Automation: A digital revolution for business finance

Automation has changed the finance game. It replaces time-consuming tasks like manually uploading receipts and managing approval processes and gives finance professionals more time to focus on strategy and growth.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Business finance processes are calling out for automation

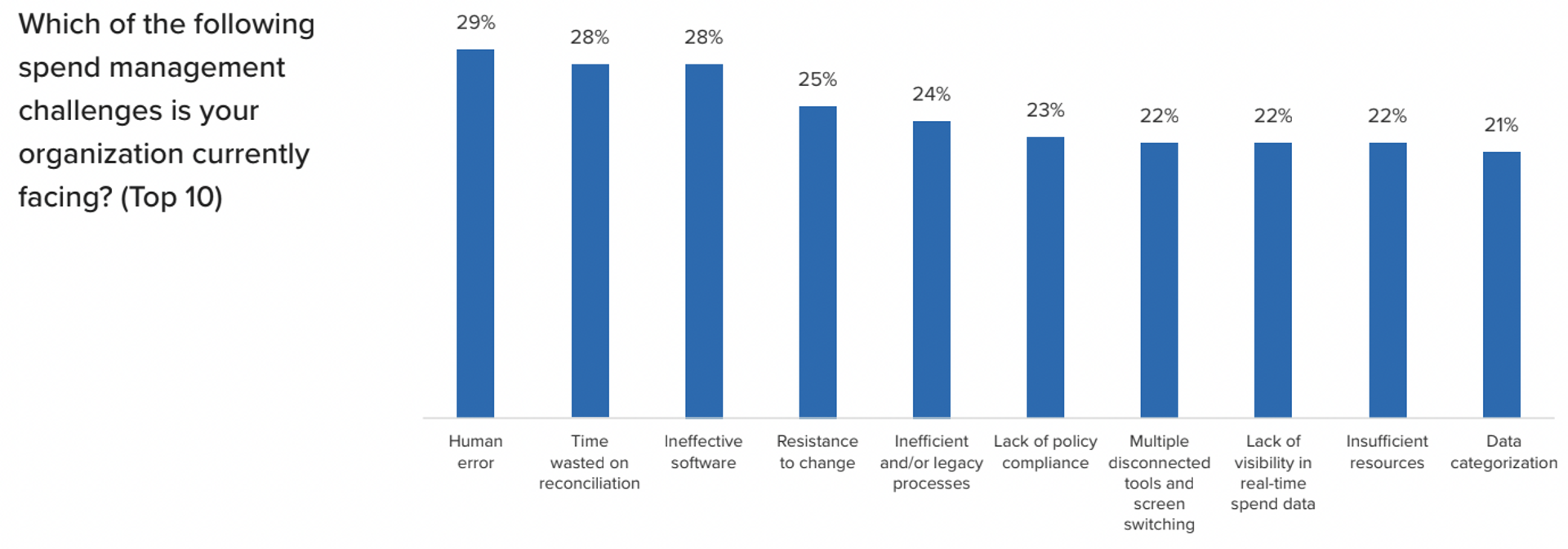

According to a recent report from The IFP Spend Management Pulse Report in collaboration with Payhawk, human error is the most significant corporate spend management challenge. It affects 38% of small and 24% of large companies and can drain resources, with many hours wasted correcting and resubmitting expense reports.

But it’s not only human error that costs companies precious time and money. The report also details that 31% of medium-sized companies work with inefficient or legacy systems, and 28% lack visibility with real-time spend data.

And when it comes to specific challenges? Business leaders at smaller companies, in particular, say they struggle to capture receipt and invoice data (38%) and waste too much time on reconciliation (30%) — a problem affecting 30% of larger companies, too.

Although different-sized companies face different challenges, they all have one thing in common — a lack of automation-driven efficiency.

Automation can free finance professionals from administrative burdens, reduce human errors, and streamline entire spend management processes while delivering unrivalled visibility and control with real-time reconciliation.

The Pulse Report: How to overcome spend management challenges

A closer look: How automation is revolutionising business finance

Automation has given finance professionals freedom like no other in recent years. Tasks and processes that were once manually labour-intensive are now left to technology.

If you're in charge of spend management, you know that keeping tabs on expenses company-wide and across various entities can be a real hassle. It's time-consuming, prone to errors, and can lead to issues with tasks like employee reimbursements, sorting out tax returns, and maintaining up-to-date spending records.

Without strong control of your company finances, you risk losing track of spending, business forecasting, and budget management. This can make it challenging to provide clear financial reports to shareholders.

But the good news is that today, businesses can attack these challenges head-on with the right spend management solution. Here are just some of the benefits of expense management automation…

Real-time reconciliation means entries are automatically matched

With real-time reconciliation, expense entries are automatically matched against your bank and credit card transactions as they happen.

By solving simple reconciliation delays, you can regain control and visibility over your finances, meaning you’re finally able to make smarter (more up-to-date) business decisions based on data instead of guesswork.

OCR technology automatically extracts important information

Optical Character Recognition (OCR) is clever technology that removes the need to enter all of your receipt and invoice details — instead, it lets you snap a picture of the receipt while the technology performs automatic data extraction.

Dim lighting, crumpled receipt paper, or poor-quality receipt ink? That’s no problem for updated AI-powered cameras. Snap the receipt once, watch the data extract, select the expense category and submit.

Auto-receipt chasing obtains missing receipts quickly

You can trim the time spent chasing missing expense receipts by using prompts and email reminders. This means no more hours spent manually poring through missing expense information and emailing specific employees. Instead, your colleagues are automatically reminded to amend or add to their expense submissions, making the entire expense reporting process more efficient and streamlined.

Automated approval workflows ensure timely approvals and policy compliance

Some spend management solutions allow you to create custom multi-level approval workflows to suit your organisation's sign-off structure. Sign-off processes differ based on expense type, level, amount, etc., so setting custom workflow approvals lets you meet every aspect of your expense needs down to granular detail.

These automated approval workflows mean your reimbursements will be quicker, and you can significantly reduce any out-of-policy spend.

At Payhawk, for example, designated approvers can set auto-approvals out of the office or assign a temporary approver in their absence, ensuring no unexpected expense sign-offs or reimbursement delays.

How Payhawk solves your challenges

Finding effective software can be challenging; with so many options, it's easy to get overwhelmed when reevaluating your tech stack.

A spend management software partner that integrates effortlessly with your ERP and accounting systems means accessing just one single source of truth for accurate data with no duplicates, while automation bears a massive load of repetitive tasks, keeping human error to a minimum.

Human error is an issue many companies face when managing their spending, a challenge behavioural analytics firm Essentia Analytics faced before switching to Payhawk.

"Pre-Payhawk, we found we were always chasing invoices and also had a lot of rekey and reentry issues, especially around payments," Julian Hall, COO at Essentia Analytics, explained. "We realised we had a huge opportunity for improvement."

By working with Payhawk, Essentia Analytics has cut out data entry issues and kept all aspects of its corporate spend management under one roof.

CFO Carolina Einarsson said, "For us, spend management was a quick win; we saw Payhawk as the future where we could have expense data entry, credit cards, approvals, spend requests, paying invoices, reimbursements, all in one."

Your next steps

Like the sound of effective, efficient spend management with in-built controls and zero input errors? Download the Payhawk Spend Management report in full to learn how other finance professionals are tackling common spend management challenges. Or book a demo to learn more about our comprehensive solution.

In her role as a Senior Content Manager, Nerissa Goedhart harbours her passion for sharing valuable insights and solutions through engaging content. This, with a clear mission to assist and empower businesses in the region by elevating their expense management.

Related Articles

Pennylane Integration: Why to connect with a spend management platform