The expert's guide to corporate spend controls

Your current financial processes could be giving you less control over company spending than you realise. In this article, we will walk you through a step-by-step guide to implementing effective expense policies. Ready to make your company finances more efficient?

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

For any CFO, cash is important, but spend management extends far beyond what's in your company's "pockets."

Proper cost control is more about spend visibility than cash. With the ability to quickly and easily determine what your money is being spent on, you can make more informed financial decisions. And without a good level of transparency? You'll struggle to make proactive, informed spending decisions and won't be able to take advantage of expenditure data.

Maybe your business has a robust cost-conscious spend culture, and you aren't too worried about overspend. That's great, but if your financial workflows are still manual, they will cost you. Instead of being a physical payment, the cost is the hours of manual work fixing human errors in reconciliation, chasing receipts, and tracking down missing info.

As the team at GDS Group, explains:

Before Payhawk, my expensing experience was a nightmare. We used to sign receipts, add them to Excel spreadsheets, and send them off .. we were unable to track when they were coming back or where they were. Then the finance team would have to read and decodify all the receipts to work out which buckets the spend should sit in for the general ledger!

Investing into effective spend management is cheaper than not having one, but how do you know what controls, solutions, and tech stacks are right for you? Here's a breakdown of efficient spend control measures to keep your business ahead of the game in 2025.

What is spend control, and why is it important for your company?

Corporate spend control means controlling company spend in any form, from expenditure in cash and credit cards to invoices and subscriptions.

Getting tight control and complete visibility over spend means you can make more informed business decisions, your stakeholders know where the company stands, and you can forecast business expenses more accurately, better positioning the company for future growth.

Efficient spending in your company is like having sails on a ship. Without them, you can't expect to embark on a successful journey to your destination.

Why efficient spend controls matter:

- Maximising profitability — you effectively expand your bottom line by cutting unnecessary expenditure. Whether you're paying for two of the same subscriptions or notice a lot of out-of-policy spending from employees, there's always room for improvement. But you can't spot these sorts of savings opportunities without proper cost control measures and spend visibility.

- Improving financial visibility — Not using a spend control system is like steering your car in complete darkness in hopes of getting your organization from point A to point B. It's important to understand where money is being spent, what it is being spent on, and what the effects are on your profitability, cutting out the least important items.

- Better informed business decisions — with real-time insight into your financial performance, you're empowered to make better business decisions. Proper spend control means 100% real-time access to all your spending data. And this data can help you make more accurate forecasts and provide the info that stakeholders are interested in, fueling their confidence in your company.

Out-of-control spending can damage your business

If you can’t categorically outline what your organization spends its money on each month, you won’t have adequate control over spend. That’s why creating rigorous business spend categories to classify spending is essential.

The spend classifications can also help you protect the business from unauthorized expenses charged to a business card.

When creating business spend categories that help you measure and track what employees are spending on (think classification by project, venue, team, etc.), you need to consider three crucial factors:

1. Visibility: make sure that all your employees understand how and why they must categorize any expenses

2. Transparency: Ensure employees understand how their spending relates to the broader business picture

3. Accuracy: Ensure that tools are in place to enable employees to record their business spend accurately and efficiently

If your organization’s spend control workflows lack these three core factors, you should consider formalizing your spend management process.

Now that we understand why classifying out-of-control policy spending is essential — let’s see what happens if you don’t do it.

Here are five consequences of out-of-control spending:

1) Poor financial planning

If you struggle to control your business spending, you won’t be able to plan budgets accurately. Poorly constructed budgets mean you might underestimate or overestimate your spending, jeopardizing your stakeholders’ trust in your actions.

2) Unnecessary and time-consuming admin

Without proper spending control measures, employees will struggle to stay compliant with your spending policies and take longer to submit reimbursement claims. This means finance professionals are correcting expense submissions or asking for resubmission, leading to delays in reimbursements and general ambiguity over spending effectiveness.

3) High error rate

Inefficient and manual spend management processes lead to more human errors. Staff aren’t sure what’s expected of them, so they will likely make mistakes when submitting their expense reports. From manually entering the wrong invoice details to miscategorizing spending, finance teams must correct these mistakes before reimbursement.

4) Serious fraud risks

Without restrictive spending policies and with the ability to submit expenses without automatic checks, it’s easy for out-of-policy spending to go unnoticed. Without proper spend management tools, monitoring all financial transactions within the company becomes even more challenging, making expense fraud more risky.

5) Loss of long-term stability

For business longevity, you must be able to manage cash flow confidently. And that means knowing what spending is leaving your organization against revenue coming in. If you don’t have a handle on monthly expenditures, you will likely overspend, leading to reduced capital reserves. This means you’re not in a strong position to maintain long-term growth.

The cost of inefficiency: Why US businesses can't afford manual workflows

A recent study from our CFO Agenda report highlights that improving forecasting (77%) and enhancing finance metrics and insights (74%) are the top priorities for CFOs in the UK and Europe heading into 2025.

However, achieving these goals isn't without its challenges. With 59% of respondents stating that gaining complete, centralized control and visibility over departmental or project spending is extremely difficult, it's clear that businesses need to adopt smarter, more agile approaches to finance. Investing in centralized finance technology is no longer just a nice-to-have but a crucial step for CFOs to align financial strategies with operational goals and secure long-term growth.

Meanwhile, navigating a tough economic climate demands both resilience and precision. According to the report, 54% of respondents see cost streamlining as a vital strategy, while 48% aim to improve cash flow forecasting to stay competitive. For US businesses like yours, leveraging tools like BI software, deemed 'very useful' by 59% of respondents, can play a pivotal role in building financial agility. By automating expense management and adopting real-time spend visibility solutions, businesses can eliminate inefficiencies and make data-driven decisions that support growth — even in uncertain times.

A clear path to growth through smarter spend visibility

For CFOs aiming to drive sustainable growth, the ability to see and manage spend across the business is critical. Yet, our CFO Agenda report reveals that 59% of finance leaders find it extremely difficult to achieve complete, centralized visibility over departmental or project budgets. This lack of clarity creates inefficiencies that hold businesses back. By adopting smarter, centralized finance technology, CFOs can overcome these hurdles, enabling real-time insights, empowering teams to manage budgets responsibly, and aligning financial operations with long-term strategic goals. The result? A smoother, clearer path to growth.

A step-by-step guide to implementing effective corporate spend controls

Here, we provide a step-by-step approach to implementing effective cost-control policies within your organization, from assessing current spending to automating expense management.

1. Assess current spending

Without analyzing current spending, you won’t be able to improve spend management processes because you have nothing to measure against.

To analyze current spending, you need to gather relevant expense data. Typically, you’ll find this data inside your spend management tool, but if you don’t have a tool like this, you’ll find the data you need searching through your procurement tools, corporate credit cards or bank accounts, ERP, accounting software or payroll tools.

Unless you have a spend management tool with in-built customisable categories, as the next step, you’ll want to group your spending by team or category to understand where money is being spent and on what.

2. Set financial goals and allocate budget

To understand your company spending and its impact on business growth, you must set realistic and achievable goals to structure and focus your business spend.

After you’ve set your goals, it’s time to allocate budgets. That might include introducing credit card limits and creating a comprehensive spend policy to reduce out-of-policy purchases.

3. Implement approval processes

Employee fraud costs businesses 5% of their revenue each year. If you’re losing money through unauthorized spending or fraudulent expense claims, don’t worry — alongside implementing a new expense policy, you can also implement an approval process to heavily mitigate these losses.

This can easily be done via corporate spend management solutions including corporate cards with custom limits, blocks, and in-built approvals.

If you go down the software road, you can even automate this entire process using custom approval workflows for different spend types, departments, or by the amount and designated approvers to oversee each purchase. This helps stop unauthorized spending, helping you get a handle on every penny spent without being overbearing.

Daniel Tang, Finance Manager at PinPoint Media says:

Payhawk's workflow designer has improved the overall ease of use by being very intuitive. It has also improved the customization functionality, as we can modify the workflows depending on the project department.

4. Monitoring and analyzing expenses

Monitoring and analyzing expenses quickly and effectively are half the battle of effective spending management. This is where expense management software comes in handy, helping you identify areas where you’re overspending or using inefficient processes.

For example, if you’re currently using several tech solutions, spend management software like Payhawk (hello!) can help you integrate all tech stacks like ERP, accounting, and business tools under one roof to help you access your financial data in one place. This makes financial reporting processes much more efficient, streamlined, and automated.

17% of finance teams were still using manual processes exclusively in 2021, so manual reconciliation still poses significant challenges for many businesses as it’s time-consuming and error-prone; in short, it’s an inefficient use of your internal resources.

On the other hand, real-time reconciliation gives you accurate, up-to-the-minute financial information, empowering your finance and business operation teams to make impactful business decisions.

5. Build better supplier relationships

If you’re looking for ways to reduce costs for your organisation, building stronger relationships with suppliers will help. Having proper spend control policies in place gives you access to supplier spend data, that better positions you to renegotiate payment terms and unit prices.

Setting up new supplier relationships can drain resources and finances — so staying with one trusted supplier benefits both parties.

The stronger the relationship between you and your supplier, the more efficient your processes become. And using a spend management solution with supplier management features, like ours, can help you get there.

6. Introduce spend control policies

It’s important to create clear employee policies around spending limits, including what expenses are reimbursable and your reimbursement processes. Without spend control policies, your employees won’t know what you expect of them, leading to incorrect expense submittal and expense data categorization mistakes.

Controlling expenses in business should be about making it less stressful for employees and easier for finance professionals. Educate employees on your spending boundaries and explain how they can submit an expense report.

7. Automate expense management

Ensuring your financial information is accurate is crucial for many reasons, including financial projections, budget planning and management, and tax returns.

Technology can give you this accuracy and more. You can streamline your expense reporting and management processes by removing the tedium of manual reconciliation, receipt collection, data entry, human errors — the list goes on.

So, how can we help you automate your spend controls?

Automating corporate spend control workflows with Payhawk

1. Track all payment methods automatically in one dashboard

If you’re managing finances across multiple entities, it can quickly become a headache. But by automating spend control, you can easily track spending across all entities through the Group Dashboard. And see which teams spend the most money, analyze spending patterns by department or entity, and make smarter financial decisions.

2. Real-time visibility over spending

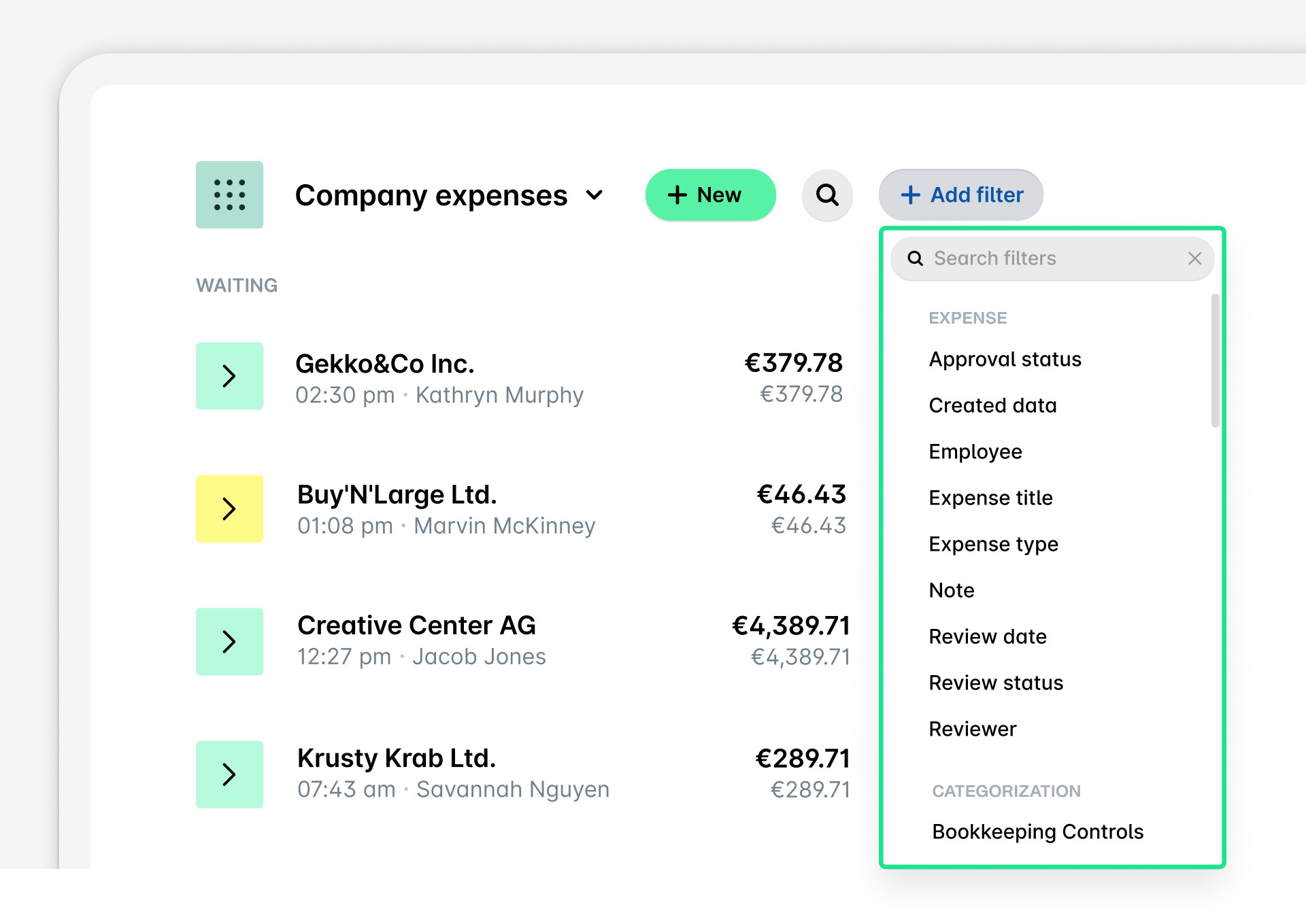

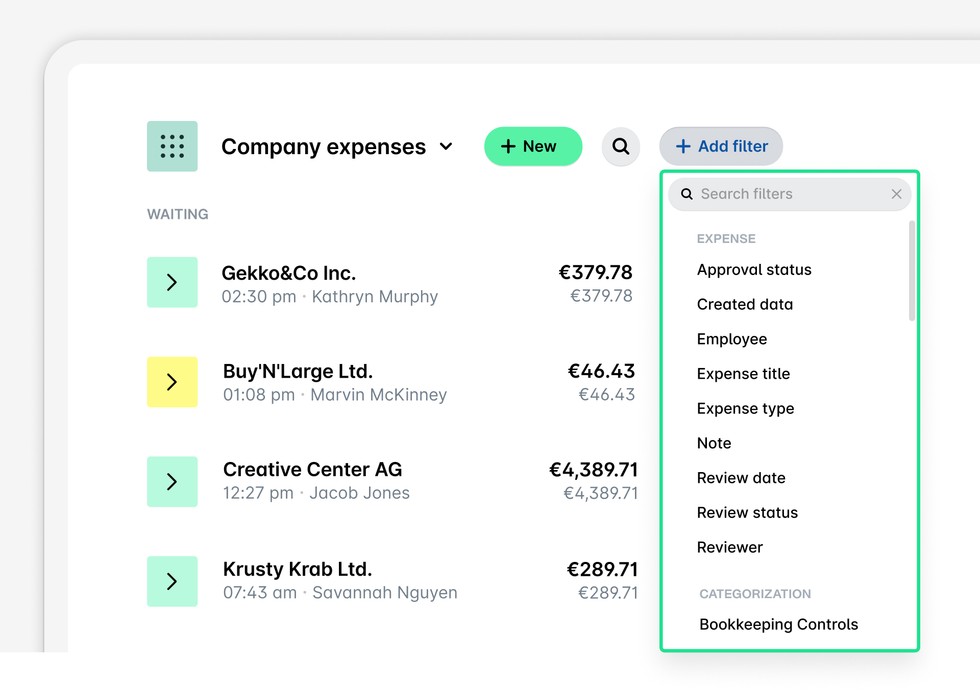

You can monitor, track and manage spend from a central, user-friendly dashboard with complete export functionality and multiple filter options, providing full granularity of business expenses.

After implementing our spend management solution, H.R. and Staffing Agency, HRS, enjoys the benefits of real-time reconciliation.

Kiril Boradjiev, Co-founder and Managing Partner at HRS, says:

We can now see where money is being spent and why, all in real time. And we have found ways to save money because of good spend visibility.

After employees submit their expense report, the spend management software automatically transfers the data to a supported ERP or accounting software, meaning that all the spend data flows in real-time, making reconciliation a breeze.

3. Easy receipt collection

Our Optical Character Recognition (OCR) technology, complete with an AI-powered camera, makes snapping an expense receipt or invoice as easy as possible. Employees take a picture; the AI technology works effortlessly to extract all the information receipt data across multiple languages, including the total amount, items purchased, supplier information, and expense date.

Low lighting or creased receipts are also no problem either, thanks to our smart AI camera technology that improves the receipt scans. This means expense data is usually entered correctly by default, drastically reducing human error rates and boosting company-wide efficiency.

Plus, our latest update means our software can now recognize the difference between receipt and invoice.

4. Built-in spend policies and custom spend workflows

Wouldn’t it be great if you could automatically enforce your spend policies? Using our solution, you can. From customized spend rules and spend limits to compliance automation, at Payhawk, our expense management software promotes accountable spending while providing real-time visibility into spending.

5. Easily approve spending in advance

Keeping expense approvals ticking over while designated approvers are out of the office is crucial — efficiency can’t just stop when one person can’t perform their duties. Instead, with our solution, Payhawk customers can set out-of-office spend approval, shifting the responsibility of approving spend to another team member.

Alternatively, if the designated approver is simply working remotely, expense approval can be given at the touch of a button via our mobile app.

6. Best-in-class security features to combat fraud

Our spend management application security measures are best-in-class. We are PCI DSS and SOC2 Type Compliant and ISO 27001 certified. Our certifications mean your financial data is in the safest hands — only a tenth of expense management solution providers are SOC 2 Type 2 compliant.

Our security features include card auto-blocking, two-factor authentication, custom spend limits, vulnerability scanning and threat detection. We can help you prevent and detect fraud in real time, which is impossible to do with manual spend control processes.

7. Countless ERP, accounting, and finance Integrations

By integrating key software applications, like your accounting systems, you benefit from improved data accuracy and consistency, boosting productivity and efficiency. Not just for your finance teams but the entire organization — from cardholders to management teams.

We also offer direct ERP connections and accounting software integrations to help you achieve true automation in corporate spend management.

Unparalleled control over company spend

Without spending controls you don’t have full visibility over business expenditure, which means you can’t make impactful business decisions. That’s why it’s so important to track how much is being spent and what it’s spending on.

Expense management software like ours gives you access to real-time spend data and smart spending controls, resulting in more efficient processes to oversee spend companywide.

Learn more about smart spend management looks with Payhawk, including, how we reconcile 99.7% of expenses with zero back and forth and help you reduce your manual work by 80%. Ready to talk to an expert about your current expense challenges? Book a personalized demo to find out more.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Pennylane Integration: Why to connect with a spend management platform