Top things to assess for ERP and expense management compatibility

If you don't have a compatible tech stack, you'll never get a complete business spending picture. And you won't get accurate data if you have to enter or transfer it between these systems manually. If this sounds familiar, then you likely don't have the right setup to support your business as it scales. Find out why you need seamless system integrations to save time and improve data-led decisions, including across ERP, accounting, and expense management solutions.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Making sure your systems can communicate is crucial for business. If they can't, work slows down, making it harder to track finances and resources accurately. Worse still, this lack of connection can seriously hinder decision-making.

Having a tech stack that works well together makes work easier for everyone. One non-negotiable here: Your ERP and accounting systems must be compatible. If they're not, critical data can be hard to see, which can slow down your business.

Sync your Payhawk expenses with Xero, QuickBooks, NetSuite, and more

ERP systems in a nutshell

ERP systems are the backbone of your business, helping it run smoothly by managing different tasks in one place. ERPs integrate multiple functions to help businesses view their data in a single place, making it essential for growth.

The more your business grows, the more processes and people you have to manage. Each process needs to be as efficient as possible to optimise business finances for growth, detect inefficiencies, streamline workflows, and enable data-driven business decisions.

For data-driven decisions, you need access to accurate financial data, including transactions, records, income statements, cash flow statements, and more (all made easier by expense management software that syncs some of the vital information straight into your ERP).

Giancarlo Bruni, CFO at Heroes describes:

We use our ERP across all our departments. We have it in the People Team, for example, for payroll, taxes, etc. And in the Supply Chain, too, for inventory planning, etc. It's relevant for every single department.

Six benefits of integrating your ERP and accounting system with expense management

There are lots of benefits to integrating your systems; here are our top six:

1. Data accuracy and consistency. When your systems talk to each other, you eliminate the need for manual data entry. Instead, your data can flow seamlessly from one system to another, making it more accurate and accessible. And because the information is the same across all integrated systems, your financial data is consistent, making decisions easier.

2. Automated workflows. When data is pulled automatically through your systems, you don't need to rely on manual interference, which means fewer errors, bottlenecks and delays in your processes. For example, if you have seamless expense management software and ERP or accounting system integrations, then you'll get automatic account reconciliation, too.

3. Real-time data visibility. Integrating systems means up-to-the-minute insights into your funds across multiple entities and much more. You can generate reliable reports instantly to decide on budget, resource allocation, and forecasting.

Andrew Jacobi, VP of US Finance at State of Play Hospitality describes:

We rely on the customisable class settings within Payhawk to distinguish between venues to analyse performance. Whether it's categorising between venues or categorising it into the right general ledger code, it's extremely helpful in terms of how we allocate spend.

4. Clear audit trails. By integrating your accounting and ERP systems, you create clear audit trails, letting you easily track financial transactions, ensure compliance with expense policies, and quickly access all the documents you need if audited.

5. Boost productivity. By automating key processes, all the heavy lifting is done for you. This means your finance and accounting teams can spend time on add-value tasks to drive business growth instead of correcting manual expense report mistakes, double-checking data, or manually reconciling your accounts.

Julian Hall, COO at Essentia Analytics, explains:

Before Payhawk, we found we were always chasing invoices and had many rekey and reentry issues, especially around payments. We realized we had a huge opportunity for improvement.

6. Better support as your business scales. Your business needs change as you grow, and compatible systems can support these changing requirements. So, regardless of how you change and grow, your systems can help you maintain operational efficiency instead of upheaval and disruption by migrating to a new, more flexible system when the time comes.

Common challenges when integrating a new system (and how to overcome them)

You’ll naturally choose your ERP or expense management software based on all its biggest benefits. One thing you should consider is its integrations.

Many expense management solutions will detail their integration strategy, but not all are equal. So, make sure any integration implementation can cover the following:

1. Data consolidation

When multiple systems house lots of data, consolidating them into one system can be difficult. Consolidation requires careful planning and an understanding of what data is important and what can be disregarded. Consider working with a data integration expert to sift through and make sense of everything before integrating.

Or ask the spend management provider to confirm that its connections a) cover this with direct interactions and b) a detailed implementation plan and manager.

2. User adoption

Integrating or moving data from legacy systems can be difficult for staff members who have used your current system for many years.

Ask any providers you evaluate to show what kind of support and training for employees they offer so you can reduce operational delays. Get coworkers involved in research to ensure you integrate systems that add value to their daily work tasks.

3. Business disruption

Disruption when migrating systems and integrating data can take a toll on the bottom line if not done effectively. Integrating systems can quickly become complex and costly. To make integration successful, you need to plan carefully.

Best practices for ensuring compatibility between expense management and ERP software

Establish a clear integration strategy

Your integration strategy is key to making the process successful. Planning means the least impact on internal teams possible, no gaps between systems when the integration is complete, and all stakeholders know what’s expected.

Communicate your requirements

Good communication is the key to effective project management — but there’s no need to go it alone. At Payhawk, for example, our implementation managers will support you through every step, leveraging documents like the ‘bulk import template’ to ensure everything you need is mapped across your ERP and our software — the end result being a seamless integration.

Perform thorough testing

By testing the systems at the beginning of the integration process, you can identify issues early on to avoid further problems, such as problems with finance data synchronisation. When you do come across problems, note them to track progress. Don’t stop testing the system when the integration is complete; no system will run without errors, particularly in the early stages of use.

Payhawk integrations understand accountants' and finance team needs

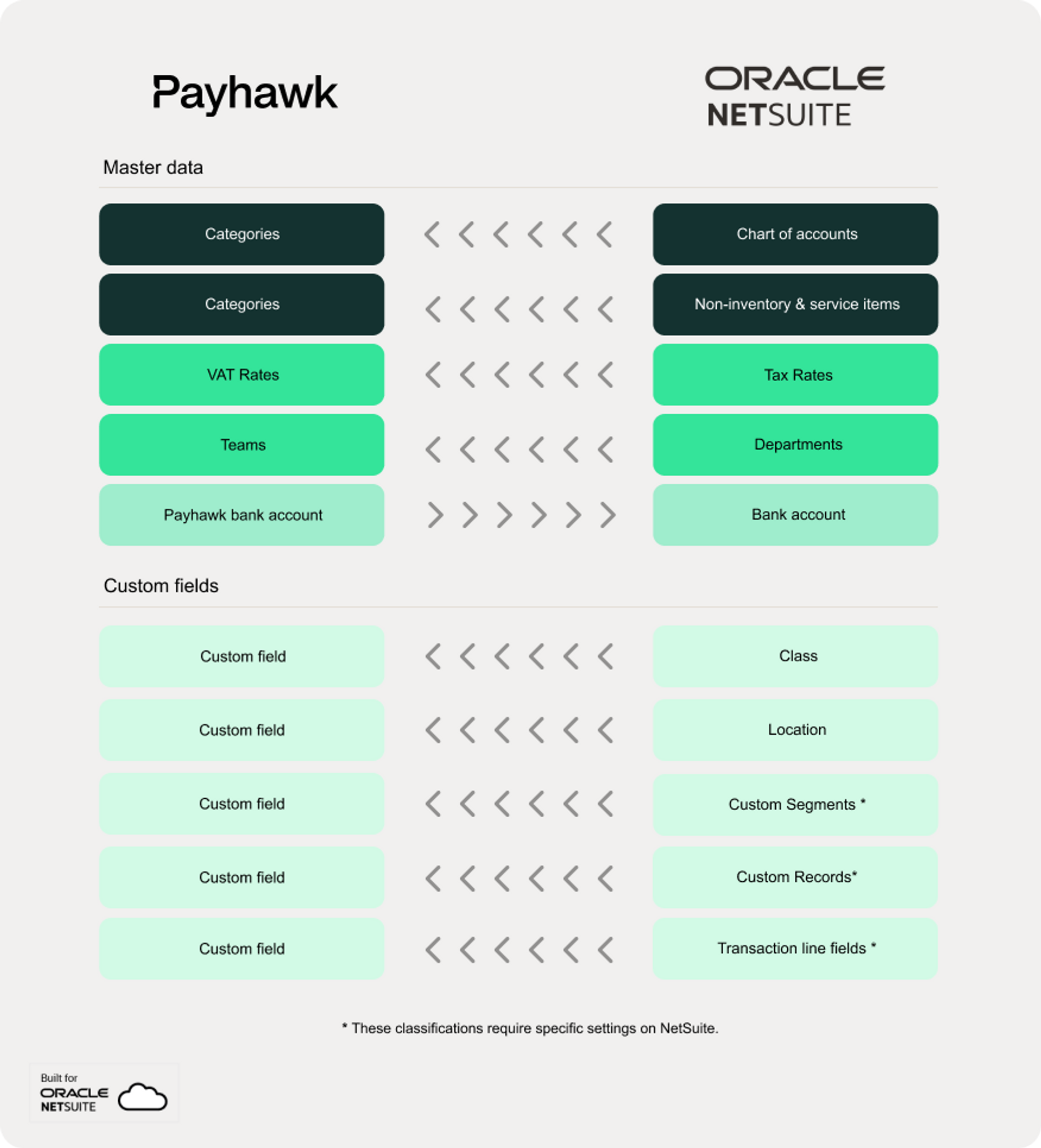

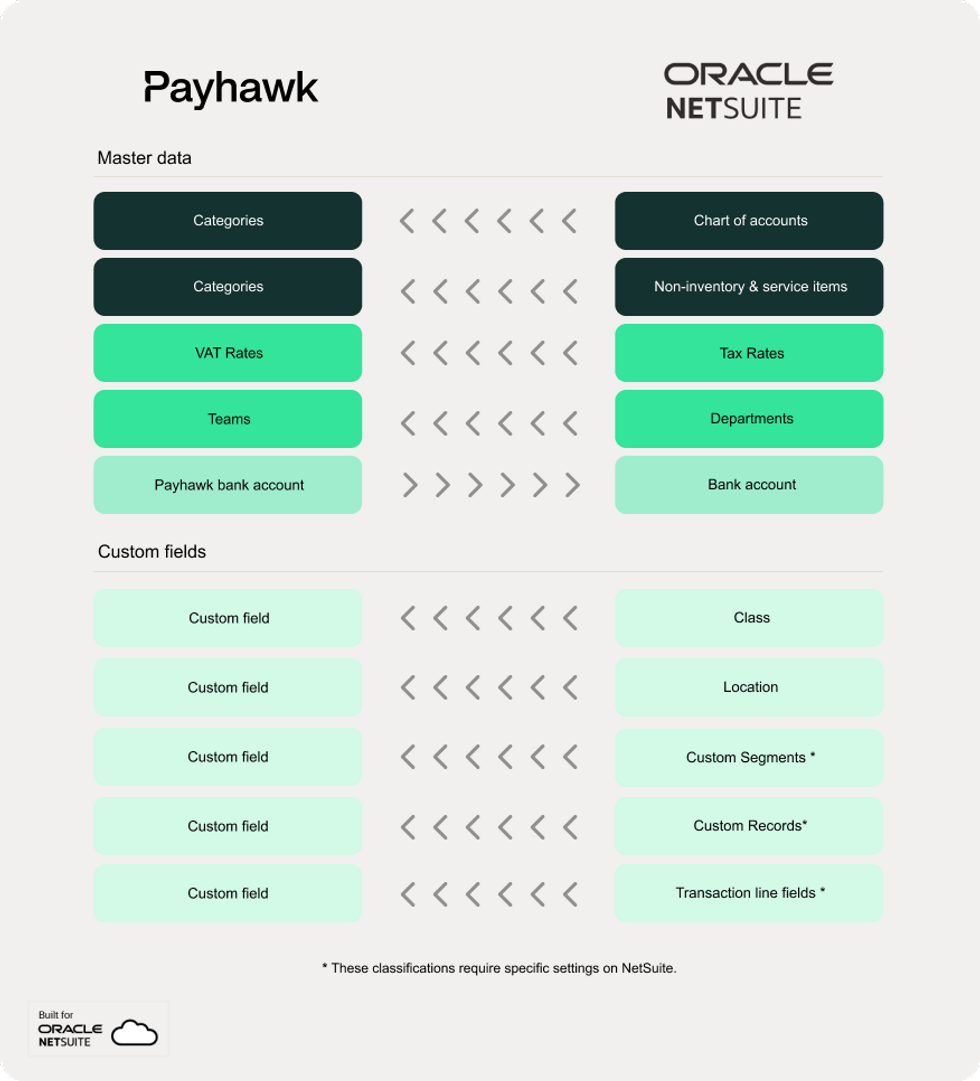

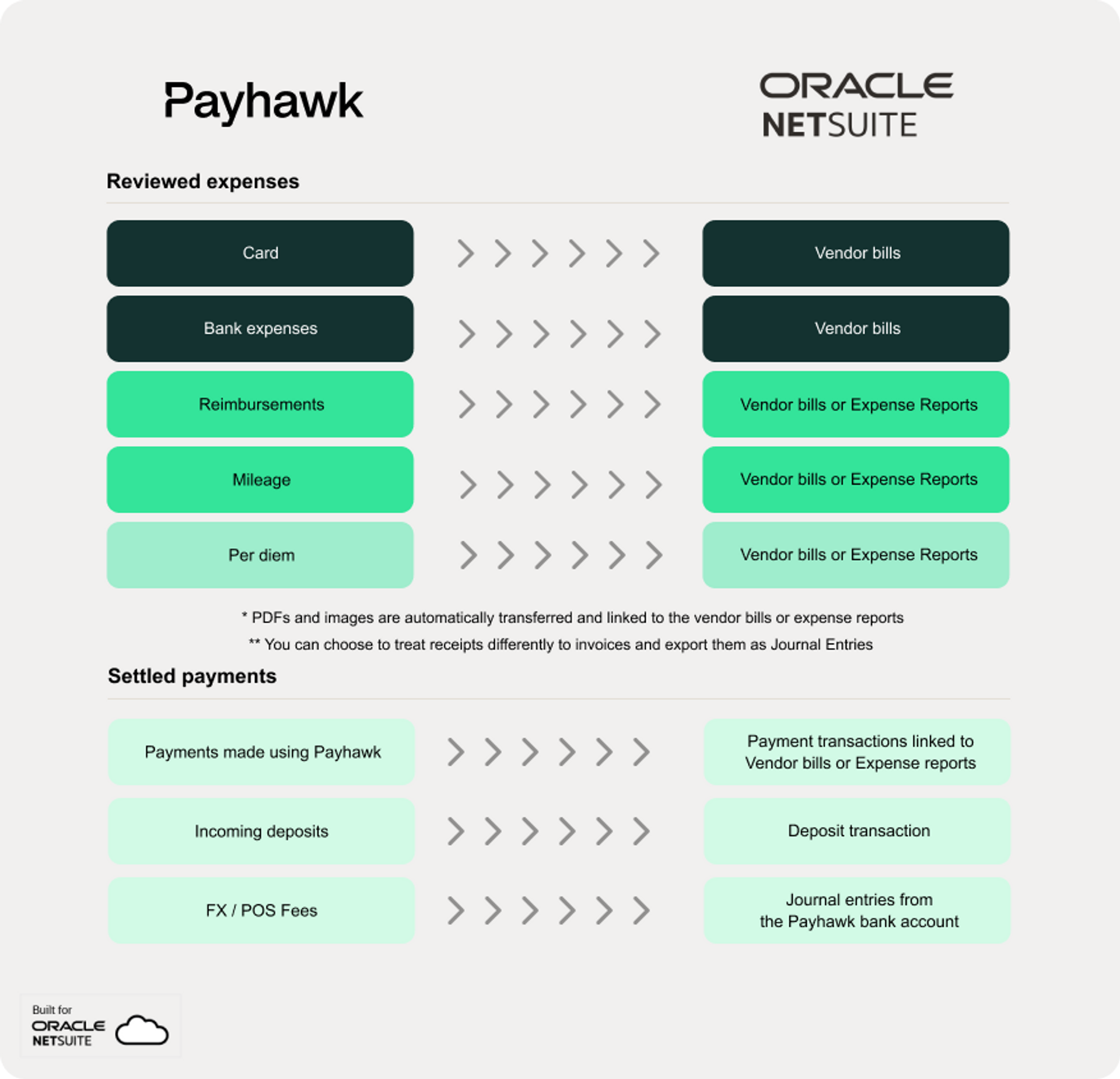

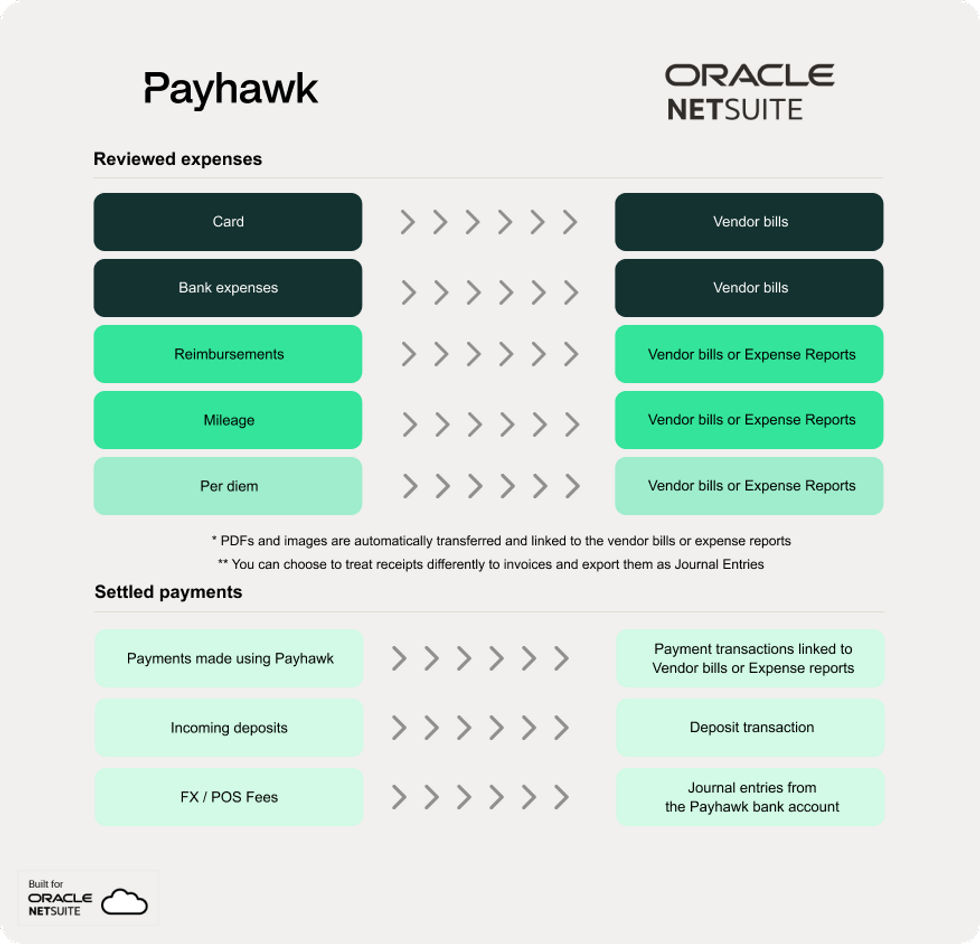

At Payhawk, we designed our integration strategy completely around finance professionals. And this strategy follows the accounting accruals concept, meaning all your spend data flows seamlessly between systems.

Payhawk integrates with many market-leading ERPs, accounting, HR, and business travel systems. From Microsoft Dynamics 365 Business Central and Oracle NetSuite to QuickBooks, Xero, HiBob, Workday and TravelPerk. We slot straight into your existing tech stack, cranking up your data visibility across all platforms, automating repetitive tasks and digitising expense management processes.

With Payhawk integrations, you can:

- Track expenses in real-time

- Customise approval workflows

- Ensure compliance with company policies

- Achieve audit-ready accounting data

- Focus on core business activities

- Save time with auto-bulk updates

- Improve security with automatic on & off-boarding

Learn more about our integrations here or schedule a demo to see them in action.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Why you should integrate Dynamics 365 Business Central with Payhawk