Top objectives to keep in mind while designing your spending policies

Company spending policies follow the same rule as any other corporate process: build as much as needed when you need it. This means different things for different companies. We will share our observations of how different companies tackle the rules around their business expenses. Building on this knowledge, we have summarised the objectives the organisation needs to consider when defining a spending policy.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

In the following article, you will not find a recipe for setting up spend management in your business. We try to give you some guidance as we work with dozens of companies on this topic. From the one-person company in Malta to a large conglomerate in the UK, we work with all of them. We know that there is no single right answer. Our research and experience also reveal that there is often a mismatch between the implemented spending policy and the results the management expects.In the end, the ultimate spending policy decision is yours. We just want to support you in making an informed choice based on your current circumstances.

Definition of spend policy

According to Rene Wies, policies define the desired behaviour of a complex system. They also specify ways to drive this behaviour. In our context, your spending employees represent the complex system and spending policies define the drivers of their actions. In other words, your employees will spend company funds based on the rules you give them.This only works if employees know and understand these rules. However, research shows that on average 66% of employees haven't read their company's expense policy; 10% of employees aren't aware they can submit expense claims or reimbursements; and 25% of employees will avoid a meeting with a client, supplier or potential hire because they do not know how to pay for it.All of the above indicates that designing a spending policy is not enough. How you implement it and enforce it distinguishes the successful ones.

How to build a finance function that drives strategy and growth

How do companies enforce their spending policies?

Option 1: Everything goes through a single person.

Our experience shows that frequently this one is either the company’s founder or the leading finance manager. If an employee needs funds, they ask directly to this manager. The advantage of this approach is that this manager has total visibility of all expenses.However, there are three main disadvantages to this setting. This manager is a bottleneck for all spend decisions and delays the whole spend management process. They are investing their time in low-admin work like chasing receipts instead of focusing on the company’s growth. Finally, as there is no standard policy on how to spend company funds, the team is unable to learn how to manage company funds in a responsible way.

Option 2: Mail chain with additional tools around it.

Email is a great tool that combines action and documentation. Hence, a lot of companies build their spend management process around it. Fund requests, approval processes, expense reports, and scanned receipts with explanations are all in the same email chain.In contrast to the previous approach, here we have a delegation of decision power. This process is more robust and scalable. Additionally, the company employs an existing tool set to manage the process. The expense report is created with a template in Excel or Google Sheets. OneDrive or Google Drive is used to store the receipts and invoices. The employees do not have to learn a new system. The company does not need to pay for one. However, a clear disadvantage of this approach is that highly skilled employees are doing low-admin level work. Instead of working on the next deal, the sales manager needs to scan receipts. It takeso 20min to complete an expense report for a business trip with a single overnight stay. The same study found that an additional 18 minutes overhead is added if there is an error in the submission. This is the case for 19% of all expense reports.

Option 3: ERP system with a procurement department.

ERP systems with a purchasing department streamline the spend management process. They enable significant automation and spend policy enforcement. Companies gain efficiency and visibility of their spending. ERPs are great for managing expenses when everything works as intended. However, from a process perspective, ERPs main disadvantage is that they cannot handle corner cases. As an example, a member of the sales team participates in a conference. During the conference, she meets a potential customer and wants to pitch the company's services over lunch. This expense was not planned. The approval process needs to undergo the same steps as buying a new computer. Also, ERPs face difficulties managing multi-company entities where a person in Company A approves the budget for a person in Company B. Intentionally, we avoided mentioning company size when describing the three cases above. In our practice, we see companies with 10 employees that have a well-documented spending policy and a well-thought-out spending management process. There are companies with 40-50 employees that have implemented ERPs and have procurement departments. We also talk to companies with 150 people where all expenses go through a single person.

4 goals to aim at when building a spending policy for your company

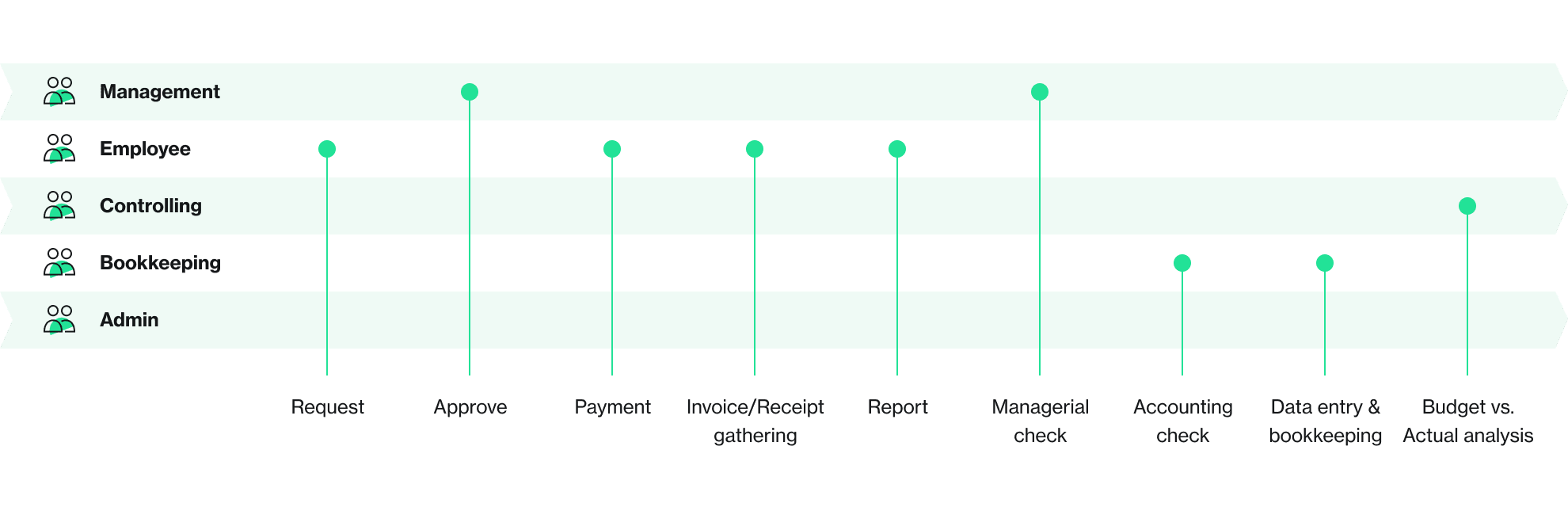

The common denominator among the three cases presented above is the meta-process they follow. Defining a similar model to solve a predefined problem. Normally, the process goes as follows: an employee requests funds; then a manager or multiple managers and/or the CFO approve the request. Then the employee spends the funds and matches the invoice or receipt with the payment transaction. Following the bookkeeping team checks the data and imports it in the accounting software. Finally, the controlling team analyzes what is happening in real time. The graph below shows the process described: Normally these are the default steps for every company. The distinction lies in the process design and the tools around it. The goal is that the process aligns with the company’s spending policy. Nevertheless, based on our experience this is not the case. Companies focus solely on spending control. In that way they miss the other aspects such policies can induce. Hence, we summarize here the four objectives organizations should aim for when they are developing a spending policy:

Normally these are the default steps for every company. The distinction lies in the process design and the tools around it. The goal is that the process aligns with the company’s spending policy. Nevertheless, based on our experience this is not the case. Companies focus solely on spending control. In that way they miss the other aspects such policies can induce. Hence, we summarize here the four objectives organizations should aim for when they are developing a spending policy:

Increase process efficiency

Previously we’ve mentioned the average processing time of an expense report (min 20min). This time correlates with the process and the tools the company has in place. It is a regulatory must to complete the accounting monthly. The process structure is the decision of the organization.If the company wants to improve process speed, it will try to automate or digitalize it. Often with stand-alone solutions that do not solve the problem comprehensively. The time saved on the execution is lost in learning a new tool and integrating it with the other systems the company has. Key question: how can you simultaneously ease the work for all process stakeholders and increase its speed?

Increase budget control

Every company tries to achieve the highest revenue at a minimal cost. The best way to achieve that is through budgets so costs are always controlled. However, research shows that 57% of companies lack visibility of their spending. Which means that most of the time there is low financial predictability and at the end of the month there are always expense surprises. If companies want to analyze the situation and react on time, they need as close to real-time data as possible. Otherwise, the business will miss a great opportunity and won't be able to cut costs in a timely manner. Key question: how can you achieve actionable, real-time expense management?

Optimize cash flow

Positive cash flow enables companies to act proactively, opening new opportunities for investments and optimizations. Blocking money in prepaid cards or in a standard bank account has zero value to the company.Key question: How can your financial tools help manage your cash flow better?

Maintain system flexibility

Most of the companies that we talk to have gone through multiple evolutions of their spending management policies. Sometimes, even the smallest change, like the amount an employee is allowed to spend, leads to confusion and increased workload. If the company wants to increase its velocity and decision speed, it needs to give additional team members access to company funds. This can lead to months of process reorganization and new IT restructuring. Key question: how can you choose a tool to enforce the spending policy that allows you to adapt it as you grow?

Payhawk's approach to spending policies

Payhawk's thinking on spend policies has evolved tremendously since we started. First, we thought about them as a meta-level process, as the image above. Our approach was that we could cover all customers’ needs with a single, pre-defined process. We aimed to reduce complexity for our customers. We soon realized that there is no single, static solution. Every company needs to cater their own, with different needs and goals. We build Payhawk's spend policy feature with this insight in mind. We give our customers the freedom to fit Payhawk to their needs. Our main objective is that all customers can achieve their spend management goals. Companies can enforce as tight or as loose spending control as its business requires. It can grant spend authority to all of its employees but differentiate their spending allowances and limits. The organisation can dynamically modify the approval levels based on request amounts.Our customers do not need to follow a predefined approval process that does not fit their needs. Coming soon, not only administrators can approve fund requests, but also teams, projects, cost centres, unit managers and CFOs. They will be able to do this in one company as in a holding with multiple entities. We make it easy for the company to enforce its current spend policy rules. We make it intuitive for the employees to follow them. Payhawk's inherent expense management software automates the pre-accounting process. Our mobile app enables employees to effortlessly gather and share their expenses with the accounting and controlling departments in real-time. The integrated request and approval flow diminishes expense surprises for the accounting department at the end of the month.

Conclusion

Creating a spending policy is not an easy task. We’ve seen that there are four main reasons why companies go through this process. Companies should consider their business needs and the company’s culture before choosing the right policy. Successful implementation of this new policy will only happen if there are the rights processes and tools in place. If you want to know more about Payhawk's customizable spending policies please book a demo with ushere.

Hristo is the compass guiding Payhawk's journey. With a rich background in engineering аnd product management he is a stalwart advocate for our products and customers, bringing a mix of innovation and user-centricity to everything we do. Outside the office, you'll catch him enjoying camper and sailing trips, shredding slopes on his snowboard, or simply soaking up precious moments with his family.

Related Articles

Pennylane Integration: Why to connect with a spend management platform