips for scaleups heading to Germany

Opening in new markets can be rough, especially if you're a scaleup who's expanding into a new country. In this scenario, you'll be growing your product offering, hiring exponentially, and delivering the objectives you've been planning. You'll need a solid roadmap to do it and the right partners. Plus, a good understanding of your timeline, as some tasks like opening a bank account can take ages.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

If you're a growing scaleup, you may have already realized that some markets are more straightforward to scale into than others. Governments actually measure the difficulty of the expansion process to prove that their country has a good ecosystem for enabling businesses. Attracting foreign companies is a major goal in the public agenda for most countries, as this brings new capital to the economy and increases the job supply.

As the fourth largest economy globally by GDP, Germany is a very attractive market. However, establishing an entity can be a long process unless you have the right partners and a good set of recommendations to work from. Last week we launched our Scaling into Germany guide, where together with the NHS* group, we summarized the main factors involved when opening an entity in Germany.

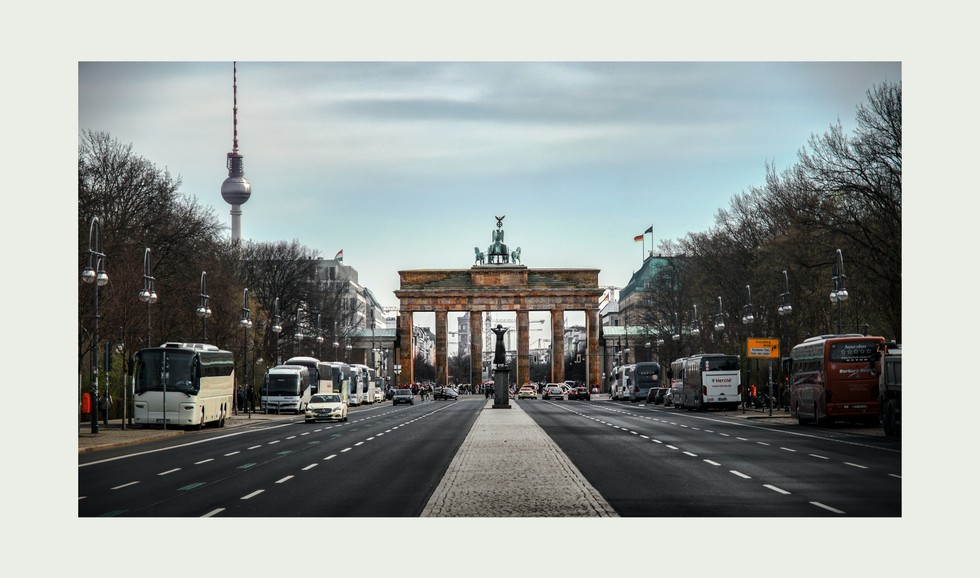

1. Choose your location wisely

Germany is more decentralized for business than most other countries in the EU. Based on this, you should look into which location is best for your business. For example, we chose Berlin for our office location, as we wanted to be part of the startup ecosystem in the city, which is valued at almost 40 US$ billion. Berlin is also one of the major fintech capitals of the world.

Mathias Niehaus, Partner at the NHS* group, mentioned that Berlin is a good place for you to set up shop if you're a startup in general. But, if you want to be close to Germany's finance hub, you could choose Frankfurt. Choosing your location is very important as you'll need to register in the local chamber of commerce.

How to open a German entity guide

2. Open a business bank account early on

In our experience, opening a business bank account should be one of the tasks you complete early in the process. It took us almost four months to open an account, and we only managed to do it remotely thanks to the support of our partners. Once you've decided that Germany is your next move, the first thing you should do is look for a bank that is willing to work with a foreign company.

You must have a German business bank account to open an entity.

3. Find the right partner

In Germany, you won't be able to establish an entity unless you work with partners. Compared to other countries in Europe, this makes the whole process a bit slower and more complicated.

Also, if someone in your C-Suite is not going to be the local representative personally, then you must select that person wisely.

"Many foreign companies appoint a sales manager to be the local representative or managing director of the GmbH. This appointment means that the company must share all the legal and financial information with this person. The selected person could legally be responsible for the business and, under certain conditions, even liable, so choose wisely," Niehaus explained.

4. Translate company documents

All the documents you present to the German authorities must be officially translated. This translation process takes time, so start looking for an official translator and ready your Articles of Association and other relevant documents. Also, if you have someone on the team who speaks German, this will help a lot. Forms and documents from the Tax and Registry agencies are all in the German language.

5. Set up your finance stack

Understanding taxes is one of the most significant drawbacks of the German market. There are numerous taxes that companies have to pay, which makes taxes and payroll pretty tricky for growing companies. We really recommend working with an expert partner like the NHS* group. When we opened in Germany, the NHS* group helped us figure out the various tax implications, including any involving our new hires.

When it comes to company cards, employee reimbursements, and bill payments, we have you covered. At Payhawk, we offer the most efficient physical and virtual company cards, with 3% cashback on every transaction, capped at your subscription.

Our all-in-one product allows you to expand your business anywhere in Europe without adding extra complications. You'll have dedicated IBANs in EUR and GBP so you can do bank transfers to pay your bills and reimburse your employees all in one single platform.

Having visibility of spending, transparency, and budget control is crucial for scaleup companies where every euro, pound, dollar, etc., counts.

Selecting the right finance SaaS tools for your different markets is very important. The software must be able to adapt to the local market, or ideally multiple markets, and fully integrate with any tools that are already in place.

If your business is looking to expand into Germany, download the guide today, and discover what you need to start the process.

An integral part of Payhawk’s journey from the very beginning, Raquel has seamlessly transitioned across key roles—starting in sales, building the customer success team from the ground up, and later moving into content and product marketing. Today, she thrives as a Senior Product Marketing Manager and also leads the company’s ESG efforts. Outside of work, Raquel is passionate about the outdoors and enjoys swimming, hiking, and baking for her two children.

Related Articles

The CFO’s edge in 2026 is not strategy. It is execution