Advanced card controls: Make all spend compliant spend

You know the drill with scaling. As your business grows, your finance team will encounter a new challenge: providing more and more employees with access to funds without relinquishing control of business spend. Learn how selecting the right corporate card program — that offers both built-in controls and expense management — can help your employees spend for work and stay agile without losing control of spending.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

In an ideal world, all company spend is compliant spend. Your employees follow company policy without hesitation or room for errors, the risk of fraud is at a steady zero, and monthly expenses are kept within budget — every single time. However, the reality is that you (and many other finance leaders) find yourselves in a constant battle, having meticulously mapped out spend policies but lacking the means to police and enforce them effectively.

Controlling spend typically starts with an iron-clad spend policy. The problem? These same spend policies often live on Notion pages or in emails, meaning you and your finance team colleagues find yourselves struggling to connect the dots and enforce company spend policies. Worse still, you face the risk of overspending or even fraud, especially as you scale.

The answer? Technology, and specifically, leveraging a corporate card program as part of a much wider spend management solution. If you do your research and select the right corporate card program for your business, you’ll get flexible credit cards, in-built controls, OCR, and intelligent receipt chasing all in one place.

Unlock better financial controls: Explore expense management with Payhawk

Understanding corporate card controls

In a nutshell, corporate card controls are a set of security features and restrictions companies put in place to regulate corporate credit and debit card use. These controls can help you translate your corporate spend policy into action, ensuring you can monitor and manage employee spending, minimise the risk of fraud and abuse, and support compliance with company policies and procedures.

Some examples of corporate card controls include:

1. Spend limits: Typically, one of the most basic types of control, spend limits relate to how much employees can spend with their corporate cards. You can set limits per single transaction, which can be recurring, such as daily, weekly, monthly, etc, which is a great way to prevent overspending and keep expenses within budget.

2. Vendors / merchants: You can set controls for only specific merchants, ensuring that spend is only possible with pre-approved vendors. This not only prevents fraud but is also a powerful way to ensure vendor exclusivity agreements are adhered to.

3. Vendor/ merchant category restrictions: You can limit entire categories of merchants, ensuring that employees adhere to the company policy, for example, blocking spend at clothing and apparel stores while enabling spend for train travel, etc.

4. Time and day restrictions: You can set controls that allow spending only at certain hours and on specific days of the week. As fraud typically occurs at night, this is a great tool to prevent fraudulent transactions. It’s also an easy way to restrict spend to business hours, so employees don’t mistakenly use their company card instead of their personal one.

5. Country and region restrictions: You can restrict the countries or regions in which corporate cards work, further restricting any opportunities for fraudulent transactions. This type of control also ensures employees don’t misuse company cards when on vacation for example.

6. ATM withdrawals: You can block ATM withdrawals in case cash payments go against their company spend, or they can enable ATM withdrawals upon request.

7. Online payments: You can choose to block online spend to further protect your business against fraud.

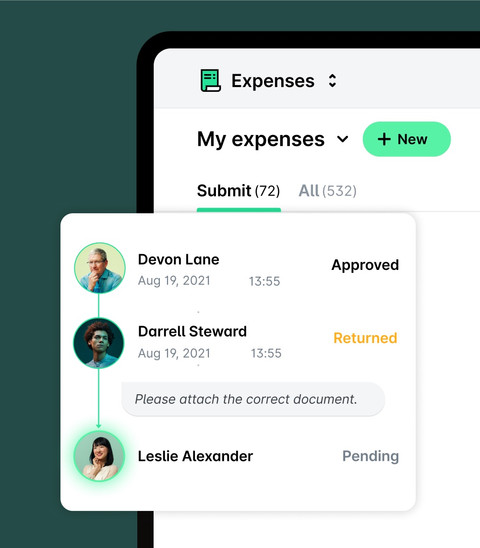

8. Fund requests: Not all card controls have to do with limiting spend; there are instances where employees need to act quickly and outside of the predetermined spend limits, which is where fund requests come in to save the day. With some solutions, employees will then need to simply request a specific amount, which is then sent for approval to the appropriate manager.

Overall, your business should use corporate card management (including controls) to manage its expenses, reduce the risk of fraud, and ensure that employees use company funds in line with company policy.

The importance of corporate card controls

Corporate cards with advanced controls offer enhanced security and compliance to support spend policies. They mitigate the risk of overspending, fraudulent transactions, and misuse of company funds, providing a safer, more efficient solution for managing company expenses.

Many finance leaders falsely believe that using cash and reimbursing employees provides enough protection against company funds misuse (thanks to spenders using their own funds), but this approach carries many risks. Firstly, cash transactions are inherently less transparent than digital transactions, making it easier for misuse to go undetected and reducing accountability.

Secondly, handling large amounts of cash carries a lot of risks, including fraud, theft, etc, which doesn’t happen with card transactions. Finally, employees using their own funds often end up waiting to be reimbursed for ages, which is an inefficient process and can even lead to employee disengagement at work.

The good news?

Corporate cards with advanced controls eliminate risks, provide transparency over spending, ensure compliance, and greatly reduce fraud risk.

By limiting the amounts that can be spent through company cards, restricting certain merchant categories, or supporting spend during working hours only, finance teams can translate their spend policy into action and ensure it is adhered to.

At Payhawk, we recently launched four new types of controls, further improving the level of control available to CFOs and finance leaders and supporting businesses to give employees funds without worrying about overspending or misuse:

Advanced corporate card controls:

- Vendor controls

- Vendor category controls

- Date and time

- Country and region

The six biggest benefits of implementing advanced corporate card controls

Companies implementing advanced company card controls find that they can dramatically cut overspending. At Payhawk, our software lets businesses convert policy into restrictions that only admins can override (if needed).

1. Enhanced financial security: By implementing a comprehensive set of controls, companies can significantly reduce the risk of fraud, unauthorised transactions, and misuse of corporate funds

2. Fraud prevention: Country and region restrictions, time and day restrictions, and other controls help mitigate the risk of fraudulent activities, unauthorised purchases, and suspicious transactions

3. Improved compliance: These controls help enforce company policies and ensure that employees adhere to spending guidelines, vendor agreements, and other financial regulations

4. Increased transparency: By restricting spending based on various criteria, companies can enhance transparency in financial transactions and promote accountability among employees

5. Cost control: Setting spend limits and restricting spending to specific vendors or categories helps organisations manage expenses effectively and stay within budgetary constraints

6. Operational efficiency: Streamlining the approval process for fund requests and providing flexibility in ATM withdrawals can improve operational efficiency and ensure that employees have timely access to necessary funds.

Two real-life examples of businesses using card controls

Let’s see how these will look in practice with some real-life examples.

Minimise the risk of fraud

With Payhawk’s recently launched advanced card controls, Alberto Segovia, Head of Finance at HarBest Market, says he finds it much easier to enforce the company’s spend policy and protect the business against overspending. The company operates in Spain, so all spend is limited to only that country, minimising the risk of fraud that originates from foreign countries.

Also, as the company’s operations are mainly divided among two teams that operate in different shifts, each team uses cards that are enabled for the respective times and days of the week when they need them, making sure that employees are fully enabled, reducing the risk of fraud or company funds misuse outside of business hours.

Vendor exclusivity

Larger companies typically have a list of preferred vendors who give them the best rates or whose products and services are of the highest quality. Adhering to exclusivity policies has never been easier with merchant controls: finance teams simply have to allow spending with the agreed vendor(s) and block all others.

Vendor exclusivity is particularly useful for hospitality companies like State Of Play, restaurant groups, manufacturing, etc.

Your next steps

Maintaining transparency and control over spending becomes more complex as your business expands. You introduce more rules and policies and update processes. The problem arises when these same processes get in the way of people doing their jobs, staying agile, and moving the business further forward.

Enter advanced controls (the latest in a long line of our control-boosting features). Alberto Segovia, Head of Finance for HarBest Market, says:

Thanks to Payhawk’s advanced controls, we’ve effectively enforced our spending policies. By blocking transactions outside our country of operations and beyond our work hours, we’re containing costs and enhancing fraud prevention measures”.

Book a demo with Payhawk to learn how smart approval workflows, efficiency-boosting automation, and advanced controls could empower your teammates while ensuring compliance every step of the way.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Best Spendesk alternatives for advanced spend management

.jpg)