Budgeting for business: How startups can control spending

Budgeting for business is… everything. You know this already. It gathers the resources and makes objectives achievable, keeps the business running and the payroll flowing. There’s no better sign of a healthy business than one that budgets with discipline and that gets close to its own predictions about the future over time.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

What is a business budget?

A budget for a business is a financial plan. A line in the sand that sets the limits for costs and investments, taking into account predicted profits for the year ahead. The CFO or finance lead will work with other directors and heads of department to review proposed budgets, discuss their expected return on investments and finally, approve or adjust.

Once budgets are in place, heads of departments will do their jobs: to spend the money.

However, not all costs to the organisation will come from the teams’ budgets. There are many other costs to consider, such as payroll, office rental, liabilities, and discretionary spending. Only the CFO and finance team can get such a well-rounded view of how money flows in and out of the company, which puts them right at the centre of business budgeting.

How to control the budget in a business?

Controlling a business budget effectively is key to maintaining financial health and supporting growth. Start by setting clear financial goals, reviewing past statements, and estimating future income. Categorise expenses into fixed (e.g., rent) and variable (e.g., marketing), create a cash flow forecast, and set aside funds for unexpected costs. Continuously track spending, compare it to your budget, and adjust as needed. The goal isn’t just to cut costs but to ensure every expense supports your business strategy and long-term profitability.

When do businesses draft up their budgets?

Businesses may budget annually, although revisions and adjustments might happen as the business makes unexpected wins, or if the macro-economic landscape shifts.

Typically this will happen around the time of year-end close when businesses have the best available information on how the year has performed.

Year-end close happens at different months by country and company. For example, most companies in the UK close their financial years in April, but the US tends to finish in October.

The importance of budgeting for business and expense management

For small companies, it can be tempting to have a relaxed discipline around budgeting. Maybe in the beginning because they don't have the right financial team in place, or because they’re focused solely on product and research. However, as companies grow, budgeting and financial control become the difference between success or bankruptcy.

Smaller companies sometimes resist department budgeting in the beginning, as founders and directors wish to retain full control of spending and decision-making. Said small companies tend to remain small, as founders fail to see the value in investments proposed with other specialists in the teams.

Growing companies know that financial success means budgeting. Here are some of the reasons why that is:

Why you should budget for business

- A business budget determines if there is enough money to fund operations, grow, and generate revenue

- It gives you the control over your business you wouldn’t have otherwise

- If you don’t know precisely how money is coming in or out you don’t know how your business is performing

- Without a budget, it's impossible to forecast where you will be next month, let alone the year ahead

- How can you secure funding or attract potential investors if you have nothing to show them?

- Budgets offer a reliable financial plan so you can pinpoint available capital, forecast revenues and estimate expenditures

- Your business can highlight leftover funds to reinvest

- The data from budgets provides information to learn from. It allows for predictions to be made, like knowing when to expect slow months (seasonality) and how to adapt accordingly

How to create a budget for your business

Different companies need different approaches to budgeting, depending on size, team dynamics, sector, or wider context.

To keep it simple, we’re focusing on the basics that most companies will need to take care of budgeting:

1. Check industry averages

It can be helpful to check some industry averages, to see what similar companies spend. These averages can be helpful as they tend to be shown as a percentage of revenue.

These benchmarks can be really helpful if you’re unsure of what’s right to allocate per team, or if you need to debate with a team that wants to increase their budgets (without a great reason). It’s a universal truth that teams want to spend as much as they can, so use data to remain in control and make the budget count for everyone.

2. Setting financial targets

A budget is fairly meaningless without a purpose. The budget’s real purpose is to provide the means for the company to achieve its objectives.

Does the company want to perform exactly like last year? If so, having the exact same budget as last year could work.

This aim is of course, quite rare. Most companies wish to grow. To gain market share and increase their profits. Perhaps they want to improve the value they bring to society or reduce the cost to the environment.

Any of these objectives need to grapple with a simple idea, although an idea that not every CEO will be on board with: to achieve more, you often need to spend more. The financial targets should be set by the company directors. It’s important that they are both realistic and grounded in a rationale.

Some early startup companies may be tempted to put a finger in the air and come back with “we want to grow profits by 20%”. However, if this is in the face of a contracting market, new competition, and increasing costs of supplies, the plan won’t succeed.

Instead, there should be a thorough analysis of market trends, competitive landscape, and consumer behaviour. In addition to this, the company should analyse previous performance against the market in previous years if available. Armed with this data, the finance team can set the context where more realistic and achievable objectives can be achieved.

3. Determine costs of running the business

Next, there should be an analysis of costs and liabilities to understand what it takes to run the business the way it is today.

This is because if any budget increases, salary reviews or new cost centres are considered, the business needs to make sure they can cover their current costs first and foremost.

4. Discuss with heads of department

At this point in time, you know what the company costs to run, and what are the targets for next year.

It’s time to talk to the Marketing Director, the HR director, the Ops Director, and anyone else with a budget to let them know what the targets are (of course, some of these people might have been involved in setting financial targets to start with).

More importantly, it’s time to hear what they have in mind. Is the Marketing Director planning on increasing marketing budgets to account for increased competition or increased customer demand? If their analysis is sound, this marketing plan could be the way to achieve the bottom line set out on the targets.

After you’ve gathered inputs, allocate budgets to owners (by department, project, or entity) with clear limits and approval rules.

5. Factor in some contingency

Of course, working with predictions means error. You’re essentially casting your eye into the future and forecasting revenue.

But revenue depends on many factors beyond your control. Shifts in consumer demand, competitive investment, and macro factors such as the legal landscape can be just some of the ways in which your revenue forecast could fall through.

Equally, costs to the business could go up. Inflation, increased rents, or a sudden need to lean on contracted employees can increase your costs with little notice.

A little contingency, a couple of months of everyone’s salaries for example, can make a massive difference and allow for a better nights’ sleep.

6. Draft the final budget

The final budget includes all the forecast spending, line by line, covering all the business costs, as well as planned activity for the year ahead.

This budget now gives everyone clarity. Department leads can start work, and finance can track progress by team, project, and entity from day one.

Different kinds of budget to consider

There are many different types of budgets, and you likely already use them to maintain financial control and align your spending with strategic goals, they include:

- Operational budgets cover day-to-day expenses like salaries, utilities, and office costs, ensuring companies run smoothly.

- Capital budgets focus on long-term investments, such as equipment, infrastructure, or expansion plans.

- Project budgets track spending for specific initiatives, helping teams stay within allocated funds.

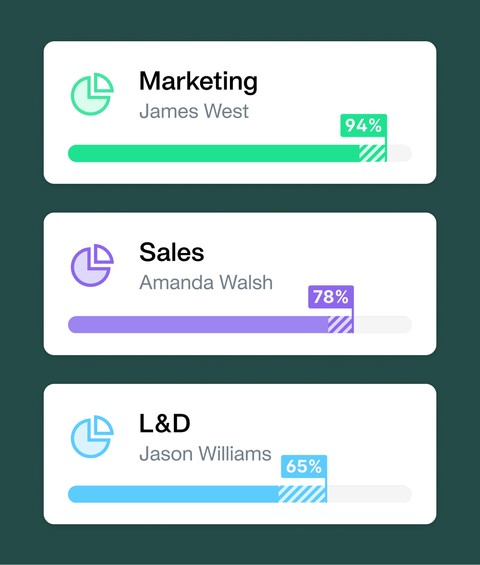

- Departmental budgets provide visibility into each team's financials, ensuring that marketing, sales, HR, and other departments operate within their limits.

- Rolling forecasts and accrual-based budgets allow for flexibility and more accurate tracking by adjusting projections based on actual financial performance.

And the good news about these budgets? With Payhawk, you can seamlessly track and manage all these budget types in real time, eliminating manual spreadsheets and enhancing financial oversight.

Tips to stay in control of your budget

After budgets are drafted and costs are approved, the finance team plays a very important role: Controlling money coming in and out and safeguarding the budget for the achievement of the business targets.

Here are some tips to stay on top of your budgets:

1. Regularly review your costs and compare them to your budget projections

Businesses might budget annually, but it would be a mistake to say that budgets are a once-a-year, set-it-and-forget-it thing.

Instead, the business should review its yearly budget and revise accordingly as new information is reviewed, goals change, people come and go or the context changes.

Having the discipline to close the month and compare to projections can raise some early red flags, preventing any damage.

2. Write expense policies

Expense policies set the limits for expenses claimed back from employees, Typical categories of expenses include staff entertainment, client entertainment, transport, food, and accommodation.

You will need policies for each category. For example: how much can be spent on staff entertainment per quarter?

Or how much can be spent per meal while travelling on business? And, what is the maximum price per night of a hotel? This will help your employees feel confident to spend the company’s money in good faith. And it will reduce your expenses too.

3. Give cost centres debit cards with workflows for spend management

It’s great to approve budgets further down the company and allow employees to achieve their own objectives and use their own resources.

However, an even better way to stay in control is to issue corporate cards. Not only is this a simpler way for teams to pay for anything that isn’t being invoiced, but it also allows the business to set limits on the card itself, preventing any spending not previously agreed upon.

With our corporate cards, finance teams also get to access real-time information on spending, which is another way to cross-check what is being spent, on what, and where.

4. Work with department heads to ensure they have budget trackers

Whether you’re able to offer corporate cards to your employees at this time or not, you still need to ensure that every cost centre to the business has a sound method to keep track of expenses.

Let’s say that the Marketing Team has an annual budget of $100,000. However four months in, the CEO has already seen invoices for a total of $60,000. This would make them nervous, wouldn’t it?

However, if they work closely with the head of that team, they might see that they have a budget tracker that plots costs per month and available left. Knowing that they have the discipline to manage their costs would be reassuring.

There are other benefits to having strong relationships with other department heads: For one, they will be more likely to let you know in advance of unforeseen expenses or “situations”.

What to do when you go over budget

If things change and the business is starting to use up more budget than it has allowed (without revenue surpassing its forecast), it’s time to keep calm and roll up your sleeves.

Businesses tend to operate with costs that can be cut at the time of need. Depending on the size of the problem, you will need to look at different costs that can be cut.

Discretionary spend such as staff entertainment can be an easy one to cut, as long as proper communication is given to the staff on the reasons. Most people are reasonable and happy to have a smaller Christmas party if it means keeping the business in a good state.

If the problem is bigger than anticipated, a massive cost to the business that can help short-term is advertising and other marketing tactics. These are really important short- and especially long term, but of course, keeping the lights on trumps everything

There are other things that can be done without cutting costs, however. Waiting for another billing cycle can be enough to weather the storm, as well as make the most of payment terms offered by suppliers and creditors.

How to handle unexpected expenses

Unexpected expenses are the very reason why you need an emergency fund. And if that’s in place, that might cover the shortfall.

Otherwise, it’s time to review your monthly budgets and make adjustments. Look at some of the variable costs and see what savings can be made to course correct them.

How Payhawk's expense management software can help your business

Payhawk’s expense management software is an ideal companion to the art and science of budgeting. This is because it allows finance teams to control and safeguard spending on anything from subscriptions and marketing costs to discretionary spending all from one integrated platform.

Giving employees company cards with spending limits, control workflows, and real-time dashboards will help you keep tabs on money coming out and empower them to spend when they need to, without using their own funds.

As Olivier Lamoral, VP of Sales at Luxair, says:

Employees are happy with it... they feel comfortable and empowered ... And we're tracking everything better than before. It's a win-win for everyone!

Book a Payhawk demo to learn how to use real-time data, smart budget management, and much more to keep in control of your business spending.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

How Starship Reduced Financial Process Costs by 40% with Payhawk