Company cards at scale

We’re improving how you manage card spend at scale and automating your manual accounting processes. With this release, you can issue Visa credit cards across the US, UK, and Europe, set advanced card controls, and so much more. Plus, we now integrate with over 50 HR systems.

Get more cash management options and bring all your company card spend into a single platform. Issue credit cards in the UK, US, and now the EEA, and proactively control spend across debit and credit cards.

- Up to €500k per business entity based on assessment

- Improve cash flow with a 38-day repayment period

- Completely digital application process

- No personal guarantees required

- Approved in 24 hours or less on average

- Switch between debit and credit at any time

More ways to control card spend before it happens

Enable more advanced granular policies to prevent non-compliant spend and avoid clawbacks.

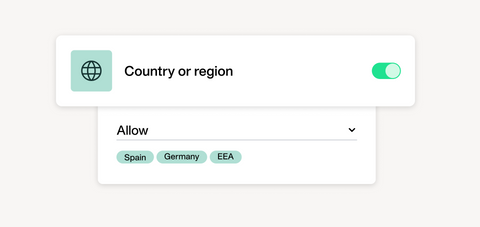

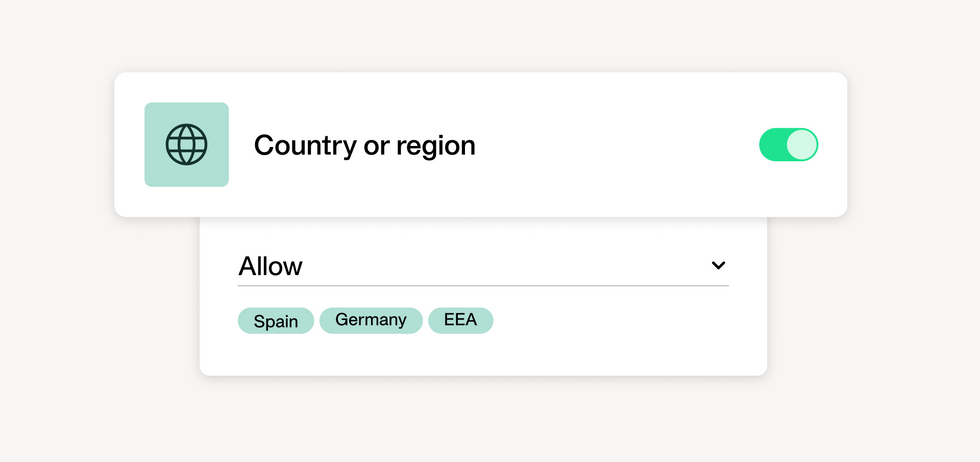

Ever had an employee use a company card on holiday by mistake? Limit spend by geolocation to reduce accidental purchases or block transactions in countries with a higher risk of fraud.

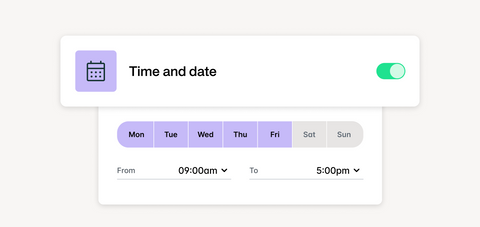

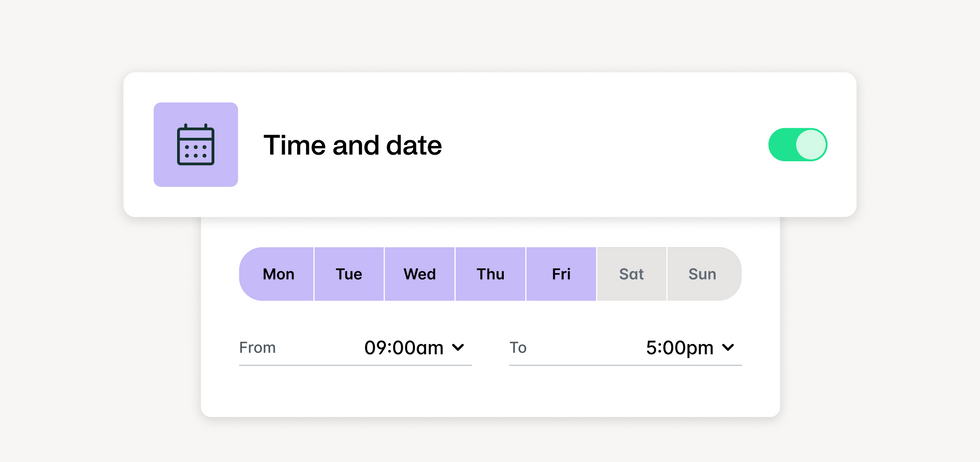

No one wants to deal with suspicious transactions in the middle of the night or on the weekend. Restrict spend to business hours to avoid misuse.

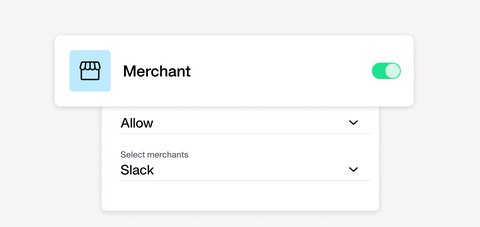

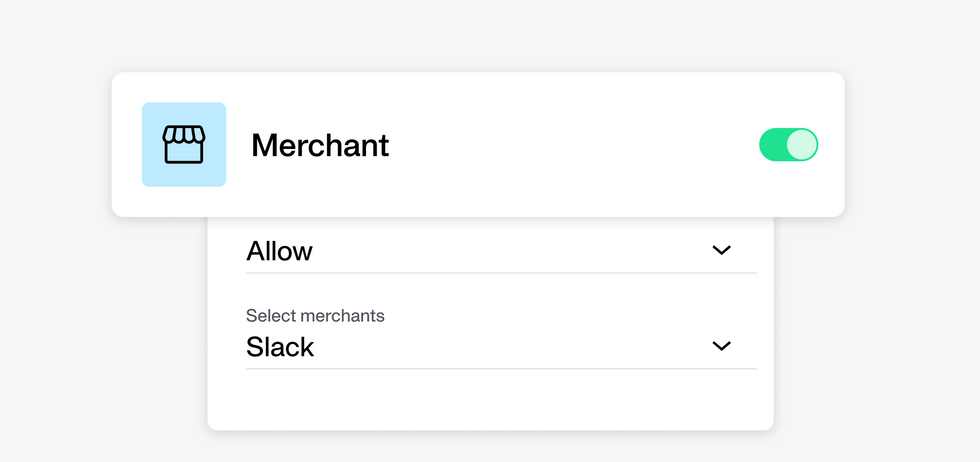

Comply with your preferred vendor lists by blocking or allowing specific merchants. Plus, block any non-compliant spend and honour any active supplier-exclusivity agreements.

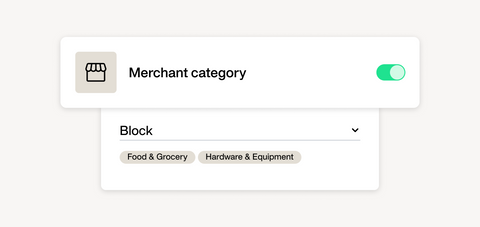

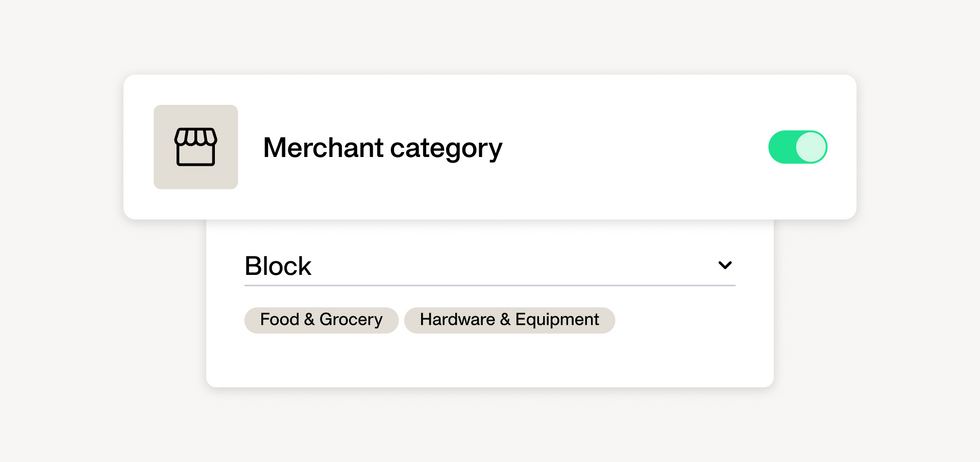

Ever wondered if a company card transaction is actually a cleverly disguised personal expense? Block or allow transactions based on merchant category to proactively enforce spend policies.

Connect Payhawk to one of the 50+ compatible HRIS to sync your employee data and spend management solution. Get a complete picture of your organisation and reduce manual work and fraud with features like automatic employee on and off-boarding and auto-termination of users and cards.

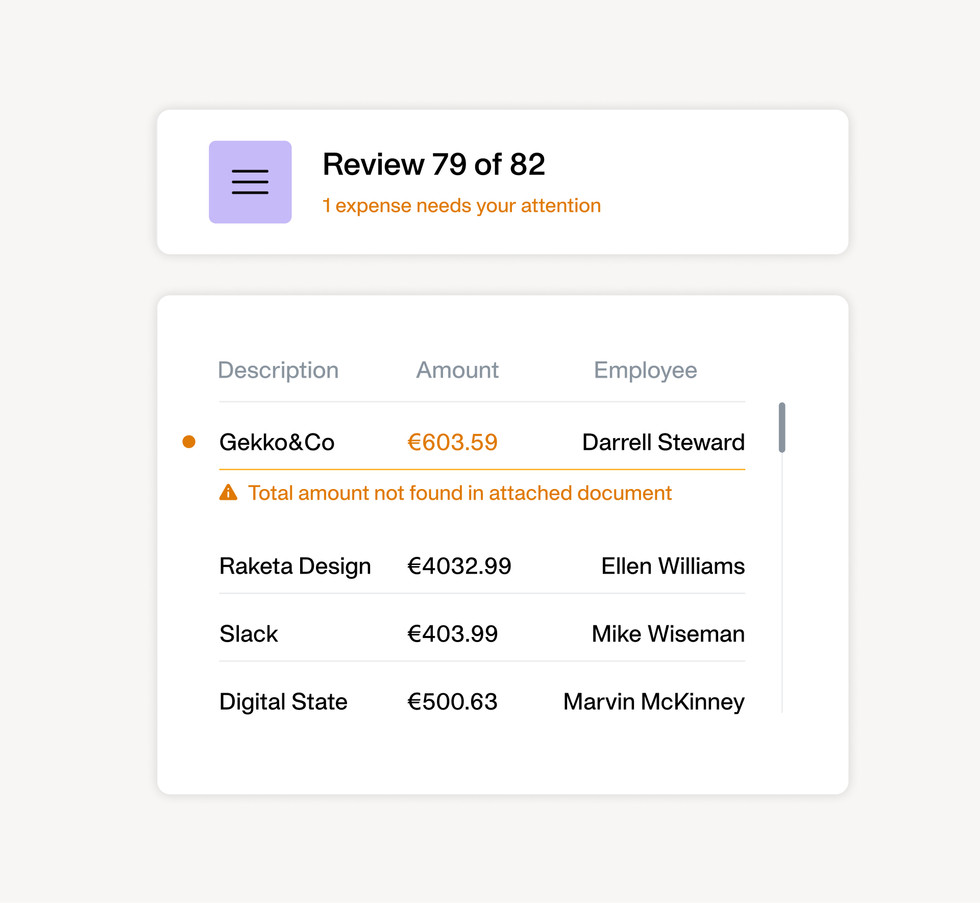

Optimise day-to-day processing by configuring the review assistant to your needs. Available for all business expenses (including cards), the review assistant can flag expenses where an employee edited a field, the attachment amount is missing, and more. Save time by speeding through the un-flagged expenses to focus on those that need your attention.

Impress clients, prospects, and partners with a credit card that stands out. Leave a lasting impression with meticulously crafted 18g brushed metal cards.

Enhanced expense management controls and automation

No optimisation is too small when managing expenses at scale. That’s why we’re introducing new features with even more automation and customisation to save you time and reduce errors.

Making accounts payable easier than ever

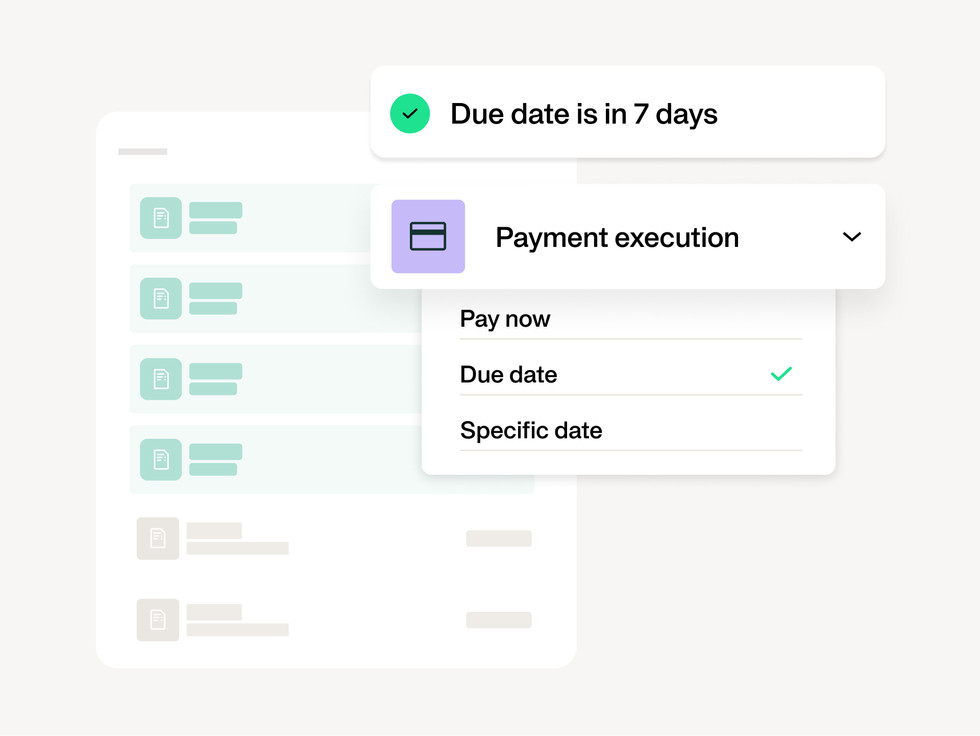

Automate your payment run and reduce errors by scheduling your upcoming payments individually or in bulk and selecting to pay on either the due date or a specific date.

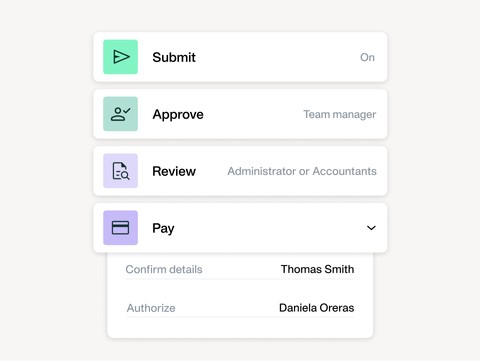

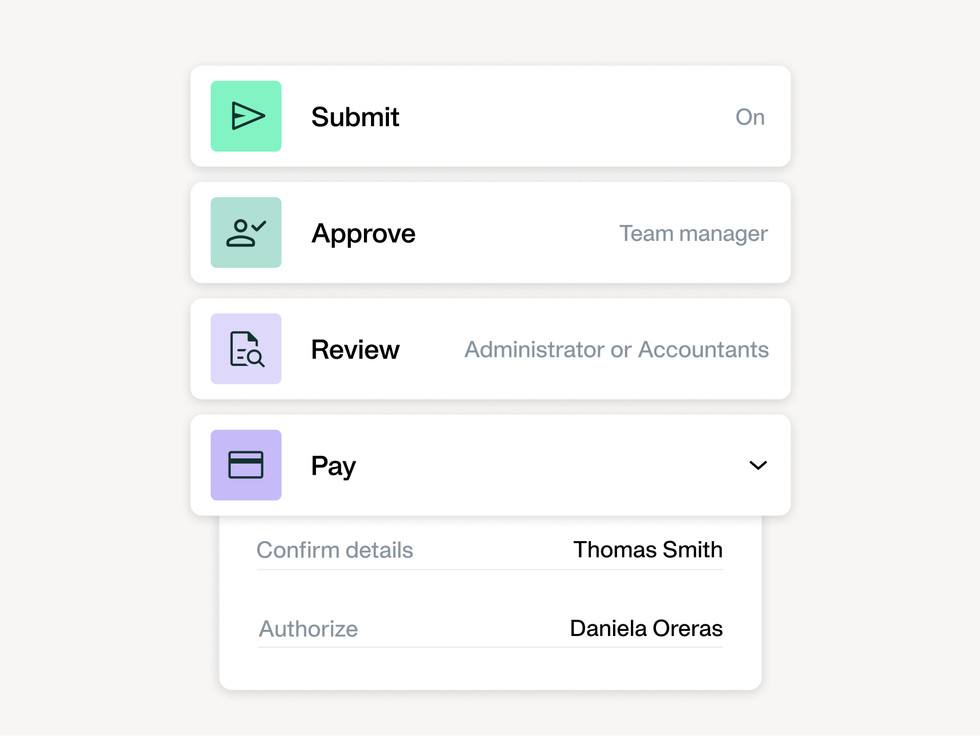

Enforce the four eyes principle with separate payment steps. You can now define different people to confirm and execute payments to prevent errors and avoid misuse.

Smarter expense capture and categorisation

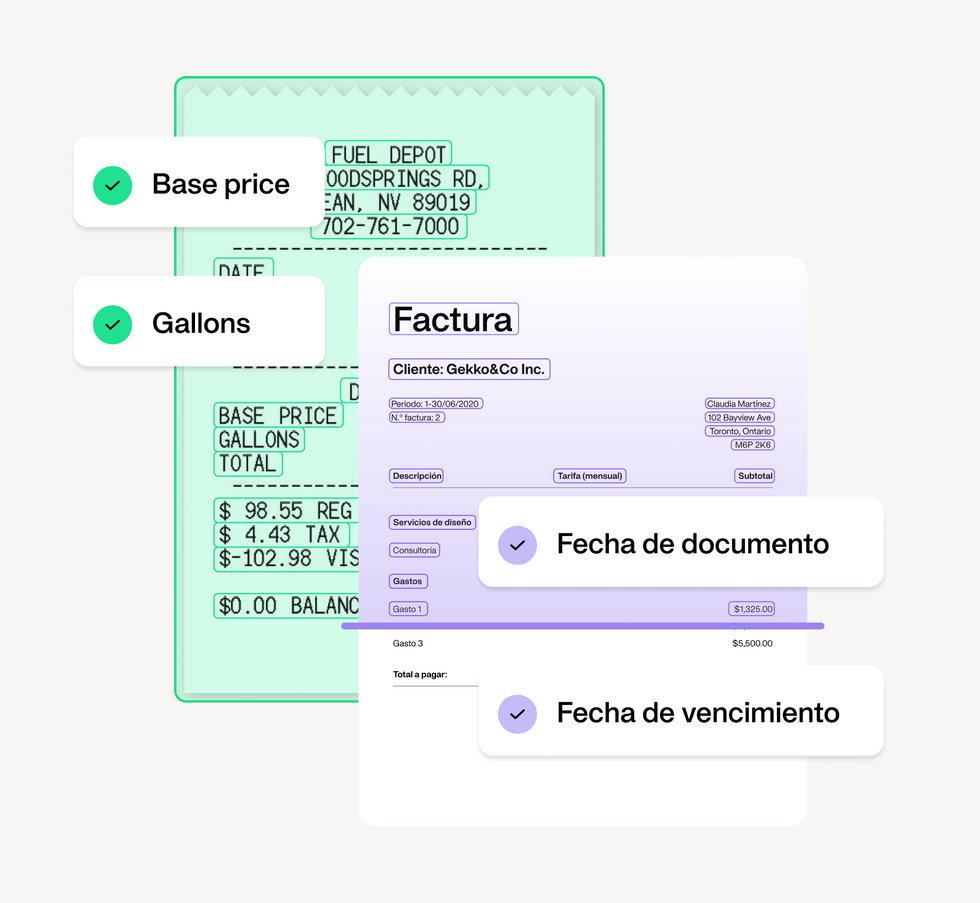

Automated Receipts and Invoices Analysis (ARIA) is our in-house developed data extraction algorithm. ARIA helps Payhawk customers process receipts and invoices automatically, saving precious time. The model can read invoices in over 65 languages, improving performance with every new invoice. ARIA's re-launch has boosted Payhawk's successful field auto-population by 16 percentage points.

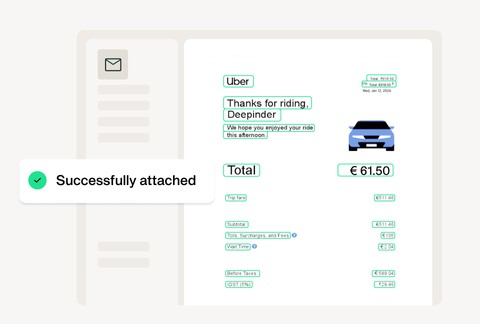

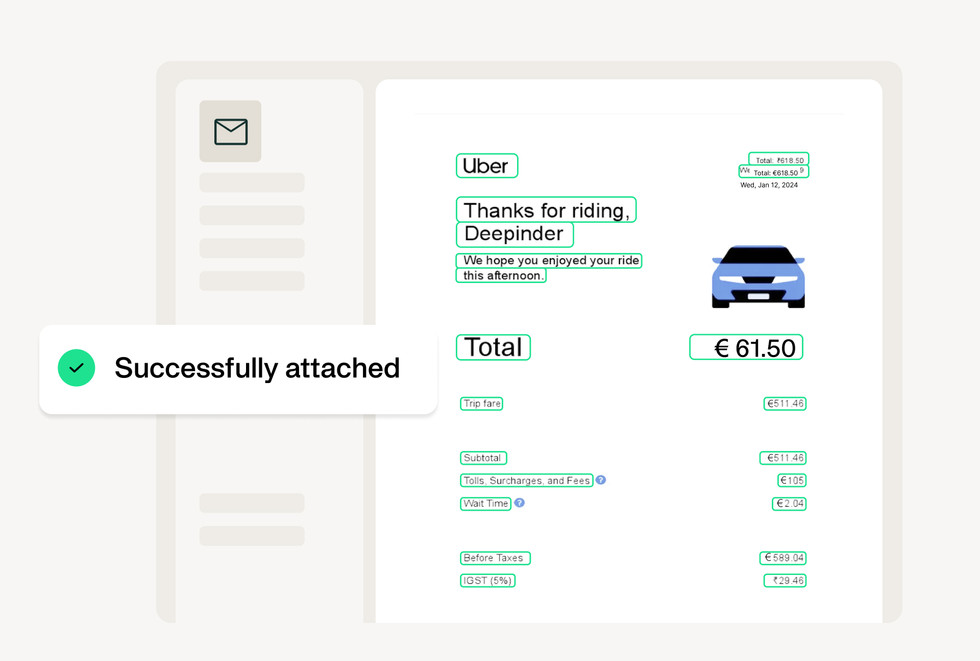

Payhawk's smart receipts mailbox now scans the entire email, ensuring no receipts or invoices are missed — whether they’re embedded or attached.

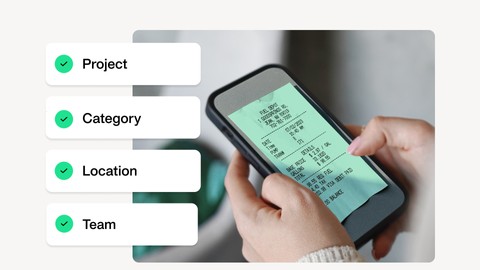

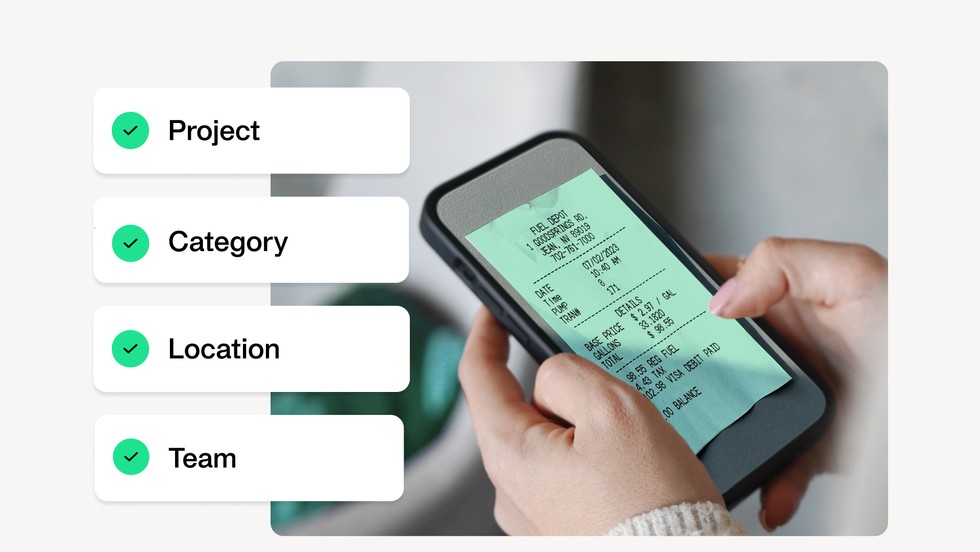

You can now leverage automated expense categorisation based on suppliers, employees, and teams. Further to our AI algorithm, which suggests the best values for categories and custom fields, you can now also auto-populate project, location, category, and any other custom field with the values you’ve predefined.

Greater possibilities with new integrations and developer APIs

Ensure a seamless data flow from your spend management solution to your other business tools. Payhawk is now compatible with 15 new ERPs and accounting systems like Sage 50, Sage 100, Sage 200, Cegid, SAP S/4HANA, SAP Business One, and SAP Business ByDesign.

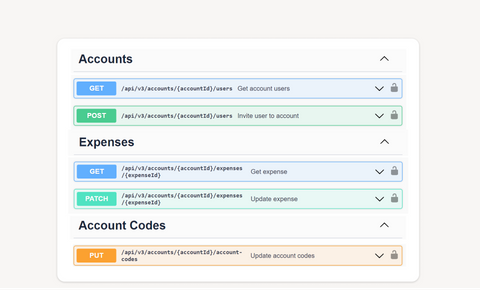

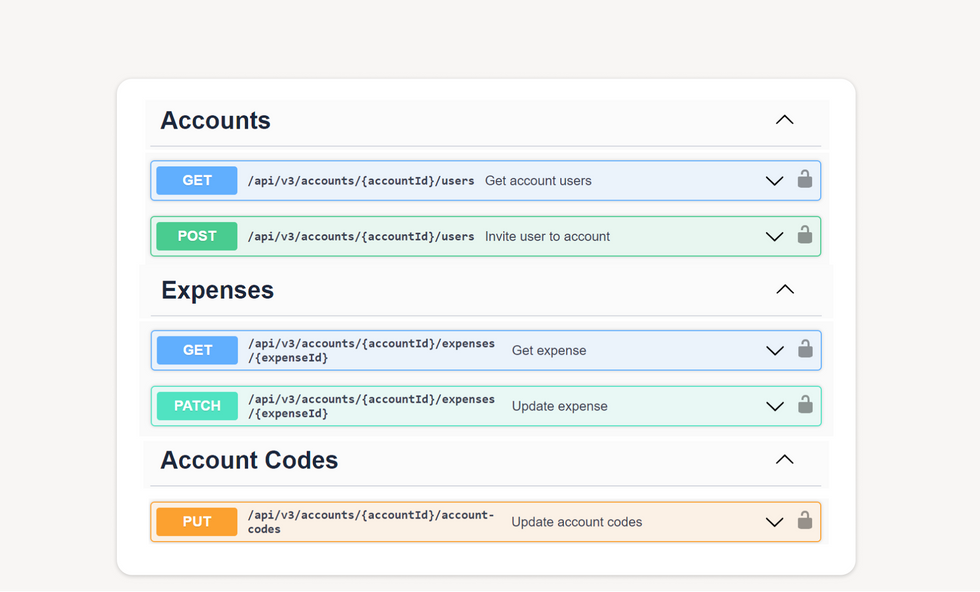

Leverage reliable developer APIs to build custom connections or integrate with partners from the Payhawk marketplace. Benefit from a standardised and versatile approach to data exchange with enhanced real-time communication and automated event-driven processes.

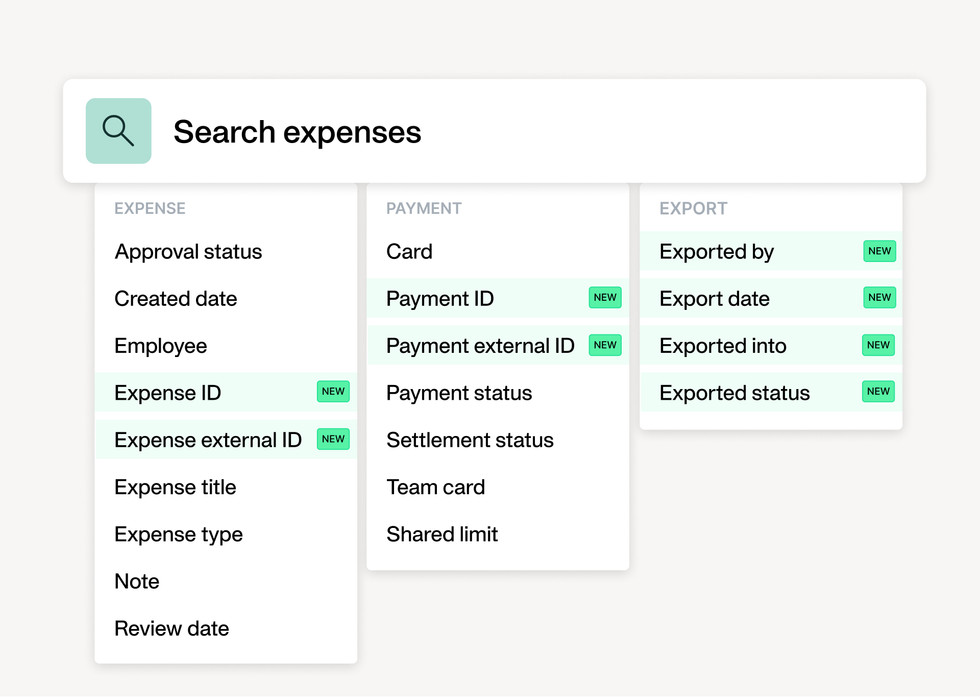

Get better visibility on when and which expenses were synced with your ERP. Oversee which files and expenses were downloaded for analysis and by who. Plus, use ten new filters to customise your expense view based on new export and integration parameters.

We build fast, so you can scale faster

Ready to switch to Payhawk and save time on your month-end?