Save time and take control of multi-entity management with our latest features

Minimise multi-entity management headaches with some of our newest spend management features. Add and remove employees across entities easily from the Group module to reduce insider threats and sensitive data leaks. And filter your expenses across multiple entities using our custom date filter to understand current and future spend, and improve expense processing efficiency.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

The words ‘multi-entity management’ often elicit deep breaths and sighs across finance and accounting teams. It’s complex and usually leaves finance professionals without the visibility they need to fully control company cash flow and spend.

The sigh-reducing good news? Now, armed with our latest features, finance leaders can embrace a more efficient way of controlling multi-entity expenses.

New feature 1: Bulk add/remove employees from your expense management system

As a finance leader in a growing business, you likely know the stress of keeping up with employee additions and turnover.

New or departing employees? Our latest feature update lets you add and remove staff from your Payhawk solution in bulk across multiple entities. This feature is especially useful as your organization grows, helps keep insider threats down, and reduces administrative headaches.

Discover effortless multi-entity expense management

The dangers of not removing user access when employees leave

Regardless of whether the employee leaves under positive or negative circumstances, having access to sensitive company information can leave your organization vulnerable to insider threats and data breaches. Whether buying personal items on a business card seconds after a contract termination or destroying financial documents, unfortunately, there’s always the potential that offboarded employees can sabotage your systems.

It’s essential to have a strategy around departing employees, your spend management system, and company cards, as money and sensitive financial documents are involved. At Payhawk, we’ve made offboarding an employee from your corporate expense management software and auto-blocking their cards fast, simple, and done in just a few clicks.

How to mitigate risk and manage user access after an employee leaves or is fired

Mitigating risk is essential after an employee chooses to move on or has their contract terminated. That means prompt removal from all corporate systems across all of your entities as soon as possible. You should create and follow an offboarding checklist to ensure you remove all ex-employee access and take extra precautions to reduce data breaches and other unwanted risks.

Here's a rundown of some of the best employee offboarding practices to wrap into your strategy or checklist and help reduce security vulnerabilities.

1. Monitor user activity

You’ll need to identify potential threats or unauthorized access quickly. Monitoring their actions within company systems can help you spot unusual behavior quickly, protecting yourself from breaches.

2. Implement enhanced security methods

You should implement enhanced security measures to keep your data protected. Such measures include two-factor authentication, resetting shared passwords, and automatically terminating all employee accounts during offboarding. These best practices can help you avoid access to unwanted eyes and protect your internal systems.

3. Use a security-compliant expense management software

When managing multiple entities, you need the ability to quickly add and securely remove employees from your expense management system. At Payhawk, our powerful security features can help ensure employees don’t abuse company money before they leave an organization.

We enable organizations to add different employee access levels to minimize sensitive data leaks. We also recommend you act quickly when removing access employees who are leaving to reduce any risk of a security breach, i.e., sharing or accessing sensitive data.

How does Payhawk bulk employee removal and addition work across multiple entities?

Removing and adding employees and all associated expense accounts from the system reduces the threat of financial abuse and document leaks in case an employee leaves.

With our new bulk employee management feature, administrators and finance team members can quickly add and remove employees from and to all applicable entities.

The screenshot above shows that you can see which entities they’re part of before removing an employee, their user access, and whether they have any corporate cards to close.

New feature 2: Filter expenses by date with our multi-entity management feature

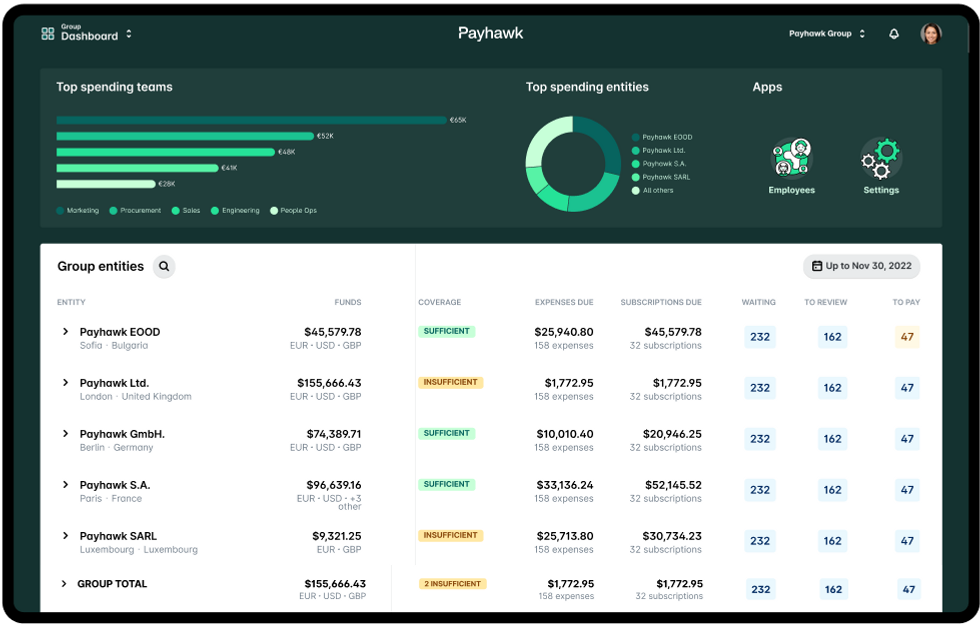

Another of our latest feature releases allows finance teams to filter their expenses by custom dates on the Group Dashboard across multiple entities. So now, not only can you gain complete visibility into spend across multiple entities, but you can also filter by custom date. This improves cash flow visibility and helps you accurately map out your budgets, which is crucial as your enterprise expands.

Why is expense filtering important?

Managing expenses across multiple entities can get complex quickly. And no doubt, you're always looking for ways to reduce and optimize budgets. But you can only find them with a clear picture of company-wide business expenses.

With an improved ability to filter expenses across entities, you can better manage cash flow by checking if funds will cover future spending. You can also improve operational efficiency by viewing past expense volumes and processing to double-check month-end accuracy.

Filtering expenses improves spending visibility, reduces manual processes, and ensures compliance with company policies and regulations. All this means reducing errors, which helps you make more informed decisions across all entities.

Data should inform all business decisions, so having an expense filtering system you can rely on as a CFO or finance leader matters.

.png)

.png)

Payhawk expense filter by custom date

Filtering expenses by date offers several big benefits for understanding corporate spending, including:

- Month-end efficiency: You can set a specific date in the future, for example, at month-end, to see how your expenses are tracked by entity. Or you can select a date in the past to see if you have processed all expenses incurred within a specific month

- Cash flow: Filter expenses by a future date to check if the funds you have within the platform are sufficient to cover future payments

- Filter by top spending teams: Quickly and easily check which teams spend the most within your date range and make adjustments to their budgets if needed

Our newest expense date sorting empowers financial professionals to gain insight into corporate spending patterns and make more informed, impactful decisions.

Next steps

Are you curious to learn more about our newest features and how they can help your business? Schedule a demo to see these new features in action.

Or if you’re an existing customer, don't hesitate to contact your dedicated account manager today to schedule a feature demo instead.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Payhawk transforms spending experience for businesses with four enterprise-ready AI agents