Why the finance function needs 20/20 vision in 2024

A clear view of what’s happening throughout a business is the holy grail for CFOs, but attaining this requires a highly coordinated approach to implementing new tech. As the digital revolution continues to transform how businesses operate, and ongoing regulatory interventions make many financial processes more complex, it’s becoming ever more important for finance teams to obtain and maintain as full an overview of their firms’ operations as possible.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Editorial note: This article is a derivative of the Raconteur data-driven finance insights

Without a complete and current picture of what’s happening, CFOs and their colleagues across the organization can not quickly to changes affecting the business, while senior leaders risk basing key strategic decisions on old and/or incomplete information.

Yet many finance teams struggle to obtain such a picture, particularly those in companies that still use manual processes to generate reports.

“The more manual your processes, the more mistakes you can make along the way,” notes Matthias Heiden, CFO of enterprise software provider Industrial and Financial Systems (IFS). “Without the right technology, you’re always in doubt. A single source of truth is needed more than ever in times like this so that you’re fully on top of all your divisions.”

Firms that have been on takeover sprees can also face problems if they don’t have a consolidated view when trying to integrate their newly acquired businesses. Equiniti serves as a case in point. The company, a specialist in shareholder and pensions services outsourcing, recently made a series of acquisitions, meaning that various parts of the expanded business had different ways of working, recalls its group financial controller, Rob Bloor.

“Our business became very fragmented, so crafting information required a huge amount of effort,” he says. “Accounting matters such as the consolidation of foreign exchange required a very complex human intervention.”

Pre-approve spending and streamline procure-to-pay

Improving data processes

Some firms are also relying on “cottage industry data sets”, which tend to lack consistency, making it even harder for their finance teams to obtain an accurate picture. That’s the view of Clare Walsh, director of education at the Institute of Analytics.

“People are often using completely different terminology and there are subtle differences in the numbers they’re collecting,” she reports. “There needs to be more focus on interoperability.”

Other companies are trying to improve the visibility of their operations by adopting a single enterprise resource planning (ERP) system that gives users a better view across the organization, often enabling them to see changes happening in real-time.

Equiniti recently adopted a new ERP system that has helped the firm streamline several processes and given its finance team a better understanding of what’s occurring throughout the business.

“This was a quantum leap in achieving consistency,” says Bloor, adding that most of the finance team’s processes are being performed inside the ERP system. Any third-party applications the team uses can be connected via an application programming interface without any manual input.

This approach can also help manage payments, particularly when sending money across borders – a traditionally slow and clunky process.

Marco Torrente, global CFO at travel services company WebBeds, says that his firm manages “all cross-border payments through one global provider. We manage FX risk through hedging, and then we integrate payment processes as much as possible with our ERP system.”

Streamlining payments activities

But the payment process is not only about execution; it’s also about stewardship and compliance. For instance, CFOs must ensure that payment data cannot be manipulated once it enters the system.

Heiden explains that this security measure is crucial because the risk of fraud increases significantly when data is transferred from an ERP system in a file format that can be tampered with inside the payment system.

“On the execution side, it’s about speed and efficiency – and that is where we need a lot of technology,” he adds.

IFS is working on a project to run several virtual account structures through one central global cash management bank to improve efficiency and cut processing costs.

“Payments are a constant challenge for the office of the CFO,” Heiden says. “Whether you have economic headwinds or tailwinds, you must always combine stewardship with execution. That’s because, while you’re constantly seeking efficiency gains, you can’t compromise on the compliance side.”

In any organization, some change-averse employees’ll have to be persuaded of the need to embrace new tech and working methods if their firm is to become more efficient and remain competitive.

“The obvious first thing that people fear about technology and automation is that it will put them out of a job,” Torrente says. “Communication is therefore important in ensuring that all employees understand the benefits they will gain.”

By outlining how advanced IT can help everyone to work more efficiently, employers can ease such concerns and build support for the tech investments that should give their finance teams the holistic overview they require.

“We’re working towards an end state of spending more time on value-adding activities and gaining a proper view of what’s happening across the enterprise,” Torrente says of his team’s recent efforts. “That way, we can serve as a strategic business partner and be more predictive about the challenges and opportunities our company will face.”

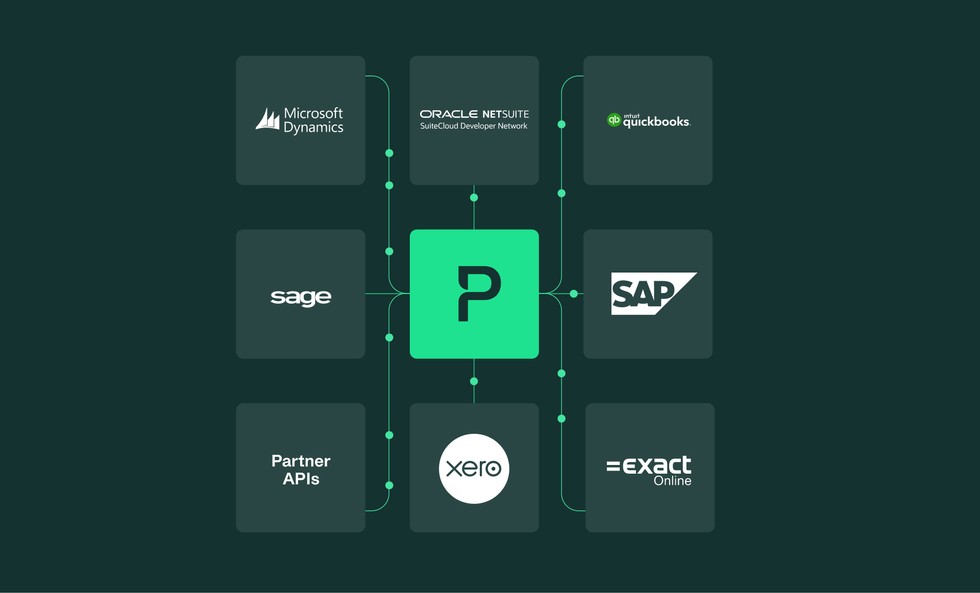

A note from Payhawk

Need to improve data processes and streamline payment activities? At Payhawk, we can save you anything from two hours a day to four days a week. Find out how we improve business decision-making at companies like GDS Group and State of Play Hospitality and book a demo to learn more about saving time and improving accuracy with automation.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Pennylane Integration: Why to connect with a spend management platform