Optimise your spend management workflows with a new configurable fallback feature

Every organisation is structured differently, so your expense approval workflows will also look different. Some teams have team managers; some don't. But whatever your team's size and structure, you're no doubt always looking for ways to speed up, boost processes, and drive efficiency. That's where features control-boosting approval workflow automation come in —along with customisable workflow fallbacks — that fit with your specific organisational structure. Find out how to build these and ensure no expense request goes unnoticed.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Approval workflow automation, including customizable workflow fallbacks, is crucial to keeping your business operations running smoothly across departments and entities.

What happens without them? Expenses get muddled or missed in static approval workflows, and delays slow down processes.

As a finance professional, you know that when you can’t fulfill the primary workflow, your financial expenses can get missed. But not with a workflow fallback: it acts as a contingency plan, so no expense request goes uncovered, and you can continue business as usual.

But what do you need for workflow fallbacks to do their jobs properly? For a start, the software must include a high level of customization to grow with your scaling business, and that’s precisely what we offer at Payhawk.

Optimise spend management with customisable approvals and controls

The challenges of traditional approval workflow software

Let's say your marketing department has ten people but no team manager right now. Delays in expense submissions and requests will slow down your operations.

Here's where workflow fallbacks can help you — they reroute the workflow to a secondary approver, meaning expenses will never go unnoticed and won't delay business operations, reimbursements, or growth initiatives.

Workflow fallbacks by Payhawk

With our configurable workflow fallbacks, your designated approvers will never miss expense approval requests. We automatically apply the fallback procedures for cost requests if an approver, a category, team, or custom field value has been added, withdrawn, or altered ( for example, if the approver was off-boarded).

Customizable workflow fallbacks also mean your approval processes won’t get stuck. You can limit the number of expenses that end up in a black hole and must be resubmitted.

Plus, with the help of our comprehensive Workflow Designer feature, you can take your approval automation to the next level and have a reliable solution for almost any situation. For example, when you introduce a new department and there aren’t any spend managers, you can decide who should sign off on team expenses individually.

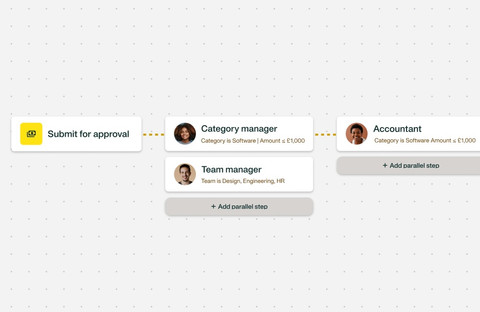

How configurable workflow fallbacks work

We’re with you: It all sounds great in theory, but how does it work?

At Payhawk, our workflow fallbacks allow administrators to fully customize what happens when an expense management workflow can't be executed as planned.

An approval fallback triggers when the assigned value lacks a manager. If a team does not have a team manager, Payhawk applies the default fallback mechanisms so that all expense requests can still be processed using an alternative approval chain.

Our default fallback configuration looks like this:

How to customise fallback behaviours

Payhawk customer? Here's how to make the feature work even more efficiently for you.

Of course, you can easily set the workflow fallbacks with our default mechanisms, but if these don't work exactly how you want, you can easily define your own.

Here's how to create custom approval workflow fallbacks to suit your company's specific needs:

- First, navigate to Settings > Workflows > Advanced Tab

- Click "edit fallbacks"

- Use the drop-down menu to define each fallback

- Save your changes

Hidden fallbacks you should know about

In some instances, workflows have a fallback behavior that isn't configurable in the system:

- Second-level team manager: If there is a Team assigned, but that team has no parent team (it's the highest level in the hierarchy), then the request is sent to the Team managers of the actual (assigned on the expense) team

- Any accountant: If there are no accountants in the account at all, this falls back to "Any administrator"

- Any administrator: If there are no administrators, this is an error, as not having a single administrator should not be allowed in Payhawk's spend management system

- Specific User: If the user is not part of the account, the requests "hang" waiting for "0 approvers"

The impact on finance teams and CFOs

To ensure you get the most out of your spend management software, you need workflow management features that let you customize your approval workflows to support your unique business needs.

Static workflow approvals just don't achieve efficiency for every organization (especially for enterprise-grade expense management complexities).

By implementing our configurable workflow fallback functionality, you can get complete control over all expense and invoice approval workflows, even when they don't follow your standard workflow chains.

You'll have peace of mind knowing that no expense will go missing. And no, your expense requests will always end up on a to-do list (never in a black hole!) as the solution will notify your chosen administrator even if you are 'unable to execute fallback' triggers.

By configuring your fallbacks to suit your organization's hierarchy, you can drastically reduce the administrative burden on your busy finance team. As you learn more about your workflow fallback needs, you can continue building your custom approval workflows to self-manage, further streamlining the spend management process.

Payhawk customer Carolina Einarsson, Finance Director, Essentia Analytics, says:

What's great about Payhawk is that you can design and set up workflows that work for your business. For example, at Essentia Analytics, we want to centralize accounts payable and subscriptions, but we want to delegate the employee expenses. And Payhawk lets you set that up in a way that works best for you.

Transform your expense management process with Payhawk. Reimburse employees promptly, track every penny spent, and build custom workflows to suit your exact organizational needs. Learn more.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Pennylane Integration: Why to connect with a spend management platform