How to streamline expense reporting with required expense fields

Take your corporate expense management to the next level with mandatory fields supporting better consistency and efficiency. Find out about our new ‘required fields,’ including tax rate, category, and document date, and how they can help you capture accurate expense data and maximise tax deductions.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

At Payhawk, we're dedicated to providing top-notch spend management for all our clients, big or small. We're always enhancing our features to meet your needs. And with our latest update, you get even more flexibility and customisation via your expense fields, making managing expenses even more efficient and controlled.

What are the new required fields?

Payhawk customer? Get ready to streamline your expense processes even further.

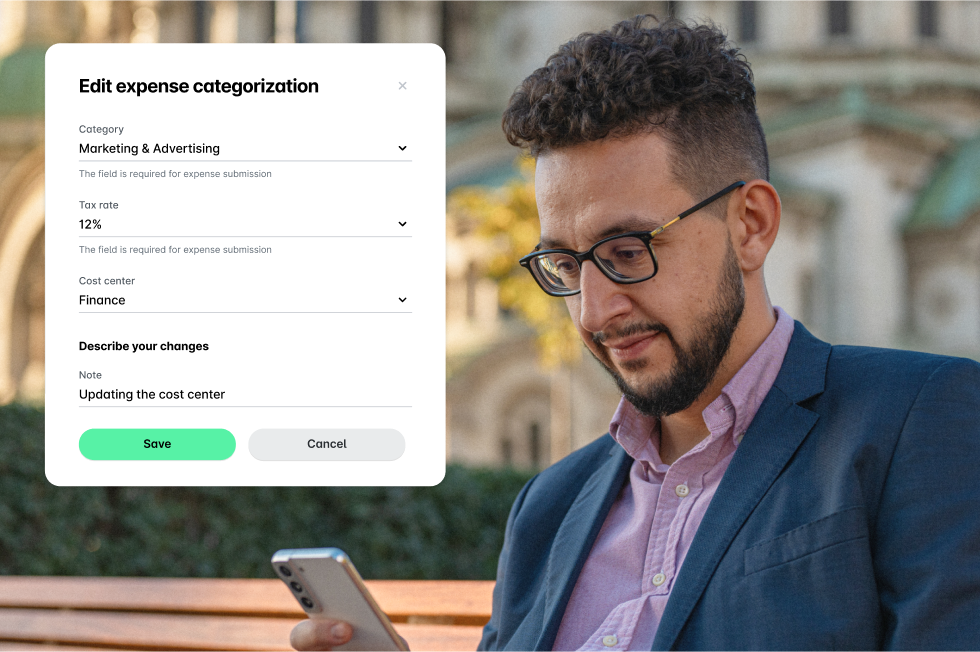

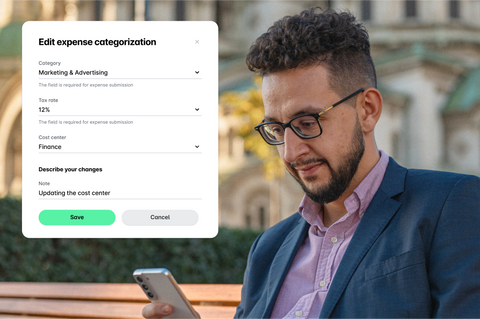

Submitting expenses and defining expense categories just got even easier (and more efficient). You asked, and we listened — and you can now make sure your expense submissions include all the necessary details with auto-required fields, like tax rate, project ID, cost centre, and more.

Even better - our customers get all these amazing features at no extra cost.

Enhancing expense management with the requirement configuration

We introduced the requirement configuration to make life easier for accounting and finance teams using our solution. Our customers can now further ensure more accurate expense data without lifting a finger.

With required fields, reporting on expenses must include vital information like tax rates before approval. No more incorrect data slipping through the cracks — instead, you get improved compliance and better uniformity across your spenders.

If you’re an existing spend management customer, you can view the fields by navigating to settings and selecting ‘expense fields.’

Making spend control even easier with Payhawk

Controlling spending is vital for business growth, so finding spend management software that adapts with you as you scale is critical. At Payhawk, our spend management platform is dynamic, helping organisations create custom approval workflows and custom expense fields so the software aligns with all their business processes even as they expand.

Automation, artificial intelligence (AI), machine learning, multi-entity management, and international payments all play their part in delivering an innovative spending solution too, learning and growing as you evolve business processes, open new entities, and trade in multiple currencies. In a nutshell, you need a solution that can do them all.

Uchenna, Finance Manager at MDM Props says:

Before Payhawk, our team was still collecting paper receipts, and if they couldn’t find them, then we couldn’t claim VAT. We spend a lot on materials for events and can get VAT bills of around £240K just for one quarter, so missing out on the reclaims was massive. Now, with Payhawk, our cardholders take a photo of the receipt, upload it to the app, and select a spend category in seconds. It’s no effort for them and can save the business thousands.

Learn more about our latest updates by visiting our What’s new page.

In her role as a Senior Content Manager, Nerissa Goedhart harbours her passion for sharing valuable insights and solutions through engaging content. This, with a clear mission to assist and empower businesses in the region by elevating their expense management.

Related Articles

Smart money just got smarter: How AI is helping move money in 2026