Payhawk expands Marqeta partnership to tackle fraud with Advanced Card Controls

Payhawk, the global spend management solution, has expanded its partnership with Marqeta, the global modern card issuing platform powering some of today’s most innovative embedded finance solutions, to tackle fraud and the misuse of company funds using Advanced Card Controls.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

This article first appeared as a Press release.

The news

- Enhanced fraud prevention: Payhawk and Marqeta's Advanced Card Controls combat fraud and ensure compliant corporate spending across 32 countries

- Robust spend controls: Payhawk's Visa business cards now feature sophisticated spend controls, including vendor restrictions and spend caps, powered by Marqeta

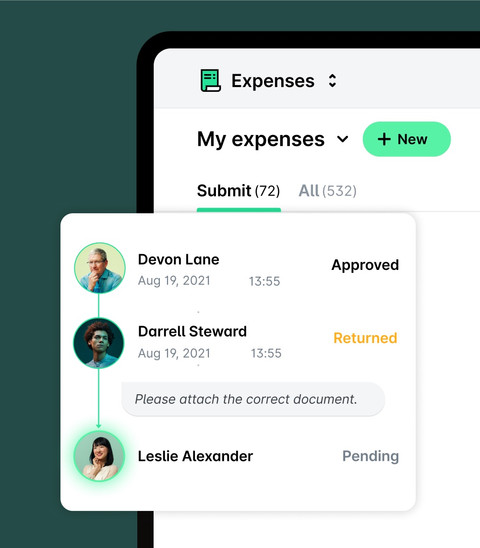

- Streamlined expense management: This collaboration supports easy spending policy enforcement, boosting security and efficiency in corporate expense management

London, UK, 7th August 2024 – Payhawk, the global spend management solution, has expanded its partnership with Marqeta, the global modern card issuing platform powering some of today’s most innovative embedded finance solutions, to tackle fraud and the misuse of company funds using Advanced Card Controls. The new capability is available across all 32 countries served by Payhawk where it operates its premium Visa debit and credit cards. This marks the next step towards corporate expense management that is safe and convenient in equal measure.

Unlock flexible financial controls with Payhawk

Businesses face an uphill battle to ensure that all company spend is compliant spend. Despite having meticulously mapped out spend policies, many finance teams lack the means to monitor and enforce them effectively, and face vulnerability to fraud.

In comparison to traditional providers, Payhawk’s smart Visa credit and debit business cards come with in-built spend control policies and automated approval workflows. These advanced controls were created to give finance teams control over spending without hampering employees’ access to the funds needed for efficient operation and growth. Powered by Marqeta, they make it much easier for companies to empower employees to spend in a way that aligns with policy and corporate objectives. Combating fraud, ensuring compliance, and increasing operational efficiency has never been easier.

Now, companies using Payhawk’s smart cards can set additional controls, including restrictions on vendors, merchant categories, time and day, and country and region, as well as regulating spend caps, ATM withdrawals, online payments, and fund requests. These innovations are enabled by Marqeta, whose expert collaboration has accelerated the drive towards integrated smart card management.

Hristo Borisov, CEO and Co-Founder of Payhawk, says:

Payhawk’s product collaboration with Marqeta makes it easy for businesses to implement sophisticated card spend controls on debit and credit cards issued in 32 countries. We're committed to continuously developing new technology providing rich customisation options without compromising on user experience. Our cutting-edge Advanced Card Controls make it easier than ever for finance teams to ensure all card spending is compliant.

Marcin Glogowski, SVP, Managing Director Europe and UK CEO at Marqeta, says:

Tracking and managing employee expenses accurately is a critical part of every business, but it’s also a potential vulnerability. At Marqeta, through the use of open API’s we create customised card products on demand with dynamic spend controls that fund expenses in real-time to minimise fraud and manage employee purchasing power. Our partnership with Payhawk showcases the future of corporate expense management which will be built on robust fraud prevention, compliance, efficiency, and seamless customisation.

Learn more about Payhawk’s advanced card controls and policy-compliance-boosting features and advanced card controls.

The Payhawk Editorial Team consists seasoned finance professionals boasting years of experience in spend management, digital transformation, and the finance profession. We're dedicated to delivering insightful content to empower your financial journey.

Related Articles

10 key takeaways from SuiteWorld 2025: What they mean for system integrators