Learning from B2C to provide B2B seamless expense management process

Payhawk's CEO Hristo Borisov highlights the potential for seamless B2B expense management, inspired by B2C models like Apple Card. Currently, B2B processes involve time-consuming manual expense reports, and lots of paper but Payhawk envisions a streamlined solution htat leaves these in the past.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

As Dion Lisle often says: Digital is when you enter the data once. In the B2B world, we are not there yet.

A 2016 study in the USA and UK found out that 41% of corporate travelers spend between 30min and 2 hours manually doing expense reports per one business trip. As Director Product & Channels at Payhawk I constantly talk to companies about this very same topic. In the SME sector, the numbers rise up to 80%.

Instead of following up on sales leads or executing on new learnings, highly paid professionals are investing their time in low-level admin work. Moreover, this is only the beginning of this corporate process chain. Think about the handover to the accounting team and them chasing the missing invoices. Think about the handover and data normalizing for the controlling team. Enormous amounts of resources are wasted.

For a person with a software product background, this is a very frustrating situation. All the data is already there in a digital format. It is just not used. And it constantly changes its medium from digital to paper and from paper to digital as it flows from supplier to client and then within the company from one department to another.

Thinking about how such a seamless process can be achieved in a B2B context, I look for inspiration in the B2C world and its developments.

Seamless payment/expense process in B2C context

In March of this year, Apple presented the Apple Card. A great post from Brian Roemmele explains the strategic narrative behind this product. Hristo Borisov visualized the mathematics of the business model behind the card. Both of them touch the concept of data privacy. Brian talks about not sharing card data with other companies for marketing needs as a selling point. Hristo explains the need for scoring, the representation of the creditworthiness of a person or company for the bank. The goal of the scoring is to minimize credit defaults. The more data a scoring company has the better it can predict which customers will bring it the most value. By not sharing data, Apple secures a competitive advantage for itself.

With the announcement of the AppleID we have the same discussion. On the one side, people are pointing at the privacy feature, especially in comparison to Google and Facebook. On the other side, Rafael Otero clearly shows that Apple wants access to more data (link in German). Again, the idea is to increase its competitive advantage.

There is a third very interesting announcement. It has not seen a lot of publicity yet. The update to the Core NFC framework for iOS 13 includes support for reading passports and ID documents' data.

If we exclude the data-as-a-competitive-advantage topic, the first two announcements have the potential to change whole industries. Combined with the third, however, the potential for change increases manifold.

With an Apple Card and an AppleID I can sign-in and pay in a seamless way for a lot of services. Remember all the times you had to enter your personal data and your card information — taking a taxi/shared ride, renting a car, booking a hotel/trip. Now you can do this with just one click. Add your passport ID data into the picture and you will be able to subscribe to a telecom service, changing your electricity/gas provider, open a new bank account, pay your taxes, etc.. All of the data entry gets eliminated. All stakeholders get the data or service they need. Hence, this is a truly seamless experience for the end customer.

The current state of the seamless process in B2B context

The current state of “a seamless” customer process in B2B context can be divided into three levels.

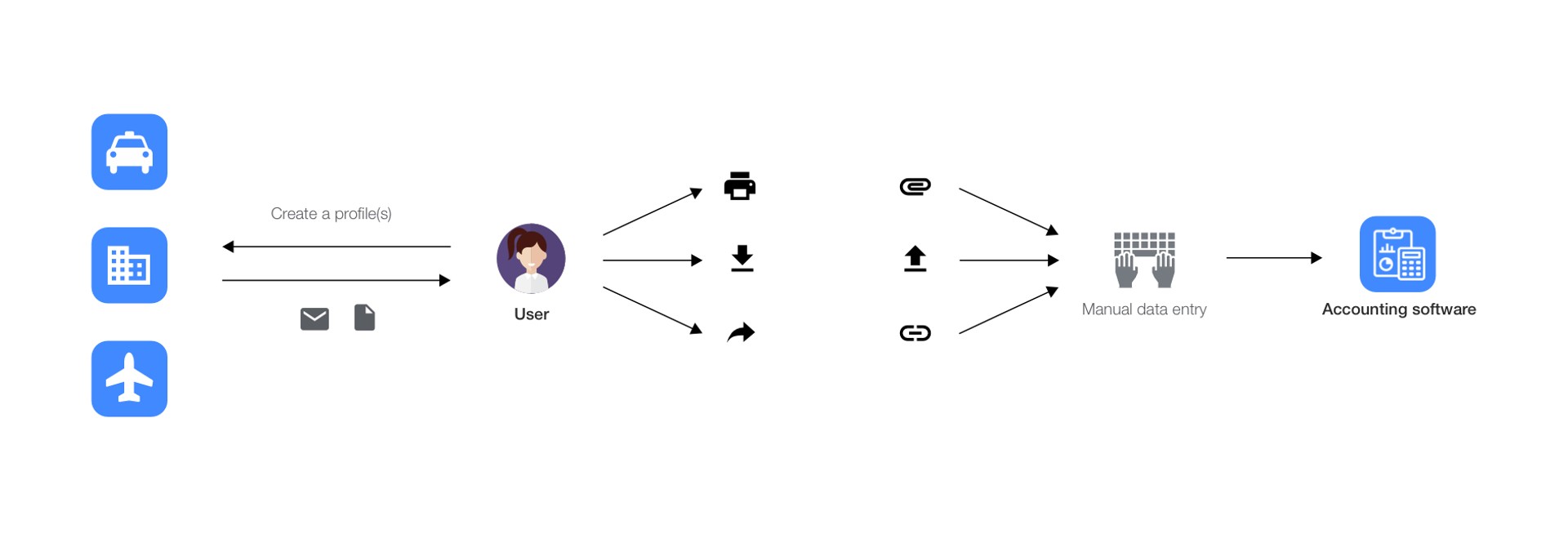

1/ Level: E-mails

Talking to a lot of heavy travelers, they are super happy that taxi apps, hotels, and airlines send them the invoice per mail. That way they don’t need to deal with paper receipts or invoices during their travels. They don’t need to scan them for their expense reports. They “just” need to download them and attach them to the report. Some go as far as that they automatically forward the mail to a different system, which does the scanning (data extraction) of the data. From here, the paper or digitized invoices are given to the accounting team for the (manual) bookkeeping.

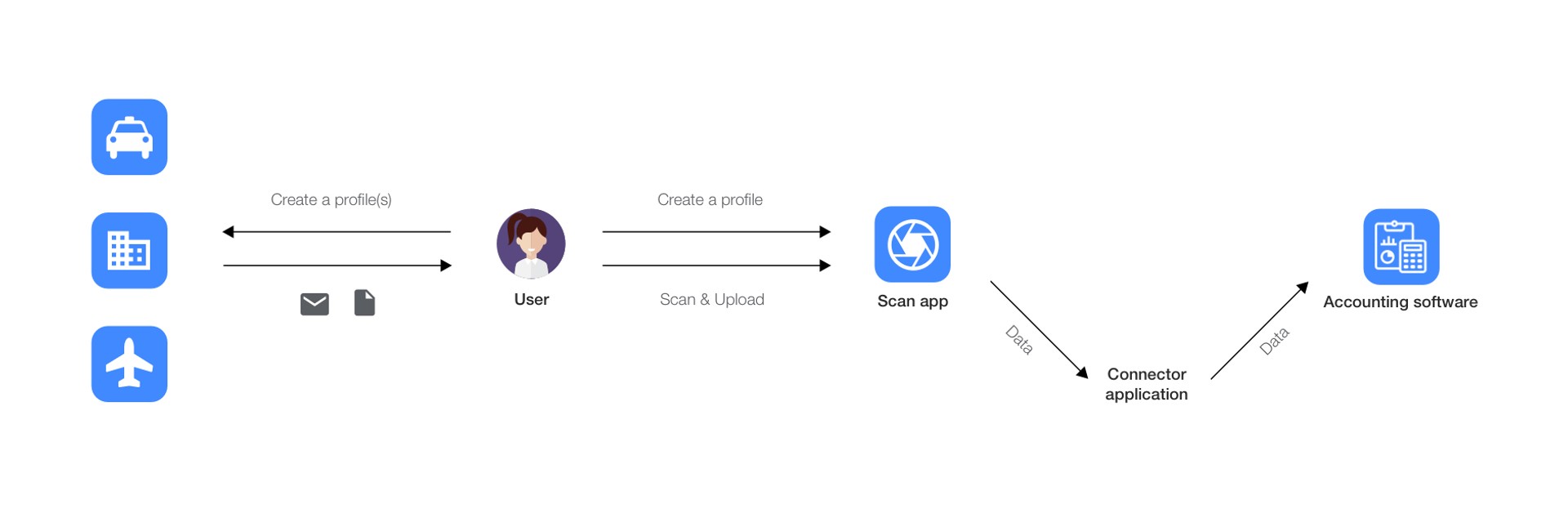

2/ Level: Integration over 3rd party

Products like CData enable developers to link different software services used by a company. In our example case, the traveling employee can use a scanning app on their smartphone. The company’s IT can create a 3rd party connector. Then a link between the scan app, the connector and your company’s ERP will enable a direct transfer of the scanned data between the services.

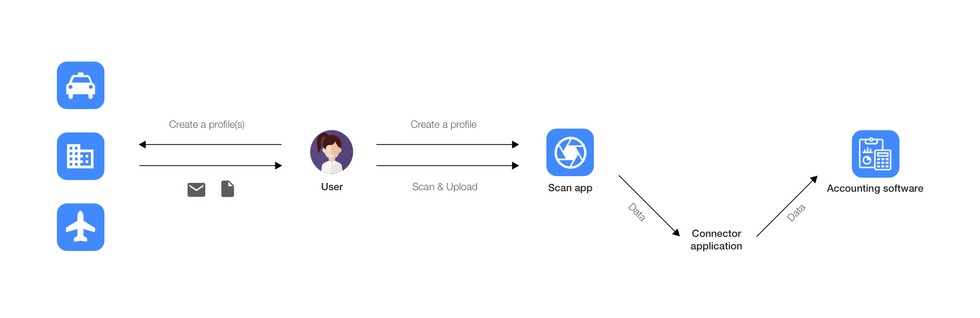

3/ Level: Direct integration

The most direct way of sharing data is a one-to-one integration between two software services that your company uses. For example, the employee pays with a Payhawk smart corporate card. Scans the receipt or the invoice and categorize them. Through direct integration, the data flows straight to the company’s ERP or accounting software and the bookkeeping is done automatically.

Although these integrations options are already better than a paper or excel based workflows with manual data entry, they are not seamless. In all of the above cases, the company has to create a profile for itself and for its employees and enter its payment information in all of the services. Using Dilon’s definition for digital neither of these use cases is truly seamless. Moreover, achieving direct integration is also related to the highest development and maintenance cost and effort.

Can a seamless process be achieved in a B2B context?

On a recent panel on the topic of “Digitalizing the urban landscape” the CPO of Wirecard Susane Steidl together with executives from BMW, Daimler and Accenture talked about the need for a seamless customer experience powered by the data from the payment provider. Talking about the future Ryan Campbell from Discover presented different use cases where this scenario can increase the added value for all stakeholders. He emphasized the point that such customer experience should be the goal in a B2B context too.

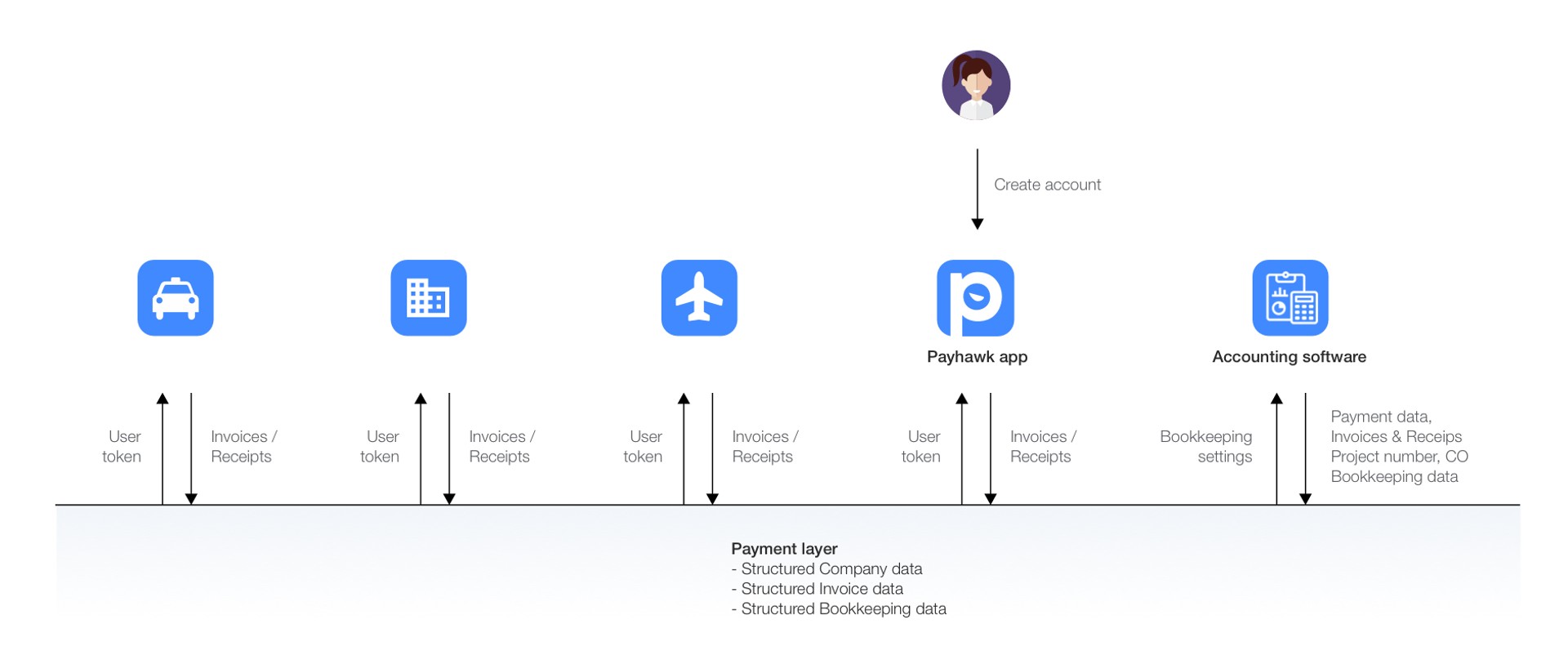

An approach based on the current payment provider data solves the identification and payment information problem. In order to issue a corporate card, the company undergoes a KYB (Know Your Business) process. The result is 1/ all the data needed in a B2B context like company name, VAT number (in the EU), etc. and 2/ verified existence of the company, which adds an additional level of security. This will make it possible to click on a button and directly use a new service.

For the business front-end, the traveling sales teams, such a solution enables a B2C like seamless processes. However, the company’s backend, the accounting, and controlling teams, still have to deal with interrupted data flows and manual processes. In order to solve the B2B process chain holistically, we need two additional layers of information.

The company’s taxation is based on the invoice data and its bookkeeping interpretation. Hence, a connectivity layer should go two steps further. It needs to provide standardized invoices and bookkeeping data structures. This will open up the communication between all B2B services. Instead of having to integrate with every provider separately, a single sign-in to the connectivity layer will enable access to a fast array of integrations and structured data.

Imagine the following scenario: As an employee, you have a corporate card with Payhawk. You open the MyTaxi or Uber apps. Click on a button and that’s it. You don’t have to manually enter any additional information. After your trip, you just confirm the sum to be paid. The invoice flows directly into Payhawk’s platform and is automatically prepared for your accounting and controlling teams. After their check, it transfers into your ERP and the bookkeeping and basic controlling are done automatically. No more low-level admin work. No more repeatable, manual work. The company can save up to 200k USD and increase its productivity by 300%. All stakeholders can focus on growing their businesses. Or spending more time with their families and hobbies. I am looking forward to this future!

Hristo is the compass guiding Payhawk's journey. With a rich background in engineering аnd product management he is a stalwart advocate for our products and customers, bringing a mix of innovation and user-centricity to everything we do. Outside the office, you'll catch him enjoying camper and sailing trips, shredding slopes on his snowboard, or simply soaking up precious moments with his family.

Related Articles

10 key takeaways from SuiteWorld 2025: What they mean for system integrators