Cons of Prepaid Travels Cards - Why You Should Get a Corporate Card Instead.

Exploring prepaid travel cards for your employees? While there are a few perks to prepaid travel cards, there are a lot of limitations, too. This article investigates how they can directly impact your employees' travel experience and hamper how you manage and analyze company spending.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

B2B payments are monetary transactions between two businesses rather than between a company and a consumer (B2C). B2B payments play an essential role in your business — with faster processing times, B2B payments can remove the friction associated with doing business domestically and across borders.

If you’re in the B2B industry and looking for more information about different B2B payment methods and want to explore different trends taking the B2B payment industry by storm, including real-time payments and cross-border business payments, then keep reading.

Should I use a prepaid travel card for business?

Giving your traveling employees prepaid travel cards might seem like a no-brainer. They're built for that purpose, right? Hand them over, load them with funds, and send the employee on their way, avoiding the headache…

The problems arise, however, if your employees are frequent business travelers, as these cards can pose more challenges than solutions. Prepaid cards have limited spend control and visibility, less flexibility than other card products, and don't offer many commercial travel benefits.

So, if you're on the cusp of setting up prepaid travel cards, hit pause and consider using corporate cards instead.

If you implement the right spend management solution, aside from cards, you'll also get connected expense management software. Plus, you can expect this software to help you effectively manage and control business travel costs, save hours and even days of manual admin, enforce spending policies, and dive deep into all business spending.

Take control of spend with better business travel expense management

Nine limitations of prepaid travel cards

Still deciding whether implementing prepaid cards is best for your business needs? Here are the nine most significant limitations of prepaid travel cards:

1. Limited merchant acceptance

Prepaid travel cards aren't as widely accepted as corporate cards, mainly if the card issuer is lesser known or regional. If your employee relies on prepaid cards and their payment isn't accepted, this can create unnecessary stress, especially if they don't have another way to pay.

2. You can’t set custom travel expense policies

Most prepaid travel cards don't allow you to set custom travel policies. Without built-in expense policies, you can't support compliance, and your employees are left in the dark about what they can and can't spend their money on. This confusion can also leave your organization open to fraudulent expense claims.

3. You have to preload the card with funds before the trip

You can only use your best guesswork when preloading the cards with suitable funds. That means if employees need to spend more to cover unforeseen business travel expenses, they can't. Lack of funds and the stress involved can destroy the employee's travel confidence and impact business purchases. Some prepaid cards also have reloading limitations, further restricting employees requiring frequent or large fund reloads.

4. You have to pay high fees

Prepaid cards are notorious for having tonnes of hidden fees. Be mindful of activation and monthly maintenance fees, charges for inactivity, card reloading fees, ATM withdrawals charges, and more. Prepaid card fees can soon add up, making you reassess whether the card is worth the cost.

5. There’s limited consumer protection

As prepaid cards aren't linked to a bank account, like credit or debit cards, it can be difficult to recover funds from fraudulent transactions. More robust fraud protection can protect your organization in these instances; the card provider seeks to recover the money on your behalf.

6. You can’t build credit

Prepaid cards can't help your organization build credit lines. Prepaid cards can only be preloaded with funds to spend, limiting your ability to cover unforeseen travel expenses.

7. There are limited rewards

Although some prepaid travel card providers offer their customers rewards and/or cashback, they're often less generous than what corporate credit card companies offer. More often, prepaid travel card companies do not offer any additional benefits at all. Always check with your prepaid card provider about what's included and what's not.

8. Limited accounting tool integrations

Although some prepaid card providers offer integrations with business tools, most of them don't. Users can find tracking spending and managing their finances difficult without accounting integrations.

9. Withdrawal limits

Many prepaid cards set low daily or monthly ATM or cash withdrawal limits, so they can't use their prepaid card if your employees need to access more funds to make large transactions. It's also worth noting many prepaid cards change ATM withdrawal fees, which can get costly if employees withdraw money frequently.

Prepaid travel card FAQs

What is a prepaid travel card?

A prepaid travel card is a card you can reload with funds for employees to make purchases as they travel. These cards aren’t linked to your business bank account, so employees can only spend the funds preloaded onto the card.

What fees are associated with prepaid travel cards?

You should be aware of a few fees, including inactivity fees, ATM withdrawal fees, and monthly or annual fees to keep the card account running.

How are prepaid travel cards loaded?

To load your card, transfer funds from your bank account with the local currency needed for each country. You can usually do this through the card provider's app or website.

Should I get a prepaid travel card for my business?

Whether you should implement prepaid or corporate cards depends on your business needs. The cons of prepaid travel cards might outweigh the pros or vice versa. You should know that corporate cards generally offer better security, control over spending, and wider acceptance.

Take off with travel expense management

Payhawk corporate cards: a great alternative to prepaid travel cards

Corporate cards are designed to meet the specific needs of individual businesses and are an excellent choice for all employees, whether they’re traveling or not.

At Payhawk, our corporate cards are a great alternative to prepaid travel cards. Here are a few of the most important benefits:

1. Spend at over 46 million merchants globally

With global acceptance, your employees can travel and spend freely without worrying their purchases won’t go through. With our virtual cards, you can open accounts in seconds, empowering employees to spend immediately across more than 32 countries.

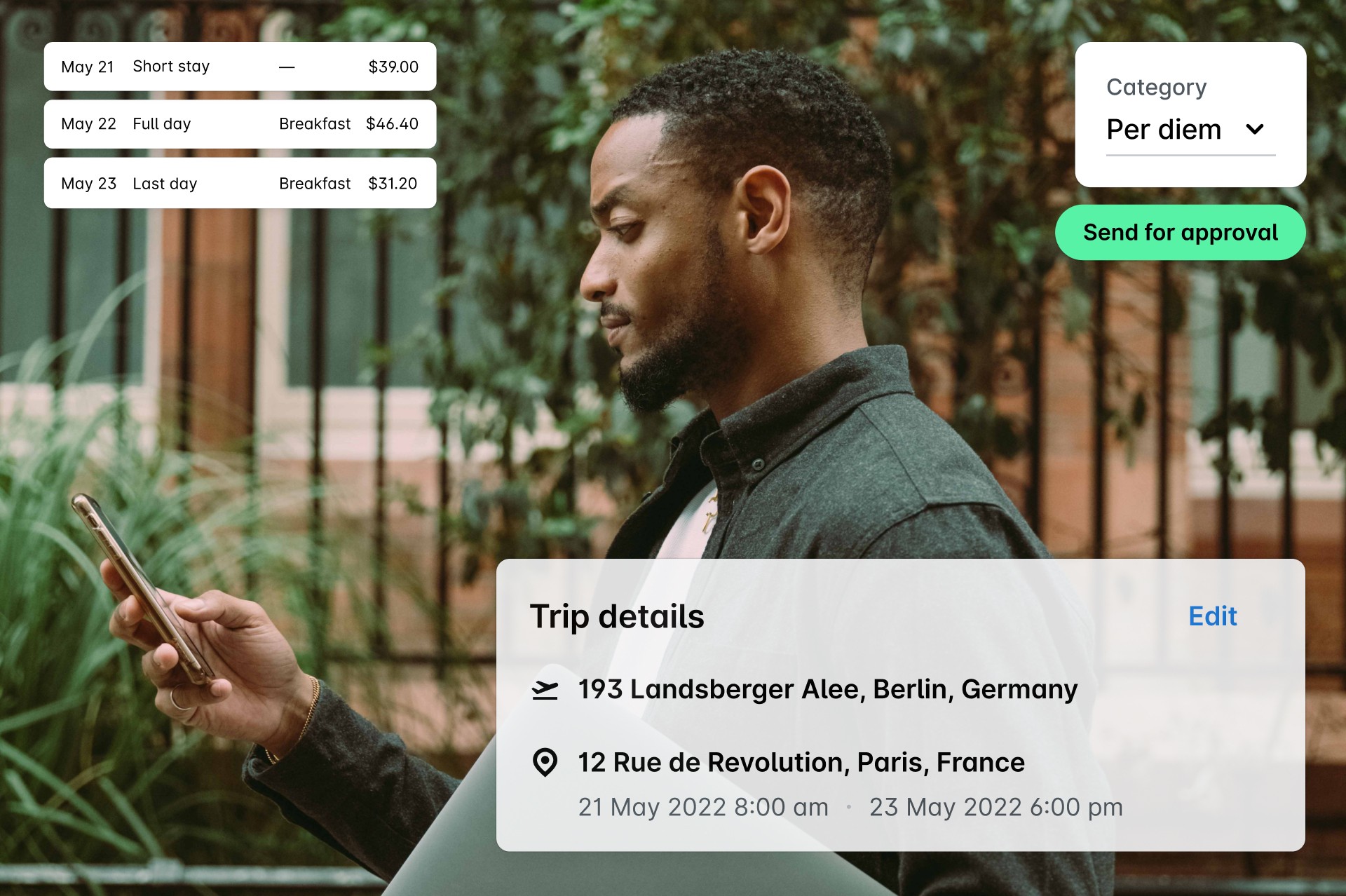

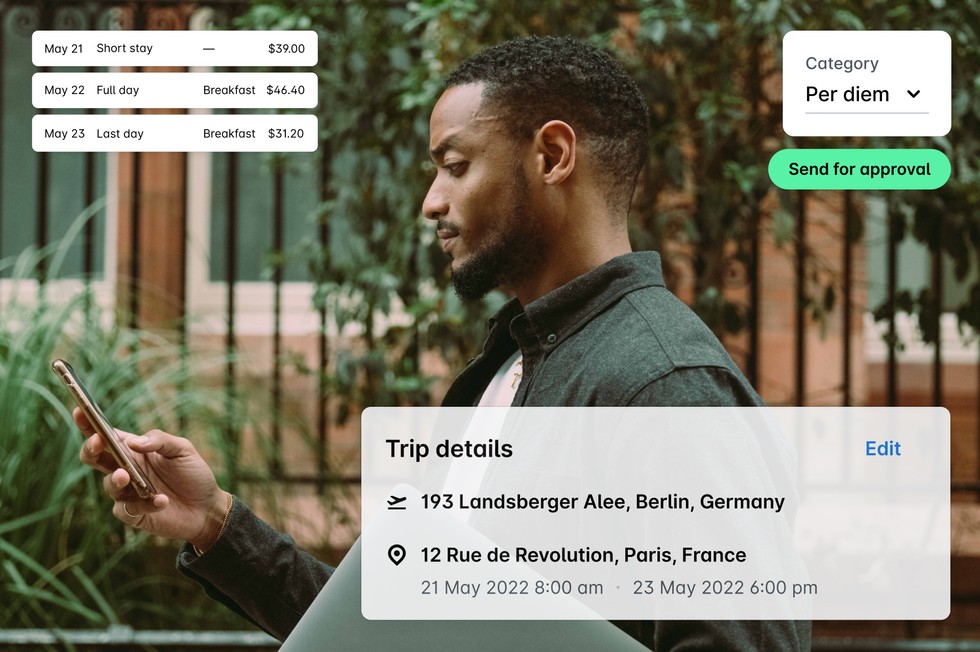

2. Set custom travel policies to keep tabs on spending

By setting custom travel policies, you improve policy compliance, which means you can reduce overspending and keep within budget. In-built custom travel policies like per diems, spend limits, and more also give employees clear guidelines on allowable business travel expenses and how to report them easily without expecting them to dig out policies or collect paper receipts.

Diana Ruseva, Finance Manager at Eleven Ventures, says:

"One of my favorite features is missing document reminders. It saves me from chasing my teammates for uploading invoices from their trips.”

3. Corporate cards are linked to your bank account

By linking your corporate cards to your bank account, you ensure employees are never left high and dry — they’ll always have access to funds if needed (and they’re within policy), and you can even check when accounts are running low.

Diana Ruseva, continues:

"My absolute favorite feature is low funds alert. It helps me not to leave some of my teammates without any funds in the middle of a business trip abroad."

4. No monthly card fees

Payhawk corporate cards don’t come with monthly fees. Users can also enjoy 0% in foreign exchange fees in six currencies and just 1.99% exchange markup on all other currencies.

5. Comprehensive consumer protection with Payhawk

Our stringent card controls mean you can immediately freeze or block lost or stolen cards from within our software; users can also block their cards if they suspect fraudulent activity. We have strict security measures to protect user information and sensitive data.

6. Build credit with our corporate credit cards

We’re one of the only spend management solutions offering businesses corporate credit cards. These cards not only give you more options when managing business spending, but they also help you build credit. Paying off the credit card balance each month helps establish your business as credit-worthy, which can help you access business finance should you need it to help your business grow in the future.

7. Market-leading accounting and ERP integrations

Centralized access to finance data across multiple entities is crucial for effective spend management. That’s why we offer market-leading integrations with ERP, accounting, business productivity, and business travel systems. Or, if your software isn’t on the list, you can build your custom API. Real-time reconciliation and reporting across integrations means you never lose sight of your spending. You stay informed, always.

8. Set custom spending limits

With Payhawk, finance teams can set individual or company-wide spending limits. These limits encourage policy compliance and reduce overspending. But remember that Visa sets daily and monthly ATM withdrawal limits; employees can withdraw up to $5,000 daily or $15,000 weekly (approx).

Are corporate cards better than prepaid travel cards?

In short, yes. But of course, this depends on your business needs. If you’re looking for corporate cards to give you flexibility, control, and peace of mind when managing business travel expenses, then yes.

Unlike prepaid cards, there’s no need to preload them; instead, use spending controls to set limits and manage spending from afar. Build custom approval workflows to ensure spending remains compliant and request additional funds in just a few clicks.

Corporate cards give businesses unparalleled visibility into business spending. See it in action with a custom demo: book here.

| Authorization | Request from the acquirer to the issuer that the card has enough funds to cover a specific amount. The approval is sent from the processor of the acquirer to the processor of the issuer. An authorization must complete in 9000 milliseconds before it times out. |

| Automated reconciliation | The process of matching card transactions and outstanding documents for consistent, accurate and complete accounting. |

| BIN | Bank Identification Number is the four or six initial digits of a credit card that uniquely identifies the issuer of the card. |

| Card Not Present | Card not present (CNP) is the description of a transaction during which the card wasn’t physically presented such as in the case of online transactions. |

| Card Verification Value | Card verification value (CVV) is a 3 digit number used for additional security of online transactions often found at the back of the card. From 2019, Visa and Mastercard allow printing of the 3 digit number on the same side as the PAN. Payhawk Visa debit cards use this approach. |

| Chargeback | The processor of disputing a fraudulent transaction with the issuing bank. |

| Clearing | The process of turning an authorization promise into actual movement of money until the transaction is settled. |

| Domestic payment | Payments made within the geographical region of the issuer. It’s often the country, but some fintech companies define it more broadly on a currency level. |

| Foreign exchange rate | Foreign exchange FX rate is the percentage markup issuers charge on top of the scheme exchange rates. Products like Revolut and Payhawk charge as low as 0.40% FX rate. Here is a comparison. |

| Interchange fee | Interchange is a fee paid from the scheme to the issuer to cover the costs of handling the transactions. The interchange fee is a strong revenue stream for card issuers. |

| International payment | Payments made outside the geographical region of the issuer. It’s often the country, but Payhawk defines it more broadly on a currency level. |

| Discount rate | Acquirers charge merchants in the form of a discount rate for handling card payments. Discount rates are charged from the transaction amount, so that card payments can be the same cost as cash payments to the consumers. In this case the interchange fees for the issuers are paid out of the merchant discount rate. |

| PAN | Primary Account Number (PAN) is a 16 digit account number that uniquely identifies the scheme, issuing bank and cardholder. |

| Reconciliation | The process of matching card transactions with receipts and invoices for consistent, accurate and complete accounting. |

| Refund | Return of funds for transactions that were already settled. |

| Revert | Withdraw of an authorization request. Often used with test authorization to ensure the card is valid and has a positive balance. |

| Scheme exchange rate | The spot exchange rate charged by the schemes for a given transaction, currency, and date. |

| Settlement | The actual movement of funds as part of the clearing process from an issuer to an acquirer. |

| Strong customer authentication | To improve the security of online transactions, schemes enforce a strong customer authentication (SCA) method that uses 2 of the following 3 things: something the user has (credit card), something the user knows (password), something the customer is (biometrics). |

| Velocity limits | Velocity limits or card limits are scheme enforced limits on cards to prevent frauds, and are configured by the issuer when a card program is set up. Some modern processors like Marqeta, Wirecard, Paynetics, GPS, and others allow dynamically controlling the card limits. |

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Why manual travel management doesn’t scale — and what finance teams are doing about it