The cure for disconnected spend systems (and how to fix visibility gaps in finance)

Does month-end feel like a dreaded week of stress every single time? What about day-to-day? Can you find the insights you need quickly to make the best decisions? If you answered yes to these questions, then you’ve likely been relying on fragmented data and legacy tools for too long, and it’s time for an upgrade. Find out how a stress-free month-end and ‘continuous close’ could change your life with expenses, invoicing, and cards all under one roof.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Spend visibility is the ticket to impactful decisions, better financial health, and cost-saving opportunities. But if you’re battling with one system for expenses, another for cards, and a third for invoices, you’ll lose the vital visibility and speed you need.

Is consolidation the future of finance? Yes and here’s why

Picture the scene. You’ve been through digital transformation. You onboarded a slick accounts payable tool to make your life easier. Then, a corporate card provider. Then some expense software. Then, a procurement platform. And so on.

You’ve built a useful tech stack. But the problem is, your tools don’t talk to each other. And worse, they don’t talk to your ERP. So, what started as a fix (or multiple fixes) now creates more problems than you started with. You’re not alone; 85% of CFOs say visibility is a major challenge when managing multiple tools, with data quality and consistency coming a close second at 73%.

Here’s where you might be among the many CFOs who are now switching to complete spend management solutions that give them more. With the right tech, you can consolidate tasks and transform your financial processes to become part of a dynamic financial ecosystem. One that offers visibility, efficiency, compliance, and delivers an intuitive and empowering employee experience.

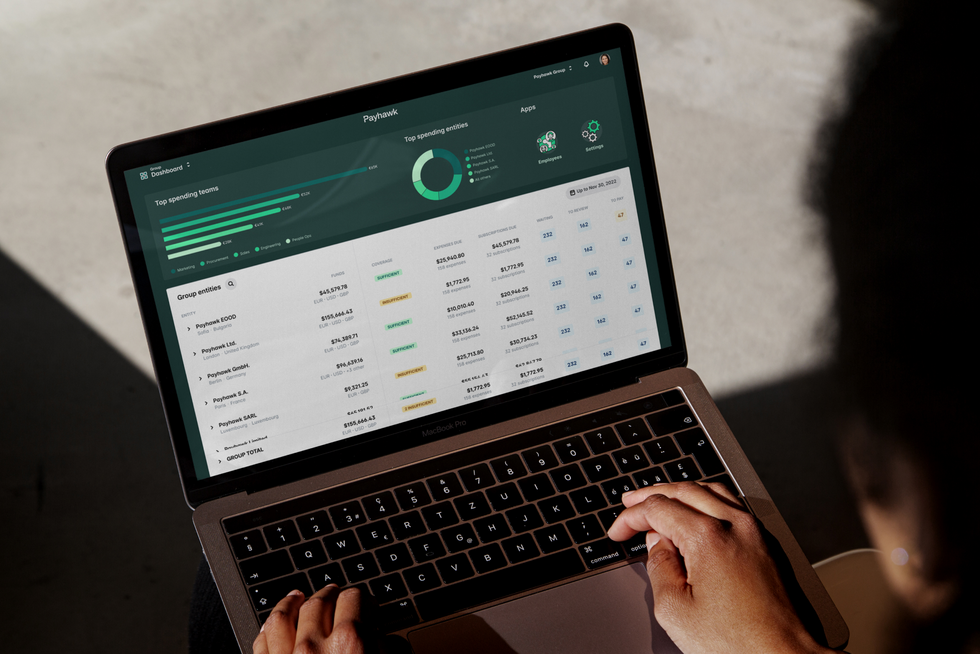

Payhawk: One platform for all your finance processes

At Payhawk, we unify all of your processes, giving you complete control and visibility over company spend and cancelling out issues like those raised by Carolina Einarsson, CFO at Essentia Analytics:

Before Payhawk, we used a couple of point solutions, Excel, and a few different credit cards, but we didn't have an all-in-one centralised solution...we saw Payhawk as the future where we could have expense data entry, credit cards, approvals, spend requests, paying invoices, reimbursements, all in one.

1. Global cards with advanced controls

According to research from eCommerceNews, 44% of high earners still pay out of pocket for client entertainment. That’s a headache, not just for employees but for finance teams. Without company cards, there’s delay, stress, admin overload, and zero visibility.

At Payhawk, we fix that. Our corporate cards come with built-in controls and full platform integration, so you can define what’s allowed, set limits, restrict spend by merchant, time, or region, track it all in real time, and ensure all spend is compliant. You turn policy into action, reduce fraud risk, and keep cash flow in check.

For the global digital platform agency, FFW, that’s made a real difference. They replaced scattered cards across countries with one unified system.

Krasimir Angelov, Finance Manager Europe & Managing Director at FFW Bulgaria, describes: “The transparency that Payhawk provides lets us get a much better overview of company spend. And having our corporate card transactions in one place (and only a click away) adds value to our finance process, contributing to better cost control and optimisation.”

2. Invoices and accounts payable

Automate your invoice processing and use custom approval workflows to ensure prompt payments. This automation will eliminate late fees while reducing processing errors, improving financial data accuracy and strengthening long-term vendor relationships.

At Payhawk, our AI-powered OCR captures and processes invoices with zero manual effort, while flexible workflows route approvals based on project, department, or entity. You can link invoices to purchase orders, match them automatically, and pay suppliers in 160+ countries — all from one platform.

We track every invoice, approval, and payment in real time, so you never lose sight of what's been paid, what's pending, and what's coming next.

3. Expense reporting

With our expense reporting features, there's no need for external apps. Snap a picture of your receipt and watch as OCR extracts all the important information, populates your expenses report, and automatically categorises your expense reports.

And thanks to our built-in approval workflows, you'll always know the right people have signed off; no more guessing, chasing, or jumping between tools, emails, or side chats. Everything happens on one platform in real time, making expense management transparent and easy to manage across all entities.

4. Purchase orders

Purchase orders used to be something your purchasing team handled behind the scenes, often informally, with employees just flagging what they needed. But that kind of process can lead to confusion, delays, and the wrong POs being created.

With us, you bring structure and control to the process. Employees submit purchase requests that automatically flow through your approval workflows. Once approved, they instantly become purchase orders — no manual chasing, no guesswork. You get full visibility and fewer errors, right from the start.

From there, our two-way and three-way matching helps you stay on top of payments. We match the PO, invoice, and receipt note to make sure everything lines up before any funds leave your account. Once verified, the payment and invoice are exported straight to your ERP or accounting system, following your existing booking logic.

Ryan Franklin, Financial Controller at Greystone GT, highlights some of the benefits of procurement with Payhawk, saying:

I particularly like Payhawk’s line-item functionality. It breaks down invoice details and splits them into lines. We can then analyse these line items in much more detail than with a traditional PO system.

That level of detail means you can see exactly what’s being purchased and why, helping you stay on budget, track spend accurately, and make smarter decisions overall.

5. Supplier management

Sync supplier details from your ERP with our smart integration to ensure data consistency and correct payment details. You can even standardise the process by only giving system administrators or accountants access to supplier creation, letting you control supplier creation more closely. Alternatively, just import suppliers from your connected system.

At Payhawk, our supplier management features also keep your admins accountable by logging all supplier detail changes, and custom expense categorisation makes reporting more insightful and accurate.

Technology platform Flowdesk found our native integration with NetSuite helped optimise their supplier management, Eric Olombel, CFO at Flowdesk, describes:

With Payhawk, new suppliers can be integrated in one go without wasting time — a real bonus because we now have hundreds of suppliers. The interface is easy to use and ergonomic. Payhawk is already connected to NetSuite, and the accounting is practically done automatically! What's more, the time taken to process expenses has been reduced to a few minutes, whereas it used to take a whole day to manage them each month.

6. Budget tracking

Tracking budgets shouldn’t feel like detective work. With our solution you can track budgets against real-time spend, and get real-time visibility into budget usage across departments, projects, or individuals — no spreadsheets, no blind spots.

Whether it’s marketing spend, travel costs, or supplier invoices, every type of expense is automatically tracked and updated live. You can see committed spend and remaining budget instantly, empowering you to make proactive, not reactive, decisions.

Need to tweak a budget? Do it on the fly. Need to stop overspending before it happens? You’ll get notified the moment a fund request pushes a team into the red.

7. Subscriptions

Manage subscriptions in one place. Easily identify duplicate subscriptions and track price over time to make informed decisions about price versus value. These insights will give you a great negotiation advantage, or at least will point you to what you can cut and spend elsewhere.

Before Payhawk, photo and video equipment retailer, Kamera Express had subscriptions spread across multiple cards, making subscription visibility almost non-existent:

Ahmed Mustafa, Financial Controller at Kamera Express, says, “Previously, subscriptions were on the ICS card, but with Payhawk, we have insight into all our subscriptions via the overview in the platform. This makes it much easier to identify and manage unused subscriptions.”

8. AI agents

AI in finance and accounting is truly game-changing. Instead of being exhausted by the tedious, manual tasks, hand them over to our AI agent. Need to book travel without going out of policy? No problem. Or perhaps someone forgot to upload their expense receipts? Let our AI agent automatically follow that up, so you don't have to!

Our AI agent is always learning, but cannot go outside the remits you set for your staff. This doesn't take away from valuable human interactions; it only helps speed processes along, freeing up precious financial resources.

9. UX that empowers employees

You want good policy compliance? You need good adoption. And for that, you need a tool that everyone loves.

According to G2, TrustPilot, et al., employees love using Payhawk. Our mobile app is intuitive and intelligent, making submitting a receipt or invoice super easy and enabling them to request funds at the touch of a button.

Our G2 reviews say things like:

- "The app's clean design makes navigating a breeze, and submitting expenses, especially via the mobile app, is incredibly fast. I appreciate not having to wrestle with complicated interfaces anymore. It's user-friendly, efficient, and has freed up valuable time!"

- "The mobile app and real-time visibility are big wins, especially for teams on the go."

10. It’s a global solution

If you manage budgets for multiple entities (or plan to someday), you need a solution that can grow with you as you scale.

From processing invoices in over 60 languages and paying them in over 50 currencies, to giving you visibility into every one of your entities through the group dashboard and everything in between.

Just because you have multiple entities doesn't mean you should invest in multiple tools. With us, you don't have to worry about barriers to spending visibility. Our platform is really a one-stop shop for global spend management.

11. Keep your ERP, upgrade the experience

At Payhawk, we ensure there's no need to swap out your ERP. Instead, we seamlessly integrate with all the big players, from Microsoft Dynamics 365 Finance and NetSuite to Xero, QuickBooks and Exact Online:

Nick Millard, VP of Finance at GDS Group, explains;

Payhawk has done a great job of getting our custom fields and project code from NetSuite into Payhawk and vice versa... When we were picking our expense management platform, I built a matrix of the criteria we had to decide against. So first and foremost, did it integrate with NetSuite, our accounting platform, and of course, Payhawk definitely ticks this box.

The payoff: one platform, zero vendor mess

There’s no argument, consolidating simplifies vendor management and budgeting. It gives you unrivalled visibility over spend, while giving you granular control over how money is spent and managed.

By consolidating all your tools into one platform, you save time. Employees don’t need to hop between products, log in, log out, and then log back in again to verify vendor details, which is time-consuming.

Having everything under one roof means less IT maintenance, fewer renewals and easier compliance — you can enjoy a finance team that works fast and smarter on a global scale.

Brand experience agency, Undercurrent, have got complete real-time visibility, stronger team accountability, and significant time savings. Stuart Bellet, Finance Controller at Undercurrent, describes:

If we were to add up the hours of admin across the business… We've easily saved about five days a month! That’s an incredible amount of time, and as a creative business, less time doing admin is a win-win for everyone!"

Request a free personalised product demo and let our expert team show you how to connect your spend systems for complete and effortless spend visibility. Book your demo today.

In her role as a Senior Content Manager, Nerissa Goedhart harbours her passion for sharing valuable insights and solutions through engaging content. This, with a clear mission to assist and empower businesses in the region by elevating their expense management.

Related Articles

Best ZipHQ alternatives for Mid-Market Finance Teams