Multi-entity accounting software: The seven key traits to look for

Suppose your growing business wants to improve its payment automation. In that case, you might ask one) whether it's time to upgrade your accounting tools or two) whether you should continue using your current multi-entity management software.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Many other factors may influence your decision on whether to upgrade multi-entity accounting software, like whether you've grown organically or grown through acquisition. If you need to include multiple venues, subsidiaries, and entities, you'll also need to consider your subsidiary managers and the critical real-time decisions they must make when choosing the right tech stack.

There will be different opinions, of course, but to get you started, here are seven tips for finding the right accounting software for multiple businesses.

Seven things to consider when choosing multi-c

ompany accounting software that works

1. Find one that works well for your setup

It's hard to make accounting look friendly, so recognize a job well done when you see it, but remember that the software you choose 'can't be just another pretty interface'. Intuitive navigation and fluid customer experience are at least as important as the ease of generating — and reading — reports.

According to PCMag, FreshBooks leads the UX pack, providing a smooth user experience, while Zoho Books and Patriot Software Accounting also score high, with Xero looking good for a positive user experience.

Sync your Payhawk expenses with Xero, QuickBooks, NetSuite, and more

2. Pick a solution that puts corporate spend management into the palm of your hand (via your phone)

Accounting for multiple businesses can be intimidating, so the simpler and handier you can make those dashboards, the better. The best multi-company accounting software allows viewing them — and performing other basic functions — via an app on your smartphone.

Best multi-entity accounting software according to PC Magazine readers

Again, PC Magazine gives FreshBooks and Patriot a nod, but it reserves overwhelming praise for Intuit QuickBooks online. It's not for nothing that QuickBooks has become the leader in this category.

Pro tip #1: You can even fully-automate your month-end-close process using Payhawk’s direct QuickBooks integration.

3. Look for functionality that extends to multi-entity expense management

A $100 million business has different accounting requirements than ten related $10 million businesses. If you’re looking for accounting software for multiple entities, it must easily handle intercompany transactions and multi-entity consolidation. Differing charts of accounts, closing dates and currencies are the beginning of the headaches of accounting for multiple entities.

With accounting software providers aimed at smaller or mid-market businesses, you’re looking at digital-native service providers working on a subscription revenue model. These providers may not always know how to handle bigger, more complex issues, for example, inventory tracking.

And for something like inventory tracking, you’re better off looking at multi-entity accounting solutions like NetSuite or Sage.

They should know how to handle credit notes and purchase orders, but Xero and Zoho books take the lead in transaction documents beyond invoices and bills.

Pro tip #2: Don’t select multi-entity accounting software in a vacuum. It’s vital that your chosen expense management solution and your chosen accounting software can sync seamlessly. It is even better if your expense management solution lets you automate data capture with OCR and includes corporate cards with in-built controls, and more.

David Watson, Group Financial Controller at global hospitality business State of Play, explains:

Taking corporate credit card transactions away from the traditional banks to a product [Payhawk] that directly integrates with NetSuite was a game changer! Now we save time and make better decisions thanks to complete visibility over our multi-entity spend.

Howard Thompson, Global Financial Controller at digital events company GDS Group, adds:

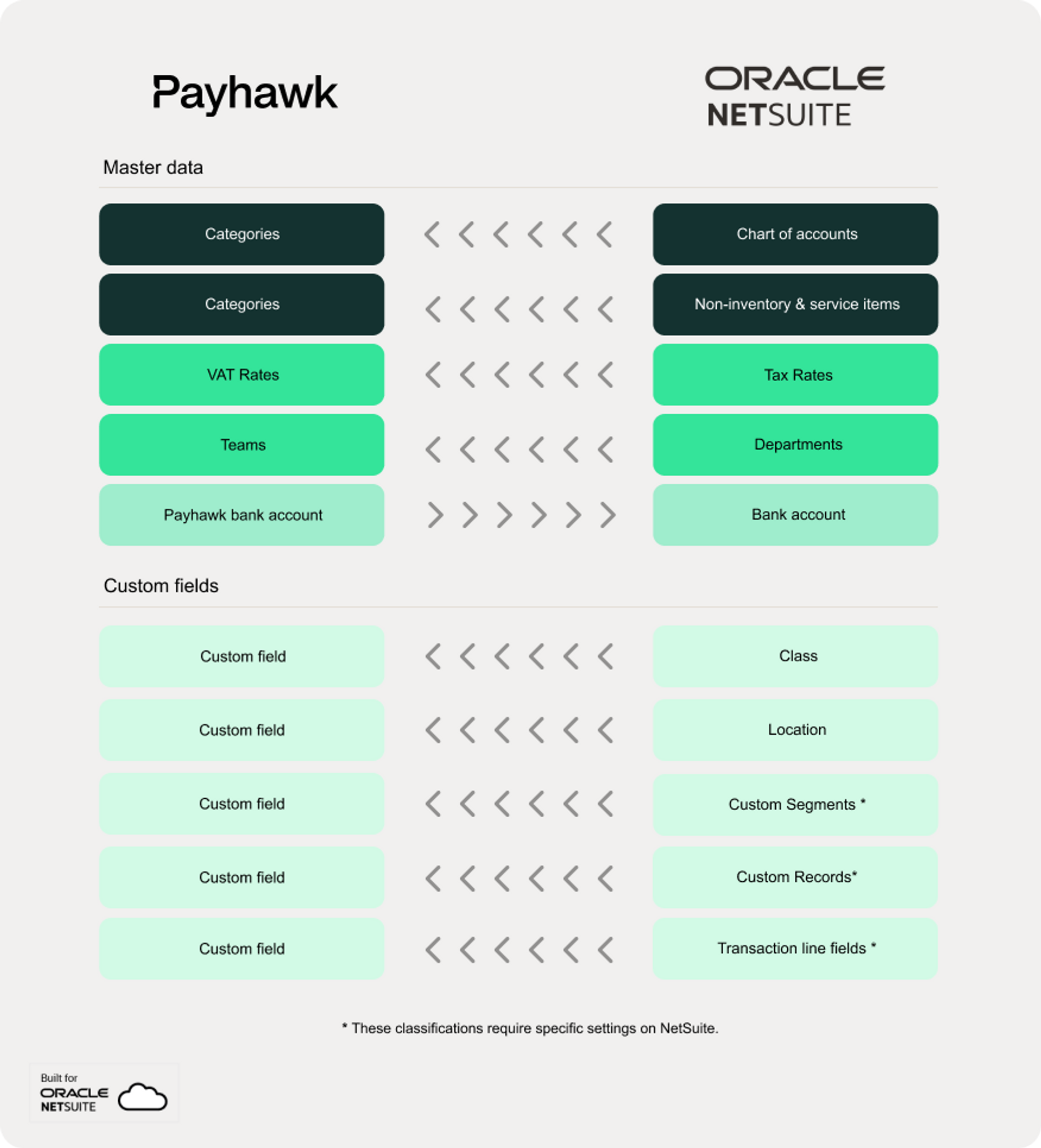

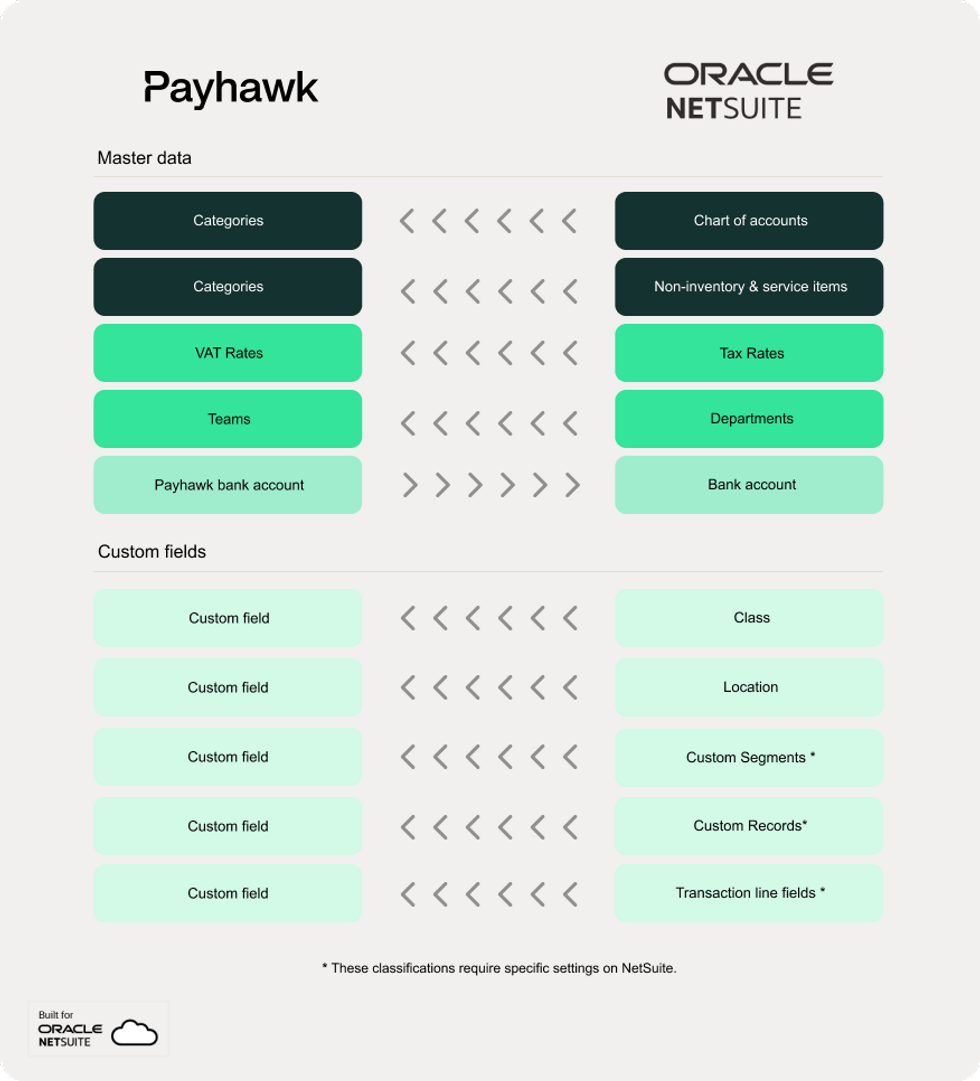

Payhawk has done a great job of getting that custom field from NetSuite and the project code from NetSuite into Payhawk. And as we have all of our expenses coded up to project codes in the Payhawk solution, we can now report on our margins by event and so on at the end of each month.

4: Pick a multi-entity accounting software that can scale with your business

We won't assume you're a giant business just because you have more than one corporate shell. If you're an aspiring startup owner looking for a stable cash inflow, your accounting requirements may be lower than those of a Fortune 500 conglomerate, but it may not always be that way.

Growth adds complexity, so unless you want to swap out accounting software every time you refresh your laptop, you'll want a suite that meets you where you are and can take you where you're going. You may need basic multi-location accounting software right now, but soon, you'll need a package to handle bookkeeping for multiple businesses.

Eventually, if you maintain course and speed, you'll need the best accounting software for multiple entities or the best accounting software for intercompany transactions. PC Magazine cites FreshBooks for its ability to work with the smallest companies and help them scale up. Wave, which also targets the smallest companies, doesn't get the same love in this regard.

Giancarlo Bruno, CFO at global e-commerce business Heroes, explains how Payhawk met their multi-entity accounting needs:

One reason we picked Payhawk for spend management was the accounting and ERP integrations. When we started using Payhawk, we were still using Xero, which was seamless. So, we trusted Payhawk to help us achieve the same with the NetSuite integration. We wanted everything to flow into the ERP and knew that Payhawk would be a true scaling partner in this way.

5. Pick a software that integrates well with all of your software solutions

The ability to integrate with the other applications running your enterprise is critical, especially if you yourself are trying to integrate disparate businesses. PC Magazine is quite complimentary about Xero in this regard.

At Payhawk, our solution integrates seamlessly with multiple accounting providers, including Xero, QuickBooks, and more.

Carolina Einarsson, Finance Director and Julian Hall, COO at international investment analytics company Essentia Analytics, agree, saying:

Payhawk's Xero integration is one of the strongest I've seen on the market. You don't really need to do anything but click in Xero, and all of the input information is done in Payhawk… It means we're spending fewer hours on the manual tasks that can be done easily and more time on value-added activities that help the efficiency of our business.

6. Choose software with a strong market presence: Here today, here tomorrow

As you look for software to help you with accounting for multiple entities, be sure the vendors on your list already provide their services to multiple entities.

If the vendor doesn’t bring up the topic of upgrades, that might indicate it doesn’t know if it will be around long enough to publish one. The one you sign up with needs a track record to suggest it’ll be in business as long as you will.

It must also work in all the geographies you intend to expand into. It’s great to do business with another American company, but global reach is a bigger selling point.

7. Don’t overpay, and remember, nothing’s ever free

The multi-entity accounting program you choose will ultimately depend on your company’s size, accounting needs, existing workflows and challenges.

For example, you might choose Xero if you're a smaller business looking for an affordable, user-friendly accounting solution. But opt for NetSuite if you are a larger enterprise with complex business processes requiring a comprehensive ERP solution that can scale with your growth.

Whichever you choose, you should consider how the pricing works and check the terms of your subscription. Is it a flat annual rate? Does the publisher charge per user, per location or maybe through some other variable?

Ready to choose your next multi-entity accounting solution?

Making a wise choice of multi-entity accounting software can improve the accuracy of your financial data, reduce busywork, and provide greater support for top-level decision-makers.

So what's our recommendation? This is a trick question, as we can't really answer it in good faith. As much as we know about payment processing, overall spend management, and accounting software, we don't know enough about your business.

Yet.

So, let's fix that. Whichever way you select your multi-entity accounting software, we can work with it. Book a demo today, and we'll reach out to discuss your unique needs and how our solution (and accounting integrations) can help.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Why you should integrate Dynamics 365 Business Central with Payhawk