How to automate the procure-to-pay process

Business purchases are often tedious, involving lots of manual work across systems. Procure-to-pay software simplifies this by automating requests, approvals, purchase order creation, 3-way matching, and supplier payments in one place. See how Payhawk tackles this to save you time and improve spend control.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Navigating the business purchasing process can be a real maze for your finance and procurement teams. From tracking requests across multiple systems and matching incoming invoices to ensuring data is accurate and within the pre-agreed thresholds to avoid overspending, there are many places to get lost.

Introducing innovative procure-to-pay automation from Payhawk.

Our new purchase order system and automated accounts payable solution lets you streamline your procurement operations, avoid human error, catch discrepancies, control spending, and issue payments to suppliers.

Still not sure if procure-to-pay automation is for you? Discover the five challenges of inefficient procurement below and see how the right solution could help you eliminate inefficiencies, slash errors, and stay on top of your company spend.

Transform the way you spend with integrated procure-to-pay features

The five biggest challenges of the manual procure-to-pay process

Is it such a big deal if you don't use a solution that automates your procure-to-pay process? In a word, yes.

You risk slowing down the approval process, causing errors and delays around processing business purchases, and creating opaque accountability where you should have complete transparency. Ultimately, these issues directly impact your business, as poor spend visibility can cause uninformed decision-making. Meanwhile, a lack of approval automation can lead to maverick spending and increased costs.

In addition, the time you and your finance team spends on manual tasks could be better used elsewhere, such as finding new opportunities for cost savings and establishing new processes.

Here are the five biggest problems with manual procure-to-pay processes, in case you need more reasons to consider automation:

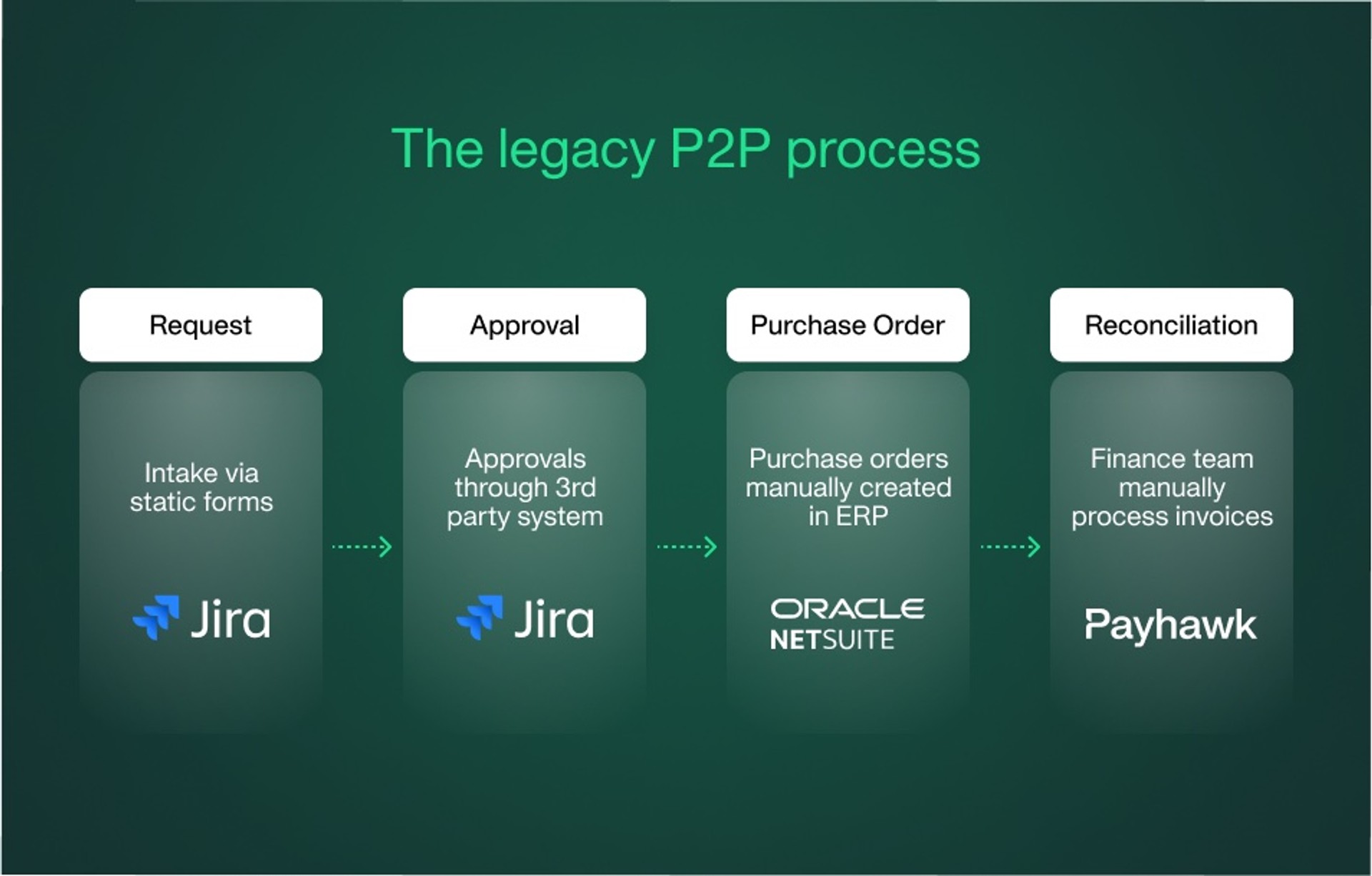

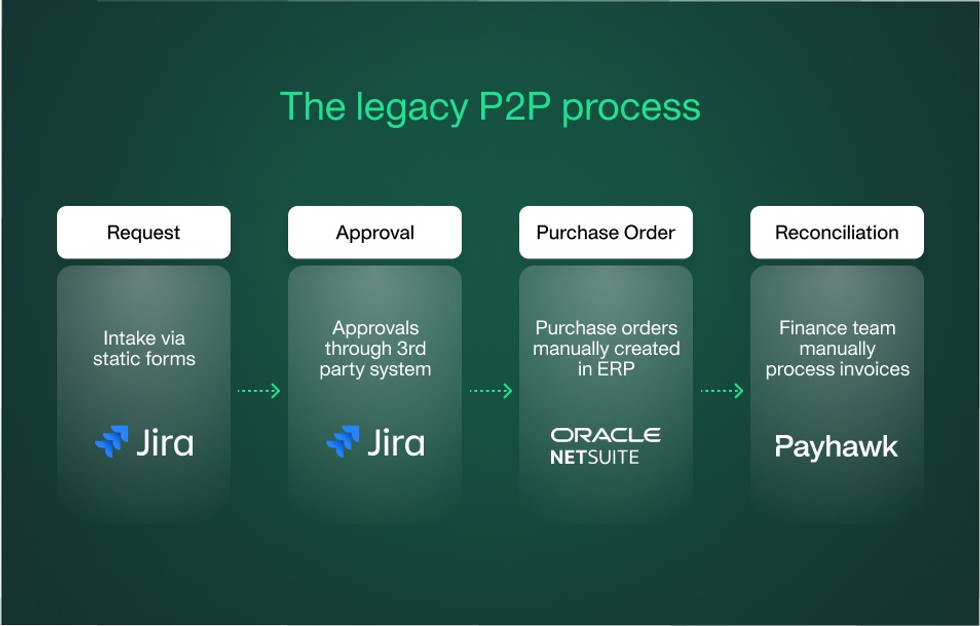

1. Inefficient processes

We’re all human, which means errors are inevitable in manual processes. And errors lead to delays. Relying on manual processes for your purchase requisitions, approvals, purchase orders, and invoices is not an efficient way to manage and oversee the procurement process. Worse still, this process is usually handled across multiple, disconnected, third-party systems, making it hard to identify bottlenecks and get end-to-end visibility on business purchases.

Our solution automates most of the procurement process, meaning no more manual data entry or wasted time, huge error reduction, and more potential to find savings and control costs. Here’s how it works:

- All purchase requests are submitted and organised within a centralised database, allowing you to check their current status and see the required next steps

- You can set custom approval workflows, defining who should sign off purchase requests before proceeding with the purchase

- Approvers are then notified and reminded that they need to take action. Once you upload the incoming supplier invoices to Payhawk, we automatically link them to the respective purchase orders, and the system identifies any discrepancies between the delivered quantity and the pre-agreed price

- And finally, once you are ready to pay your supplier, you can do so directly through Payhawk

Additionally, we support free local and low-cost international bank payments, allowing you to pay suppliers across various countries. The bottom line is that you can streamline business purchases from request to payment within a single platform.

2. Unauthorised spending

Uncontrolled spending can lead to cash flow problems, making it impossible to forecast accurately and plan budgets. Poor spend visibility in your procurement activities means you might miss opportunities to identify cost savings and nip overspending in the bud. And, worst of all, you might overspend to the extent that you have to shuffle budgets and resources to cover planned expenses and turn down great opportunities simply because of a lack of funds.

But with Payhawk, you can tightly control how your company spends company money with approval flows built into the procurement process and automation around set limits and discrepancies. Any spending or discrepancy over a certain limit gets flagged for more action, and anything that goes under can flow through (according to your own specified limits).

3. Lengthy and complex approval cycles

Manually seeking purchase order request approvals can cause unnecessary delays and bottlenecks. Sometimes, you might submit a request via a third-party solution such as Jira and then get approvals via email or Slack, leading to prolonged approvals and a lack of transparency over the entire process.

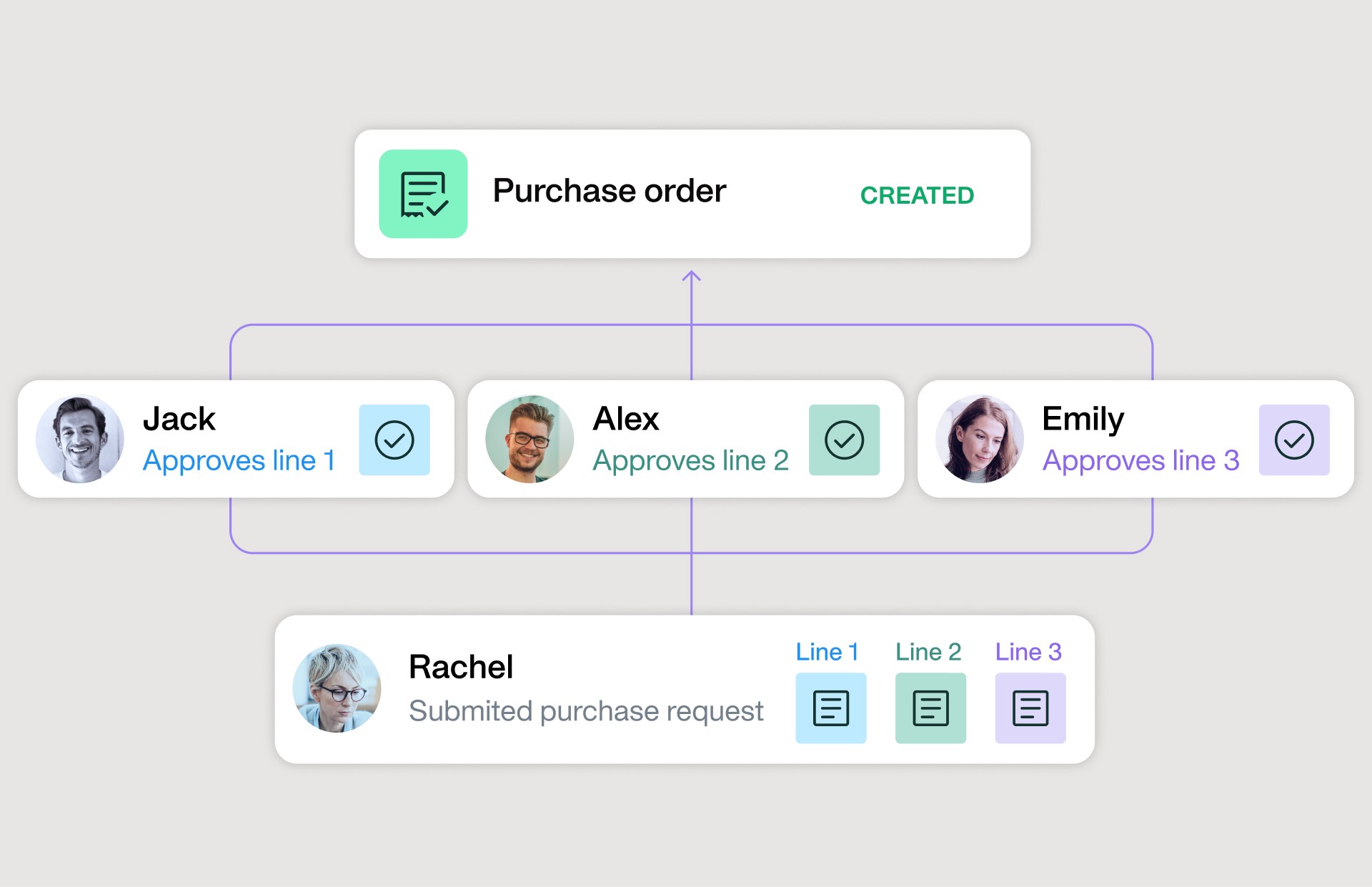

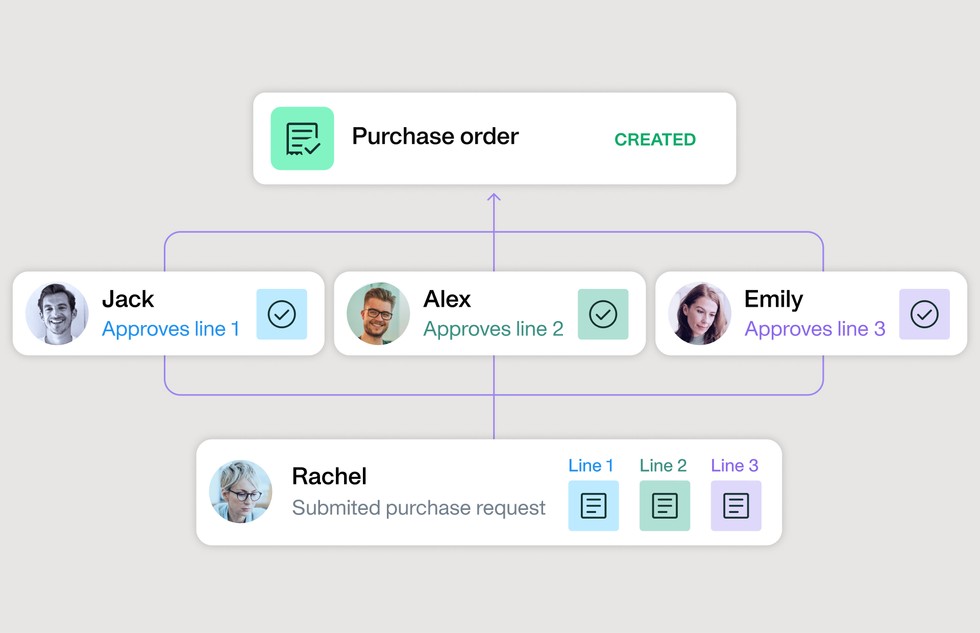

By automating the approval process and leveraging custom approval workflows, you can make lengthy and complicated approval cycles a thing of the past. Instead, your organisation can ensure the correct person (or a chain of people) reviews requests promptly while keeping a record of who, when, and what was approved.

At Payhawk, our platform provides highly customisable approval and payment workflows to solve the issues above. These workflows allow you to tailor the approval chain to your internal process and company structure, letting you choose between specific people, team managers, cost center owners, location managers, project managers, and more as the required approver.

But that’s not all. You can also create advanced approval workflows, requiring multiple people to approve an expense or request, either sequentially or non-sequentially, before moving it to the next stage.

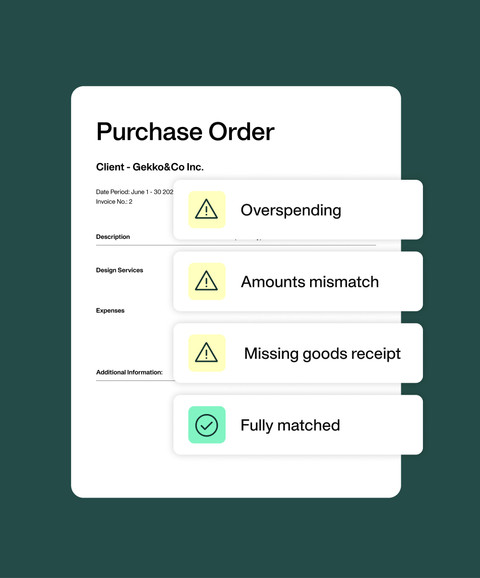

4. Quantity and amount discrepancy identification

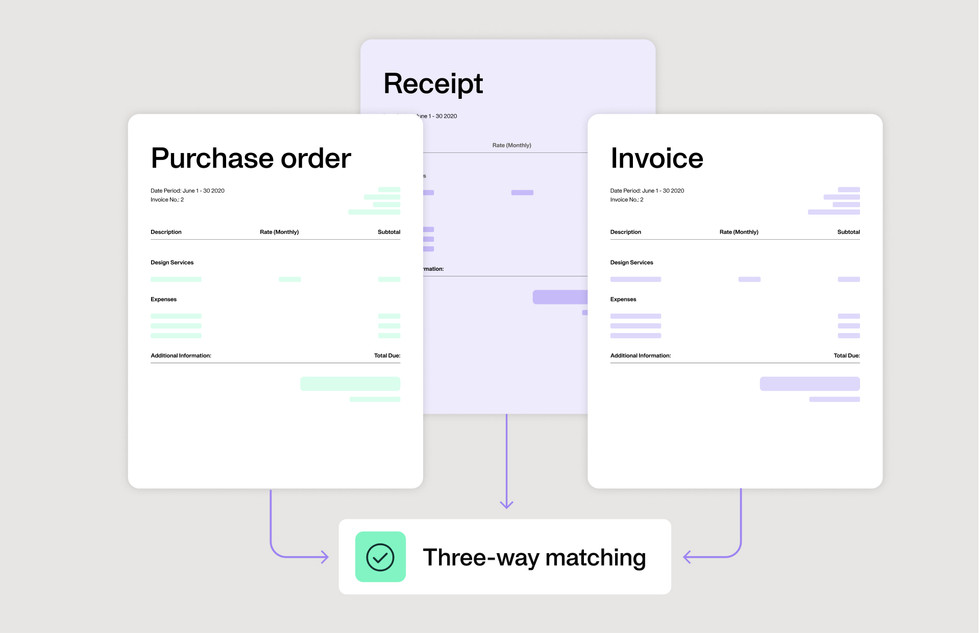

Late payments typically happen when manual processes like matching supplier invoices, receipts, and orders are involved. Delays get even longer if suppliers ask you to pay for partial shipments or if the invoice amount exceeds what you initially agreed.

Flagging these problems fast to your organisation and supplier is vital. Yet, manually comparing invoices, orders, and receipts takes forever, slowing everything down and meaning any flags are too late.

It's a bit of a vicious circle, but you can easily navigate with our procure-to-pay automation. Our automatic 3-way matching and discrepancy identification functionalities let you speed up the entire data capture and matching process, preventing costly mistakes due to manually matching the documents.

Our OCR (optical character recognition) technology reviews the purchase orders, receipts, and invoices and extracts all the information to Payhawk while also matching and validating the details on all documents.

5. Lack of standardisation

Inconsistent processes breed inconsistent results and leave space for errors. Data needs to be accurate and consistent across departments; otherwise, managing and optimising the procure-to-pay process becomes challenging.

At Payhawk, we minimise confusion and conflict by standardising and centralising all company spend processes. From automating accounts payable to streamlining supplier management, we ensure all parties standard processes throughout, generating consistent results and expectations.

Our procure-to-pay capability does all the heavy lifting throughout the supplier management process, so you don’t have to.

Understanding the phases of procurement: Why & how the flow works

Each stage in the procure-to-pay process is vital, but what happens at each one and why? Answers below:

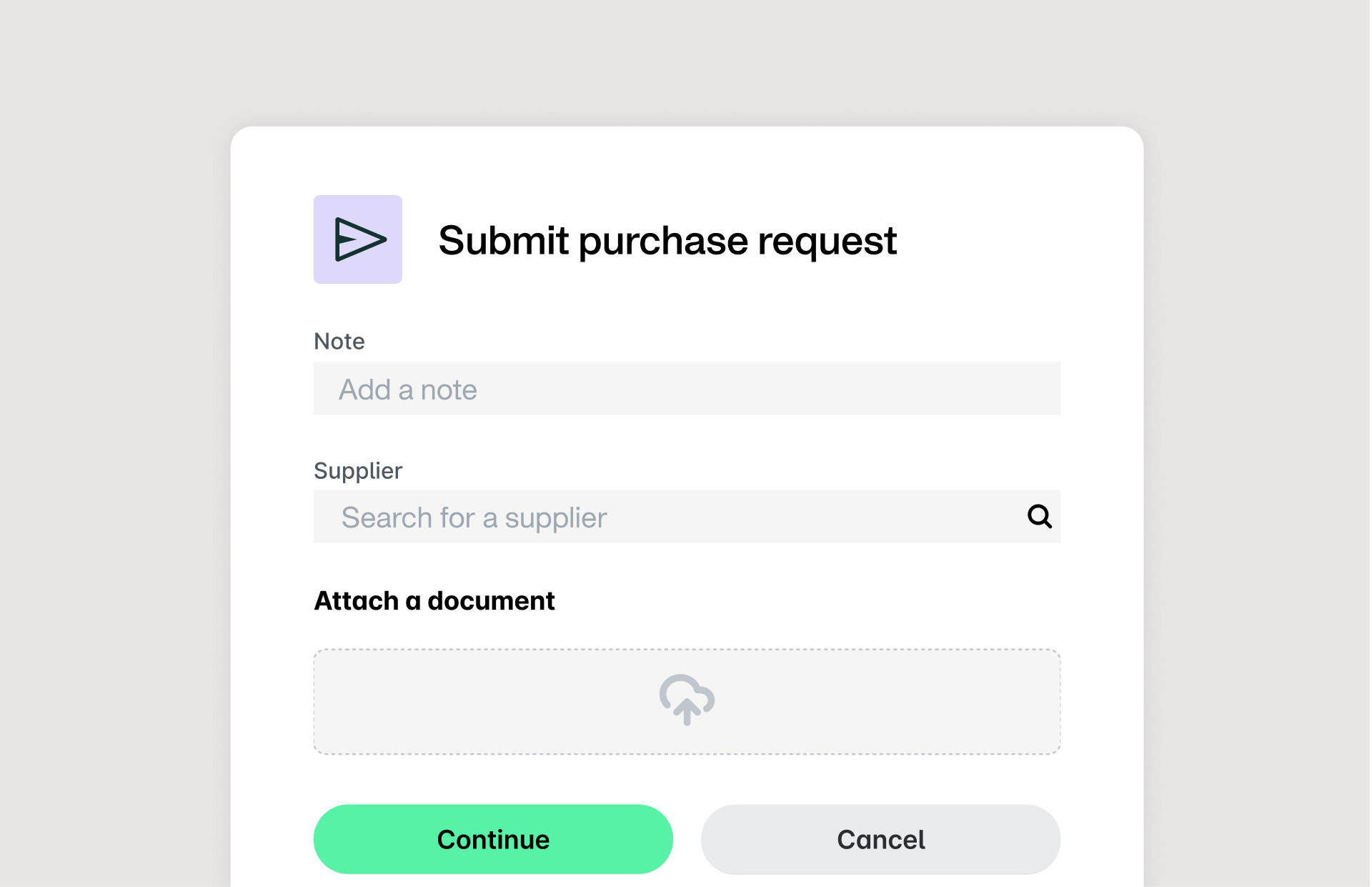

- Submit purchase request

Employees start the process by submitting a purchase request. They fill in the details, like what they want to buy and how much, and attach any necessary documents, like quotes or contracts, to provide all the information upfront. - Approve request & create purchase order

Once the request is submitted, it goes through an approval process. The relevant people review it, and if everything checks out, a purchase order is automatically created and sent to the supplier. - Three-way match & discrepancy check

After the purchase order is placed, the system matches it with the receipt notes and invoice to check for any discrepancies, like differences in price or quantity. This step ensures everything aligns before moving forward. - Pay supplier

Once the documents are verified, the system processes payment to the supplier. Payments can be made directly from the platform using a variety of payment methods, making it quick and easy to settle invoices. - Purchasing transparency

The process gives you full visibility of all purchases—both past and upcoming. This way, you can keep track of open requests, monitor spend, and quickly close the books without any surprises. - Automated approval workflows

Purchase requests go through custom approval workflows, ensuring the right people sign off before anything is committed. This step helps avoid unauthorized purchases and keeps everything under control. - AI-driven OCR for invoice processing

The system uses AI-powered optical character recognition (OCR) to automatically scan and extract important information from invoices and receipt notes. This reduces manual data entry and speeds up the process. - Supplier management

Supplier information is easily managed and updated within the system. It syncs with your ERP, making it simple to keep track of supplier details and maintain accurate records. - Custom discrepancy thresholds

You can set custom thresholds for discrepancies like price or quantity differences. If any discrepancies exceed the set limits, the system triggers additional approval workflows to ensure everything is reviewed before payment is made.

Payhawk procure-to-pay benefits in a nutshell

At Payhawk, we’re already helping customers in more than 32+ countries optimise spend management with automated accounts payable, including invoice capture and management, approval workflows for invoices, international payments, and more.

On top of the above, we now also offer a time-saving, control-boosting purchase order system. As a user, you can:

- Submit purchase requests within the platform

- Set up approval workflows for purchase requests

- Create purchase orders upon approval

- Run two or three-way matching between invoices, purchase orders, and goods receipt notes

- Identify discrepancies in goods or service quantity received and/or payment amount

Need to move faster, reduce errors, and get a firmer grip on spend control? With our automated accounts payable features and purchase orders system, you can (and all in one place).

How does the Payhawk procure-to-pay feature work?

The new procure-to-pay features are super simple to use. Here’s how they look in action:

1. Setting the stage

You can customise your purchase order setup, including choosing a PO prefix and formatting a starting number, keeping all purchase orders following the same structure. You can also set the 'purchase order categories' for which receipt notes are required and set discrepancy rules for purchase orders tipping over a certain amount.

2. Creating purchase request approval workflows

You can set customer approval workflows based on purchase request amount, ensuring the right person at the right level is making important spending decisions. This limits unnecessary spending, helping you keep control of costs.

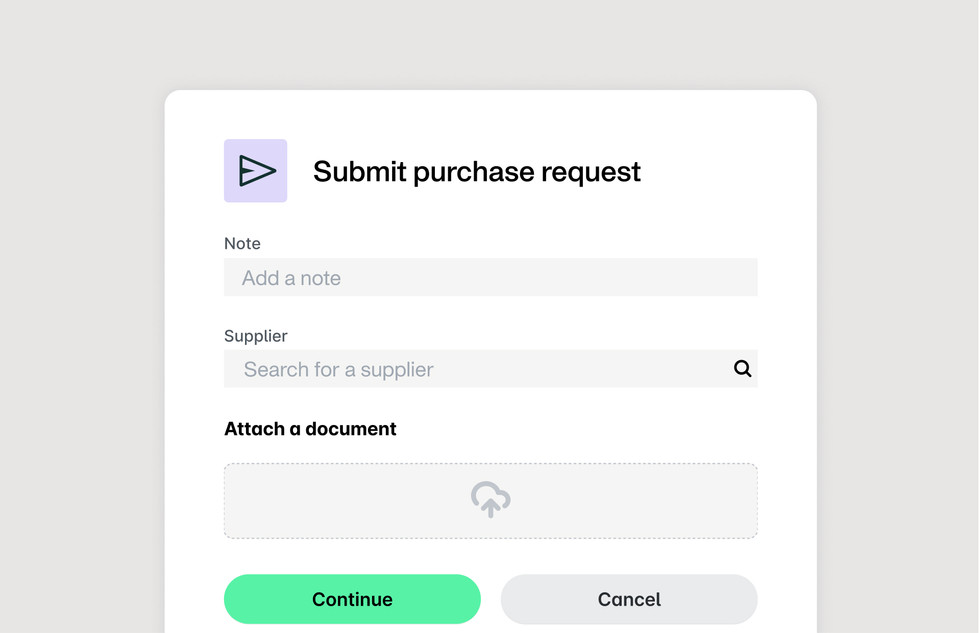

3. Submitting a purchase request

The Payhawk interface makes it easy for users to submit a purchase request, prompting them to attach the quote for approval. The requester then has a chance to review all information on the purchase request before submitting it for approval.

4. Approving a purchase requests

The approver then receives the below view of the purchase request. Supplier information is clearly displayed, saving time trying to decipher details. The approver can select ‘approve’ or ‘decline’.

5. Submitting invoice for payment

In every window, both the approver and the requester can view the history of the purchase order, from creation to submission to approval. Once the purchase request has been approved and the purchase order is created, it’s time to upload the invoice once you have it.

6. Linking the invoice to the purchase order

When you receive the invoice, simply click ‘add invoice’ in the top right corner of the window; you’ll then be prompted to select the corresponding purchase order number to link it correctly.

The biggest benefits beyond procure-to-pay automation from Payhawk

Streamlined, efficient procure-to-pay automation is just one string in our bow. Our spend management solution lets you achieve a lot more, including the following seven (international) benefits:

1. Get a complete solution

Stop switching between solutions and missing out on real-time info. Get corporate cards, expense management, multi-currency functionality, and market-leading integrations all in one place with Payhawk. We have all the features you need to oversee business finances and processes, control spending, and get real-time impactful visibility.

2. Spend globally with confidence

Spend easily and securely, no matter whether domestically or internationally. Empower your employees to spend within limits wherever they are in the world with our globally accepted corporate cards.

3. Make cross-border payments with ease

Get faster and more cost-effective global payments in over 160 countries and 50 currencies.

4. Integrate your market-leading ERP and other tools

Effortlessly integrate with your ERP and accounting systems, to increase spend visibility and speedy, data-backed decisions. From NetSuite and Microsoft Dynamics to QuickBooks and EXACT, import everything from tax codes to Chart of Accounts and automate bank reconciliation and VAT retrieval.

5. Track carbon emissions with Payhawk Green

Tracking your carbon emissions through our software to better understand your organisation’s carbon footprint and environmental impact. Discover data collection for sustainability reporting via Payhawk Green.

6. Work with an EMI license holder

An Electronic Money Institute (EMI) license means we can provide customers with e-money services, including IBAN accounts, debit cards, bank transfers, spot FX, credit card products, as well as Payment Initiation Services (PIS), and Account Information Services (AIS).

7. Payhawk is a principal member of Visa Europe

Issue cards more easily via a principal member of Visa Europe. (We can issue Visa cards directly without any third-party involvement. This generates better service reliability and resilience for our business customers.)

8. Increase efficiency

Automate procurement processes to reduce manual tasks, allowing your team to focus on more valuable activities, speeding up approvals, and reducing bottlenecks.

9. Reduce errors

Say goodbye to annoying mistakes! Automated workflows and intelligent matching reduce the risk of human errors, making sure purchases, invoices, and payments align correctly without discrepancies.

10. Improve compliance

Throw away your policy folders. At Payhawk, our built-in approval workflows and spend controls let you ensure that every purchase aligns with your overall spend policies, helping your team stay policy-compliant and in the black.

11. Strengthen supplier relationships

Streamline processes and cut out errors to get faster, more accurate supplier payments. Build trust and maintain strong, long-term partnerships (and reap the potential rewards).

Timothy Green, Head of Finance Transformation at Aventum Group, explains:

The PO features have given us a lot more visibility and control. We did work with some POs in the past, but these were so manual that it was easy for things to slip through. Now, with the approval workflows in PO, we can embed the controls in-company and give our procurement manager complete control.

To sum up

Manually managing your procurement processes leaves you open to inefficiencies and errors, unnecessarily slowing down the approval process.

But with software like Payhawk procure-to-pay, you can manage all supplier relationships from beginning to end, cut out unauthorised spending with enforced policy compliance, and gain real-time visibility into spend across multiple entities. Sounds pretty efficient, right?

Watch Payhawk procure-to-pay in action and see just how efficient it could make your business in a personalised demo: Book now.

Tsvetina is the creative force behind Payhawk's product marketing initiatives. She's dedicated to shaping our brand's image, refining messaging, and orchestrating our go-to-market strategy. Beyond her strategic role, she unwinds with a love for exquisite food, finds solace in yoga, and explores the world, fueled by a passion for live music experiences.

Related Articles

How to lower accounts payable error rates with an automation software