How to streamline your financial reporting process

From managing spreadsheets and unclear processes to chasing down invoice approvals, clunky accounting reporting will hold your business back. Get ready for a financial reporting revamp: Uncover the tips, tricks, and tools you need to take your financial reporting process from “meh” to magnificent.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Does your company struggle with an overload of financial reporting tools? Different teams use different platforms, including Excel, Google Sheets, email, accounting software, tax preparation tools, and more, to manage budgets, purchase orders, VAT recovery, and other financial tasks.

Additionally, juggling multiple payment methods like credit cards, bank transfers, and digital wallets complicates your control over company spending. What started out as a way to streamline the financial reporting processes with technology has ended up making everyone’s jobs harder. This multi-solution scenario is common. The typical financial planning and analysis employee spends 75% of their time collecting data, leaving just 25% to conduct value-added analysis.

The result? Complicated processes, splintered data, overwhelmed aff, and lost opportunities.

But there is another way. In this article, we’ll explore the core functions of a financial controller, plus financial planning and analysis staff to help you spot and curb manual admin. We’ll also cover some must-have strategies and tools you need to simplify accounting reporting.

Uncover top CFO insights on driving growth without compromise

The key responsibilities of finance controllers

If the CFO is the captain, a financial controller is the second in command. They oversee the company’s financial health and ensure the integrity of financial reporting. A financial controller also guides the company on monetary targets and ensures each team has the resources to achieve them.

The ICAEW describes a financial controller as:

The financial controller (FC) is a vital and senior role in the accounting or finance department. Usually reporting to a finance director or chief financial officer, the FC is responsible for a business's accounting operations.

What’s the role of a finance controller?

In recent years, the role of a financial controller has evolved to include some new and varying duties. Depending on your business setup, the essential functions of this position typically include:

- Overseeing financial reporting to ensure teams create accurate and timely financial statements and reports

- Leading or supporting budget and forecast creation. This task includes predicting and tracking financial performance based on historical data, market trends, and company strategies

- Ensuring compliance with accounting standards, regulations, and internal policies. The financial controller will also manage audits to ensure accuracy in financial reporting

- Developing and enforcing internal controls, such as policies and procedures to protect financial resources

- Managing cash flow and costs to maintain liquidity and financial stability. This position also involves overseeing financial operations like payroll, accounts receivable, and accounts payable to optimise cash flow

- Providing financial analysis to support strategic decision-making. This task often looks like assessing financial performance and investment opportunities

- Creating and implementing financial strategies aligned with the company’s objectives and goals and providing insights and advice

- Controlling costs. A financial controller will analyse expenses to spot cost-saving opportunities. They'll also work with other departments to optimise resource use and adoption

- Overseeing the adoption and maintenance of technology and systems to ensure accurate data capture and processing for accounting reporting

- Risk management, including identifying credit, market, and operational risks and creating strategies to mitigate them

- Communicating financial performance and information to stakeholders through clear and concise reports and presentations

Key responsibilities in financial planning and analysis

We asked a handful of financial controllers to name their top priorities when it comes to financial planning and analysis, a.k.a. FP&A. It’s a critical function for any finance department and supports strategic decision-making, efficiencies and more.

The top ten priorities include:

- Budgeting, e.g., budget preparation and monitoring to keep spending on track

- Revenue and expense forecasting, such as scenario analysis and rolling forecasts to spot opportunities and challenges early

- Financial analysis like performance, profitability, and cost-benefit analysis

- Reporting to bring management, board, and regulator-commissioned reports to life

- Strategic planning, like creating financial models and evaluating capital allocation to hit financial targets

- Data analysis, such as trend and variance analysis to provide actionable insights

- Process improvement, like upgrading tools and procedures for operational excellence

- Collaboration with other departments and stakeholders to gather insights and understand company drivers

- Communication with stakeholders to share financial data and advise them

- Risk assessment, including keeping an eye on legal obligations and potential threats

- Building and managing teams, including recruiting, training, and mentoring staff to build a high-performing finance function

And one thread that connects all of these is accurate spend data. Without it, you can’t take care of any of the above priorities. You must be able to accurately track your outgoings to inform the health of your business now and in the future.

How to manage the financial reporting process

As a finance executive, improving financial reporting is one big priority, but where do you start? Surprisingly, it’s at the end. Set the goals of what you want to achieve and why to help forge a clearer path. Before switching things up, you should assess your company’s current position.

Here are some questions to ask by category:

Objectives, goals, and policies

- What are the main objectives and goals for financial reporting?

- How do our accounting reporting objectives align with the company’s strategic goals?

- What do we need to ensure consistency and accuracy in our accounting reporting process?

Technology and systems

- How well does our current tech stack support our accounting reporting obligations?

- What tasks can we automate to reduce errors and save resources?

- What gaps or issues exist in our data integration processes?

Internal controls

- How successfully have our existing rules and processes helped maintain compliance and security?

- What actions can we take to strengthen the security within Finance?

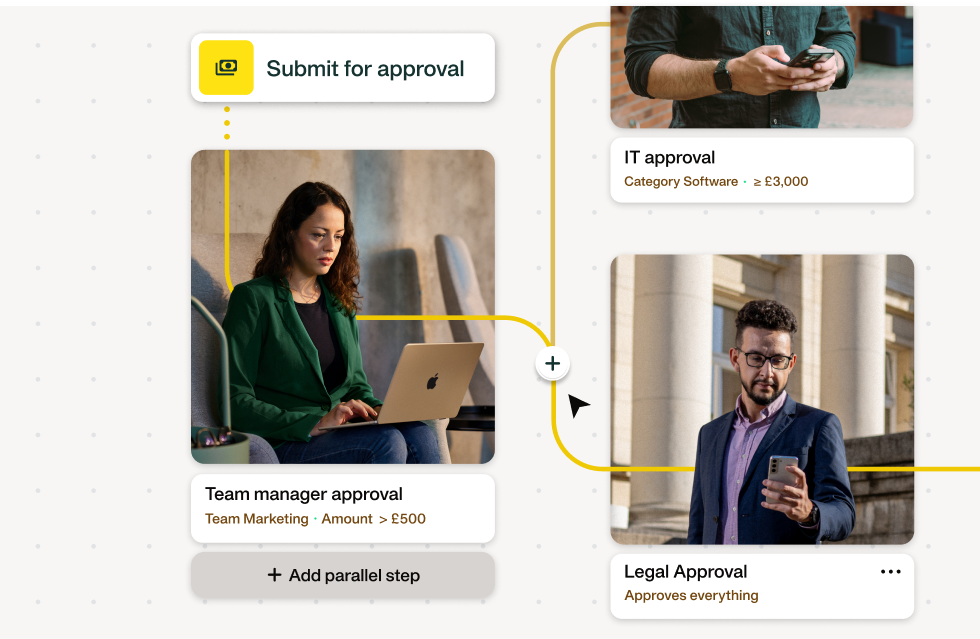

- How can we streamline approval workflows without compromising security and controls?

Legal and regulatory

- What are our existing financial reporting obligations, and how do we stay updated?

- What steps can we take to get ready for audits and reviews?

- What documents and reports do we need to maintain for audits?

Team structure

- What skills gaps exist in our current finance team?

- What training must we take to stay informed on best practices and regulatory changes?

- How do we split duties among staff to maximise productivity and security?

How to automate your financial reporting and streamline your accounting processes

Automating financial reporting means leveraging software and systems to gather, process, analyse, and present financial data with minimal human input. This approach increases efficiency, improves accuracy, and allows your finance team to focus on more strategic initiatives.

Turning your automation up a notch can pay huge dividends. From supercharged efficiency to improved cash flow management, here are some of the top reasons you should leverage accounting reporting automation.

Level up your team’s efficiency (and satisfaction)

The average finance professional wears many hats. So, endless flicking between clunky solutions and manual legwork slows them down.

According to our research for The CFO Agenda: Unlocking growth without compromise, 85% of CFOs say visibility is the biggest challenge when managing multiple tools (along with data quality and consistency at 73%).

But automation can prevent you and your team from spending all your time on manual work, such as filing and data entry, giving you more time to focus on high-value tasks.

Take accounts payable (AP) automation, for example; AP automation can save 70-80% of staff's time, with no human error and no manual entry.

Automating manual data entry frees up finance teams and accountants to focus on strategic initiatives that drive growth, leading to more satisfied staff and greater overall efficiency.

Simplify workflows to speed up processes and enhance accuracy

When using manual and complicated tools, all it takes is a typing slip-up or a staff member on leave to wreak havoc. Financial automation removes these barriers, driving operational efficiency. For example, your team can reclaim time by setting fully customisable approval workflows and exceptions for all expenses, invoices, and purchase orders.

Take corporate decarbonisation provider Plan A, for example; they saved two days a month with smart financial automation.

Improve cash flow management and vendor relationships

Leveraging financial automation means you'll never wonder about your company's cash status. You'll get real-time data visibility on liabilities to forecast more accurately. Your team can also use these insights to time payments to maximise liquidity while observing suppliers' terms. This position improves not only your company's financial health but also its vendor relationships.

Reinforce internal controls and compliance

Need to enhance security? Automation can help. For instance, within Payhawk, you can create different corporate card spending controls based on countries, regions, times, and merchants. You can also facilitate segregating duties to enhance security and mitigate risk.

Automate data gathering for insights and analytics

Many financial reporting tools and processes are stifling finance teams. Financial analysts spend 49% of their time collecting, validating, and managing data but just 10% on crunching numbers. Also, 45% of companies spend too much time on low-value tasks like managing spreadsheets and data validation. These statistics are worrying, considering the opportunity cost and the fact that 65% of FP&A staff work at or over 100%. It’s time to turn over a new leaf.

Here’s how to automate data acquisition and analysis:

Step 1: Set goals and requirements

First, define which accounting reporting insights and analytics are most important. Note the required data types and sources and how often you must collect insights to meet your goal.

Step 2: Pick the right solutions and tools

Our report found that 61% of people strongly agree that having better finance technology makes better cost-saving decisions. So, be prepared to upgrade your tech stack. Each solution should be comprehensive and work well with other tools. It should also leverage accounting reporting automation and have built-in security features. For example, this could look like expense management software, corporate cards, customisable spend controls, integrations, procurement, multi-entity management, and accounts payable tools (ideally all in one).

Step 3: Integrate data sources and tech systems

- Your business probably uses many tools for financial reporting. Eliminating them may not make sense. This scenario is common. 90% of FP&A teams supplement financial planning systems with Excel. So, integrate all relevant data and systems to create one source of truth.

- In some cases, direct integration won’t be possible. Find solutions that allow users to customise and export data via Excel financial templates without native integration. Take our Excel accounting template library and builder, for example. They enable our platform to integrate with over 90% of the ERP and Accounting systems and allow users to import financial data with fully customisable Excel and CSV templates.

Step 4: Automate data extraction and organisation

Set up channels to pull relevant data from different sources. This could look like using:

- Artificial intelligence (AI) and machine learning (ML) tools automatically extract and sort data (more on this later)

- Native integrations, APIs, and connectors for a seamless data exchange

Use cloud-based solutions for real-time reporting

Siloed data, whether in physical files or computer hard drives, hold your business back. Why? You could be using those insights to improve operations. Giving your team access to real-time data enhances the accuracy of accounting reporting. It’ll also equip other departments in your organisation to make better decisions. So, look for cloud-based solutions with live data tracking.

If you can’t go cloud-based in one go, don’t worry. Start with solutions that create the most mission-critical reports, such as expense tracking, cash flow management, P&L statements, and KPIs.

According to the CFO Agenda report, business leaders view the following tools as the most useful: 1, accounting software (58%) and 2, BI software (59%).

Use AI in data processing for improved accuracy

Eliminating admin is critical for your finance department's success. Yet, 67% of C-suite directors say their team focused on chasing receipts and invoices.

Here's where AI comes in, acting as your team's trusted assistant, dotting the i's and crossing the t's. AI also ensures efficient data processing and faster month-end closing. Despite this, just 24% of finance departments use AI tools regularly, and 36% don't use AI tools at all. Also, only 20% of finance companies use ML tools often, while 37% don't leverage them.

To inspire your automation and AI technology strategy, let's run through some of the most impactful solutions:

- AI camera, OCR technology, and ML: Release your team from expense filing's grip with our automated data capture tools. These solutions extract invoices and receipts without human intervention. They also spot and correct errors in transaction data via an easy app and online software. ML also ensures our software learns and improves at tasks without direct instructions

- Automated workflows and real-time processing: No more running down colleagues to get expenses tweaked or signed off. Save time and energy with our three-way matching for purchase orders and expense filters. You can also leverage our automation to set limits for your approvals and discrepancies. All deviations under the set limit get approved automatically. All planned spending that exceeds set parameters gets flagged

- Automatic discrepancy detection: Auto-match purchase orders, receipt notes, and invoices to identify discrepancies before issuing payments to suppliers

- Corporate cards with spend controls: Give your finance team instant visibility into all transactions with our corporate cards. You can also increase security and budget adherence by setting spending limits and ATM blocks

For example, before Payhawk, Porsche e-Bike had a clunky system for managing travel expenses. So, submissions and approvals were slow and complicated.

But once the team onboarded our virtual cards, OCR, per diems, and expense management software (all-in-one) and integrated TravelPerk into our solution, they were able to really accelerate their processes. Now, the Porsche e-Bike team has real-time spend visibility, an efficient bookkeeping process, and strong internal controls. This setup makes managing travel expenses, tracking mileage, and booking trips simple. And the team has also saved time, money, and energy by shedding the admin load, which they’ve redirected to needle-moving tasks like analytics.

How to improve communication and collaboration in financial reporting

"Teamwork makes the dream work", as the saying goes. 43% of finance leaders say positioning finance as a business partner is one of the top three priorities over the next 12 months. Yet, in some companies, Finance joining forces with other departments isn't always common practice.

In our CFO agenda report, 59% of respondents said it was extremely challenging to achieve complete, centralised control of private and department spending and expenses across the business.

Enhance communication with stakeholders

When you're hyper-focused on tasks like analytics and reporting, it's easy for stakeholder collaboration to take a backseat. But communication is just as essential. It's helped businesses raise funds, win contracts, solve conflicts, and build social proof.

So, make your communications stand out:

- Develop a communication strategy. Identify key stakeholders and tailor messaging for each group

- Use multiple communication channels. E.g., an investor relations website, email newsletter, and social media

- Improve transparency. Have an open-door policy, provide regular updates, and address concerns quickly

- Provide timely and accurate reports. Use visual aids to break down complex topics and executive summaries to highlight key points

- Forge personal relationships. Schedule meetings with stakeholders, actively listen to concerns and set up feedback loops

How to ensure compliance and security in reporting

Cybercrime isn't going away anytime soon. By 2023, 72.7% of businesses had experienced a ransomware attack, so shielding your financial data and funds is essential. Let's cover some ways to enhance security and compliance.

Implement internal controls for data security

Strategy and technology will be your trusted comrades in the fight against cybercrime. They'll enable offensive and defensive approaches, which are critical for robust protection. To bolster security:

- Conduct a risk assessment to highlight vulnerabilities in your financial reporting process

- Establish a governance framework, including a comprehensive data security policy, standards, and procedures

- Use AI for executing risk mitigation, internal controls, and data analysis

- Integrate your cyber-risk framework into your company's enterprise risk framework. Ensure executive leadership and cybersecurity operations agree on priorities and assess risk holistically (65% of cyber transformers take these actions to thrive)

- Use access controls and encryptions. E.g., role-based access, multi-factor authentication, audit trails, and SSL/TLS protocols

- Segregate duties to prevent any single employee from controlling all aspects of accounting reporting and transactions

- Have automated, multistep approvals for financial transactions

- Ensure regular data backups and create a disaster recovery plan

- Use firewalls, anti-virus, anti-malware, and intrusion detection systems to identify and block potential security breaches

Ensure compliance with regulatory reporting standards

Next, you want to get compliant with regulatory requirements for financial reporting. This move will keep your business out of legal hot water. It’ll also build stakeholder trust and maintain integrity in your accounting reporting. Here are some ways to boost compliance:

- Automate routine reporting tasks and use data analytics tools to spot potential issues early

- Create a robust control environment that encourages ethical behaviour and compliance

- Set milestones and reminders to ensure timely submissions

- Foster a culture of compliance through leadership's example, training programmes, and whistle-blower policies

- Establish a compliance committee

- Stay informed of current regulations and standards from bodies like the:

-FCA, PRA, FRC (UK)

-ESMA, EBA, EIOPA, IASB (EU)

-SEC, FINRA, and FASB (US)

Stay audit-ready

Your treasure trove of knowledge and experience will shape how you approach audits. However, there are some key markers you’ll need to hit to boost accuracy in financial reporting, no matter the industry or company size.

These include:

- Creating an audit plan and team with a strong understanding of the accounting reporting process, regulations, and accounting principles

- Engaging in scheduled audits to go over transactions and existing processes

- Implementing surprise audits to prevent fraud and catch issues not picked up in the planned audits

- Conducting a detailed review of financial statements and comparative analysis with previous periods to highlight any large variances

- Regularly reviewing reconciliations for critical accounts. E.g. payables, bank accounts, receivables, and inventory

- Reconciling sub-ledger accounts to general ledger accounts

- Maintaining thorough documentation of the accounting reporting process and internal controls

- Fostering a culture of accountability

A simple way to measure success and drive continuous improvement

All the nips and tucks to financial reporting will set your business up for huge wins. But for continued success, you’ve got to make upgrading accounting reporting the norm. Let’s examine some ways to do it.

Set KPIs and metrics for monitoring accounting reporting efficiency

On your journey to streamlined accounting reporting, checking your progress is essential to stay on the right road. KPIs and metrics will act as your GPS, instructing which turn to take next and how long until you reach the desired destination. What KPIs you should track depends on your company’s objectives.

Some common KPI and metric picks in finance departments include:

- Accuracy-related KPIs: Error rate and reconciliation differences

- Time-centred KPIs: Report preparation time and close-cycle time

- Efficiency-focused KPIs: Compliance rate and number of adjustments made

- Stakeholder satisfaction KPIs: Customer, employee, and investor satisfaction ratings and user error reports

- Financial metrics: Revenue growth rate, gross profit margin, net profit margin, return on assets, and return on equity

- Liquidity metrics: Current ratio and quick ratio

- Operational metrics: Days of sales outstanding, inventory turnover, and operating expense ratio

- Efficiency metrics: Asset turnover ratio and employee productivity

- Customer and market metrics: Customer lifetime value and customer acquisition costs

Analyse data for performance evaluation

Once you’ve selected KPIs and metrics, build the proper setup to track them. This could look like:

- Using dashboards and financial reporting tools to track and visualise progress in real time

- Conducting regular reviews to identify what needs adjusting or culling to hit targets

- Creating benchmarks against industry peers to aid in realistic target-setting

- Committing to continuous improvement and agile practices

Adopt continuous training and development for the controller team

You’ll only be as effective as your team’s capabilities allow. Investing in your staff will improve their competency and your business results. Companies that train engaged employees are 17% more productive and 21% more profitable. To get started, here are core skills to provide training in:

- Financial modelling

- Financial planning and analysis

- Technical accounting

- Data management and analysis

- Regulatory compliance

- Ethical standards

- Project management

- Communications

- Leadership and team development

The blueprint for accounting reporting success

Optimised financial reporting is the key to unlocking growth, new opportunities, and bigger profits. But achieving it is a team effort.

Work with your executive team to set achievable goals and processes.

Then, make upgrading technology a priority. Select comprehensive solutions that empower your finance team to complete accounting reporting tasks easily without compromising security and compliance.

Finally, innovative fraud detection tools should be leveraged to guard resources from potential threats, whether staff are on the clock or not. Take these steps, keep improving tools and procedures, and it won’t be long until you have a winning financial reporting process.

Want to learn more about reporting – and, more importantly – gathering accurate data for reporting? Book a personalised demo now to see how Payhawk could work in practice at your business.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Pennylane Integration: Why to connect with a spend management platform