Inside Payhawk: Happy 1st birthday! Here is how things are shaping.

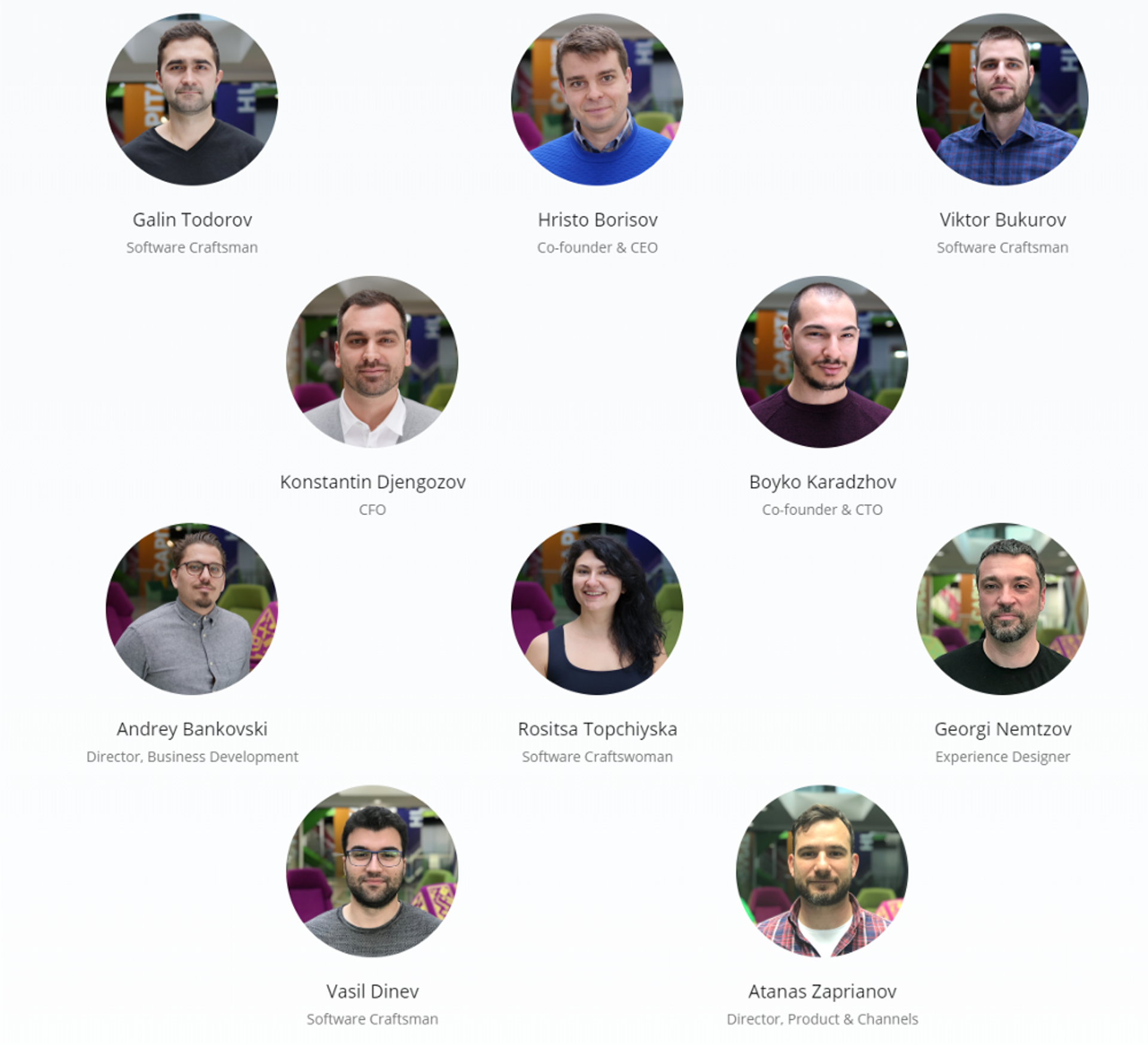

Payhawk's first year has been a whirlwind of growth and innovation. Co-founders Boyko and I embarked on a mission to build a billion-dollar business that profoundly impacts the local ecosystem and economy. In just one year, we've developed a financial product, welcomed customers from nine countries, expanded our team to ten, and launched 131 new product versions. Find out more.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Whether a business WILL become a billion dollar business or not depends on many factors, not the least luck. But whether a business CAN become a billion dollar business depends on three big factors that we wanted to architect right from the beginning: the culture, the market (timing), and the customer experience.

The culture

As Walt Disney once said, “All our dreams can come true if we have the courage to pursue them.” Pursuing your dream with a team starts by being bold enough to share it with others. Our first tradition in the company is for every new employee to share his dream. We call this Daydreams.

The purpose of the Daydreaming exercise is to describe your dream job, mentor, career, investor, company, market, workday or whatever you feel important. No commitments, no pressure, no judging, no specific format. It’s simply there to stay and remind everybody on the team what you dream for so that we can collectively strive for it. The only guidance is to start with “I dream to…”. So here is what I and Boyko wrote exactly 1 year ago.

I dream to build a company that….

- Encourages people to experiment, fail and learn every day

- Where everybody represents the company and is empowered to make decisions

- People are free to choose who to follow as a lead

- Where career level and compensation are independent

- Where every idea is equally plausible regardless of where it comes from

- Can become a billion dollar business and have a significant impact on customers, employees and investors

- Has integrity in its relationships

- Inspires and cultivates ideas

- Encourages personal growth

- Is a source of confidence and pride for its employees

- And knows how to party :)

We have been killing it except for the last one. Let's fix it this week!

Discover smarter, more scalable spend management

The market

When a great team meets a lousy market, market wins. When a lousy team meets a great market, market wins. When a great team meets a great market, something special happens.

To create a big company, you need to find a big problem in a big market. The market always comes first, because this is the only thing you cannot change. We knew from day 1 that this is something we need to nail. After two Google Design sprints and pitching the idea to 20+ CFOs from across 4 continents for 1 month, we discovered a bigger pain point for CFOs — managing all of their company expenses rather than simply overspend on subscriptions. We pivoted from a virtual card that manages subscriptions to a company card that does your expense reports.

In a digital-first world, where the definition of digital is when you enter data once, companies struggle to manage expenses and still follow super complex spending processes. We love democracy and ease of use, and we couldn’t understand why companies don’t let employees have a company card. Michael Landreth, CFO at MacStadium in the US gave us a pretty clear picture on that. There is a lack of spend control around company cards today. You simply cannot let an employee have a card and hope that he will spend reasonably. It can take up to 45 days from the day you make a transaction to the time your company reconciles a card statement and reviews the actual payment. To simplify things, most companies focus on the old school reimbursement method and lengthy expense reports. We saw an opportunity to change all that and build a company that cultivates democracy and simplifies administration.

Not to forget timing. 10 years ago it would have been hard to convince a business issue company cards without going to the bank. The neobanks revolution, PSD2 open banking initiatives, and the foray to digitize every part of the business are playing its part in the current emerging market category formation. People love to spend time on growing their business instead of dealing with administrative tasks like collecting receipts, invoices and filling out expense reports. Our goal is to create the ultimate digital banking experience for every business without becoming a bank ourselves. One where money follows the way you do business.

The Customer Experience

Everybody talks about the importance of the customer experience. We have learned a ton of customers who are a) either moving from conventional banking where it takes 5 trips to the bank to issue cards for remote employees, or b) don’t have company cards for employees as they don’t have a way to control them or c) have joined the (revolut)ion a few months ago but forgot to ask when the customer support team will also join the party. (Having zero customer support might work for consumers paying zero, but it kinda sux when your business depends on it.)

Great customer experience start with the founders. If you are not ready to be answering support calls at 8:30 am on Sunday and prioritize customer conversations to investors relationships, you have already failed the business. But this is table stakes. Getting a UX architect is too. So we have taken two extra steps to ensure that our customer and product experience is top notch.

We don’t hire Customer Support

Everybody is responsible for handling incoming customer requests. Our definition for great customer experience is the ability to know that there is a problem before your customer has contacted you. Only 1 in 10 customer problems get reported to support, so it’s important for us to be proactive and reach out to customers if we have received an error related to a customer.

“Hello there. I am calling from Payhawk. We just noticed that your company registration didn’t go through because we have messed up the Czech Republic VAT numbers, can you please try again in 10 minutes? There is also a free month waiting for you once you complete your registration. Thank you.”

When you are developing a financial product, your customers are expecting that you are at the top of your game when it comes to quality and customer experience. Failing in any of these departments might kill your business.

We don’t hire Quality Assurance (and DevOps engineers too)

Everybody is responsible for the quality of the code he writes. Understanding the business requirements, and how the product should work is the responsibility of every developer. You cannot make excuses that your product manager hasn’t provided you with a checklist of scenarios, or that the QA has missed something after you dumped him with a bunch of vaguely written Trello cards for him to check.

No DevOps engineers too. Developing a modern SaaS product involves having an understanding of how your code will act in a clustered environment, behind a load balancer or a firewall or in an asynchronous event system. Simple.

For many more to come!

I can tell you that we definitely learned and failed a ton! To all employees, customers and investors who are with us on this journey — hold on! We are just getting started :)

Update: The journey continues - here is what we've learned in 2 years Payhawk.

Hristo is the compass guiding Payhawk's journey. With a rich background in engineering аnd product management he is a stalwart advocate for our products and customers, bringing a mix of innovation and user-centricity to everything we do. Outside the office, you'll catch him enjoying camper and sailing trips, shredding slopes on his snowboard, or simply soaking up precious moments with his family.

Related Articles

10 key takeaways from SuiteWorld 2025: What they mean for system integrators