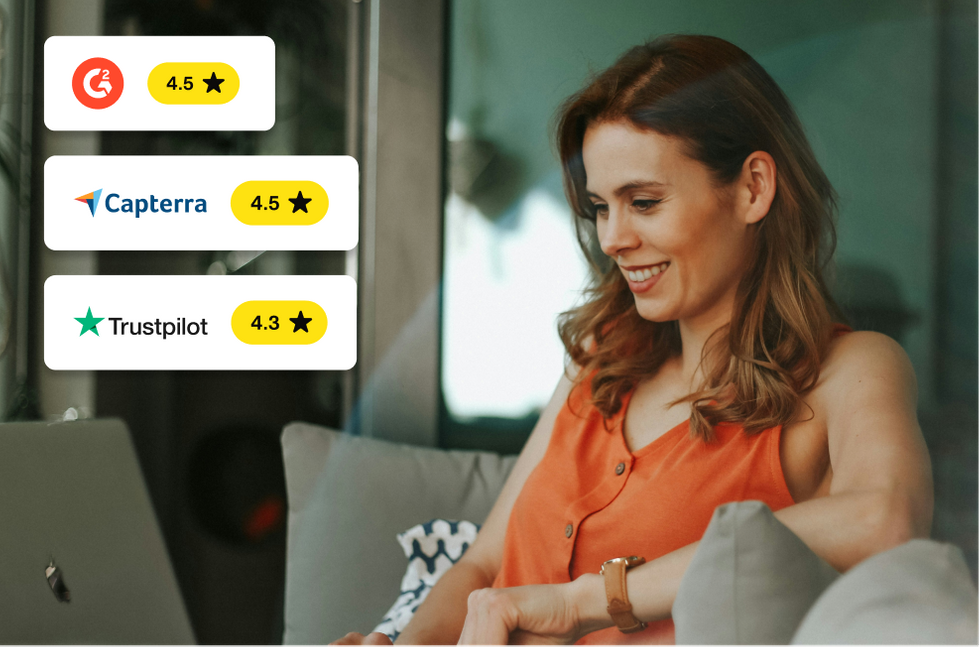

Game-changing spend management: Payhawk, according to CB Insights and G2 & Capterra reviews

At Payhawk, our customers are at the center of everything we do. And by putting them first, listening to them, and acting on feedback, we continuously iterate and improve our product.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

But don't take our word for it. Look at our 2023 Fall Season Capterra and G2 results to see how we delight our customers across software features, usability, customer success, and more.

G2 high performer in invoice management

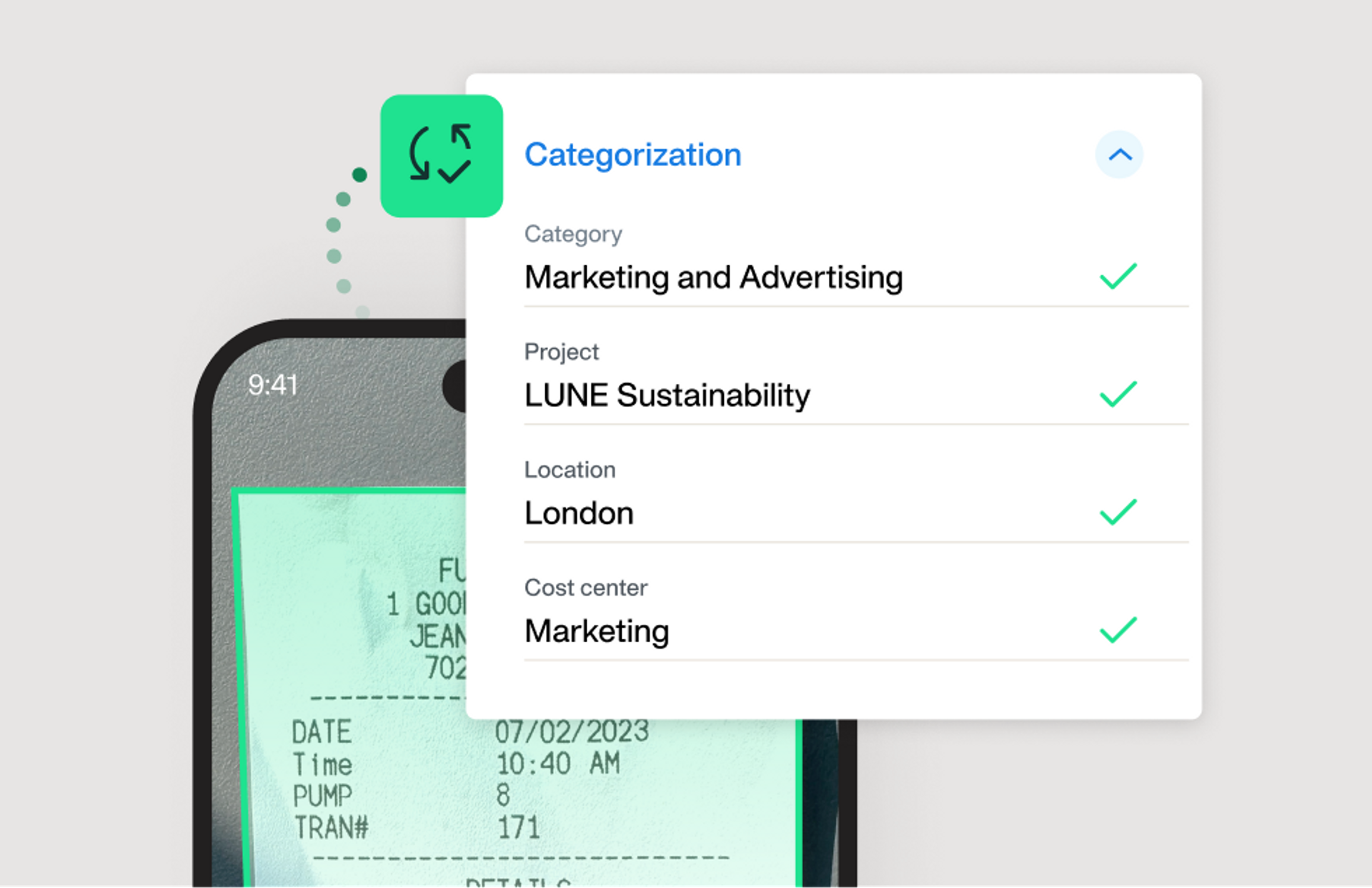

As a Payhawk customer, you could streamline your financial processes and reclaim over two hours of manual work daily through intelligent automation.

Our invoice management software, powered by OCR data extraction and machine learning, automates data extraction in over 60 languages, digitizes bookkeeping, and captures crucial invoice details like supplier names, dates, due dates, countries, VAT numbers, and amounts across multiple entities and currencies.

Here's what our users had to say on G2:

“Now we can control all the expenses across the company; the invoice payment is outstandingly defined, and you can pay all your pending vendor invoices and expenses in bulk. I can also manage monthly subscriptions, define the spending categories and departments, and synchronize them with my accounting software.”

Take control of business spend, schedule a demo

G2 high performer in expense management

Need to effortlessly track company expenses and transactions in real-time? With our expense management software, you can prioritize payment traceability by linking corporate visa cards to specific employees and enabling individual and team spending, complete with approval flows.

You can also simplify budget management with cost-center or project-based budgets linked to cards and monitor real-time spend for valuable insights and adjustments. Plus, never miss payments or subscriptions again, with automated reminders for insufficient card funds and missing receipts.

Streamline accounting by configuring cost centers, categories, and VAT while leveraging AI-driven expense data suggestions and machine learning for invoices and recurring payments.

G2 user Laura J. says:

“Expense management has really improved as expenses are automatically sent to the manager for approval, removing our finance team as a middleman.”

While a G2 review from Parkos details:

“Payhawk currently has the best expense management product for SMBs Exact Online users in the Netherlands. Additionally, Payhawk is always continuously improving to ensure their product continues to be better than the competition.”

"Payhawk is always improving to ensure their product continues to be better than the competition.”

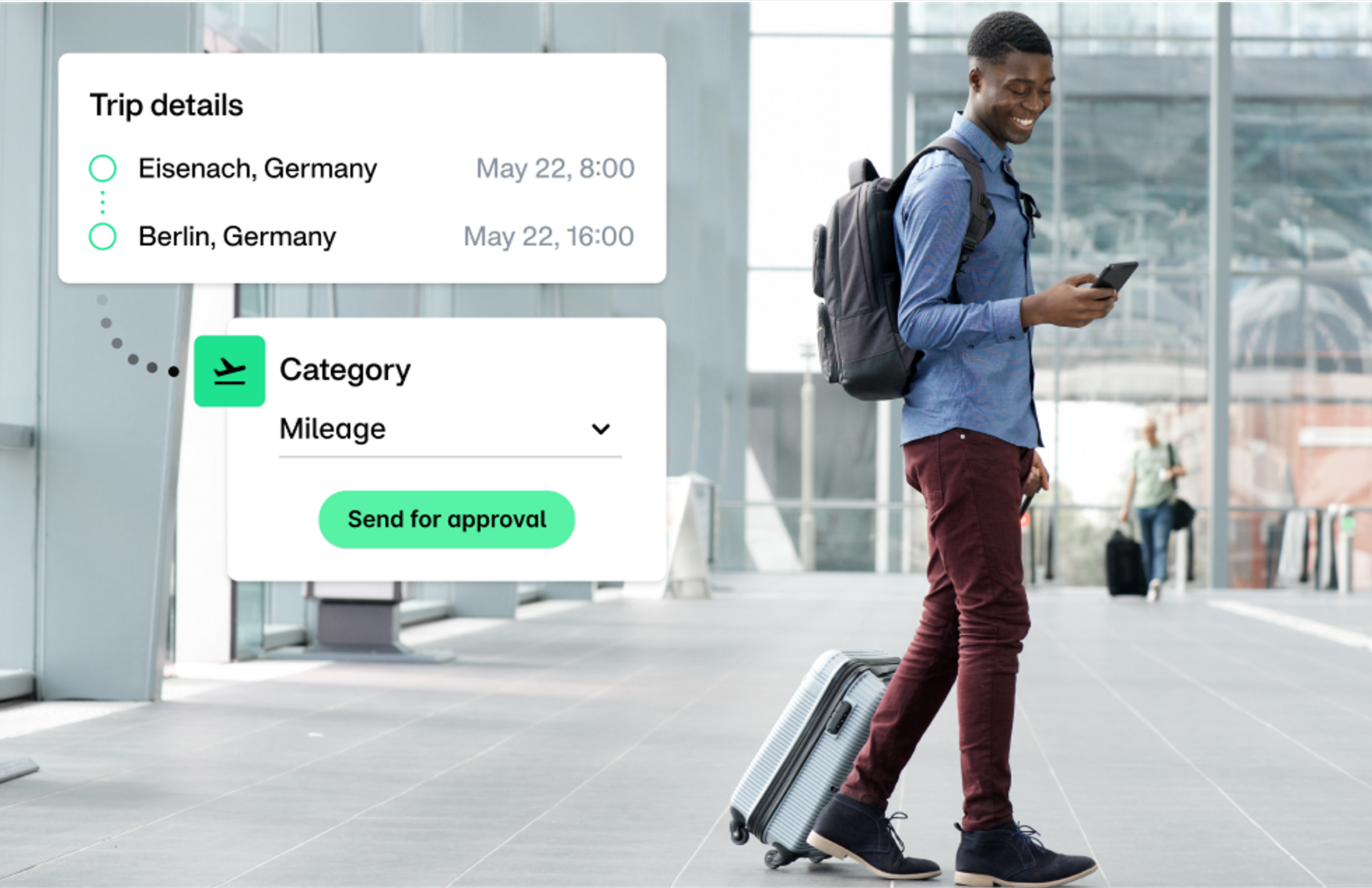

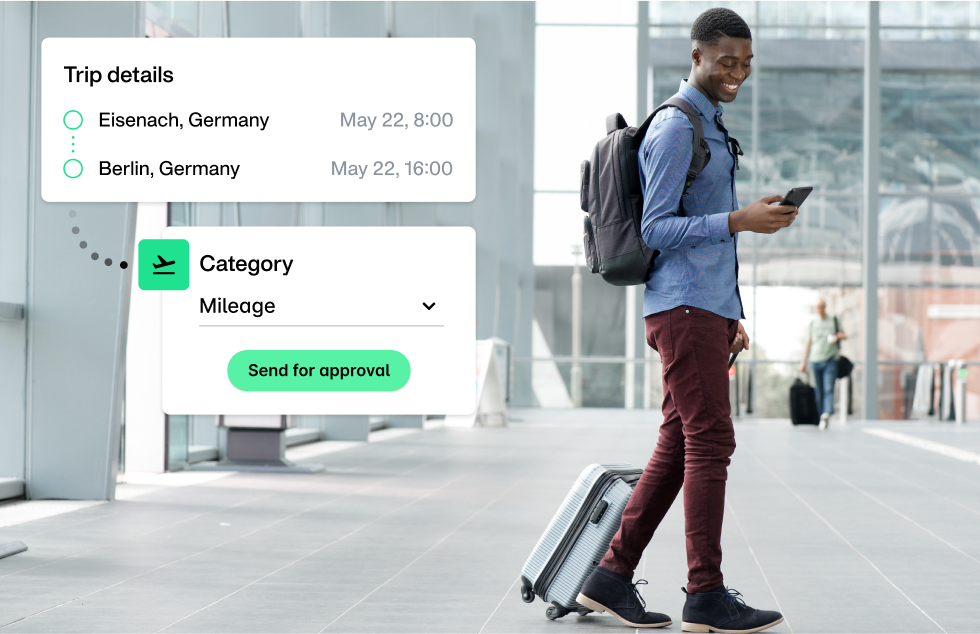

G2 high performer in travel and expense

Tracking business travel expenses can be challenging, especially when payments are literally flying all over the place.

At Payhawk, our comprehensive suite of business travel expenses features include:

- Per diems

- Mileage

- Accommodation via a TravelPerk integration

- And globally-accepted corporate cards

One G2 reviewer describes the business travel features in a nutshell, saying:

“You can ask for different credit cards, physical or virtual, assign them to other holders, manage teams and categories, control expenses, define budgets, and manage subscriptions. All in different currencies! The best part is that it can be synchronised with NetSuite, for your accounting purpose, with Travelperk, for travel invoicing, Microsoft Dynamics 365, Xero and Google Workspaces, and more.”

G2 easiest setup

As a finance leader, you expect to set up your expense management solution quickly and easily. Some of the biggest reasons are:

- Streamlining operations

- Reducing costs associated with IT support and training

- Encouraging employee adoption (and therefore compliance)

- Enhancing productivity

- Ensuring data accuracy

- Accelerating a speedy ROI

G2 user Linsey E. says:

“What do I like best about Payhawk? How easy it is to navigate, set up, cancel, and freeze cards and the Xero integration.”

Cutting-edge financial innovation: Hitting the CB Insights Top 100

CB Insights has just unveiled its much-anticipated sixth-annual Fintech 100 ranking, featuring (drumroll) Payhawk! We're very pleased to be named on the exclusive list of the 100 most exciting private fintech companies of the year.

Using the CB Insights platform, the research team handpicked the 100 most standout businesses from a vast pool of more than 19,000 privately held companies.

The selection process considered a range of factors, including:

- Equity funding

- Investor profiles

- Business partnerships

- Research and development activity

- Sentiment analysis of news

- The competitive landscape

- Unique Mosaic scores and transcripts from Yardstiq

The CB Insights criteria for selection also looked at technological innovation and the potential for success in the market. So, it's really a great testament to our product-led, customer-centred solution to be recognised on the list.

Capterra best ease of use ‘financial reporting’

If you’re based at a multi-entity organization, you know managing expenses across various operators can be a pain. You must consistently monitor expenditure, forecast, and align it with budgetary constraints.

At Payhawk, our customizable categories are specifically tailored to address these complexities. Our solution will empower your finance teams to pinpoint discrepancies and potential overspending by leveraging distinct, customizable expense categories.

Brad, Head of Financial Reporting, based in the UK says:

“The best expense management system I've ever used. The product is very easy to use. It couldn't be easier for employees to upload their receipts. And all receipts and payments are synced automatically with our finance system, making it completely seamless.”

Capterra best value ‘financial reporting’

Before adopting Payhawk, many customers relied on multiple fragmented tools, Excel spreadsheets, and various credit cards for their financial processes.

However, with Payhawk, finance teams can quickly centralize their spend management, control their expenses, achieve crucial visibility, eliminate data entry issues, and save hours.

Our comprehensive spend management solution offers a streamlined and unified experience, encompassing credit cards, accounts payable, expense management workflows, corporate card controls, and reimbursements, all within a single platform.

Sara, P&C Operations Specialist, based in the Spain says:

“Payhawk is the best tool we have. It’s very useful to manage all our monthly purchases, control spend, define limits, add funds, and manage payments easily. You can also have the recurrent subscriptions in the same panel to monitor the monthly expenses. And you can pay invoices, reimburse expenses, and use credit cards...”

Capterra best ease of use ‘bookkeeper’

As a data-driven business, you need data at your fingertips 24/7 to make the best decisions.

At Payhawk, our spend management solution can help you do the following and more:

- Improve decision-making based on real-time data

- Save time by accessing multiple data sets efficiently

- Customise spend controls on the fly, based on the above insights

- Seamlessly keep your data flowing (via direct ERP integrations) from the minute you tap your card to the minute you close the month in your ERP

Timely and accurate financial month-end reports give your business crucial insights into its financial status, helping you make informed decisions. By digging into the data, you can spot trends, evaluate your actions' effects, and make necessary adjustments. This data-driven approach enhances financial stability, optimizes resource allocation, and supports overall business success and growth.

Charlotte, SDR, based in the UK says:

“Payhawk is a game-changer! Payhawk has shortened our month-end processes and has been incredibly involved and helpful throughout our use. The time spent chasing for receipts is in real-time and not always left until the end of the month.”

With a high rating across both Capterra and G2 and many coveted G2 badges under our belt, it’s clear to see why many finance leaders rate us so highly. But don’t take our word for it. Book a demo today to see for yourself.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

10 key takeaways from SuiteWorld 2025: What they mean for system integrators