Five types of invoices and when to use them

There are many different kinds of invoices, and they’re used for various reasons. So which ones do you, as a mid-market or SME Finance Leader, use the most and what exactly are you required to include in each one, and what kind of billing is acceptable?

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

What’s an invoice?

In short, an invoice is a demand for payment. A legally enforceable document that details what someone must pay, what for, who to pay, and when.

People may wrongly tell you that Purchase Orders, Quotes, and Statements are invoices, but in accounting terms, and more importantly, legally, they aren’t.

What is an invoice used for?

For the payee (ins) , an invoice is used to make a legal demand for money following your terms of business and any contract you have with your customer. But they can also be used to itemise work done or report on project progress.

As long as you’ve covered the legal requirements, you can include pretty much anything you want on your invoice.

It’s best practice to include your customer’s purchase order (PO) number and the name of any purchasing manager. If you’re producing stage payments, include the project, contract, job name, or number.

It’s pretty obvious, but don’t forget to include your bank details or method of payment as if your customer can’t easily work out how to pay, then they normally won’t.

You should aim to include any and all of the information that will help your customer’s Accounts Payable department and stop any delays to payment.

For the payer (outs), the invoice is an official agreed-upon document detailing who and what you must pay. You should expect any invoice to describe exactly what you’re paying for, too, ideally in an itemised way to help manage spending with more granularity.

Remember to always check for the payment terms, as these will let you know exactly when you need to make payment.

Pre-approve spending and streamline procure-to-pay

Five main types of invoices with examples

If you’re re-familiarising yourself with invoice types, then a good starting point for any business is to say that they fall into two simple categories: ins and outs. In other words, the “ins” are invoices you send to your customers and “outs” are invoices that your suppliers send to you.

You have a great deal of leeway when you’re thinking about how you will invoice your customers, but you also have some opportunities when you’re being charged by your suppliers.

Let’s ignore the legal requirements for a moment (they’re dealt with below) and think about any of your invoices going “outwards”. You must set up your invoicing to match your terms of business which you decide.

For example, some companies might only ever do work once they have been paid in full, some might send goods on 30-, 45- or 60-days credit, and some might do some work on a project, send an invoice for what has been completed and then send another for the balance once the job is finished.

1: Pro Forma Invoice

The starting point here is to decide how you want to run your business, what your needs are, what risk you’re prepared to accept — and then set your invoicing policy to match.

If you have challenging cash flow, your industry is a risky one, and you need to pay for your goods quickly then you may choose to invoice before handing over any goods or doing any work (called the ‘point of supply’ by the taxman). Typically this will be done with a pro forma invoice. In other words, you send the invoice and only finish what you need to for the customer when it’s paid do you do.

2: Credit-invoice

If you do a lot of work in B2B then often, you’ll find that its customary to send an invoice after the point of supply and give people time to pay. A ‘Credit Invoice’ assumes that the customer will pay you within or on the credit period. This again can be chosen by you.

If you do mainly cash or credit card sales at the point of supply, such as in a cafe or petrol station then you’ll probably issue what most people know as a receipt but the taxman calls a less detailed invoice.

3: Staged Payment Invoices

Companies that work on long projects or that have to pay out for materials in advance like builders, project managers, or engineers might send invoices periodically as the job progresses. Staged payment invoices will show the exact items being charged for, and what overall job it relates to and may include a running total of payments made.

4: Recurring invoices

Recurring invoices are beloved by companies that provide the same service at periodic intervals. A good example here would be software subscription management, which involves monthly billing and takes a direct debit payment a few days later.

5: Composite Invoice

And if that wasn’t enough invoice types for you then you could end up sending a composite invoice that includes some items paid for in advance and some after they’ve been received. The most common example of this would be an electricity bill that has a standing charge (advance) and a usage element (arrears).

Although we mainly looked at outgoing sales invoices above, if you’re actually in a sales process with potential suppliers you can also ask about tweaking your ongoing supplier invoice management.

You can ask them to bill you in stage payments for example, or if you need longer to pay. The worst they can do is say no.

In essence then, different types of billing drive different types of invoices. So, it won’t surprise you that there are some legal requirements regarding what to include on an invoice.

What data to include on invoices? Legal requirements

For any invoice you must include:

- A unique invoice number

- Your company name, address and contact information

- The company name and address of the customer you’re invoicing

- A clear description of what you’re charging for

- The date the goods or service were provided (supply date)

- The date of the invoice

- The amount(s) being charged

- Your VAT number (if you’re VAT registered)

- VAT amount if applicable

- The total amount owed

Sole traders have to include their own name as well as any trading name or trading style they use together with a document service address.

And limited companies have to show the company name as registered with Companies House in their invoices. They don’t have to include the names of their directors but if they do then they must include all of them.

You can find the HMRC guide to invoicing here as well as an explanation of less detailed invoices.

Mid-market and SME invoice processing challenges

For SMEs, the challenges in invoice management largely depend upon size and complexity.

With larger and mid-market businesses that have more defined purchase order processing and delegation of authority, the invoice approval workflow can be fraught with errors and take a huge amount of time.

And finally for SMEs, invoice processing can be incredibly tiresome and inefficient if you don’t have a suitable and cost-effective method of dealing with the sheer amount of admin involved.

Simplifying accounts payable with procure-to-pay processes

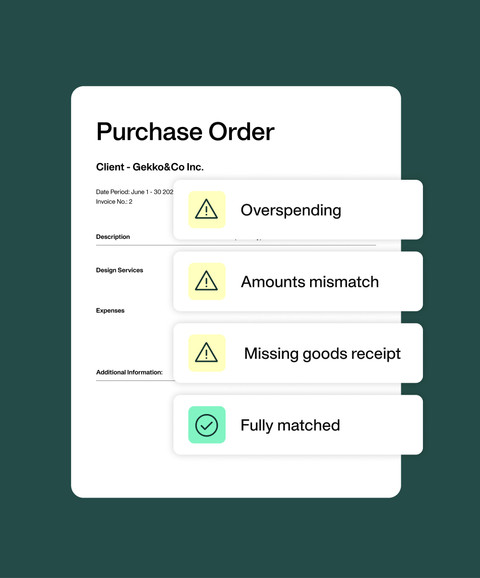

Automated procure-to-pay features empower your business (and save you time) by proactively approving spending via purchase orders before it even happens.

At Payhawk, our purchase order features let you:

- Effortlessly capture and process invoices with minimal manual fuss

- Say goodbye to unnecessary back-and-forth while maintaining control and visibility

- Avoid overspending and costly mistakes.

- Centralise all your payments, managing them conveniently in just one place

- Break free from the hassle of stitching together spreadsheets and statements

Watch a full review below.

Summary: Invoicing is a mixed bag

Invoicing boils down to the process of getting paid — or paying on time — for completed work. While best practice dictates that suppliers include information that will be useful for customers to identify what they are being asked for and why.

There’s also a list of things that suppliers must include as a legal requirement on your invoices, and you should check for as a payer. Plus, remember that when you’re being charged for goods or services by your suppliers, you don't have to just accept their invoicing terms. See if you can’t negotiate extra time to pay or get the invoices sent to you in a way that makes it easy for you to process.

Want to learn more about simplifying invoice management, leveraging PO, and more. Book a personalised demo today.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Pennylane Integration: Why to connect with a spend management platform