Revolutionizing the budgeting cycle: Insights from industry leaders

As we approach Q4, your organization is likely gearing up for the annual budgeting cycle. Following our recent roundtable discussion at the World Finance Forum (WFF) on "Mastering the Budgeting Cycle: Empowering Finance and Beyond," we've put together the most valuable insights from industry leaders on how to create a culture of accountability, streamline processes, and align budgeting with strategic goals.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

The conversation flowed at the WFF roundtable "World Finance Forum on "Mastering the Budgeting Cycle: Empowering Finance and Beyond," and we left with many actionable tips and strategies we're keen to share — so let's dive in.

Drive accountability: A collaborative approach

One of the central themes that emerged from our discussion was the importance of driving accountability throughout your organization. Here are some of our key takeaways:

- Link bonuses to budget performance: Aligning individual and team incentives with budget goals can significantly increase accountability. However, you'll need to carefully design these incentives to create additional work for finance teams.

- Adopt a bottom-up approach: Engage budget owners early in the process. Take the time to sit down with stakeholders and discuss their needs. By taking this collaborative approach, you can even discover creative solutions, such as reallocating savings from one area to fund initiatives in another.

- Provide a strategic framework: You and your finance teams can set the stage by creating a high-level budget framework aligned with strategic goals. This approach gives budget owners flexibility within defined parameters, fostering buy-in and ensuring alignment with overall business objectives.

- Upskill non-financial staff: Offer training on financial concepts and tools like Excel to empower budget owners. Your investment in skill development can lead to more informed decision-making and smoother collaboration with finance teams.

Cultivate a culture of proactive budget management

Budgeting isn't just about numbers and forecasts; it's about building a spend culture of transparency, accountability, and smart decision-making all year round. To make it work, everyone needs to stay aligned with the organization's financial goals.

Here are some of the top takeaways from the discussion:

- Regular risk and opportunity reviews: Implement proactive weekly meetings to discuss potential risks and opportunities. Encourage a balanced approach (as teams often focus more on risks than opportunities).

- Set clear reporting expectations: Establish parameters for reporting variances, risks, and opportunities. Provide feedback on the quality of reporting to improve the process continuously.

- Foster a collective mindset: While individual departments manage their budgets, emphasize the importance of considering business-level impacts; this approach helps create a culture of shared responsibility.

- Simplify communication: When discussing financial matters with non-finance stakeholders, consider using terms like "cash in/out" instead of accounting jargon to improve understanding and engagement.

Streamlining the budgeting process with technology and best practices

At the roundtable, finance leaders dug into budgeting challenges and shared their strategies for making the process smoother and more efficient. From refining communication to leveraging technology, here are some of their best tips:

- Clear communication and expectations: Provide budget owners with clear guidelines on what's expected from them well in advance. This preparation can significantly smooth the process.

- Iterative collaboration: Some organizations have found success with a two-step process. Budget owners create an initial version, which finance teams then refine and validate with the owners.

- Optimise the timeline: Consider compressing the budgeting timeline to maintain focus and momentum. One CFO mentioned reducing their process from six months to three months (October to December).

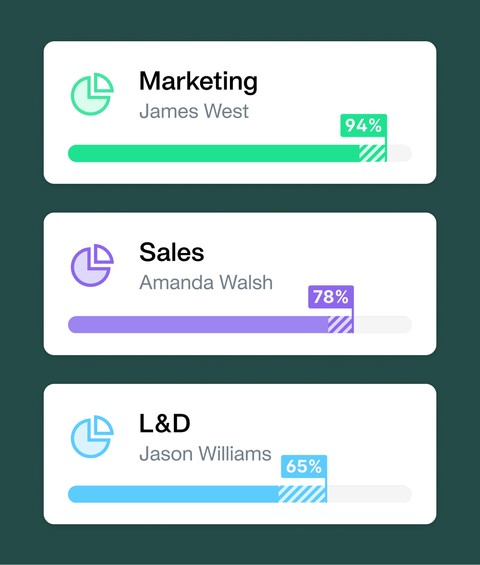

- Leverage technology: While nobody mentioned specific tools, it's clear that using the right technology can greatly enhance business budgeting tracking. Look for solutions that facilitate collaboration, provide real-time insights, and automate routine tasks.

Conclusion: Empowering the entire organization

The key message from our roundtable is clear: effective budgeting is a collaborative effort that extends beyond the finance department. By fostering accountability, providing the right tools and training, and creating a culture of proactive management, organizations can transform their budgeting cycle from a dreaded annual exercise into a strategic tool for success.

As you prepare for your upcoming budgeting cycle, consider implementing some of these strategies. Remember, the goal is not just to create a budget but to align your entire organization's efforts with your strategic objectives. With the right approach, your budgeting process can become a catalyst for growth and innovation.

Ready to begin your budget cycle and create a robust spend culture? Find out more about budgets and how they support robust spend cultures, or book a demo to explore in more detail.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Pennylane Integration: Why to connect with a spend management platform