Payhawk leads the way in corporate card and spend management with Enterprise Suite 2.0 with Oracle NetSuite integration

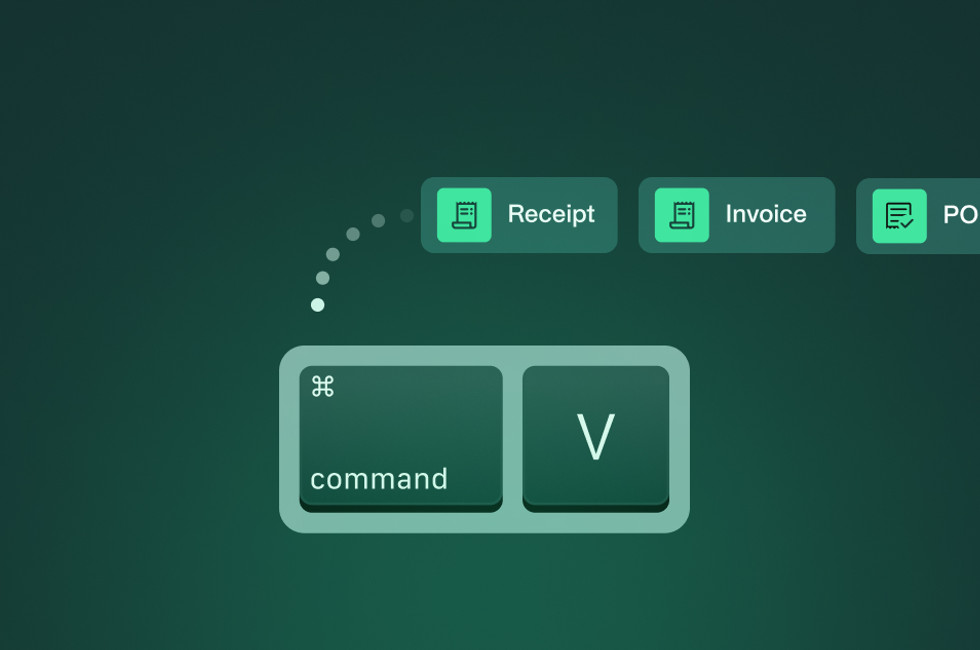

Payhawk, the all in one finance system that helps businesses spend effortlessly, has today announced the second iteration of its enterprise suite, Enterprise Suite 2.0. New features include Subscription Tracking, Mileage Tracking, Oracle NetSuite native Integration, Reimbursements, Multilingual Portal and automatic Supplier IBAN checks.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Press release

Payhawk’s expanded Enterprise Suite works to both streamline the function of finance teams and improve the satisfaction of staff making payments. Finance teams can spend less time manually tracking spend on subscriptions and validating supplier IBANs, as well as automatically transferring their accounting data to Oracle NetSuite; whilst employees are reimbursed automatically for approved spending and mileage, avoiding weeks or months of being out of pocket to their employer.

Payhawk’s expanded suite of enterprise tools and features are targeted at fast-growing multinational companies that are expanding their international presence, and need a strong and efficient financial stack to control company spend without prohibitive administrative overhead.

Make multi-entity expense management efficient with Payhawk

Hristo Borisov, CEO and Co-Founder of Payhawk said: "Thanks to our direct integration with Oracle NetSuite we can better satisfy the needs of enterprise-size businesses. With our integration, all expense information flows to the ERP in real-time. In Europe, we are the first company in the sector to provide this type of API integration. Finance teams currently spend a great deal of dead time chasing payments and tracking budgets across spending by numerous individual team members. After payroll, subscriptions tend to be what companies spend the highest amount of funds on. Our software identifies subscriptions and tracks them, offering a visual representation of its value and predicted future use. What finance team members have previously logged in spreadsheets now becomes trackable".

Payhawk combines card payments, bank transfers, invoices and expense management to reduce the gap between banks and ERP (Enterprise Resource Planning) systems. Payhawk enables finance teams to reduce the time spent on manual work, get an overview of up-to-the-minute budget management and automate company spending across every payment method and type of transaction. Payhawk delivers a single, integrated solution for finance teams that can serve businesses in over 30 countries.

The new plans are available on our pricing page, and new customers can sign-up from today.

Payhawk is not a partner of Oracle NetSuite. Nothing in this text should be construed as or purports to be Payhawk announcing an official partnership or any other kind of a formal relationship with Oracle NetSuite. The contents of this blogpost reflect Payhawk's technical capability to support its customers with their Oracle NetSuite integration and by no means represent joint marketing effort between Payhawk and Oracle NetSuite.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Beyond chaos: Structured data access controls for secure expense management