How to use purchase orders most effectively for business

Purchase orders hold the power to streamline your entire procurement process. They give finance teams visibility into future spending — and the ability to forecast and plan finances accurately. But how do they work, and do you need them?

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

A purchase order is a legally binding document showing your intent to purchase from a supplier at a future date. Purchase orders are beneficial for both the buyer and seller (suppliers). As the buyer, you can budget more efficiently for the coming months, knowing what money is coming out and when. And for suppliers, they can better keep track of incoming orders and manage production, cash flow, and more.

Using purchase orders as part of a larger procurement process can help finance teams stay in control of spend, too. The processes ensure they know of upcoming invoices, can better manage cash flow, and keep the business operating smoothly.

(See Payhawk's PO features in action in the video below).

When to use a purchase order

Technically, you could use purchase orders every time you transact with a supplier for goods or services. Many companies treat it as good practice, particularly for larger transactions or ongoing relationships with suppliers, as they help ensure clarity, avoid misunderstandings, and maintain a clear record of the transaction terms for both parties involved.

Some of the biggest benefits include:

- To provide legal protection for both parties

- To help you track and manage your budget

- To secure product costs

- To keep the order management process efficient (particularly if automating your purchase orders with procurement software)

Of course, your business doesn't only pay for suppliers and services, though. So, it's beneficial to offer your employees multiple ways to transact, including purchase orders. For example:

The fictional international software company “Company A”. They would most likely purchase goods and services from multiple suppliers. Here's how they spend…

Services

Company A has a subscription for SEO software for its marketing team that leverages invoices to pay per month

Company A also has a subscription for CRM software for its sales team that it pays monthly

Company A also pays a provider for web hosting services via a yearly contract

Goods

Company A is constantly growing and hiring new employees every month. They purchase new MacBooks for all new employees

Company A also buys new Dell monitors for existing and new employees

Employee expenses

Company A has a Commuting allowance policy and reimburses employees for taxi rides and subway tickets

Company A also gives out several corporate cards (with in-built controls) and connected software, allowing their Sales teams to expense accommodation, meals, merch, and more, and automating receipt data capture chasing

That's multiple methods of procurement or payment, and each one is vital.

Company A, therefore, needs a solution that can offer each of these options — all in one place. Without this, they will have a disconnected overview of spend and cash flow and risk making uninformed decisions with inaccurate, out-of-date information.

Where do purchase orders fit in the procure-to-pay process?

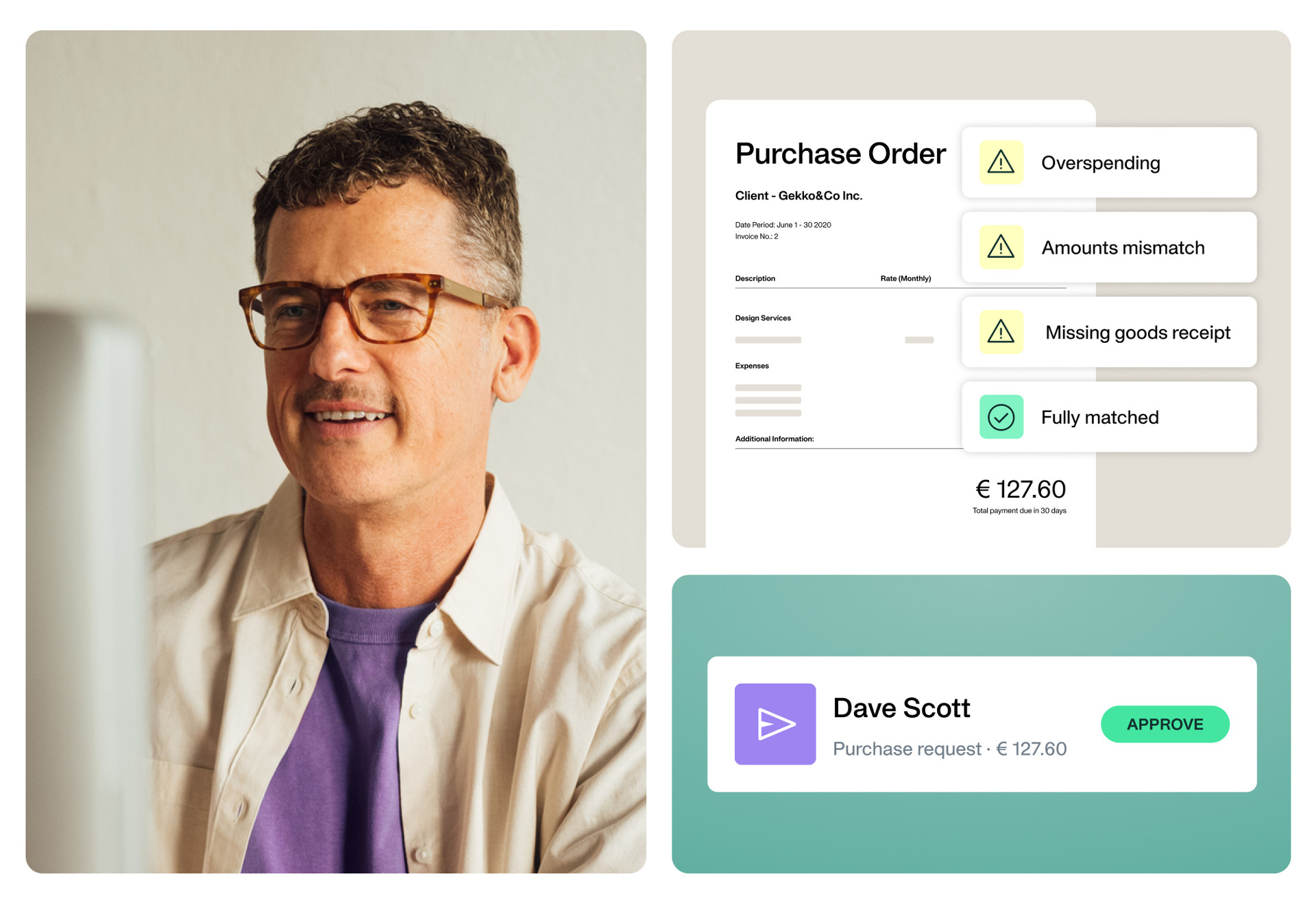

Once you identify the need for a product and your purchase request goes through an approval process, you typically create and send a purchase order to the supplier. If you use smart procure-to-pay software, it should automatically populate the purchase order with your requisition details (and automate much of the approval workflow), streamlining the process and saving you time.

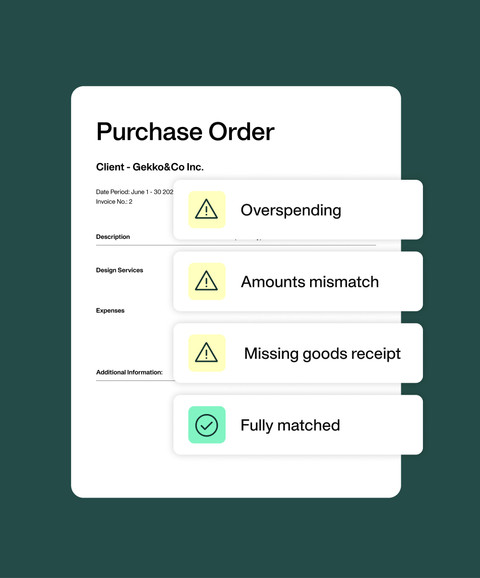

Once the supplier receives and acknowledges the purchase order, it becomes legally enforceable. After you receive the goods, the supplier sends an invoice. Before payment — whether in full or as agreed — accounts payable verifies that the invoice matches both the goods received, and the purchase order via a three-way match (again, smart procure-to-pay software can automate a lot of the verification process, including flagging any issues).

How purchase orders streamline the procurement process

Without a purchase order, you and your finance team will be in the dark regarding any new subscriptions or products that your non-finance colleagues have procured across the business. This lack of visibility means you have no transparency over costs and no standardisation throughout your procurement process. Instead, after getting approval from the team leader or line management, employees can spend left, right and centre without much thought to cash flow or budget forecasting.

Invoices submitted outside of a procure-to-pay system can potentially reach the finance team for payment without prior knowledge of the impending purchase. Again, this lack of transparency can leave a gap in your overall spending visibility.

POs restore order to the procurement process, enabling you to control and plan costs and pay invoices on time.

With procure-to-pay automation, you can streamline and standardise how you acquire new products and services. Everyone follows the same steps for purchase requisition, approval, issuing purchase orders, receiving goods, and paying invoices. You get clarity on the creator of the purchase order and its purpose, simplifying PO-number-matching to the invoice for swift, delay-free payment.

Transform the way you spend with integrated procure-to-pay features

What to include in your purchase order

Your purchase order should be clear and easy to understand, so ensure you include all the following information so both parties are aware of the expectations.

- Supplier information: The supplier’s company name, contact name, and address.

- Your information: Your company name, address and specific contact details.

- Expected delivery date: A rough timeline or specific date of when you expect the delivery.

- Purchase order date: The date the purchase order was created.

- Purchase order number: To help track your PO, include a unique identifier for each purchase order.

- Description of goods or services: Describe in detail the products you’re ordering. Include details like quantities, payment terms, agreed pricing, and any other information you feel is important.

- Delivery address: If it is different from your company address, be sure to state your delivery address.

- Terms and conditions: These can be within your purchase order or attached as a separate document. Include details of return, warranties, fines, or penalties if part of the shipment is delayed or missing.

Three best practices for creating and managing purchase orders

Your purchase order system should remain accurate and efficient for the sake of your suppliers (so they receive timely and accurate payment) and for your internal teams — e.g. for finance to oversee and manage company spending effortlessly and for employees to feel empowered to complete purchase requests confidently.

1. Create clear procurement policies

With a smart, automated solution, you can build spending policies right into the process, meaning no one has to go back to check and recheck policies before submission.

At Payhawk, for example, our procure-to-pay automation lets you set customisable approval workflows and discrepancy thresholds for both quantity and amount. The system triggers additional approval workflows when values exceed or fall below these limits.

So if your marketing team has ordered some merchandise and the three-way match pulls up a minor discrepancy, you can let it pass through, provided it falls under the agreed limit you already set. However, if the difference is much more significant, our system flags you so you can take action fast.

2. Store your supplier details in one place

Having a centralised spend management solution and seamless ERP integrations means you can keep all your supplier details up to date. This means one place to update contact details, ensuring information is kept updated at all times across the supply chain.

At Payhawk, our suppliers feature lets you manage all your supplier data in one app. We automatically import all of your supplier data from your ERP (or you can manually upload it with an xlsx template if you choose). The feature means you can edit supplier data in one system, like your ERP, and it will automatically sync with your other system, Payhawk.

3. Automate the purchase order process

Automating your purchase order process minimises errors and speeds up procurement. Use procure-to-pay software to integrate every part of the process, from purchase requests to approvals, purchase order creation, and three-way matching. Then, with a solution like Payhawk, you can even seamlessly pay your suppliers domestically or with cross-border transfers through the same platform.

Purchase order misconceptions debunked

There are some common misconceptions about purchase orders, so we’re debunking four of them.

“Purchase orders slow everything down”

Nope. As mentioned above, purchase orders can now be fast and efficient thanks to automation. Sure, there might be a slightly longer process than when you hand over a big chunk of cold hard cash, for example, but if this means correct approvals and a digital ‘paper’ trail for company purchases, it’s worth it.

“Purchase orders are unnecessary for informal agreements”

Here you might ask yourself: What are the risks of paying for goods and services using informal agreements? With audits, cash flow statements, VAT, and other taxes to worry about, it’s not a great way to keep everything in line.

“Purchase orders are only for large orders”

It’s up to your business to decide how, when, and why you use purchase orders. In the ‘When to use a purchase order’ section above, we detail how “Company A” uses a mix of corporate cards, invoices, and purchase orders to meet their needs. For them, finding the perfect blend of different spending types lets them stay agile and in control.

Purchase order challenges and how to overcome them

Purchase orders enable formal communication between you and your suppliers, so they’re an essential part of your business’s procurement process. Although necessary, managing and creating them can come with challenges, especially if using more traditional systems, for example:

Errors in purchase orders

When the purchase order creation process is manual, errors can occur quickly, from incorrect quantities and shipping details to pricing. Errors can mean delays in shipment, overpaying for goods and more.

How to overcome: Introducing automation into your procurement process is the best way to reduce these manual errors. Procurement software can automatically create a purchase order from the details you initially include in your purchase requisition, removing unnecessary admin tasks and ensuring purchase order accuracy.

Difficulty tracking purchase order status

If you rely on manual purchase order creation and distribution or disparate systems, you'll find it challenging to track purchase order statuses. This means you can't pinpoint delays and take reactive action.

How to overcome: With procure-to-payment automation, you can track order status throughout the procurement cycle.

Delayed delivery of goods

Even though you set out delivery timelines in your purchase order, some orders are inevitably delayed due to unforeseen circumstances or errors on either your or the supplier's end.

How to overcome: The only way to combat these timely delays is to set realistic lead times and issue your purchase order in plenty of time. You'll learn more about setting these lead times as your supplier relationship establishes, as you can investigate past issues, etc, to reduce delays.

Automating purchase order processes with Payhawk

Effortlessly handle your procurement needs with Payhawk. You can create and send purchase requests, customise approval workflows, and automatically generate orders.

You can also set custom thresholds for approvals, match invoices and receipts, and benefit from AI-driven OCR technology for data extraction.

Plus, enjoy free local invoice payments and fast, low-cost international transfers, and manage suppliers easily with customisable data entry synchronised with your ERP system.

Learn more about the procure-to-pay automation here and catch our CEO-led demo live or on-demand.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Best Spendesk alternatives for advanced spend management

.jpg)