FOOD & DRINK INDUSTRYGet complete control & visibility over supply chain expenses

Streamline expenses, track supplier payments, and get complete visibility of company spend across your food and drink business. Spend more time on production and less time on process with Payhawk.

Why food & drink industry CFOs in 32 countries trust Payhawk

Track spend across your entire production cycle

Take the manual work out of expense management. With Payhawk, your users simply snap a receipt in the app, categorise it, and submit it instantly. Your finance team can track spend in real time and even auto-chase missing receipts and information.

Take complete control of company spend

Manage expenses across production and distribution with Payhawk cards and in-built controls. Give teams the flexibility to cover manufacturing costs and T&E expenses, without sacrificing control, security, or speed. Plus, instantly issue Vendor Cards to save time and support supplier payments.

Properly categorise spend for better decision-making

Create custom expense fields and categories to track spend by department, project, or team and spot savings opportunities quickly. Customise categories to best suit your business and quickly spot variances, control budgets, and identify overspending on distribution, supplies, or operational costs.

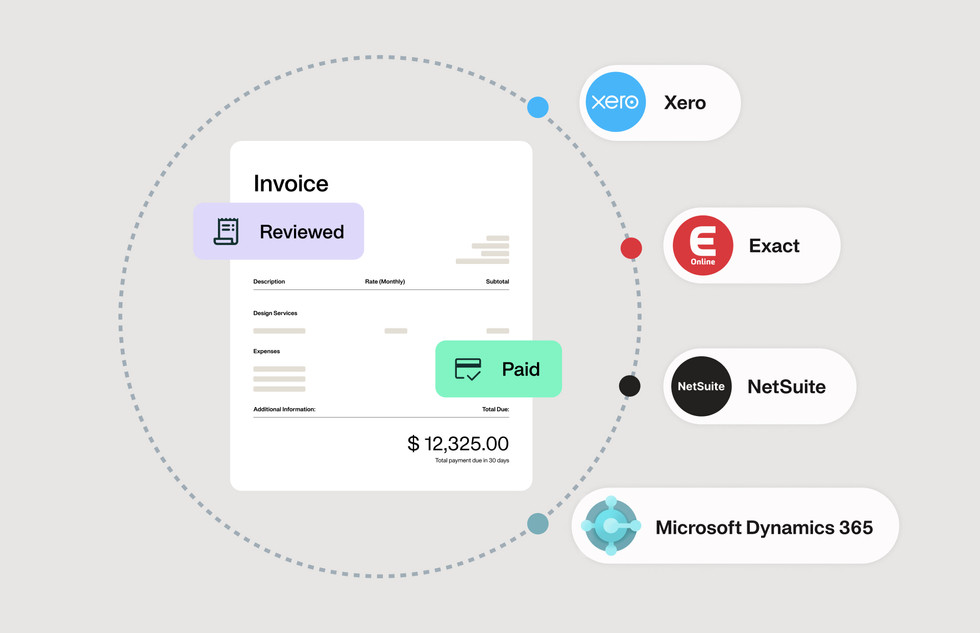

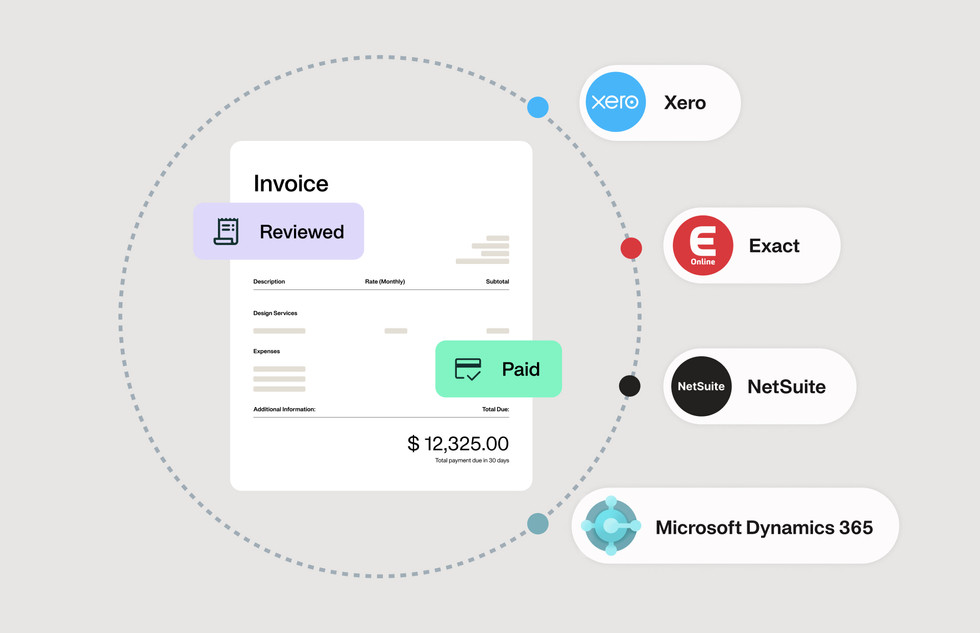

Enjoy seamless integrations

Eliminate manual expense processing to reduce errors thanks to seamless ERP integrations. With native integrations from Payhawk, you can import GL account numbers and categories effortlessly, export approved expenses (along with invoices and receipts), and close your month twice as fast.

Consolidate company spend

"The whole company loves Payhawk! We manage expenses 2x faster!"

How Cafés Candelas halved expense processes and moved from 15-day to instant card issuance.

From the moment you join us we're committed to your success

Smooth onboarding and implementation

Our dedicated team guides you through the onboarding process, ensuring a smooth transition and setting you up for success from day one.

Lightning-fast, multilingual, real human support team

Whether you have questions, technical challenges, or need assistance, our in-house experts are just a message away.

Smooth onboarding and implementation

Our dedicated team guides you through the onboarding process, ensuring a smooth transition and setting you up for success from day one.

Lightning-fast, multilingual, real human support team

Whether you have questions, technical challenges, or need assistance, our in-house experts are just a message away.

Customers love the intuitive interface and dedicated customer support

Payhawk has been a game-changer for our expense management. The app makes submitting expenses a breeze!

Payhawk's seamless integration with our existing tools has reduced our administrative workload and improved our efficiency.

Payhawk streamlines expense management by combining corporate cards, reimbursements, and accounting automation in one platform!

FAQs

You might be thinking: “Right now, this isn’t a priority.” But the reality is that until you implement a spend management solution including expense management software and corporate cards with built-in policies, automated controls, and real-time reconciliation, you can't boost efficiency, save time, and improve your financial operations overall.

In fact, you might already be dealing with common issues like:

- Expenses outside company policy

- Lost receipts and missing documentation

- Travel disruptions due to funding issues (often solvable with an extra funds request)

- Slow, delayed month-end closing

Sound familiar? If so, the best time to implement Payhawk was yesterday. The second-best time? Today.

Book a personalised demo with one of our experts and start saving time now.

Many food and drink industry businesses hesitate to issue company cards because they worry it could risk company funds. But the opposite is true.

Give your team company cards from Payhawk instead, and you get:

- Custom spending limits

- Geo and time-based restrictions: block or allow countries, days, hours, or specific merchants

- Tailored expense policies

- Real-time visibility into every transaction

- Automatic card blocking if receipts aren’t submitted

- Instant card freezing with one click

- Single-use cards for controlled, one-off payments (including supplier payments should you choose not to use accounts payable software or PO / p2p features)

- And much more

Far from being a risk, Payhawk cards put precise spend control at your fingertips, ensuring transparency and preventing financial leaks (crucial for businesses where T&E, supplier payments, and agility are part of daily operations).

Still spending time manually reconciling card transactions and bank statements at your food & drink business?

Then you're likely facing these issues all too often:

❌ Time-consuming processes

❌ Human error with data entry

❌ Tedious, repetitive work for employees

❌ Lack of real-time spend visibility

❌ Difficulty spotting discrepancies

❌ Constant manual intervention

❌ Increased risk of audit delays

❌ Hard to scale business growth

❌ High operational costs due to manual effort

❌ Duplicate data entry and disorganised documentation

❌ Compliance risks

But with automated reconciliation from Payhawk, you’ll experience a complete transformation.

With Payhawk, you can:

✅ Save time with automated matching

✅ Boost accuracy and reduce errors

✅ Instantly compare transactions

✅ Get real-time visibility into spending

✅ Automatically detect discrepancies

✅ Reduce manual workload

✅ Simplify audits

✅ Easily scale as your business grows

✅ Cut operational costs and optimise workflows

✅ Seamlessly integrate with accounting systems

✅ Centralise card and expense management

✅ Ensure effortless compliance

✅ Generate organised, automated financial reports

Ditch the manual work and take complete control of your spend & reconciliation with Payhawk.

Some companies build their own expense management software, but these in-house systems have serious limitations. The biggest issue is that they quickly become outdated. Without continuous innovation and updates — like those from a dedicated fintech company such as Payhawk — these systems struggle to keep up.

Here’s why in-house solutions fall short:

❌ No dedicated fintech team: Without a specialised team, adapting to regulatory changes or improving features takes too long.

❌ No card issuance: In-house systems can’t issue smart corporate cards with built-in spend controls, forcing businesses to rely on basic bank cards and manual reconciliation.

❌ Poor integrations: Many in-house tools don’t connect with essential business software like accounting, HR, or ERP systems, creating inefficiencies and extra work.

❌ Compliance risks: These systems often lack certifications like HMRC compliance, meaning businesses still need to store paper receipts, increasing admin and risk.

A solution like Payhawk delivers real-time innovation, smart company cards, seamless integrations, and full compliance — ensuring smarter, faster, and more secure expense management for modern businesses.