Four things we’re looking forward to at SuiteWorld 2023

We're super excited to attend the annual Oracle NetSuite conference 'SuiteWorld' in Las Vegas this week. For over ten years, the NetSuite team has invited customers, partners, and developers to get together and share expertise, network, and learn about some of the latest and greatest NetSuite features and use cases. As NetSuite SDN partners, we can’t wait to learn about the upcoming NetSuite features and how they will further improve the experience for our joint customers.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

This article looks at the outlines of some of the live sessions we plan to attend at SuiteWorld 2023 and the synergies that our spend management solution, which includes expense management software, corporate credit cards, and integration with NetSuite, has to them.

- Business strategy alignment, including ‘people’ and ‘financial’

- How to leverage financial tools to automate key processes

- E-commerce strategies to attract and win buyers in the B2B space

- Secrets of Rockstar CFOs with Jack McCullough

Optimise your accounting processes with our NetSuite integration

Business strategy alignment, including ‘people’ and ‘financial’:

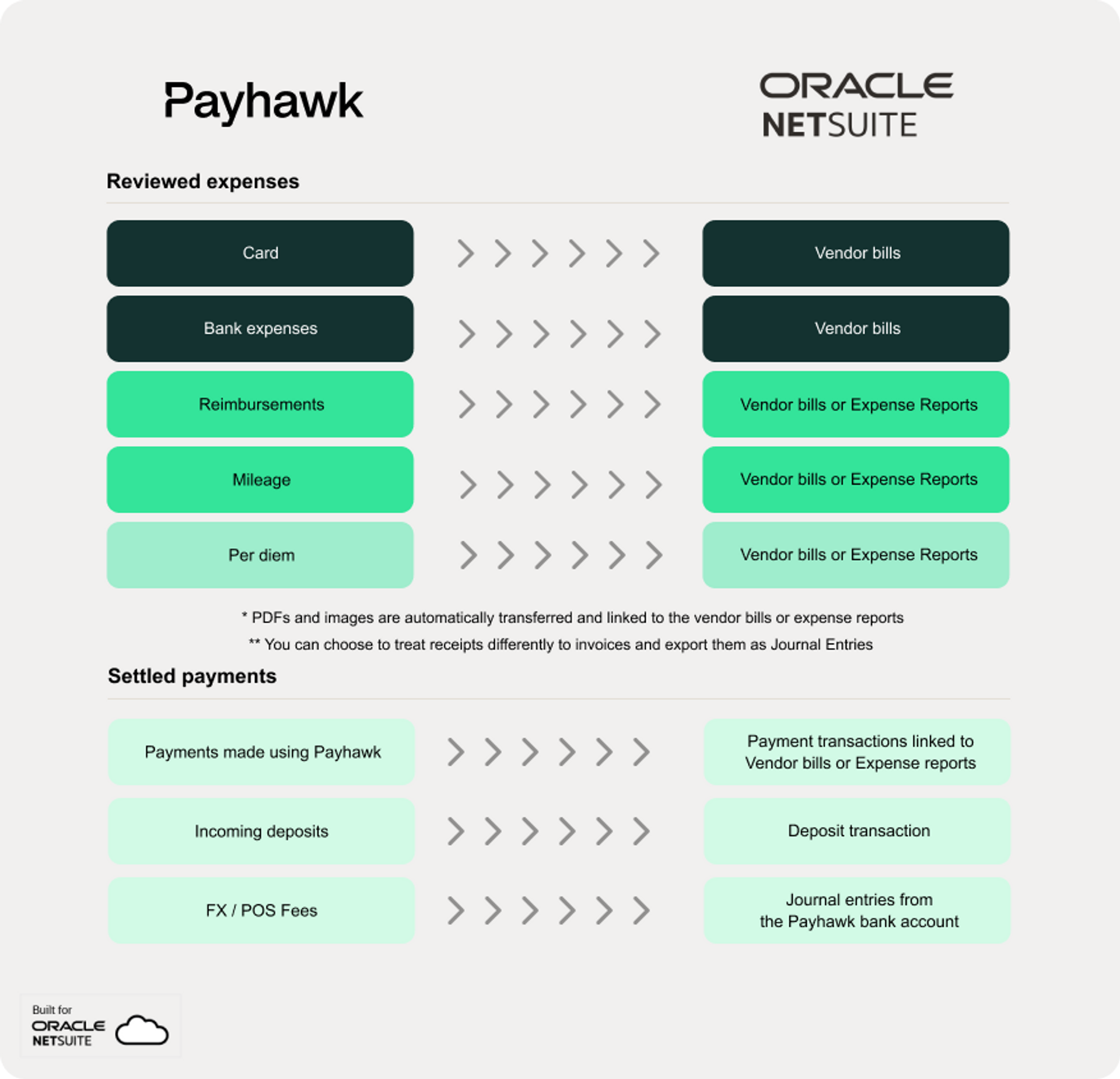

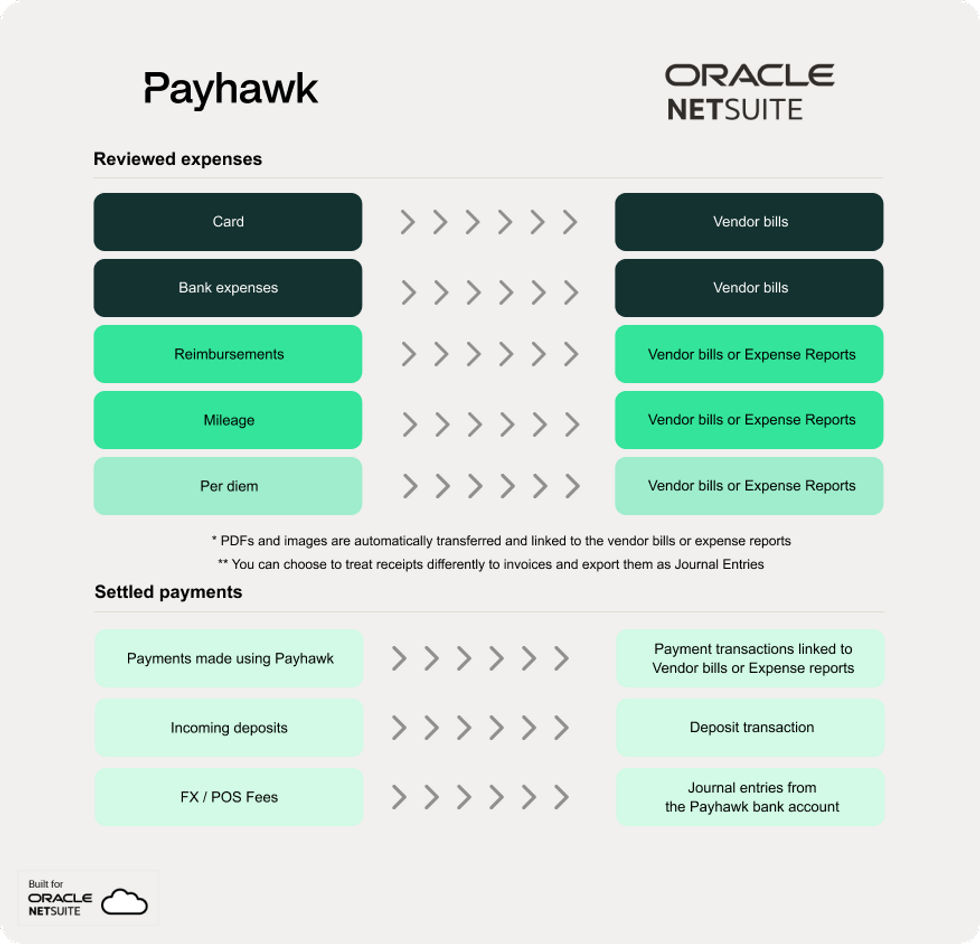

Our ‘Built for NetSuite’ spend management solution and NetSuite integration help CFOs and business leaders get a complete picture of their company’s expenses. Our corporate cards and OCR data capture let customers capture and categorize expenses and transfer spend data directly to NetSuite according to the accrual concept. This means no more time-consuming, manual, and error-prone reconciliations.

But what does clear and up-to-date spend visibility across mean in practical terms? Here’s an example from Andrew Jacobi, VP of US Finance at State of Play.

"We rely on the customizable class settings within Payhawk to distinguish between venues to analyze performance. We create the custom fields that our cardholders use in order to categorize their spend. So, whether it's categorizing between venues or categorizing it into the right general ledger code, it's extremely helpful in terms of how we allocate spend."

"At the end of the period, we look at two things. First, were we able to forecast our spend properly? For this, we put Payhawk directly in the hands of our venue managers so they can report on what they're spending money on. This approach means they can track spend against their budget and ensure they're meeting it across each general ledger category. Then, we look at variance to budget — seeing whether a spend category exceeded or came in under budget. Payhawk allows us to spot if there's overspending in specific places up and down our P&L very quickly. For example, if we see that we're spending too much or more than expected on DJs in a particular venue.”

Of course, CFOs must view business spend as a complex puzzle, considering various elements such as expenses, hiring, salaries, and more to make informed financial decisions. And at Payhawk, our solution (plus our NetSuite integration) lets them take complete control over corporate spend management outside of payroll, rent, and so on.

This kind of spend visibility is vital for effective budget analysis, planning and growth. But expenses are just part of the overall spend management puzzle.

How to leverage financial tools to automate key processes

For one of their SuiteWorld 2023 speaker sessions, NetSuite asks: Do you manually generate new monthly invoices to bill a customer for sales orders over time, and do you continue to handle amortization through spreadsheets and manual journal entries?

We’re very excited to hear about financial automation, as it is one of the biggest benefits of our customer-centric solution, too. Our benefits are different of course, but when used in synergy will offer our customers even greater spend control and visibility than ever.

For example, at Payhawk, our solution’s expense and approval automation features save customers anything from two hours a day to four days a week and offer benefits including:

1. Risk mitigation and compliance: Automated systems reduce the risk of fraudulent spending and ensure compliance with expense policies. By enforcing approval workflows, you can account for every cent or penny and discourage employees from spending outside established guidelines.

2. Enhanced visibility: Expense automation provides a clear view of spending patterns, allowing for efficient financial management and business forecasting. These insights are vital for effective business growth and cost control.

3. Efficiency and time savings: Automation streamlines expense approval workflows, leading to faster reimbursement, reduced errors, and significant time savings for finance teams. This efficiency allows finance teams to focus on value-driven tasks while employees can easily submit expenses through user-friendly software.

In summary, automating expense reports safeguards against risk and fraud and provides visibility, efficiency, and time savings that contribute to better financial control and business growth.

Not only that, but by automating receipt chasing and leveraging VAT reclaim integration partners like 60 Dias, companies can ensure they take advantage of tax or VAT reclaims. Take our customer MDM Props, for example:

“Before Payhawk, missing receipts meant missing VAT reclaims. With quarterly VAT bills of up to £240K, that’s massive. Now, with Payhawk, our cardholders upload receipts in seconds and save the business thousands,” said Uchenna, Finance Manager at MDM Props Ltd.

E-commerce strategies to attract and win buyers in the B2B space

One of the other sessions we're most looking forward to is titled B2B E-commerce Strategies that win over buyers.

As a fast-growing B2B, we’ve naturally explored different ways to appeal to other businesses, including pricing models and offers, but we always come back to the same goal: to offer a truly efficient, game-changing spend management experience that saves customers time and delivers value.

For example, if you use Payhawk, you’ll get:

- 38% faster time to value than competitors in the G2 Expense Management category (ten months for Payhawk, compared to 13.8 months average for other competitors)*

- Average ROI of ten months (with 40% of Payhawk customers achieving ROI in under six months)*

*The above stats have been calculated by calculating the average Time To Value across all competitors on G2 Crowd. For side-by-side competitor comparison, please refer to the Competitive Comparison Stats page.

You will also get a spend management solution that has garnered the following customer-voted awards, ratings, and badges:

- G2 high performer in invoice management

- G2 high performer in expense management

- G2 high performer in travel expense management

- G2 easiest setup

- Capterra best ease of use ‘financial reporting’

- Capterra best value ‘financial reporting’

- Capterra best ease of use ‘bookkeeper’

As one G2 reviewer describes:

"You can ask for different credit cards, physical or virtual, assign them to other holders, manage teams and categories, control expenses, define budgets and manage subscriptions. All in different currencies! The best part is that it can be synchronized with NetSuite for your accounting purposes and with Travelperk for travel invoicing. Plus, Microsoft Dynamics 365, Xero, Google Workspaces, and more."

Secrets of Rockstar CFOs with Jack McCullough

There is so much going on over the next few days at SuiteWorld, it’s been almost impossible to hone in on just a few topics. The final one being, Secrets of Rockstar CFOs.

The session, featuring author, speaker and thought leader, Jack McCullough explores the secrets, practices, and insights of the most successful ‘rockstar’ CFOs.

Employing the same title as his popular [podcast](https://open.spotify.com/show/4hxdmOtsmRgEWMx9o6IOaC https://open.spotify.com/show/4hxdmOtsmRgEWMx9o6IOaC) (which we are proud to sponsor!); the session will likely cover topics like: overcoming common obstacles, peer networking, and empowering advice.

Ready to explore a high-performing spend management solution with a powerful NetSuite integration?

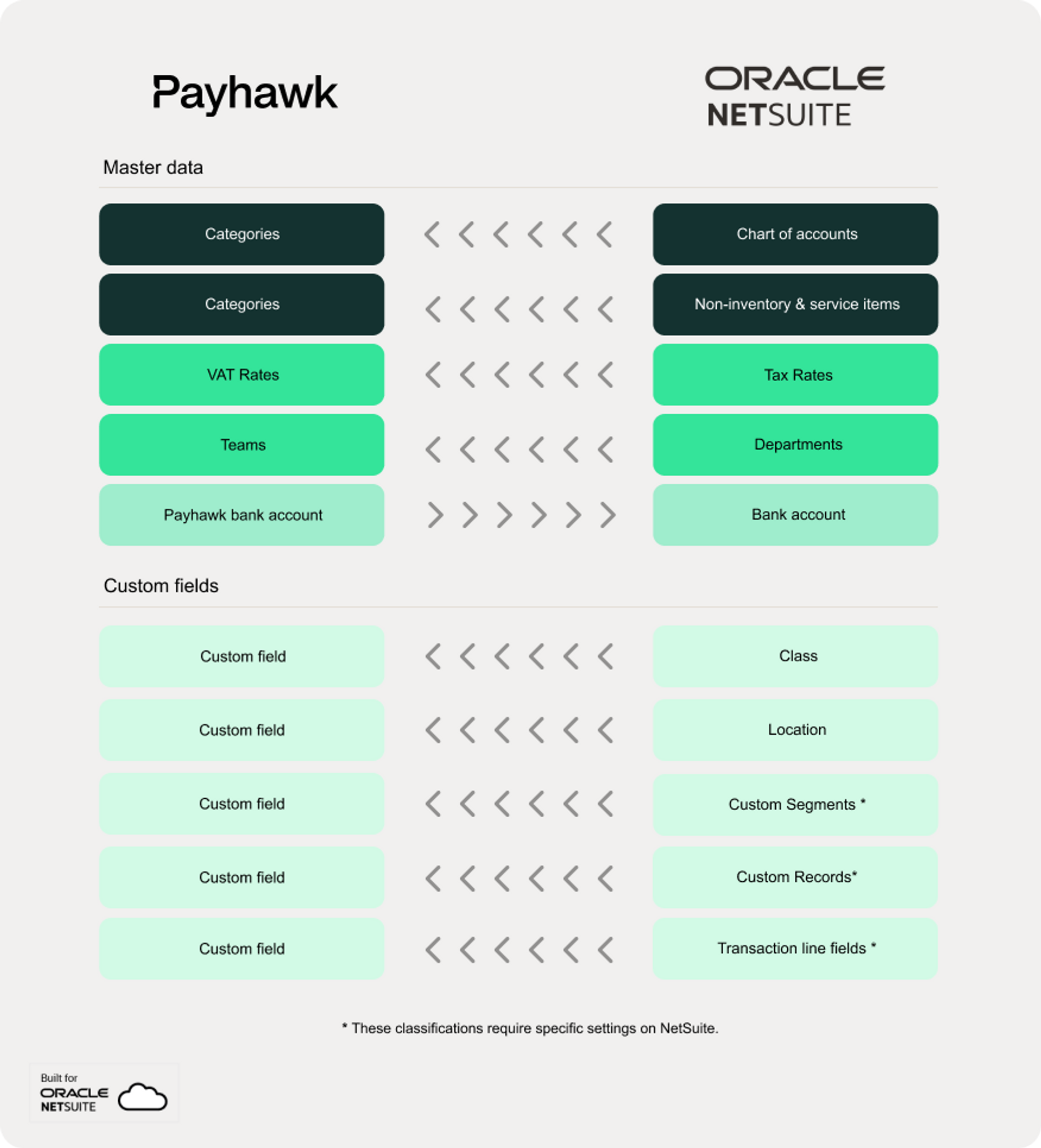

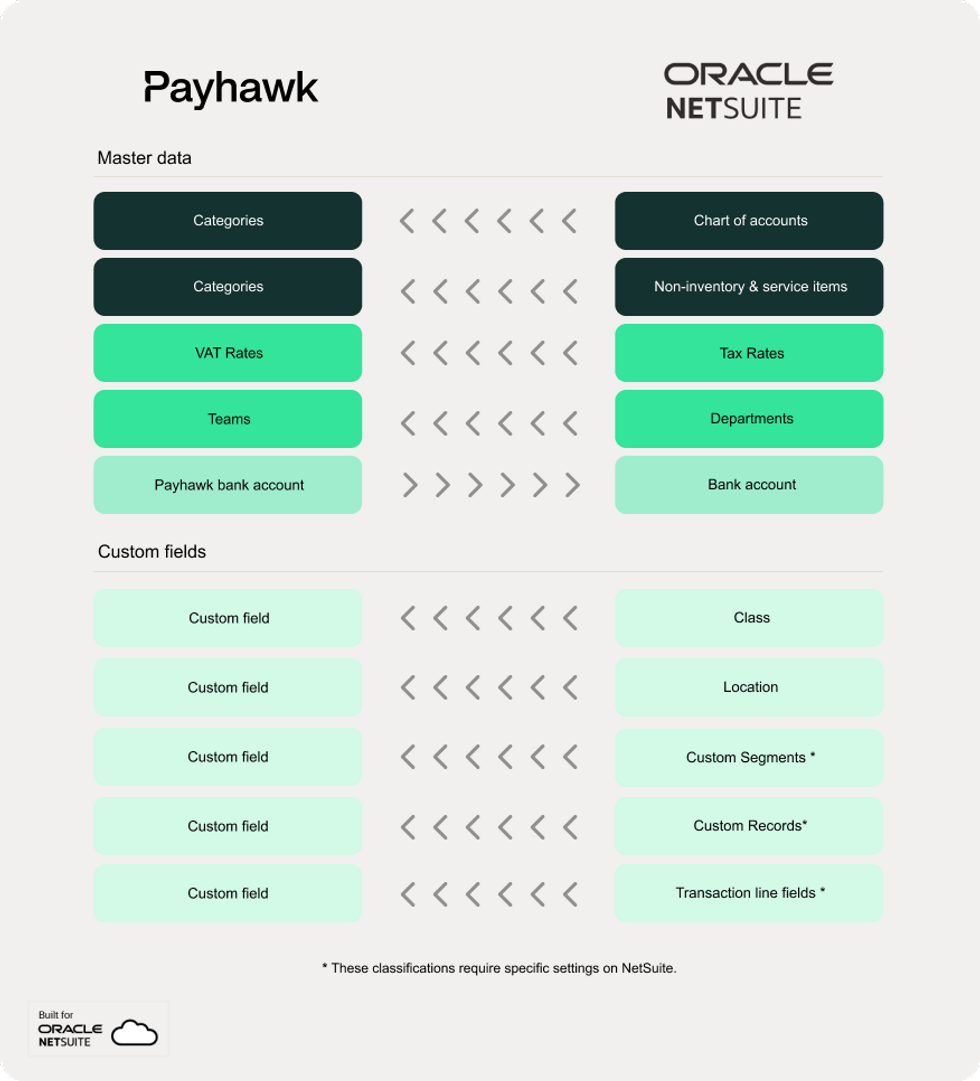

As mentioned above, at Payhawk, our streamlined spend management solution and native NetSuite integration have been designed with finance professionals in mind. It focuses on the accruals concept and enables you to achieve the following and more:

- Achieve error-free reconciliation effortlessly

- Eliminate the need for manual data entry or encountering delays in visibility

- Save significant amounts of time, potentially hours or even days that would otherwise be spent on data input and verification during the reconciliation process

- Experience a seamless and hassle-free process with automatic updates to the connector

- Quickly get started with features like pre-configured custom segments, custom records, and transaction fields, along with continuously updated master data and real-time analytics

- Benefit from the support and expertise of NetSuite Alliance Partners such as MacroFin, Balkan Services, and RSM Spain

At Payhawk, we take our customers' success seriously and are dedicated to providing them with the best products, features, and integrations. Our 'Built For NetSuite status' helps cement this, and we're thrilled to be watching the newest NetSuite innovations in action at SuiteWorld, knowing that our customers will be solving finance challenges thanks to our solutions.

Book a demo today to learn more about our time-saving solution and integrations.

Tsvetina is the creative force behind Payhawk's product marketing initiatives. She's dedicated to shaping our brand's image, refining messaging, and orchestrating our go-to-market strategy. Beyond her strategic role, she unwinds with a love for exquisite food, finds solace in yoga, and explores the world, fueled by a passion for live music experiences.

Related Articles

Audit-ready by design: Why modern finance teams are ending manual audit prep