How to simplify payment runs with a “due date is in” expense filter

Ever run into a late payment that caused you trouble? With our “due date is in” expense filter, it won’t happen again. Learn more about how sorting urgent payments via one dashboard and selecting the most appropriate filters could simplify the complex task of managing expense due dates in your business.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Manually sorting through hundreds of business expenses with varying due dates is a terrible experience for any financial controller. With hundreds of different expenses organised in thousands of receipts and Excel spreadsheets, things can easily sleep through the cracks.

After recognising this inefficiency in corporate expense management and listening to multiple CFOs, we’ve introduced a new update to our powerful expense filters. Introducing the “due date is in” expense filter. This new filter selection will streamline expense management due dates, letting you prioritise payments with unparalleled efficiency.

In corporate finance, timely expense tracking and payment isn't just an admin task — it's strategic. Suppliers and contractors are more likely to offer better rates if your company pays promptly.

Efficient expense, payment, and supplier management are key to building strong vendor relationships and effective supplier management.

Learn more about time-saving spend management

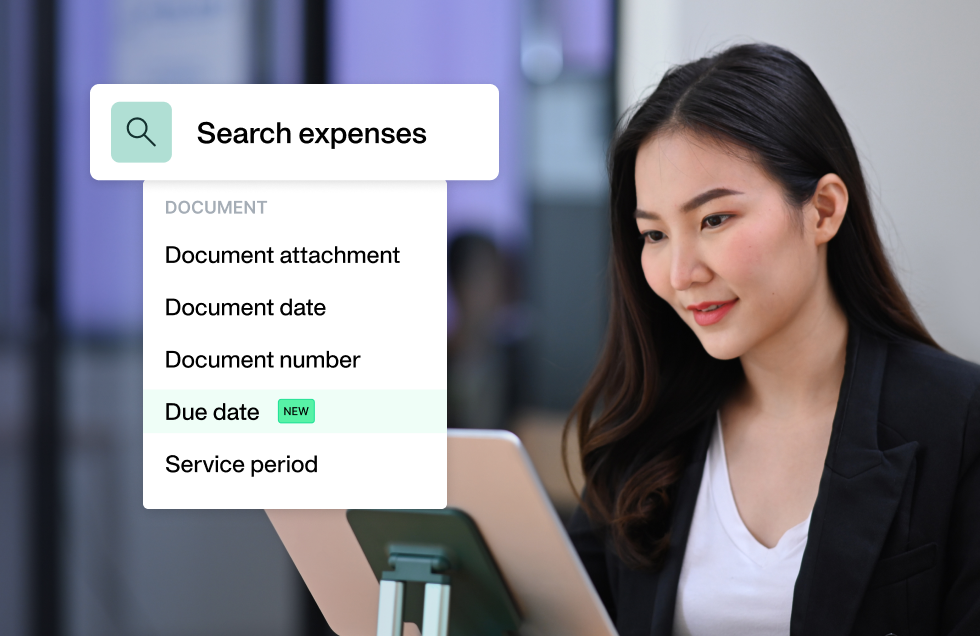

Introducing Payhawk’s due date expense filter

At Payhawk, our “due date” expense filter streamlines how finance teams organise their payment runs. The feature, which includes the “is in” option lets you see all the expenses that “are due in” the next 7-60+ days.

With complete visibility of future expenses, you and your finance team can make payments at the right time. You can supercharge the workflow even further, too, by scheduling the necessary payments, which would automatically make the payment run for you.

The new "is in" option for filtering upcoming due expenses allows for meticulous planning and prioritisation, ensuring no payment deadline slips through the cracks.

Benefits of the “due date is in” expense filter for finance controllers and CFOs

Our new filter offers many game-changing benefits for finance leaders like you who need to juggle a lot of expenses, especially during month-end closing.

Enhanced ability to prioritise urgent payments

Picture this: As the CFO or financial controller, you oversee the financial operations of a multi-entity company, including juggling multiple vendor contracts across time zones and currencies. With our "due date is in" expense filter, you can instantly identify which invoices are due within the week, prioritising payments to critical suppliers involved in time-sensitive projects.Improved cash flow management through strategic payment scheduling

Or maybe you’re leading finance at a fast-growing tech startup, where managing cash flow is as crucial as securing the next investment round. By using the "due date is in" expense filter, you can schedule payments to align with your company's cash inflow from sales and funding milestones. This strategic scheduling helping you to ensure there’s always sufficient liquidity to cover operational costs, invest in growth opportunities, and maintain a healthy cash reserve.Reduction in late payment fees and the avoidance of strained supplier relations

And if you’re a CFO at a manufacturing firm that relies heavily on a network of suppliers for raw materials? Late payments to these key partners could incur additional costs in late fees and risk souring relationships, potentially leading to delays in material delivery or even the termination of favourable terms. By leveraging our "due date is in" expense filter, you can ensure that payments to suppliers are always on time, preserving strong, mutually beneficial relationships.

How our filter works step-by-step

Achieving complete spend control and visibility is a breeze with the Payhawk solution. And our new “due date is in” expense filter is no exception; Payhawk customers simply need to do the following:

- Navigate to the “expenses” dashboard

- Select the Due Date filter and choose the "is in" option

- Specify your desired timeframe for upcoming payments

Voila! Now, you can prioritise the payments on your list and even pay them directly via Payhawk.

How Payhawk revolutionised corporate spend management: Success stories

Aside from new features like the “due date is in” filter, customers rate our user-friendly solution and power to completely transform finance management. Here’s what they say...

Transitioning from manual processes to efficient spend management at MDM Props Ltd.

Uchenna, Finance Manager at MDM Props Ltd, shares their journey from manual, paper-based expense management to discovering the right tool for their sophisticated needs. Initially bogged down by the cumbersome process of saving and chasing paper receipts, the team experimented with another solution but said it fell below their expectations.

At Payhawk, we filled this gap with our comprehensive spend management solution, transforming how MDM Props Ltd managed expenses with advanced features and a user-friendly interface.

Before switching to Payhawk's spend management solution, we mainly did everything manually... Then, we briefly used Pleo, but it wasn't sophisticated enough for our needs.

Integrating real-time financial insights with NetSuite ERP at Heroes

Meanwhile, Giancarlo Bruni, CFO at Heroes, highlights the major advantages of our direct NetSuite ERP integration.

As a CFO, I want to know how much money and profit we have in real-time and what levers I need to pull. We also need to know about our stock, including when it's arriving, how much is in transit, and if we need more. I can see all of this via my ERP, plus I can see spending in real time thanks to the direct integration with my expense management software.

Supercharge corporate expense management with Payhawk

For busy finance teams, the “due date is in” expense filter is just one piece of the puzzle. At Payhawk, our all-in-one corporate spend management platform (including corporate cards, expense reporting automation, accounts payable, and more) works harmoniously with hundreds of accounting and ERP integrations to help you completely streamline your workflows and maximise the ROI of digital transformation.

Don't let the complexity of corporate expense management slow your business down. Book a personalised demo with us today and take the first step towards simplified payment runs and enhanced financial control.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

How to lower accounts payable error rates with an automation software