Unlock effortless cash flow with scheduled payments

Managing company finances can be overwhelming, especially for large businesses. Tracking and paying numerous subscriptions and invoices on time can leave your accounts payable team feeling stressed to the max. Learn how our new scheduled payments feature is here to simplify things for your finance team.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Managing finances for a large organisation? Then, we know you’ll welcome any and all bulk features with open arms (especially if it means you can easily schedule payments and initiate a payment run through the platform). Enter our brand-new scheduled payments feature. Now (if you’re a Payhawk customer), you can schedule multiple payments at once via our accounts payable software, saving countless hours and stress.

Transform the way you spend with integrated procure-to-pay features

Understanding the power of scheduled payments

Scheduling payments gives you and your team much more control over the payment process. Instead of remembering to pay an invoice, you can schedule payments in advance, simplifying your processes and streamlining your workload.

Plus, cash flow is the lifeblood of any business, so adequately managing cash flow and planning for the future via scheduled subscription payments makes financial planning much easier.

Five problems solved by scheduled payments

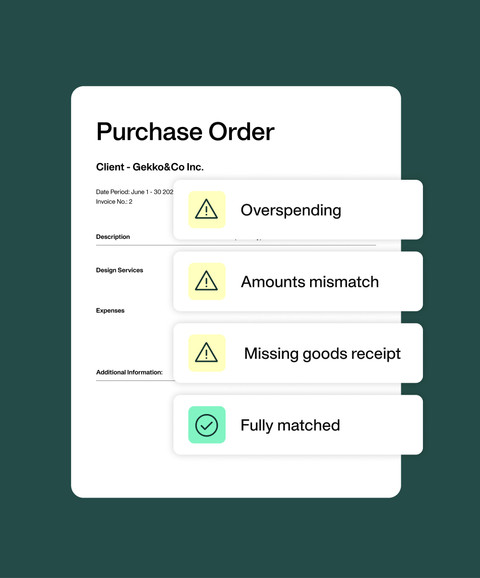

Managing payments can be challenging, from errors and cash flow issues to approval delays and security risks. By scheduling automatic payments, you can streamline processes, enhance security, ensure timely and accurate transactions, and more.

Here are some of the biggest benefits of automating your payment workflows:

- No more payment errors and discrepancies. By scheduling automatic payments, you can eliminate discrepancies in payment amounts, details, or invoice matching (as you’ve scheduled payments for a specific amount each time). This approach means no more incorrect payments or unnecessary payment delays and no more manual interventions and fixes.

- Say goodbye to poor cash flow management. Scheduling automatic payments means you can ensure the required funds are available in ample time. Instead of sitting down to pay an invoice on that date and realising there isn’t enough cash, which can lead to payment failures and delays (not great for vendor relationships).

- Remove approval bottlenecks. If you have to get approval from, let’s say, three different people before making the payment, this can significantly hinder the payment run process. Instead, scheduling payments means you’ve completed all the leg work, and now it’s set up to run itself.

- Reduce security risks and fraud attempts. When completing a payment run, unauthorised changes can be made to payment details, increasing security risks. By scheduling payments instead, you sidestep these issues. With Payhawk, our robust security measures make it easy to stay vigilant and protect against fraud.

- Forget about inefficient, manual processes. If your finance team manually inputs data or deals with paper-based invoices, your process will become inefficient and riddled with errors and unnecessary processing delays. Automating and digitising these tasks helps reduce errors and streamline the entire process from start to finish.

And life without scheduled payments? It can come with some tricky challenges, including:

- Poor vendor relationships. Vendors expect timely invoice payments, and when they don’t get them, this can damage your relationship

- Poor cash flow visibility and management. Not knowing when payments are due means you can’t plan or forecast for the future and have funds ready, when you need them

- Additional costs. If you don’t pay on time, vendors might charge late fees, impacting your cash reserves

Schedule payments flexibly

It may sound like an oxymoron, but our new scheduled payments feature lets you schedule payments flexibly. It comes with two payment options to help your accounts payable team with the following:

- Pay on due date

- Pay on a specific date

‘Pay on the due date’ is perfect for invoices you need to pay on time every time. But if you know you’ve got a large customer payment coming in on a certain date, you can choose to pay on a specific date so you know you’ll definitely have available funds.

Another reason you might choose to pay on a specific date rather than the due date is for tax purposes. If you have a monthly subscription fee, you might want to schedule payment in the next accounting period.

Or maybe even if your supplier requires a one-off payment at the start of the relationship? Like in the example below.

Andrew Jacobi, VP of US Finance at Payhawk customer State of Play Hospitality, shares:

We have several vendors who require payment at the start of a relationship in order to begin a campaign or such like. So, being able to instantly issue a card for our teammate — with the exact limit they need — for that particular vendor lets them stay nimble while we stay in control.

Ready to take advantage of the enhanced flexibility and convenience of scheduled payments? Learn more about our accounts payable automation and how it could help streamline operations in your finance team; book a personalised demo today.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Recurring expenses: The silent cash drain you can’t ignore