What’s new from Payhawk Spend Management

At Payhawk, our primary focus is our customers. Customer-centricity has been the most critical part of our culture from day one, and we make it a priority to listen to customer feedback and iterate and improve our solution based on their needs.

Our summer quarter was no different, we introduced new releases and updates to make the Payhawk experience even better for our customers. And we even found time to win some awards.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

With great data comes great responsibility. And at Payhawk, our focus in Q3 included improving data offerings and connections to give our customers more in-depth spend data to support responsible decision-making as well as improving expense and supplier management and providing increased peace of mind.

From ESG reporting to a NetSuite partnership, our cutting-edge summer updates and news included:

- Payhawk Green and the release of ESG reporting features

- Becoming an official NetSuite SuiteCloud Developer partner

- Obtaining an EMI license

- Trophies and badges including +30 G2 and Capterra awards

- Redefining expense efficiency with improved data capture and processing, accelerated expense approvals, and more

- Supercharged integrations and APIs including effortless payment reconciliation with Exact Online, journal export options, and more

- Apps, accessibility, and peace of mind

Learn how it all happened and discover how the new features will benefit you.

Supercharge your spend management efficiency

Going green with ESG reporting

Introducing Payhawk Green: our toolbox of new ESG reporting features.

The exciting, environmentally focused new features let you:

- Monitor carbon emission and expedite your ESG reporting

- Set up and roll out carbon emission tracking with ease

- Get real-time insights via CO2 reports and estimates per card transaction

Trying to track Scope 3 emissions? Then you probably know how hard it is, especially as these types of emissions occur outside of your organization's direct control.

The good news? With Payhawk Green you can streamline carbon accounting by auto-tracking Scope 3 emissions via card spend data (following the GHG Protocol for corporate accounting). Simply tag your suppliers based on sustainability criteria, use the customisable supplier-driven data fields for expenses, and export the insights to pinpoint trends and opportunities for improvement.

You can also enable real-time GHG emission or CEDA categories tracking of expenses and invoices, with flexible categories, and more.

"Every company approaches sustainability differently, but in light of the new EU regulations, it's something every company must consider. Payhawk is helping to pioneer how the spend management space can support businesses with integrated carbon emissions reporting at no extra cost," says co-founder of climate tech company Lune, Erik Stadigh.

A connector that’s “Built for NetSuite”

We're excited to announce that we've become an official NetSuite SuiteCloud Developer partner! For more than two years, our direct integration has streamlined spend management for customers in more than 28 countries, transacting with over 106,000 vendors. So, it's fantastic to cement our relationship with this important milestone.

But what does it mean for you?

In a nutshell, NetSuite is one of the most popular ERP solutions for large and growing businesses. It can help you streamline your financials, customer relationships, and operations. The missing pieces are corporate cards with in-built spend controls, time-saving expense management automation, and AP features — which is where we come in.

Many of our customers have already enjoyed the benefits of our spend management features and seamless NetSuite integration. Customers like Giancarlo Bruni, CFO at e-commerce business Heroes, for example.

"As a CFO, I want to know how much money and profit we have in real-time and what levers I need to pull. As a business, we also need to know about our stock, including when it's arriving, how much is in transit, and if we need more. I can see all of this via my ERP,” explains Giancarlo. “Plus, I can see spending in real-time thanks to the direct integration with my expense management software, Payhawk."

Like Heroes, if you use Payhawk and our NetSuite integration, you'll benefit from a streamlined spend experience centered around the accruals concept that lets you:

- Achieve faster, error-free and automated reconciliation, saving hours and even days

- Eliminate the need for manual data entry and prevent visibility delays

- Enjoy effortless automatic updates to the connector

- Quickly kickstart your integration with pre-configured custom segments, custom records, transaction fields, auto-updated master data, and real-time analytics

- Tap into the support of NetSuite Alliance Partners such as Macrofin, Balkan Services, and RSM Spain

Licensed for EMI

After a thorough due diligence process, The Bank of Lithuania awarded us Electronic Money Institution status, authorizing us to issue and manage e-money on behalf of our customers across the entire European Economic Area (EEA).

The Electronic Money Institution (EMI) license means we will now be able to offer even more payment services to our customers, and to expedite the development of innovative new products and features'

"We're thrilled to achieve another important milestone in our journey to reinvent how businesses spend," said our CEO and co-founder, Hristo Borisov.

"Exceptional product development combined with a relentless customer focus is in Payhawk's DNA and the license unlocks new innovation possibilities for us. By controlling more of the payment processing stack, we can move faster and optimise the infrastructure to best address the needs of our clients – fuelling innovation."

Winning big for customers

If you're a Payhawk customer, you're our top priority. We'll put you at the heart of everything we do, actively listen to your input, and take action based on feedback and reviews. Our customer commitment drives us to enhance our product continuously and our recent G2 results speak for themselves.

We received over 30 G2 and Capterra awards, including:

- G2 Momentum Leader in Invoice Management

- G2 Momentum Leader in Expense Management

- Leader in Europe and EMEA for Invoice Management

- High performer in Spend Management

- High performer in Expense Management

- High performer in Invoice Management

- High performer in Travel Management

- Capterra best ease of use ‘financial reporting’

- Capterra best value ‘financial reporting’

- Capterra best ease of use ‘bookkeeper’

And when we’re not improving your spend management experience and innovating on your feedback? We’re polishing our ‘Best Spend Management System’ award.

We beat off some stiff competition to win the coveted award at the recent PayTech Awards by Fintech Futures. This exciting recognition highlights our dedication to shaking up the world of spend management and cements our place as one of the leaders in the business payments space.

Redefining expense efficiency

Some releases, like Payhawk Green, have the potential to change the way you do business entirely. Others, though smaller, can save you time, improve your spend management experience, and help you make more insightful spend decisions, letting you:

Boost document capture and processing with AI

The update to our camera and OCR allows you to easily crop and align images while also providing a flashlight feature for low-light conditions. Now, you can rotate documents during the review process for enhanced usability.

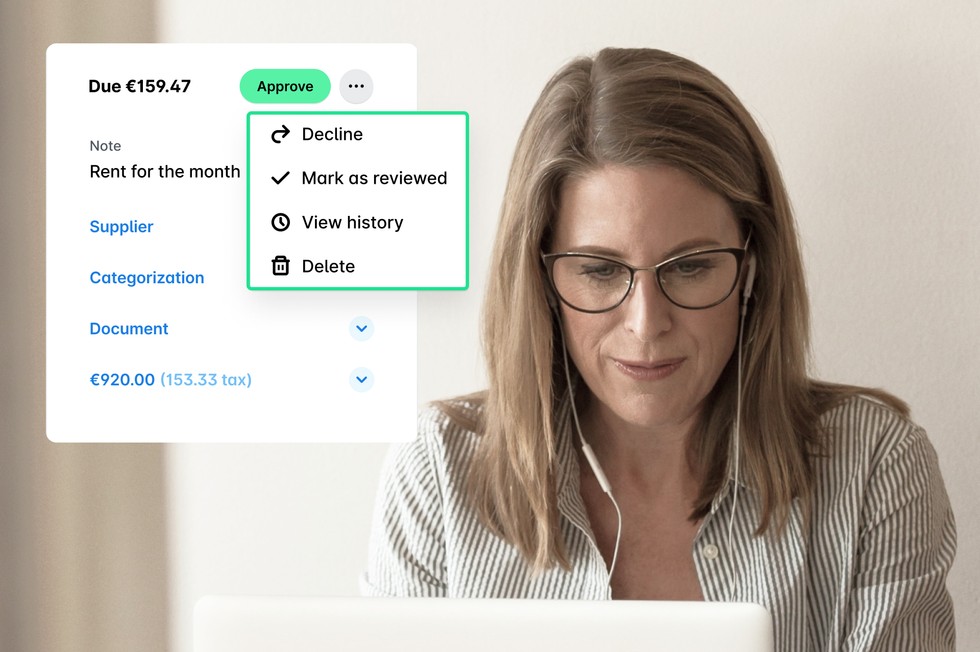

Accelerate expense approval and rejection

Streamline the process by eliminating switching between the app and your inbox. Approvers can now directly give their approval or decline expenses within the Expenses app. Plus, we've introduced new notification features for approvals to enhance the efficiency of your approval process.

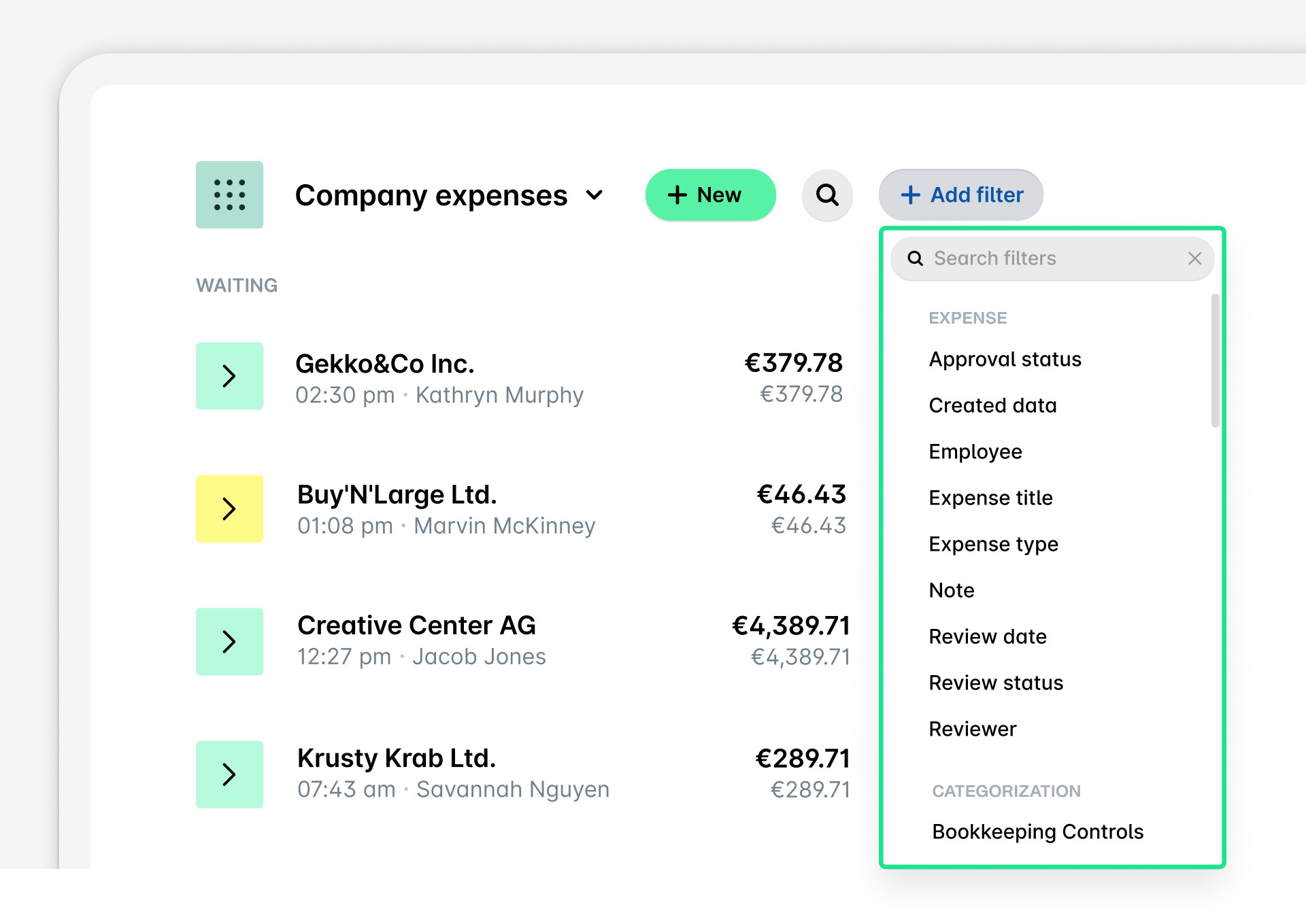

Enhance visibility using over 25 expense filters

You can now dive deeper into your reports and preserve your customized views for future reference. Our seven new filters let you refine your data based on over 25 pre-defined data fields and any custom fields you create.

Take care of employee management across multiple entities

You can now seamlessly onboard and offboard employees across multiple entities in bulk. Streamline processes and save time, especially if you work for a big company with a large employee base.

Use custom dates to filter group expenses

Explore the flexibility of filtering expenses in the group dashboard. Choose a date and check if existing funds will cover your upcoming payments. Or select a past date to check the effectiveness of expense processing and month-end close.

Enhance your supplier data handling

Set up fields for storing supplier documents, access comprehensive supplier information (including country and VAT details), and benefit from rapid data population to minimize delays and enhance overall efficiency with increased supplier data at your fingertips.

Supercharged integrations and APIs

Our relentless customer focus drives us to optimize our integrations and APIs continually. And Q3 was no different. Between the beginning of July and the end of September, we released a monumental 220 new feature updates to improve existing integrations and APIs.

Speed up your month-end close with Journal Entries

Specify distinct treatments for documents based on their type. NetSuite or Dynamics Business Central user? You now have the option to export expenses as Journal Entries, allowing for differentiation between invoices and receipts.

Achieve effortless payment reconciliation with Exact Online

Experience seamless real-time payment reconciliation, coupled with auto-linking to the corresponding purchase journal, for a super valuable enhancement to your connection with Exact Online.

Expand your capabilities with APIs

Unlock a wealth of additional data from your Payhawk solution via our recently introduced endpoints for partner APIs. Embrace the inclusion of bank feeds and supplier data fields, opening up new possibilities for your operations.

Apps, accessibility, and peace of mind

You asked, we listened… Looking for more places to access Payhawk? Want to offer your traveling employees peace of mind? Then these new updates are for you.

Use the app in Portuguese

Native Portuguese speaker? Notícia emocionante! Our platform and mobile app are now accessible in Portuguese.

Find the Payhawk App in Huawei

For Huawei device users: You can now access the Payhawk app directly from the Huawei AppGallery, meaning you can automatically install all updates with no fuss.

Ready to explore award-winning spend management?

At Payhawk, we know our customers mean business — and providing them with the best product and features we can help support their success. It's a big responsibility, and we take it very seriously.

Book a demo today to learn how you can revolutionize your company's spend management.

Tsvetina is the creative force behind Payhawk's product marketing initiatives. She's dedicated to shaping our brand's image, refining messaging, and orchestrating our go-to-market strategy. Beyond her strategic role, she unwinds with a love for exquisite food, finds solace in yoga, and explores the world, fueled by a passion for live music experiences.

Related Articles

Payhawk transforms spending experience for businesses with four enterprise-ready AI agents