Six procure-to-pay challenges multinational companies must navigate

If you’re a multinational company facing procurement process challenges, we hear you. In this article, we address the top six challenges and give you advice on how to overcome them.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Spend visibility is crucial to your business success. Even more so, if you work at a multinational company where you must track spend from many disparate places. Without visibility over all company expenses, you can’t plan for the future. From supplier relationships to cost optimisation and reduction, how efficient and effective your procurement process is can have a huge impact on every facet of your business.

What is procure-to-pay?

Procure-to-pay is the entire process from purchase request to order fulfilment and invoice payment. When managed effectively, it can help boost efficiency across your entire organisation (while also keeping a close eye on all financial activity), helping you plan and budget more effectively.

Transform the way you spend with integrated procure-to-pay features

Why it's important to address procure-to-pay problems

As a multinational company, you need efficient business processes to remain competitive, continue scaling easily, and maintain your organisation's financial health. Your procurement process affects not only the business's financial aspects but also stakeholder and supplier relationships.

A slick and seamless procurement process helps reduce the risk of fraudulent purchase order requests, ensures data accuracy and facilitates business growth.

Six procure-to-pay challenges multinational companies must overcome (and the solutions)

Leading finance at a multinational company? Then you’re likely facing several big challenges right now:

1. Lack of visibility

Visibility is key to making crucial business decisions. Without foresight into all company purchases, planning, budgeting, and forecasting growth will become difficult. As a multinational company, you must keep tabs on all spending across multiple entities. Unfortunately, disparate systems and no central view of spend hinder visibility.

Let’s say you have multiple UK and US entities, but each entity uses different tools to manage financial processes; tracking and analysing these will quickly become a nightmare for the finance team. Between switching screens and chasing colleagues for information, the more systems and information pile up, the more impossible it becomes to manage spending correctly.

Visibility is particularly critical in the procurement process — from open requests to past and upcoming payments. Gaining this visibility puts you in a powerful position to become more efficient, cut costs, and scale.

The solution: At Payhawk, we give you this visibility tenfold within one single tool. The key is in the data; it starts with ensuring your master data is synced correctly in your spend management tool.

The next step is real-time spend insights, helping you make accurate and informed decisions based on a single source of information. Track available funds across all your entities, receive low fund notifications so your accounts team can always make timely supplier payments, view all upcoming and committed spend in real time, and ensure every spend request and invoice follow the correct approval workflows, and so much more.

Adrià Vázquez, Finance Director at VICIO, says:

With the tool we used before, we felt blind about certain information. I didn’t know where to make adjustments and couldn’t find things out fast enough. Now, with Payhawk, we can maintain visibility and control over spend, even as the number of receipts and invoices multiplies. Payhawk’s traceability empowers us to invest our cash where it will generate the greatest profitability.

2. Data management and integration issues

Working with disparate systems means you can’t manage your financial data (or business spend data) from a centralised system. When overseeing finances for multi-entity companies, separate systems mean you’ll have problems with duplicates, inaccuracies and inefficiencies throughout the procurement process. This disconnection can lead to all kinds of problems, including poor supplier relationships, duplicate or delayed data, and lack of standardisation, ultimately leading to loss of control.

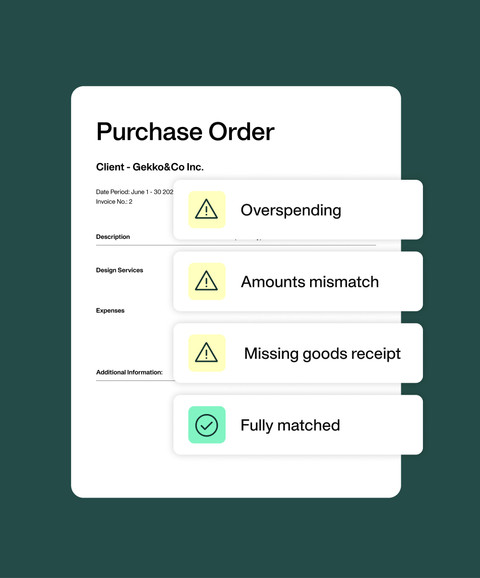

The solution: Instead, a spend management solution like ours, including procure-to-pay software, can help you keep track of all purchase order requests, raised purchase orders, and invoice management with 3-way matching, supplier information, invoice payments, and more. By integrating our solution seamlessly with your ERP and accounting systems, you also get one single platform to access all your data, making life much less complicated.

Howard Thompson, Global Financial Controller at GDS Group, says:

As we have all of our expenses coded up to project codes in the Payhawk solution, we can now report on our margins by event and so on at the end of each. Payhawk has done a great job of getting that custom field from NetSuite and the project code from NetSuite into Payhawk.

3. Supplier management and relationship building

Building good relationships with your suppliers puts you in the best position when renegotiating contract terms and getting preferential rates and reliable products or services. However, to ensure you build the relationship foundations correctly, you need to be able to pay them promptly and facilitate supplier communication.

The solution: At Payhawk, our automated procure-to-pay system means fewer inefficiencies and human errors throughout the procurement process. In contrast, you ensure supplier payments happen on time; supplier information is always accurate, supplier data syncs automatically, reducing delays, and invoice processing is much faster with OCR technology — supplier management has never been easier.

4. Technology implementation and automation

Without automated tech solutions, your processes are open to lazy errors, drawn-out processes, and ambiguous expense policies. When managing multiple entities, you must already oversee many different processes, and how one entity manages the procurement process might differ from another, making it difficult to track procure-to-pay processes company-wide.

The solution: Use automation-driven technology to reduce manual, repetitive tasks such as supplier data entry, invoice data input, and invoice matching. Our automatic three-way matching feature ensures the quantity on both the purchase order and the receipt note match, and the net amount on the purchase order matches the supplier’s invoice before making payment (saving a lot of time).

5. Cost reduction and optimisation

Reducing and optimising costs is key to sustainable growth, but global companies face internal challenges and complex operations. Proper cost optimisation requires a holistic view of company-wide finances.

The solution: Optimising costs across a multinational company can be challenging, but by leveraging technology to understand and manage cost drivers and improve inefficient processes, you can remain competitive in the industry and rethink your entire approach to managing company finances.

Cost-saving strategies can include quickly identifying duplicate subscriptions. For example, let’s say you have a marketing tool subscription. At Payhawk, once you start using our solution, you notice multiple entities have the same marketing tool subscription (when, instead, they could all be using the same one).

Technology can also help you save time, effort, and money during the purchasing process. Ensure that what you pay for is what you ordered and received, avoid being overcharged, and avoid late payment fees.

6. Inefficient invoice processing

If you manually process invoices, you’re probably dealing with human error. These errors can lead to delays in supplier payment and goods delivery and inevitably lead to delays in other business operations.

The above causes a massive headache in standard business, let alone a multinational one. Think of the multiple languages, currencies, and tax regulations you’re dealing with — processes that generate high costs all on their own.

The solution: Our expense management software takes all the heavy lifting out of your financial processes, including centralised approval workflows designed on a multi-entity level. To process an invoice efficiently, you need customisable workflows to ensure you can handle supplier invoices accordingly.

For example, with our advanced workflow designer, you can build complex workflows for your invoices and purchase orders, ensuring that each follows a structured process for sign-off and payment, keeping costs in check at all times.

Daniel Tang, Finance Manager at PinPoint Media, says:

Payhawk’s workflow designer has improved the overall ease of use by being very intuitive. It has also improved the customisation functionality, as we can modify the workflows depending on the project department.

Our optical character recognition (OCR) technology means employees can take a picture of the invoice in the mobile app and automatically extract data (even in poor lighting), minimising mistakes and making the invoice processing journey as smooth as possible.

Ready to take your next step toward full financial visibility? Request a demo, and we’ll show you how our solution will transform how you manage multinational spend.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

How to lower accounts payable error rates with an automation software