Six key ways to manage your IT budget

As digital transformation continues to top the priority list for C-level execs (and for good reason), tech is the driving force behind real change. But how can you keep your IT budget in check while making big moves? Let's dive into smarter ways to manage it and take your tech strategy to the next level.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Technology is a major driver of better business decisions and streamlining outdated processes, so it's no surprise that tech budgets have grown significantly in recent years. In 2020, tech budgets averaged 4.25% of company revenue. Fast-forward to 2024, and that number has jumped by 37% to 5.85%. This shift shows just how crucial technology has become in helping businesses stay efficient, agile, and ready for the future.

The same study found that 60% of executives have difficulty measuring their tech investments' ROI. This often gives tech spending a bad rap, making it seem overly complex and costly — cue the budget scrutiny.

But in today's world, where almost every business runs on some form of IT, the real challenge is how to manage that budget smartly. How can you get better visibility into where your tech spend is going and make sure it's being used in the right areas? Let's dive into some practical ways to stay on top of it.

What do IT budgets include?

You’re probably well aware that IT budgets cover a lot of ground, from computer systems and antivirus software to productivity tools. It’s the backbone of your business, touching everything from finance and marketing to sales and production.

Every department relies on some form of IT to get their work done, whether processing orders or managing tasks. So, this is just a quick reminder to keep a close eye on those IT costs and ensure you're budgeting smartly. After all, no one wants to be caught off guard by surprise subscriptions or system expenses that add up over time.

Why IT budget management is crucial

Your IT budget is at the core of your digital transformation journey, which is critical for businesses looking to boost productivity, streamline efficiency, control costs, and meet evolving customer expectations. But what powers all of this? The quick answer is digital infrastructure — those software packages, systems, and technologies — all of which fall under your IT budget.

With so much investment in IT, it's easy to overspend, so keeping a close eye on those budgets is crucial. It helps you stay on top of where your money is going, when it's being spent, and whether it's aligned with your strategic goals.

Tracking your budget gives you the insights you need to make smart business decisions, optimise resources, and set yourself up for long-term growth.

Six strategies for better IT budget management

Budget management is tricky, so where should you start? Here are six strategies you can implement for better IT budget management.

1. Review your current IT budget

Where are you currently spending your money, and who’s spending it? Analyse current IT spending before you implement new strategies. Check if you’re overspending excessively in some areas and perhaps not investing enough in others?

Reviewing both hardware and software costs is essential to getting a true picture of IT spending so you can move forward with a clear plan of action. Reviewing your current IT budget can givr you a holistic awareness of spending.

2. Establish spending priorities (including cyber security)

Cyber security, for example, is an area of IT you won't want to skimp on. With data breaches costing companies millions of pounds each year (not to mention the reputational damage left in their wake), robust security measures, reducing fraudulent expense claims, and other safety measures should be non-negotiable.

Ensure your spending priorities align with the overarching business goals. If spending isn't necessary or helping the organisation achieve its objectives, then it shouldn't be considered a budget priority.

3. Assess and consolidate current subscriptions

Assess recurring subscriptions and contracts — is there an alternative vendor you could switch to to cut costs? Or perhaps a chance to renegotiate a long-term vendor contract? Use expense management software and subscription management to quickly analyse current subscriptions and recurring payments.

At Payhawk, our subscription management feature gives you the insight you need to make impactful decisions on subscriptions and licences.

Our platform shows you the history of pricing for a particular supplier so you can quickly see whether vendor pricing has remained consistent over the last 12 months or has increased dramatically. Having this kind of data at your fingertips empowers you to investigate, set the ball rolling, and make positive budgetary decisions.

Lenka Bartuskova, Finance Manager at Mimo says:

Now [with Payhawk] we can easily understand how much is spent on subscriptions and analyse the need for departmental budgets and their variances.

4. Check you’re working alongside the right IT SaaS vendor

It’s essential to ensure that the vendors you’re considering align with your specific business needs. This means comparing subscription costs against the features they offer. So, remember to consider, what exactly do you need from your IT budget?

There are many things to take into account when analysing vendor fit, so take your time, compare customer reviews, and extract as much value as possible from product demos or trial periods.

5. Train your team on cost-efficient IT practices

Cost-efficient IT practices are all about getting the most bang for your buck. Switching to cloud solutions can save you a fortune on pricey hardware and upkeep. And regularly checking your software subscriptions (as above) helps you spot any unnecessary costs or unused tools, so you can streamline your spending.

Encourage your team to share resources and optimise workflows to boost efficiency, too. And don't forget to provide them with the best budgeting tools possible. At Payhawk, our comprehensive budget tracking tool stops you wasting time with managing your budgets day-to-day in spreadsheets and sharing back and forth with your colleagues. Instead, you simply upload the budget to the platform via a spreadsheet and then manage the rest in our solution.

6. Regularly analyse your IT budget

You should regularly analyse your IT spending; this is a cyclical process, not a one-time-only task. Spending priorities can change, which means re-assessing spend to see if it still aligns with company goals.

Many organisations plan an annual budget review at the end of the calendar year or fiscal year, but you don't have to wait for a year to review budgets with our solution. Analysing your IT budget has never been easier.

As a cloud-based solution, our portal allows you to access budget data wherever you are. Conduct a quick budget check to see committed spending and overspending by month to make both proactive and reactive decisions to stay within budget at all times.

Andrew Jacobi, VP of US Finance at State of Play says:

We rely on the customisable class settings within Payhawk to analyse performance. We can categorise [things] into the right general ledger code, and it's extremely helpful in terms of how we allocate spend.

How Payhawk can help you manage your IT budget

We offer customers comprehensive budget tracking software, which helps them quickly identify cost-cutting opportunities and oversee upcoming and past spending to make confident, proactive budgetary decisions.

Create your budgets in Payhawk

With our new 'built-in budget' tool, you can upload your budget via an Excel template and then access a real-time overview of budget utilisation right in the platform. Our business budget template includes dedicated columns for fields such as currency, budget owner, and more.

Select your own budget dimensions to give you granular insight into IT spending. Split your budget by teams, suppliers, entities, and more from within Payhawk. Get valuable insights into how money is spent across IT functions, adjust budgets as required, and upload new forecasts whenever necessary.

Real-time IT budget tracking

Set up your budget management per cost centre and track payments and expenses against them in real time. When someone spends money, you can see it in your Payhawk dashboard in seconds.

Real-time access to financial data means you can make up-to-the-minute decisions on spend. All expenses are automatically reconciled, too, so you can be confident that the figures you’re looking at are accurate.

Automated expense management

Expensing your IT purchases has never been easier with the help of our AI camera and optical character recognition (OCR) technology. Once cardholders have spent money, they receive an automatic alert to capture the receipt or invoice. Data is automatically extracted by taking a photo of the receipt using the camera with our app, populating a new expense report.

This tech does all the heavy lifting, ensuring the data entered is accurate.

Customisable spend policies

No matter how many times you tell cardholders what is and isn’t permissible spending, some random expenses are bound to crop up from time to time. These can not only cause you to tip over budget, but you can’t truly control spending this way.

Instead, within Payhawk, you can create and automatically enforce spending policies so employees have no choice but to spend compliantly.

As an example:

Let’s say an IT manager needs to purchase new malware protection software. You’ve already assigned them a corporate card and set it up with merchant controls, meaning the card can only be used with approved vendors like your preferred software provider.

When they go to make the purchase, the system automatically recognises that it’s within the approved merchant list, and the transaction goes through seamlessly. If they try to spend it elsewhere, the card simply won’t work — ensuring compliance without needing manual approvals. This way, you maintain control, prevent out-of-policy spend, and avoid messy manual adjustments.

— Benoît Menardo, Payflow Co-founder, says:

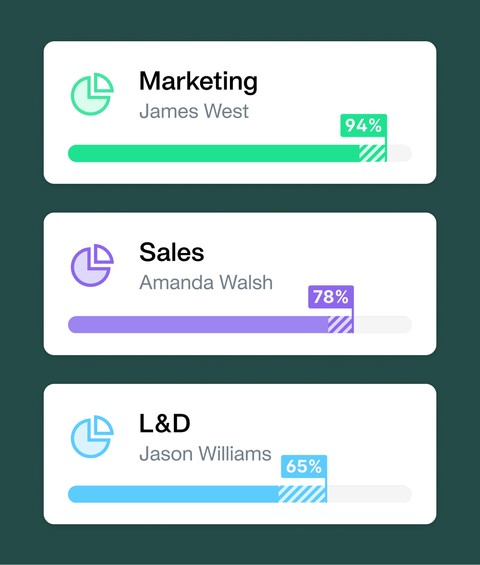

I really like being able to give each department a card and set the budget. I like how it works because it gives me control over different departments' expenses. I can tell that the Marketing team has X, the Sales one has Y, and the Operations one has Z. I use the solution a lot for spend control and to plan better from one month to the next.

Ready to take control of your IT budget and drive your digital transformation forward? At Payhawk, we make it easy to manage your spending, track your expenses in real time, and streamline your approval processes — all in one comprehensive platform.

See for yourself how our powerful tools can help you save time and optimise your budget management. Book a demo with one of our experts today.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

.jpg)

Cash flow clarity: The best spend control software of 2025