Best practices for managing recurring payments and subscriptions in SaaS

In a world where managing SaaS subscriptions feels like navigating a labyrinth, Payhawk can offer you a sneaky shortcut. Imagine effortlessly tracking every recurring payment, always paying attention to cash flow, and slashing through the jungle of overspending. With our new feature, you can say goodbye to the chaos of unmanaged subscriptions and hello to streamlined, efficient control.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Managing subscriptions can be challenging. You need to keep track of all the plans offered, stay on top of recurring payments, and eliminate double payments. Without it, you could end up with financial and accounting errors through poor company spend management that impacts your business negatively. So, what’s the solution? Use subscription management tools.

By using the correct solution to manage your subscriptions, you can reduce the manual labour involved with checking and tracking payments, avoid overspend, and more.

When it comes to SaaS for business, subscription management is essential, but not all tools are created equal. When done right, a solution will typically work alongside an integrated suite of tools that allow businesses to process payments, capture and manage cash flow, and generate accurate financial reports that track sales trends and other critical performance metrics.

What are the benefits of using subscription management software in SaaS?

The best subscription management software helps companies of all sizes. It means you no longer need to worry about clunky, outdated processes like manually entering each subscription into a spreadsheet to track.

- The best subscription management software allows you to keep track of all your information in one place, so you know how much money you will be expected to pay from each budget, and you can ensure that you have enough funds.

- Subscription spend management software helps ensure that your payments are made on time and with no problems — thus increasing productivity and efficiency and avoiding issues with Vendors.

- You can keep track of profit-impacting issues like cost creep, duplicated subscriptions, and overspending. And check who set up which subscription to ensure that any recurring payments are necessary and being utilised.

- You can keep track of profit-impacting issues like cost-creep, duplicated subscriptions, and overspend. And check who set up which subscription to ensure that any recurring payments are necessary and being utilised.

Track all your recurring business payments in one place

Best practices for SaaS subscription spend management

Here are some best practices to consider for managing recurring bill payments and subscriptions in your SaaS business:

Automate as much as possible

Automation is key in any business process, but it's especially important when it comes to subscriptions and recurring billing. The more things you can automate, the less time you'll have to spend manually processing subscription payments. Here are some specific key benefits of using automation for recurring payments and subscriptions:

- Improved accuracy – Automated recurring payments reduces errors in billing by eliminating manual data entry and reducing human error. This reduces the risk of being overcharged and misuse of your budget.

- Reduced manual labour – Automated recurring billing frees up time for your team members to focus on higher-value activities. Imagine how much your finance and accounting team can accomplish with more available time.

- Increased efficiency – Automated recurring billing allows you to scale quickly without adding additional resources to your team — a must for growing companies.

Ensure good record tracking

A robust subscription spend management system will allow you to keep track of all your information in one place (including your subscriptions and payment history).

Integrate your accounting system with the platform you use to manage recurring bills

These integrations will make it easier to track all recurring payments and subscriptions and make it easy to reconcile your accounts payable and receivable at month's end.

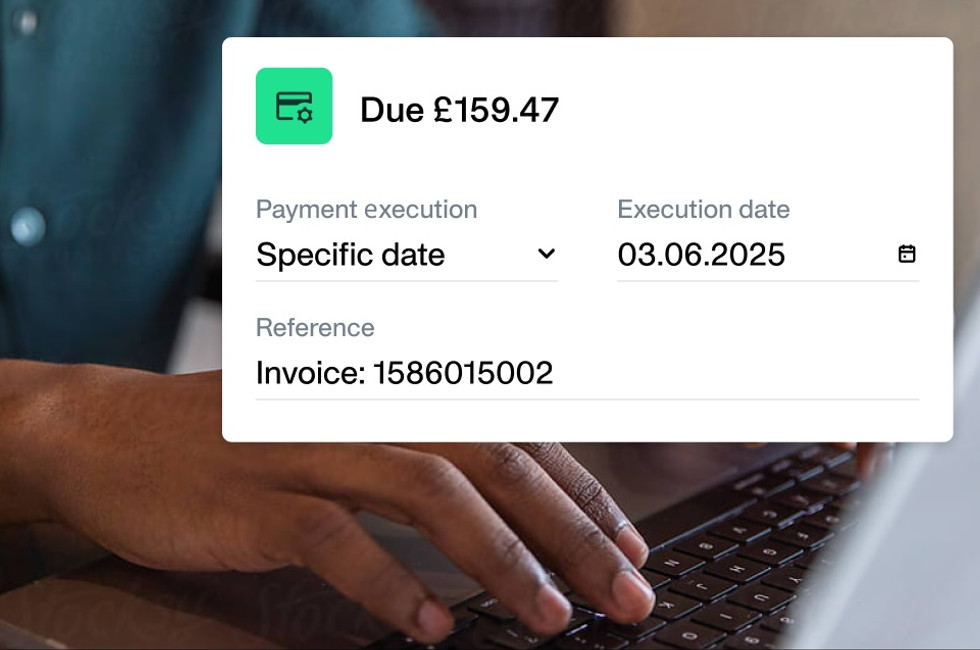

Create payment schedules that work best for your business

Some businesses may want to set up automatic monthly payments because it works best with their cash flow requirements. Others prefer quarterly or annual auto-payments, so they don't have to worry about making manual payments so often. With subscription management software, you can set up the best schedule for your business.

Choosing the right SaaS subscription spend management system for your business

Subscription management is a complex but necessary part of your business. At Payhawk, our subscription management feature is just part of our spend management solution. In fact, our all-in-one solution includes invoice management, credit and debit cards, expense management, and more – so that you can take care of every aspect of your company's spend management in one place.

Our solution also helps you build custom approval workflows to help control spending and data analytics to get insight into your financial activity and spending patterns.

As you grow and scale, the complexity of managing multiple subscriptions increases exponentially. With our subscription management software, you can manage your subscriptions across all departments with one reliable platform.

Our smart subscription management software can help streamline your company’s payment processes and save time for both you and your team.

Learn more about how you can drive massive growth for your SaaS business with the right subscription spend management software. Book a demo today.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Recurring expenses: The silent cash drain you can’t ignore