Why does manual invoice processing take so long?

Have you ever found yourself at the end of the day wondering where all the time went? If your team is still tied up in the manual processing of invoices, then this is probably you. And you may be telling yourself that a simple Accounts Payable (AP) process shouldn’t take that long.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

After all, it’s simply collecting invoices, putting them on the system and then paying your suppliers, right? So far, so false. Manual invoice management can be very time-consuming — this blog digs into the biggest challenges and the next steps you should take to resolve them.

We cover:

- Chasing receipts and invoices

- Sorting it all out

- Entering and recording all the data

- Paying the right people, the right money at the right time

- Mistake resolution

- Next steps

Chasing receipts and invoices

The first problem is obtaining the invoices, where the accountant or finance manager becomes the 'hunter-gatherer.'

Without the benefit of automated invoice capture software, you'll probably find that your documents turn up in various formats through various channels.

You may have some sent to your AP email address. In this case, someone has to monitor and manage the inbox. Often, you find that they get sent to either a general "accounts" catchall address or to specific members of your team rather than the AP invoicing address. This means you rely on busy team members to remember that they must forward these to the correct address; otherwise, the supplier won't be paid.

Typically, though, quite a high proportion of invoices will be sent to managers of other departments, and this is where the hunting and gathering skills of finance people are put to the test.

Firstly, you have to work out what invoices are missing. This is easy for standard payments because if you haven't had your monthly electricity invoice, you'll probably be able to spot it. But if you receive one-off or irregular invoices, it’s often a matter of physically visiting managers and asking them to look through their inboxes or letter trays.

Don't discount the time spent simply chasing invoices around the business or kindly asking suppliers for copies.

Transform the way you spend with integrated procure-to-pay features

Sorting it all out

If you don’t have invoice processing automation, you’ll need to take your newly found invoices and sort them into relevant types.

Physically going through emails or hard copies takes forever, but it’s essential to ensure you understand what sort of document you’ve got. Is it a pro forma to be paid immediately? Is it a standard 30-day invoice? Is it simply an acknowledgment of an order?

Once you have your invoice list, you must spend time coding.

You’ll need entity, department, project and location codes, and many others. If you have an experienced team member, they can be pretty quick, especially with standard invoices you get every month, but when a new document comes in, it takes time to work out the correct coding.

Entering and recording all the data

You now have a stack of invoices, and because you don't have automated invoice processing, you'll need to enter these into your AP system by hand.

This challenge is probably what managers think of when they think about invoice processing, but as we have seen, there's a lot of work and invested time before you even have a chance to think about making any entries.

You'll need to allocate a team member to manually input each invoice's details, but who do you choose?

An experienced, qualified, and capable team member would be quicker and more accurate than a junior, but can you really move them from more value-adding activities?

Using an office junior to input invoices makes sense. Sure, they'll be a bit slower and might make more mistakes, but at least your experienced people can do other stuff, right?

Well, not necessarily, because junior staff may ask more questions, which means they'll interrupt the workflow of the experienced people you wanted to work on other tasks.

It can be a no-win scenario.

See our expense management software in action

Paying the right people, the right money at the right time

Now, we get to the point where your invoices are in your system, and you are ready to pay your suppliers.

Remember that you have no accounts payable invoice automation, so this will be a manual invoice reconciliation process using good old brainpower and a keen eye for detail.

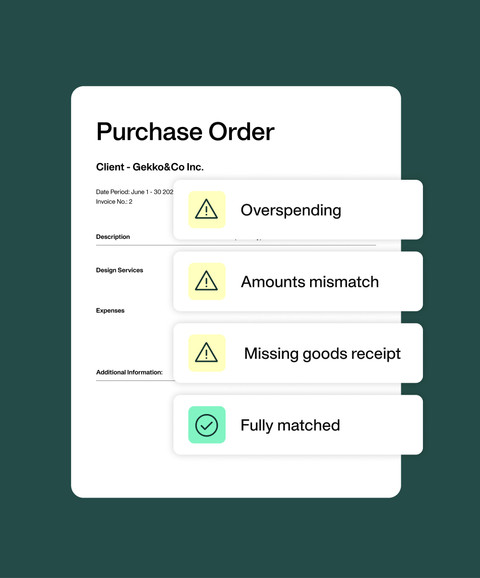

Your people need to check that the invoice has been authorized for payment, recorded correctly, and matches your Purchase Order or Work Order. If it doesn’t, there needs to be an investigation to ensure it’s still OK to pay.

Then your team needs to batch these up for payment, ensure that the total agrees with what you expect to pay, and then send this through your payment processing solution.

Mistake resolution

If that all sounds pretty time-consuming, then we can promise it is.

The problem is that the AP process sounds simple, but in real life, without any form of AP invoice automation, it just takes forever, even if there aren’t any problems.

However, error checking and resolution are the biggest drain on a finance team’s time.

If you think about the process, we have manual tasks all the way through, and with the best will in the world, people aren’t perfect. This means that in any single payment run, you could find invoices incorrectly coded, ‘fat finger’ mistakes on data entry or payments made incorrectly.

Then, you get a call from your supplier querying a payment, and someone has to check the original documents, go through the entries on the ledger, and then reconcile these with the payment file.

All incredibly time-consuming and morale-sapping.

We’d argue that mistake resolution is probably the biggest drain on an AP department or finance team’s time.

Next steps

If you want to run an efficient finance team, that must start with having a fast and accurate AP function. We can see quite clearly that even a process that sounds simple when described actually takes up a lot of time in real-world conditions.

"Using Payhawk has been a game changer; we've even been able to allocate resources to revenue-impacting teams directly. We have an employee in the finance team who now spends half of her time working as an SDR."

If the initial entries onto your system take forever and are full of errors when they are made, then you will never get to the holy grail of accurate, near-real-time reporting.

Rekey issues and chasing invoices are no joke. Julian Hall, COO at Essentia Analytics, described their experience before moving to Payhawk for spend management. "We found we were always chasing invoices and also had a lot of rekey and reentry issues, especially around payments. We realized we had a huge opportunity for improvement."

Carolina Einarsson, CFO at Essentia, continued, "Using Payhawk has been a game changer; we've even been able to allocate resources to revenue-impacting teams directly. We have an employee in the finance team who now spends half of her time working as an SDR."

Manual processing may work if you're a very tiny business, but if you want to grow without doubling your headcount, AP invoice automation is the way to go.

Eduardo Felipez, Management Accountant at Heroes, described how much time they saved when they moved to Payhawk and took advantage of both smart expense management — and a direct ERP integration.

"We have five entities, with approx 300-500 expenses a month in the parent company. It used to take me one whole day per entity to review, import and export, and put the expenses in the correct format," said Eduardo. "With the direct Payhawk integration to NetSuite, I spend just an hour daily on this. It's an enormous help."

Book a demo with our experts to learn more.

In her role as a Senior Content Manager, Nerissa Goedhart harbors her passion for sharing valuable insights and solutions through engaging content. This, with a clear mission to assist and empower businesses in the region by elevating their expense management.

Related Articles

From request to payment: Transform your buying process with Payhawk’s AI Procurement Agent