Multi-entity budget management just got a whole lot easier

Time is precious. And as a finance leader at a multi-entity company, you can’t afford to waste it tracking down missing data, chasing budget info, or answering endless budget-related questions. The good news? You don’t have to. At Payhawk, our budget features give you (and your business) the efficiency and transparency you need. Learn how to save time and achieve complete budget visibility.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

You need a cohesive solution that centralises multi-entity budgets in order to effectively plan and manage company-wide spend. If you don’t, your budget tracking may leave gaps or confusion and look something like this:

- Let’s say your company doesn’t allocate a budget per entity.

- That would mean that in the case of multiple entities, let’s say UK, France and Germany, you might decide to use Germany to set up a marketing budget.

- Now, that you’ve chosen Germany to set up your marketing budget, no other entity will have budget visibility.

- And you can’t distribute the budget evenly among all your entities, either.

- Company funds aren’t spent proportionally from each budget, so this approach to budget management wouldn’t make sense.

Enter our updated budget features.

With our updated feature, you can now upload budgets centrally and in one template (instead of entity by entity) all from your Group Dashboard.

Here are the three biggest changes and what you can do:

1. Track budgets that span multiple entities: You can customise budgets for multiple entities and set up your enterprise budgets exactly as you need them. All of your required dimensions, like categories, custom fields, teams, etc., now work across entities.

2. Save time: Upload one group template instead of one per entity to save countless hours (which you can then spend on value-added activities such as forecasting).

3. Improve visibility: Track all budgets in one place! There’s no need to switch between entities or complete external calculations to view the total: See everything all in one place.

Update your budget template centrally so that everyone has budget visibility.

Nine big benefits of Group Budgets

Multi-entity business? How could accessing the Group budgets feature help you?

Here are the top nine ways:

1. Distributed ownership

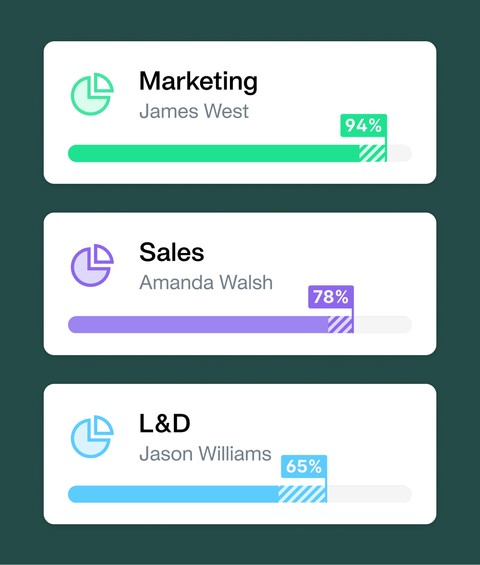

Group Budgets let you distribute ownership by allowing different departments or teams to manage their own budgets. This approach improves spend accountability and helps the busy person who might have previously managed all budgets. With each budget owner in charge of their financial performance, there’s a sense of responsibility and ownership.

2. Decentralising accountability

With Group Budgets, you can also decentralise financial accountability. Give your team the power to track their spending in real time and help ensure they remain within allocated budgets that align with your company’s strategic goals.

3. Delegation of financial responsibility

Delegate financial responsibilities to non-finance members with Group Budgets and empower those non-finance coworkers to make impactful yet informed spending decisions — reducing the burden on finance teams).

4. Real-time monitoring and re-forecasting

Group Budgets also give teams real-time insights into spending so they can track expenses, adjust as needed, and stay on budget. This visibility helps them quickly forecast and align spending with shifting business priorities.

5. Replicate your unique budget setup

Every budget setup is unique, so your platform capabilities must be, too. With Group Budgets, you can set your budget up with no limitations or workarounds. With our group-level budget management, you get complete flexibility to structure and manage your budgets across teams and entities, all from one platform.

6. Standardised reporting standards

Group budgets help establish consistent reporting standards across the organisation. This improves both consistency and transparency in financial management, which is key to business success.

7. Simplify everything with one dashboard

Get complete visibility and budget control over all your entities’ budgets with a single unified dashboard. This window into company financial performance supports quick decisions based on real-time financial data, regardless of entity.

8. Rid your processes of complexities

Managing multiple entities separately takes time and is complex. Switching between them to track spending is inefficient, and uploading multiple budget templates takes forever. Group Budgets eliminate these extra steps and make budget management easier for everyone.

9. Align closely with strategic planning

Let’s say your overarching strategic goals include market expansion, revenue growth, or cost savings; in this case, Group Budgets can help you accurately allocate financial resources to support these objectives and get closer to achieving them.

Your next steps

If your company has multiple entities, our improved budget feature will help you precisely track every penny. By cutting out unnecessary tasks — like uploading budget templates for each entity — you can free up time for high-value work while boosting spending accountability across your team.

Multi-entity budget management has never been so effortless. Request a personalised product demo to see our budget app in action and find out more.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Pennylane Integration: Why to connect with a spend management platform