Custom Workflows: Managе Complexity with Payhawk

How do you manage invoices? From manager approval to supplier payment, managing workflows can become quite complex, especially for enterprise players. See how Payhawk focuses on flexibility by allowing larger companies to customize their invoice approvals and payment permissions.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Working at a fast-growing startup is exciting.

And as with most startups, we were confident that we were solving the right problems as the solutions brought a huge part of our initial success. But as we've entered the enterprise field, we noticed the need for tackling higher complexity.

One good example is how we think about managing the invoice life cycle. From manager approval to supplier payment.

At most companies, different departments, amounts, and expense types require different approvers before the invoice gets paid.

That’s why we introduced Payhawk Workflows, ensuring every document is reviewed by the respective approver according to your company policy. Whether it’s based on an amount threshold or company structure, we make sure the request hits the right person so that employees’ mistakes are avoided.

But what happens when a company has two hierarchical structures? What if their approval is based not only on their cost centers but the projects of the company or the type of expense? And what if there are specific people responsible for paying invoices?

One thing is clear here. The bigger the opportunities, the higher the complexity.

We quickly realised that if we want to address these intricacies, we need to offer full customisation around both approval workflows and payment permissions.

So here's how we did it.

Custom Approvals

Most companies base their approval flow on their hierarchical structure. For example, the marketing manager will approve an expense coming from the marketing team.

We’ve all heard about the 4 eyed principle when it comes to spending approvals. However, bigger companies might also base their approval on the location of the entity, the type of expense that corresponds to a specific department or cost centre, or a different structure altogether.

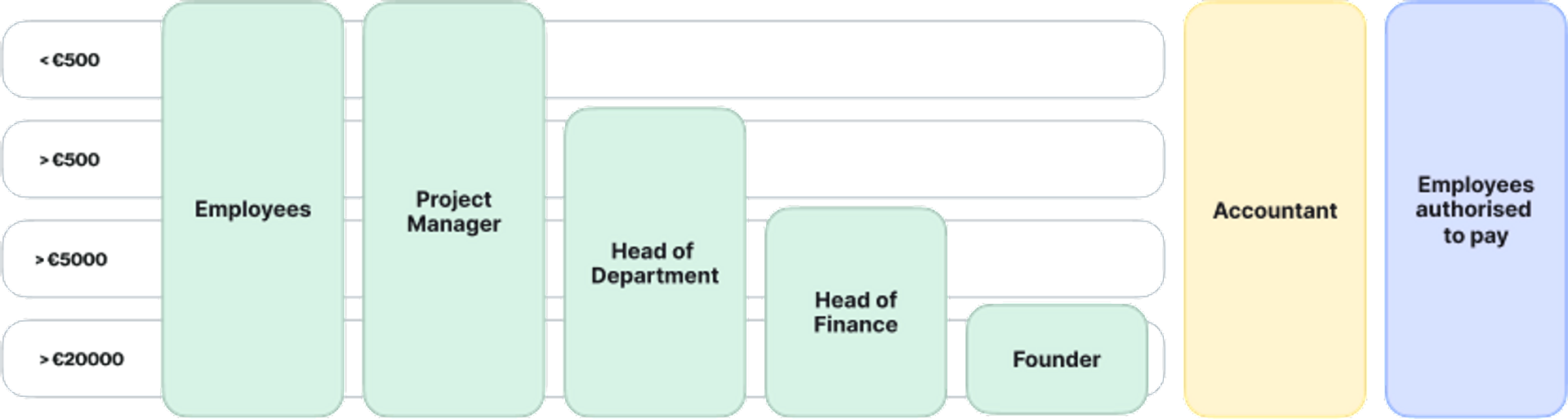

In that case, depending on its characteristics, the expense would have to go through a more complex approval chain. Here’s one example taken from one of our existing clients’ workflow diagram:

Optimise spend management with customisable approvals and controls

In the above case, the company has project-based approval followed by department-based approval. Any expense over 500 euro will have to be approved by managers of both company structures (projects & departments) before being reviewed by an accountant and finally paid.

In Payhawk, companies can update their own corporate card controls, set their own custom fields (projects, departments, etc), and assign their respective managers. In the above example, this would be projects and departments.

They can then define their approval chain based on these custom fields. In that way, every expense will be approved by the respective manager.

Custom Payment Permissions

But what happens once the expense is fully approved and subsequently reviewed by the accountant? Who are the people authorised to pay?

It’s a common practice in larger companies to have a single responsibility principle in order to minimise risk.

For example, there would be one accountant inputting the payment information and then another employee responsible for executing the actual payment, without the ability to change the payment details.

In Payhawk, you have the ability to give payment permissions to any employee from your company, irrespective of their role. At the end of the day, you have a defined list of people authorised to wire bank transfers.

Do you think your workflow is too complex to be automated?

Book a demo now and let us prove you wrong :)

Boris is a seasoned product leader with a diverse background in launching financial products and building innovative payment programs. Currently, he leads the Spend Management product area, where he is focused on revolutionising the travel management space with an enterprise-ready AI Travel Agent. Passionate about blending technology and user-centric design, Boris is dedicated to creating seamless, intelligent solutions that redefine the way businesses manage travel and expenses.

Related Articles

Smart money just got smarter: How AI is helping move money in 2026