Three game-changing benefits of international spend management software

The global value of cross-border payments is set to grow from $150 trillion in 2017 to a projected $250 trillion by 2027. These payments have become a staple part of the business environment in recent years as companies have expanded to take on opportunities overseas, reach new supplier networks, and penetrate new markets.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Cross-border or international payments are not without challenges, however, and transaction speeds can often be problematic, with data indicating that cross-border payments can take 55% longer than domestic payments for US & UK businesses.

Our recent ebook, The Ultimate Guide to International Payments: Benefits and Challenges of Paying Across Borders, digs deeper into the ins and outs of managing international payments and how to make them work for you.

Get the ultimate guide to international payments

There are lots of benefits to international payments, but again, these are not without challenges. Unless, of course, you have the right software in your arsenal to help you.

Here are three of the biggest benefits and how to make the most of them:

Benefit #1: Increased flexibility

Yes, spending across borders can open your business to new opportunities, but it also needs to be flexible, which is where getting the right technology comes into play. Not all cross-border payment solutions are created equal, and you may run into some annoying challenges by working with banks to manage international payments.

- Wire transfers often take between one and five business days to arrive

- Wire transfers typically cost up to £30 for every transaction (with zero visibility over fees)

However, you'll likely be more flexible if you make cross-border payments via intelligent expense management software.

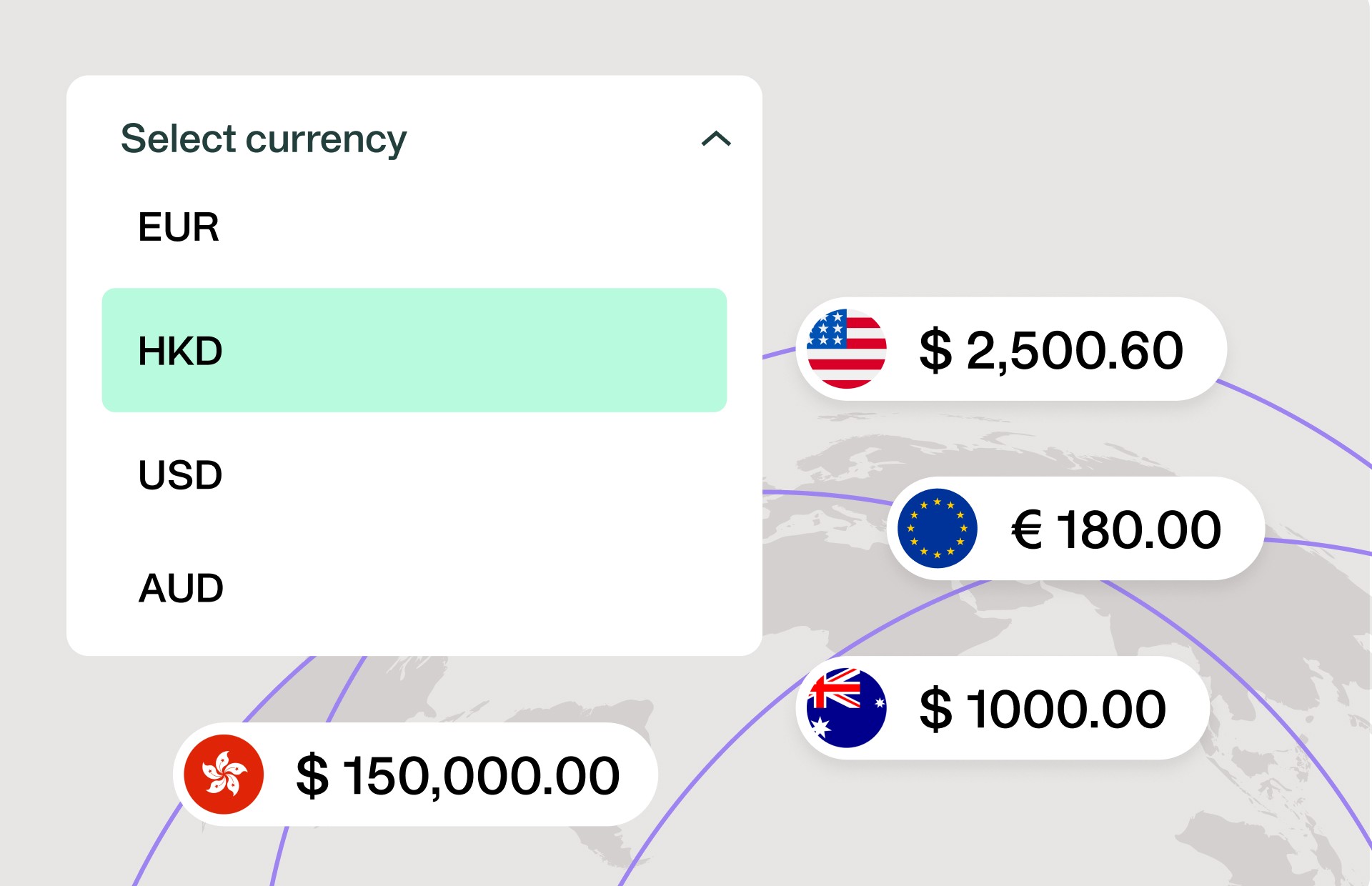

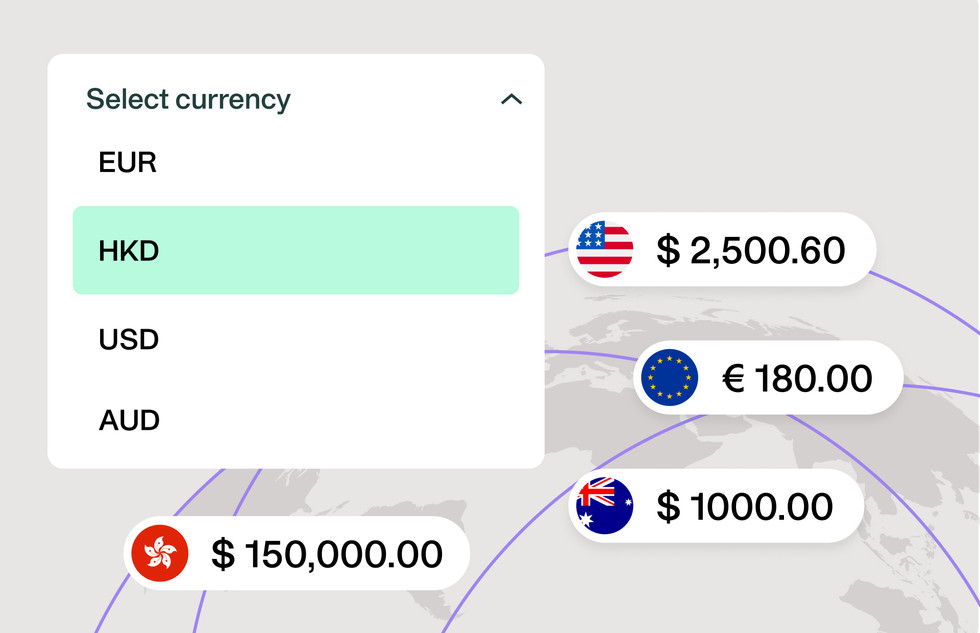

At Payhawk, for example, our spend management software featuring international payments lets you pay suppliers in under 24 hours (with 57% of transfers being instant) and make payments in over 50 currencies across +160 countries. We also give you complete visibility with real-time reconciliation, destroying the myth that cross-border payments must be time-consuming and logistically complex.

With 54% of global companies agreeing that speed of payment is the primary factor in choosing cross-border B2B payment solutions, the above is big news. It means businesses like yours can perform regular operations with complete agility. No more lengthy payment delays, no more stress about chunky FX fees, and no waiting around for data to update to make smarter business decisions about spending.

Benefit #2: Simplified Imports and Exports of Goods

Access to international markets can offer you a new customer base and open up new supplier opportunities, which can have a massive impact on your business performance.

Let's imagine for a second that you run a successful hospitality business, and you've decided to import low-cost but high-quality wine and crockery from five different countries on a relatively ad-hoc basis. By leveraging cost-effective, fast international payments from a solution like ours you can even try to match the savings you've made on produce by keeping operational finance costs down too, with *low FX fees, faster payments, and better spend transparency.

*At Payhawk, our low FX fees let businesses save up to 11 X more (EUR > USD) compared to many typical banks.

— Simon Shohet, Finance and Strategy Senior Manager at leading European Buy Now, Pay Later provider, Alma, says:

"Payhawk's international bank payments feature means we now have one platform to manage our payments, from employee reimbursements to paying suppliers across different currencies, including USD. We love that we don't have to switch between different providers to make payments and have a complete overview of spending in Payhawk."

Of course, paying sums of money internationally may raise concerns about safety and security. But at Payhawk, this is our priority and we take several measures to protect your funds and transfers, including:

- Securely held funds in safeguarded accounts via banks in line with European Electronic Money Regulations

- Faster Payments, SEPA Instant, ACH, or Bisera transfers are used for local payments

Benefit #3: Increased competitive advantage

The global payment market is big, but there's still plenty of untapped potential. Some companies haven't fully embraced international payments, maybe because of the traditionally slow transactions or a very conservative approach — either way it means there’s plenty of opportunity to outpace them.

Let’s put you back in your imaginary hospitality business for a second. You’ve switched to Payhawk and you’re ordering your latest batch of wine and crockery. The payments are instant, the FX fees are low, and you don't have to switch providers to make the payments to your different supplier in different countries, or switch platforms to check on your current spend. It’s a win-win-win situation.

International payments: What’s next?

As new technologies emerge, the barriers to making cross-border payments are rapidly disappearing. Modern software makes it possible to access more competitive foreign exchange rates, leverage local payment rails to increase speed and reduce costs, and benefit from a range of functionality that was previously impossible.

The future of international business is already here. Cross-border payments are no longer unwieldy, slow, and impractical. And instead, business customers can now be armed with the knowledge and data to make smart decisions, minimise costs, and make the whole process even more desirable.

In summary, innovations in cross-border payments have completely transformed the industry and even commerce itself. Modern spend management solutions like Payhawk have allowed businesses to expand their reach, tapping into new markets and opportunities. The advantages of faster payments, access to new markets, and even some of the lesser-known benefits of cross-border payments, such as diversification of investments, make them attractive to businesses of all sizes.

Expand your global reach with international bank transfers and pay your suppliers with just a few clicks. Save time and money with affordable, effortless international bank transfers available in over 160 countries and spanning 50+ currencies; book a demo to find out more.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Pennylane Integration: Why to connect with a spend management platform