State of business spend management 2024: Survey highlights

Labour-intensive spend management tasks are history. Modern digital tools can transform spend management manual work and replace traditional expense management with instant spend control and oversight. We asked business leaders and finance pros from the UK, US, Netherlands, Spain, and France about their main spending goals and hurdles and their plans to enhance financial control and flexibility in 2024. Here's what we found out.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Background and about the research

The Pulse: Spend Management report was conducted with IFP and surveyed over 100 US and UK senior professionals across more than 11 industries. The results provide an overview of corporate expense management today and in the future. (None of the professionals surveyed is an existing Payhawk customer.)

These results are complemented by more granular findings from three surveys, conducted with YouGov, that targeted around 800 financial professionals in the Netherlands, **France**, and Spain.

Download the full IFP Spend Management Pulse Report

Human error, reconciliation time, and ineffective software named as top spend management challenges

Human error is the most common challenge in spend management, according to 106 senior finance professionals. With 29% of respondents at companies of all sizes say they're wrestling with this.

Problems with human error are closely followed by time wasted on reconciliation and ineffective software, both at 28%.

The top three challenges show plenty of room for improvement in how businesses choose and stick to technological solutions. As finance teams can easily tackle human error, remove ineffective software, and speed up reconciliation with modern spend management tools.

Here’s a breakdown of spend management challenges by company size:

From the employee perspective, operational tasks strain finance teams, which has a direct connection to the challenges mentioned above. In the Netherlands, tasks such as recording invoices, managing employee expense notes, reconciling corporate cards, and reviewing receipts takes 42% of the workday (on average). And it's telling that 90% of these employees believe that their daily work could be streamlined with better digital solutions and processes.

Meanwhile, Spanish respondents (72%) estimate that their company wastes up to 30 hours on manual tasks every month. Another 24% estimate the waste to be more than 30 hours, while only 4% do not see any time wasted in this respect.

Concerns about corporate spending but trust in spend management

Employees have clear concerns about the amount of corporate spending: 36% of US and UK respondents are very or extremely concerned about this, whilst just 8% are not concerned at all. Still, 51% of respondents rate their organisation’s spend management effectiveness as very good.

While this statistic is relatively positive, there's still a gap between controlling spending efficiently without wasting time. Clearly, in 2024, many companies want to continue prioritising spend control. However, they should also prioritise faster, more error-free, and efficient reconciliation to save time so they can focus on strategy, growth, and cost-saving initiatives.

Regarding approval types, we can see some disparity across the different types of expenditure. Companies use pre-approved manager verification for operational spending in 66% of cases. Meanwhile, the primary method for post-expenditure approvals (or employee expense reimbursement) is still manual approval in 41% of responses.

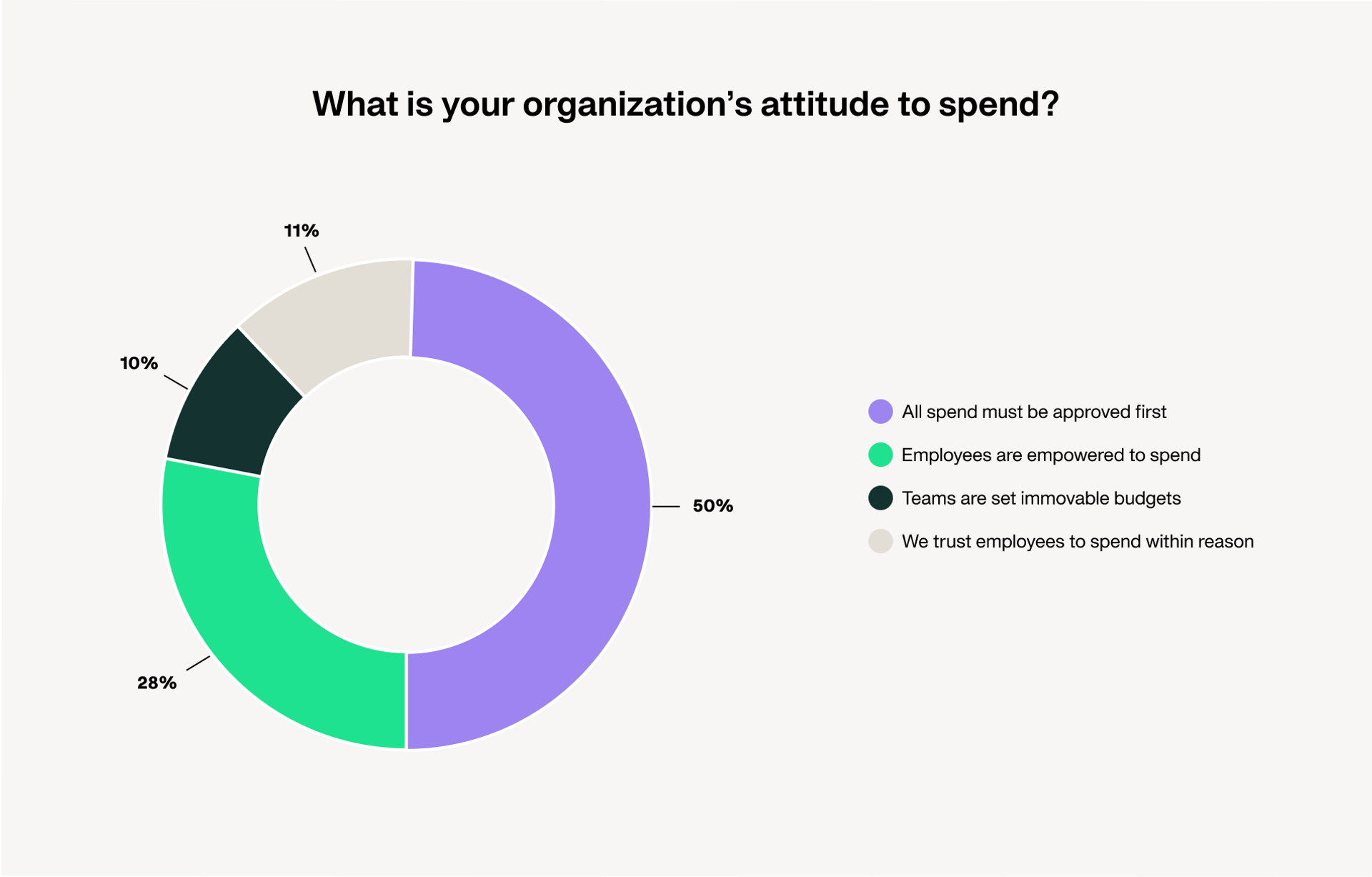

Attitudes toward spend

The Pulse Spend Management Report shows that companies still today prefer spending to be approved first, whilst a minority empowers employees to spend using only their own 'consideration'.

- 50% of organisations require that all spend must be approved first

- 28% empower employees to spend more or less freely

- 11% trust employees to spend within reason

- 10% of teams have immovable budgets to manage their spending within

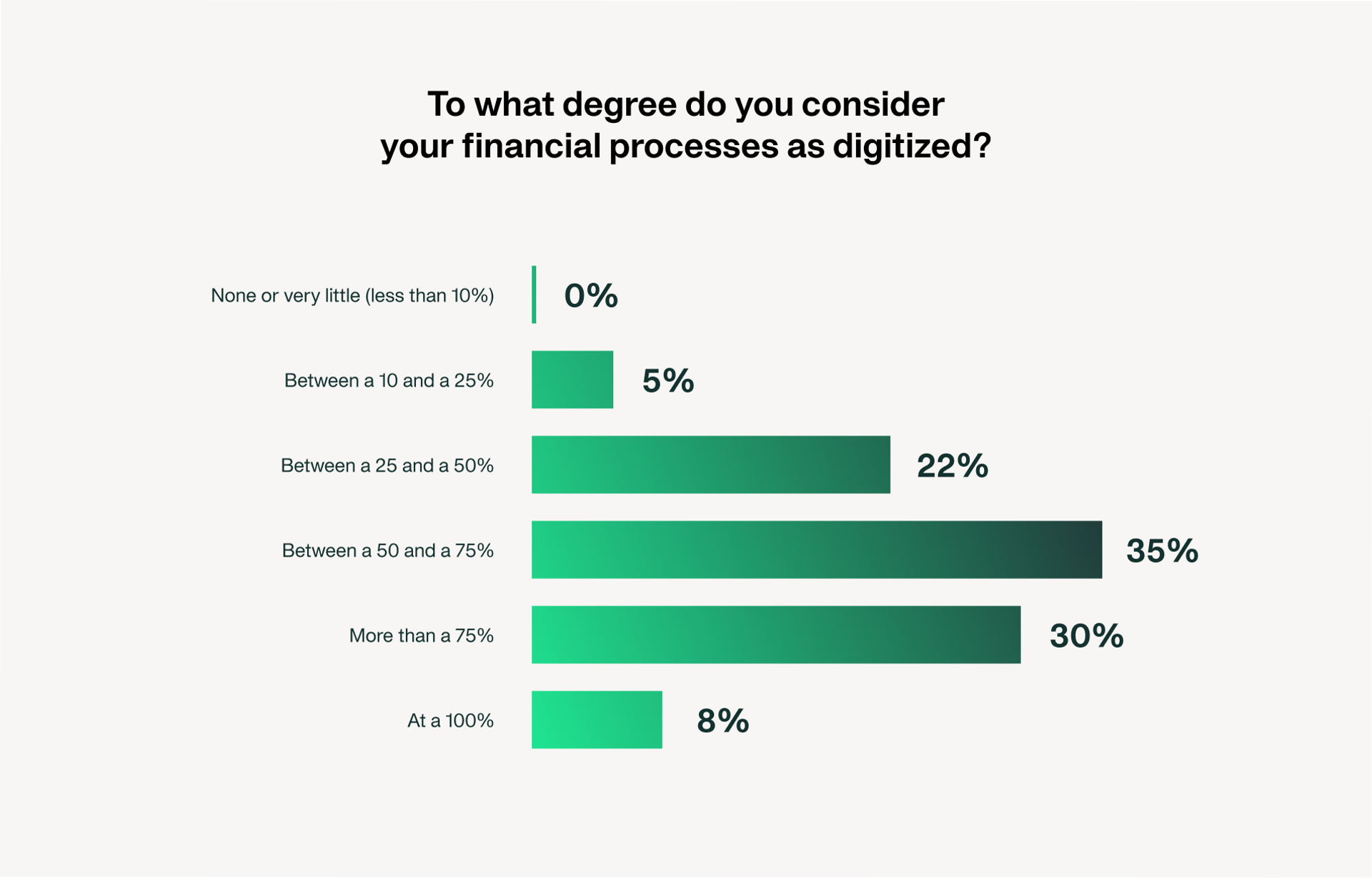

Digitisation of finance processes moving forward, but still some ground to cover

Finance pros from the Netherlands, Spain, and France mentioned progress in digitising financial processes, reaching about 50-75% on average. However, both leaders and slower adopters exist in each market, and there are differences between countries as well.

In the Netherlands, 39% consider 50-75% of their processes digitised. 29% are even more advanced, stating a 75% or higher digitisation rate.

In Spain, finance managers are more advanced — or at least more confident — as the answers lean towards the top end of the spectrum: 35% estimate a 50-75% degree of process digitisation, and 38% estimate it to be 75% or more.

The below image shows the distribution of Spanish responses to the following question: To what degree do you consider your financial processes as digitised? (n = 257)

Based on the survey results, France has some catching up to do. The French respondents most commonly estimated that about 25-50% of processes are digitised (33%), 20% rate their digital process coverage between 50-75%, and only 13% say it is more than 75%.

Spend management priorities vary by company size

When asked about top improvement priorities, US and UK respondents shared a long and even list of topics on their table. Some of the key priorities include:

- Forecasting future business spend

- Improving data verification

- Analysing spend data

- Reducing manual processes and human error

- Centralising expense data

The priorities vary considerably by company size. Improving data verification is a leading hot topic for small companies (49%). For medium-sized companies, analysing spend data climbs to the top (47%). And for large companies, forecasting future spend is number one (46%).

Investments expected to increase spend control and efficiency and to mitigate risks

By investing in new tools and initiatives, US and UK organisations are hoping to achieve better internal spend control (43%), improve efficiency (43%), and minimize risk (40%). In general, investing in spend management is seen as a way to secure a stronger financial future.

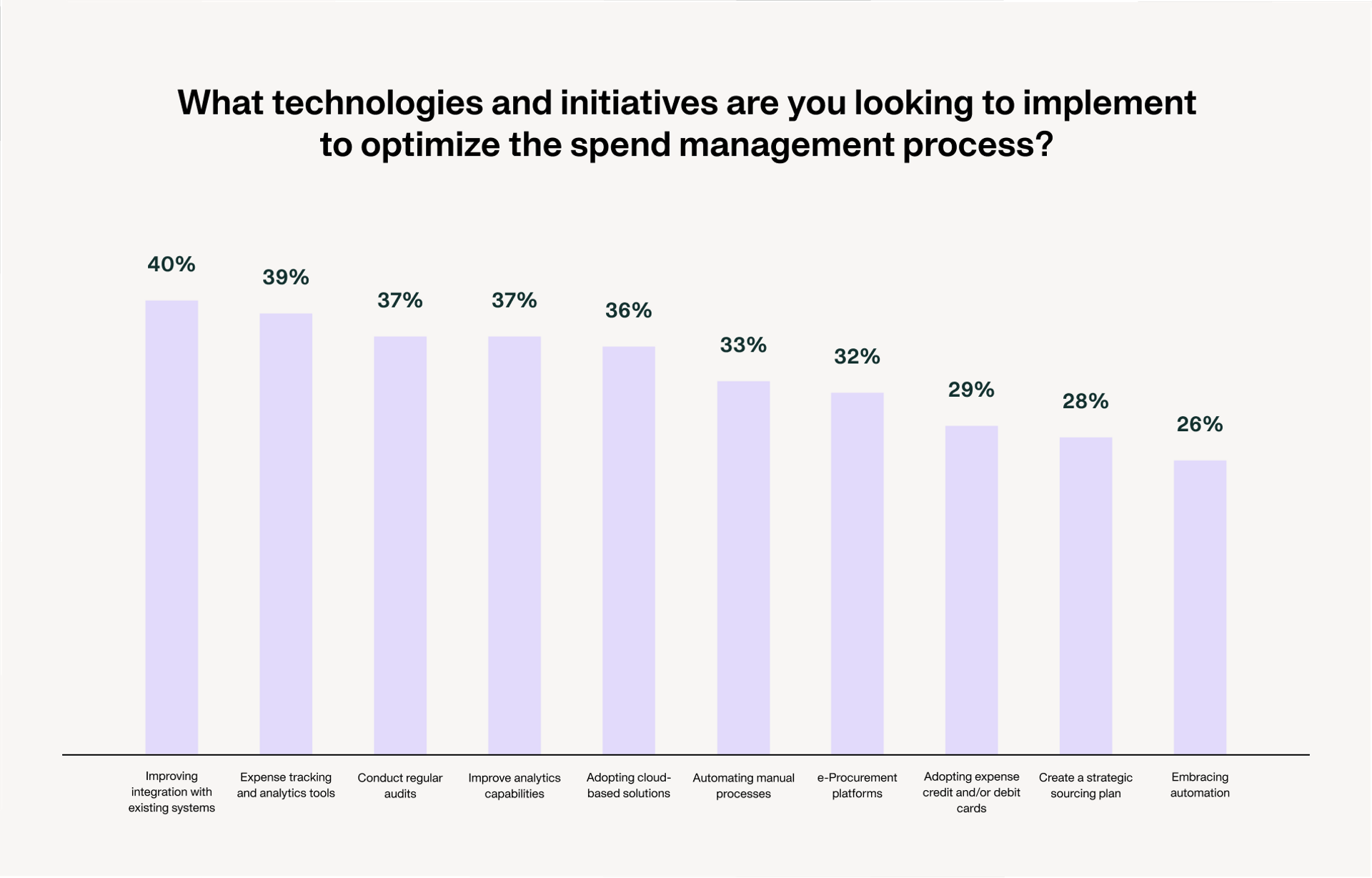

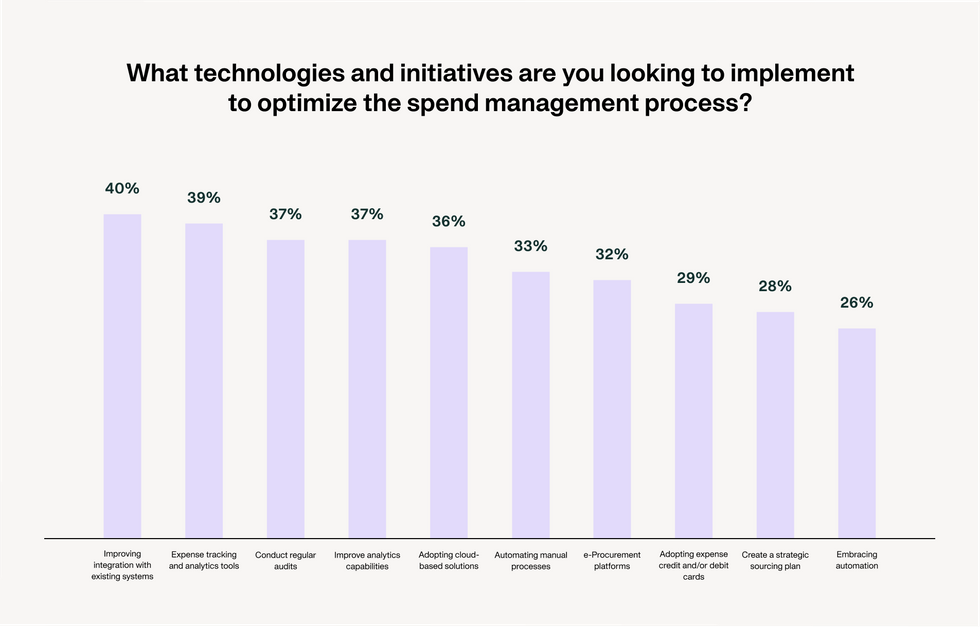

Respondents often agree that streamlining financial processes with technological solutions like expense report automation is an effective way to tackle several prominent spend management challenges. Leaders mention the following tech-related initiatives:

- Improving integration with existing systems (40%)

- Expense tracking and analytics tools (39%)

- Improving analytics capabilities (37%)

- Adopting cloud-based solutions (36%)

- Automating manual processes (33%)

What the future holds for corporate spend management

Our studies show that finance teams are on the right track and motivated to help their organisation remain competitive by improving spend management with digital solutions. Business leaders and finance professionals agree that spend management is both a) a priority and b) something that needs to be modernised and improved by technology.

One critical theme that didn't arise explicitly from the survey results but lends itself to the technology story is the second wave of digital transformation for finance teams. Many finance teams may have 'digitally transformed at some point and, as such, started using one tool for corporate cards, separate expense management software, different PO software, and more — without realising they could access a solution like Payhawk to get all of these features in one.

The combination of corporate cards and expense management in modern spend management solutions is something that can bring significant efficiencies and stability to especially medium and large companies, saving time, reducing effort, and improving control and visibility.

Another essential tech-linked factor for finance teams in 2024 is ESG. Although our spend reports focus on spend management and control, we want to highlight how finance teams can also track their company's carbon footprint by spend using the right technology.

With new ESG rules and regulations rolling out globally in 2024, it's never been more important to focus on this. Read more about how expense management can help reduce your carbon footprint.

For more detailed data and insights, download the survey reports here:

The Pulse: Spend Management in the US and UK

Spend Management Survey - France

Ready to take control of spend in your organisation? Learn how our spend management platform can help you - book a demo today.

The Payhawk Editorial Team consists seasoned finance professionals boasting years of experience in spend management, digital transformation, and the finance profession. We're dedicated to delivering insightful content to empower your financial journey.

Related Articles

Pennylane Integration: Why to connect with a spend management platform