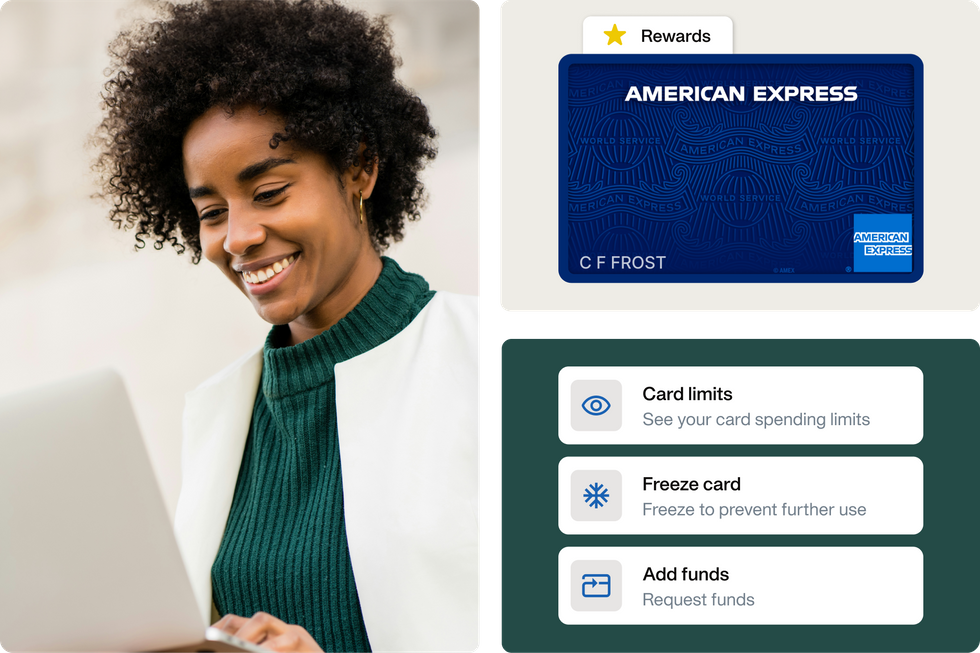

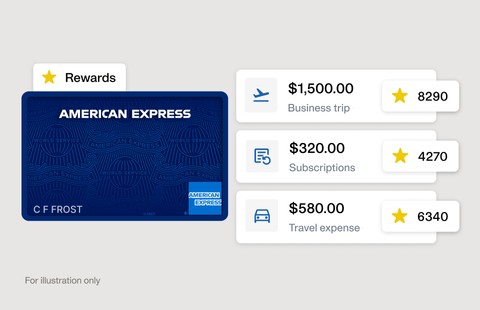

AMERICAN EXPRESS INTEGRATIONHelp speed up month end. Control Card spending. Earn the same rewards¹.

Issue unique virtual Cards with built-in spending controls from Payhawk and help manage business spending globally – all while earning the rewards of your eligible U.S. Corporate or Business American Express® Card² when making virtual Card payments.

Enrolment with Payhawk is required and fees may apply.

With Payhawk there are even more reasons to love your Card

Virtual Cards offer enhanced control and visibility into your payments

- Establish specific controls for each on-demand virtual Card

- Approve, modify, or cancel virtual Cards at any time

- Enable employees, freelancers, and subcontractors to make payments on your behalf without sharing your physical Card

Give your employees time back through simplified expense management and reporting

Distribute on-demand virtual Cards to employees, freelancers, or other authorized users for business payments and expenses without sharing the underlying funding account details or the physical Card.

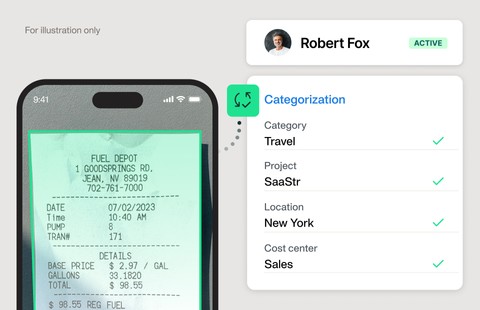

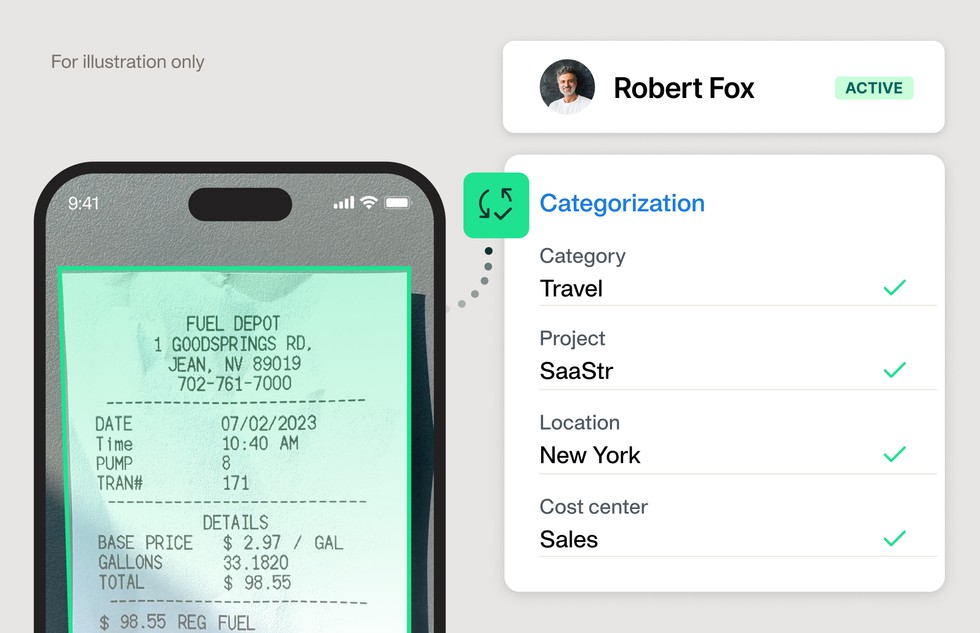

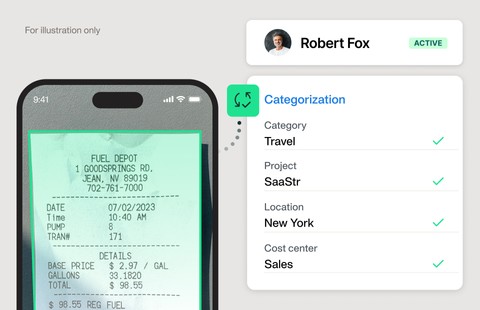

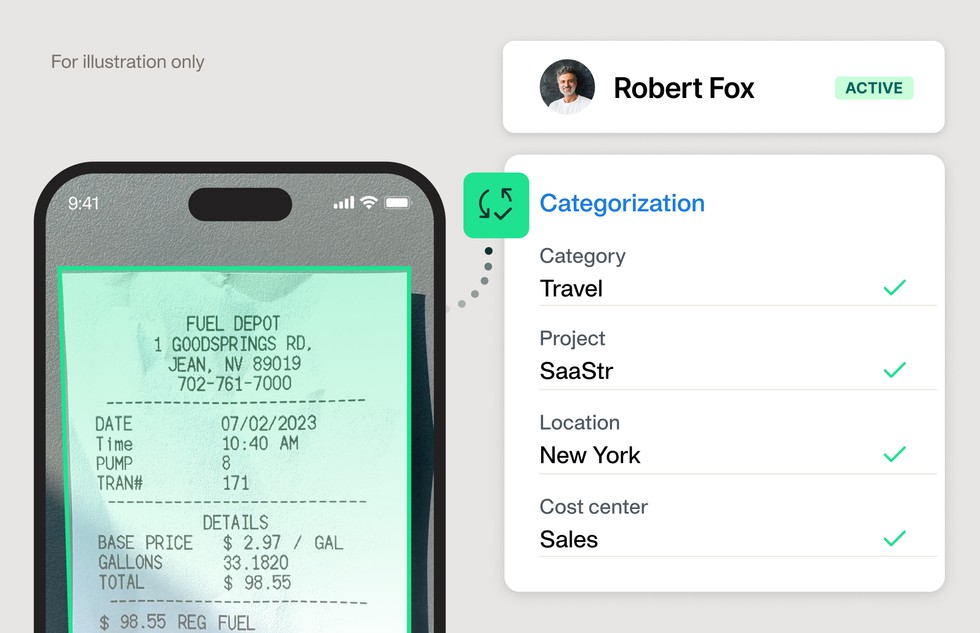

Upon payment with their virtual Card, Card Members can submit their expenses and receipts in real-time through the Payhawk mobile app. The process is accelerated through our market-leading OCR, saving time and preventing errors in manual data entry.

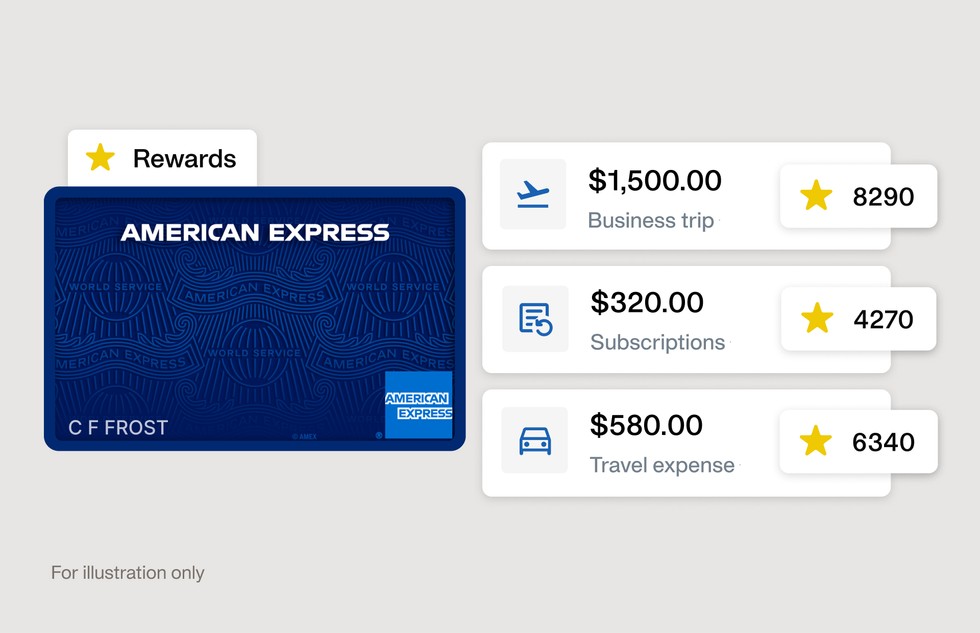

Same rewards, additional control

When you add your eligible American Express Card to Payhawk to make payments, you can earn the same rewards you currently earn but with the added benefit of being able to manage your spending in one place.

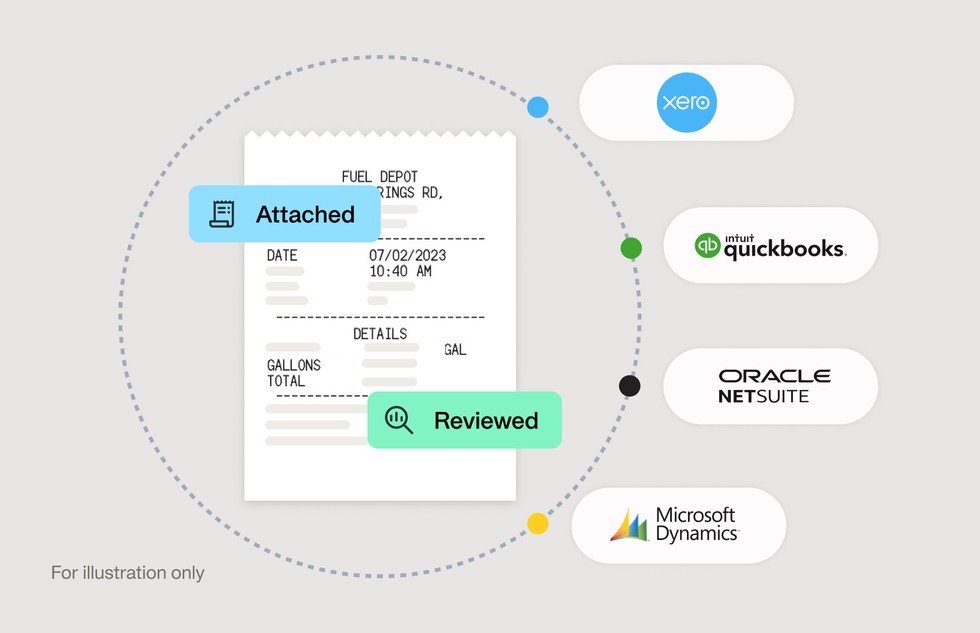

Help streamline your bookkeeping and make reconciliation more efficient

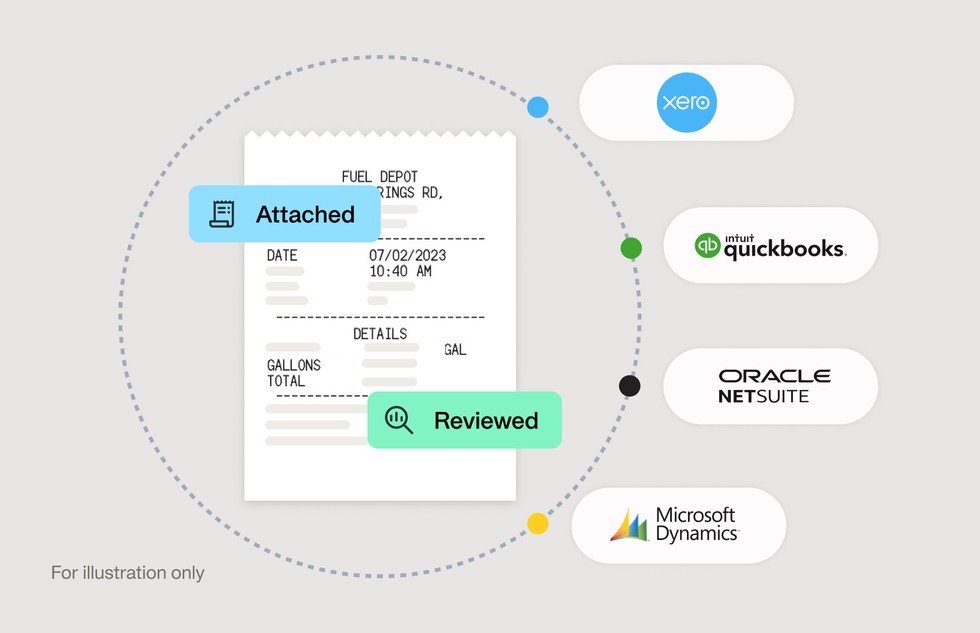

Access virtual Card transaction data within Payhawk’s platform, reducing manual processes and improving reconciliation. Settled transactions and reviewed expenses are exported to your ERP in real-time.

Pay with enhanced security

Each recipient of an on-demand virtual Card receives a unique 15-digit number, different from the underlying American Express Card funding account number.

"Payhawk has streamlined our process for managing American Express Credit Card transactions by seamlessly integrating with our company's accounting system, making inputting and tracking expenses effortless.

The platform allows us to issue virtual Cards to employees with ease, while categorizing expenses in real time, ensuring accurate and efficient financial management. This has significantly reduced the time and effort required for month-end reporting, enabling our team to focus on strategic tasks rather than manual reconciliation."

How it works

Integrate your eligible American Express Card with Payhawk to manage payments, expenses, and empower employee spending.

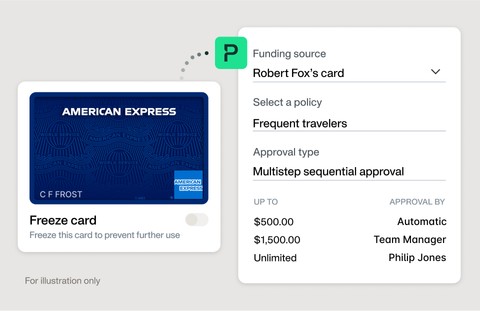

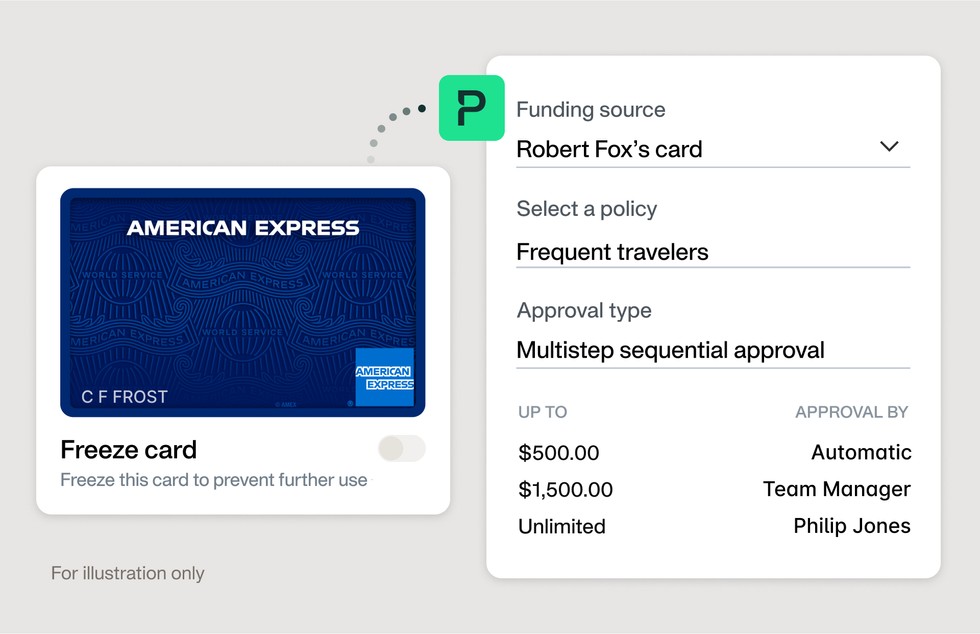

Create and assign virtual Cards for your employees or other authorized personnel, where your linked American Express Card acts as the funding source. Set custom spending limits and policies on each virtual Card to ensure policy compliance and eliminate out-of-policy spending.

Have greater visibility on the billing statement for your eligible American Express accounts enrolled in Payhawk, by seeing on-demand virtual Card transactions, helping to make reconciliation more efficient.

Highly rated in all the right places

“The UI is great! Not much of a learning curve, so getting full use out of the system is a simple process.”

“I like the automatic recognition of the tickets; it saves a lot of time in expense reporting as before it took a few hours each month."

“You can pay all your pending vendor invoices and expenses in bulk. I can also control the monthly subscriptions and define the categories and departments, and automatically synchronize them with my accounting software.“

FAQ

American Express® virtual Cards1 are a convenient and secure alternative to traditional plastic cards. Each virtual Card is a unique randomized virtual account number that Card Members can generate on demand to make payments within our platform once they have added their eligible American Express Card. Card Members can establish specific controls for each virtual Card payment, including spending limits, expiration dates, and allowed merchant categories. They can also approve, modify, or cancel virtual Cards at any time.

Card Members choose to pay with American Express virtual Cards on our platform for a wide range of payments and expenses. For example:

- Making supplier payments without sharing the underlying account number.

- Empowering employee expenditures while setting spending limits and expiration dates.

- Facilitating travel purchases while helping to enforce travel policies and budgets.

- Issuing virtual Cards for media buying that are created for each media platform, ad campaign, or client.

- Simplifying subscription management to better track recurring payments, and stay on top of free trial periods by setting expiration dates that can help you monitor your automatic renewals.

- Managing contractor expenses more efficiently by reducing the need for contractors to pay for out-of-pocket expenses up front and then request reimbursement.

An American Express Card Member who has an eligible Business, Corporate, or Corporate Purchasing Card product.

All Card accounts must be a physical card product. Eligible types are:

- Corporate Card accounts.

- Corporate Supplementary Cards.

- Corporate Purchasing Card accounts.

- Business Card accounts.

Note: Currently, Business Supplementary Cards are not eligible for enrollment.

To confirm their Card types, Card Members can log into their online account at americanexpress.com and review their Card account names.

You can set a recurring monthly limit on your virtual Cards. In addition, you can freeze cards and add an approval chain for fund requests.

Virtual Cards can have individual monthly limit (stand-alone limit) or added to an existing company spend policy.

Yes. You can pay with your Virtual Card everywhere, where American Express cards are accepted. With Payhawk you can also issue Visa cards, which have high global acceptance rate.

Once you pay with your Payhawk issued American Express Virtual Card, the transaction will immediately appear in your Payhawk portal. The Card owner can easily attach a receipt to the transaction through the Payhawk mobile app, with Payhawk automatically routing it to the correct approver once submitted. Once "Marked as Reviewed" the expense is automatically exported to your ERP or accounting software.

*All Virtual Card transactions are shown on the billing statement.

Virtual Cards can be added to a range of digital wallets. Please visit https://www.americanexpress.com/us/credit-cards/features-benefits/digital-wallets/index.shtml to explore available digital wallets.

Discover more of Payhawk

Ready to use your eligible American Express® Card within Payhawk?

1. To generate American Express virtual Cards through Payhawk, you must be an American Express Corporate, American Express Business, or American Express Corporate Purchasing Card Member. Separate enrolment with Payhawk and American Express is required to utilize combined product offering. To make an American Express Card payment to a vendor through Payhawk, the vendor must be an American Express accepting merchant. There is no fee to generate American Express virtual Cards. Certain features, upgrades, and additional payment methods may require separate activations and fees may apply. Payhawk is solely responsible for determining any and all fees associated with their product. Please contact your Payhawk representative to learn more.

2. Not all Cards are eligible to get rewards. Terms and limitations vary by Card type.