Enhance your expense approval process with a customisable Workflow Designer

Automating your expense, invoice, and purchase order approval processes saves your finance team time, improves accuracy, supercharges efficiency, and introduces accountability. And without automation? You need to rely on manual entry, leading to errors and approval delays. Discover how our new Workflow Designer will unlock the power of automated controls for your finance team.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Hearing the word 'streamline' might make you roll your eyes — it can so easily turn into just another corporate buzzword, right? But not necessarily. Particularly not when it comes to expense automation. Automating your expenses is essential, particularly as your business scales and processes become more complex. If you're still relying on manual data entry and processes, you're going to end up with a lot of mistakes and a lot of wasted time.

What do we mean by an approval process?

In a nutshell, an "approval" is the process of approving expenses, invoices, and purchase orders, usually involving the employee who submits the cost and the designated approver(s) who decide whether or not the expense is allowable. For example, when an employee submits an expense—such as a receipt for a client dinner—to a designated approver (let's say a team manager), it's the team manager's responsibility to approve or reject the expense or ask for more information if needed.

The many challenges of manual approval processes

Aside from the fact that manual expense, invoice, and purchase order approval management is not effective or scalable, what are the other big challenges?

- There's no audit trail. To manage company finances effectively, you need a substantial and accurate audit trail to encourage accountability and transparency. When managing the process manually, you only have a paper audit trail, which isn't always accurate and can be time-consuming to keep updated.

- It's a much slower process. Efficiency, particularly as your company scales, is essential. Manually managing expenses can seem impossible as you take on more employees and processes become more complex. Employees expect timely reimbursements, and stakeholders expect financial visibility — you can't deliver either with manual management.

- You can’t implement effective sequential approval processes. Requiring multiple people to sign off certain, perhaps large expenses, can give you greater financial control, visibility, and accountability across the organisation. But this is something that takes ages when managing the process manually and involves lots of emails, back and forth and even paper! Technology can facilitate easy custom multi-sequential approval processes.

- You don’t have granular control over budgets. When managing expense approvals manually, you can’t set individual, team, or project budgets and monitor spending patterns easily or quickly. Digging through folders, excel cells, and envelopes leaves you with a disconnected view and lack of control, severely limiting overall visibility into company-wide spending and making it difficult to forecast and plan for future growth accurately.

Given all these challenges and more, you need to implement an automated approval process for your expenses, invoices, and purchase orders to manage spend efficiently, stay agile, and avoid getting bogged down by slow approvals.

How to automate your approval process

Automated approvals are a key feature of spend management solutions, streamlining the review and authorisation of expenses, invoices, and purchase orders.

Take, for example, company X’s best salesperson, Maria.

Maria’s company uses a spend management solution that includes corporate cards and an expense management app. So far, she's been using her corporate card to get her to meetings and events and work on some hot leads for your product. She's dangerously low on funds, though, so she logs into her expense management app and selects "Add funds." If her company uses a solution powered by time-saving automation, then her fund request approval can be completed in seconds. Either automatically if it's below a set amount or with an extra step or two if it's over.

That's just one example, but there are lots of ways automation can support your processes. Here are a few things to consider:

Before you look for accounting automation software, first, you need to list what types of business spending your business has to process (invoices, purchase requests, employee expenses, reimbursements), how you handle approvals for each and finally, who are the respective approvers and conditions that trigger each workflow (for example - expenses over £1000 need to be reviewed by a particular person or people). Ideally, during this preliminary analysis, you can identify areas of friction (approval bottlenecks, rogue spend, etc.) and potential opportunities for improvement (additional approvers for better control or removing ones that don't add any value to your business).

Next, it’s time to find the right spend management software provider that supports approval workflow automation, powerful expense management features, fantastic customer support, and robust security and governance controls.

Ensuring the software will align with your business needs should be easier, as you’ll already understand your current process and how to improve it.

- Then, it’s time to start automating your approval process for each expense type. The software you choose will usually come with team training and support when setting up your workflows for the first time. Don’t forget to enable real-time notifications for all approvers so workflows are efficient.

Note: To keep all expenses compliant, make sure you enforce expense policy compliance through automation. That includes requiring receipts when uploading digital expenses, enforcing spending limits to keep budgets under control, or even auto-blocking corporate cards if the employee has missed providing invoices or receipts.

- Audit and optimise your process from now on. With expense automation software, it’s much easier to gain a clear picture of your company finances. This view keeps company finances agile and transparent at all times while giving you the chance to spot spending pattern issues or flag compliance problems quickly.

How to customise your spend approval workflows with Payhawk

We provide our customers with valuable tools to help them better manage their expense approval workflows. Read on to learn more about how you can customise your workflows with Payhawk.

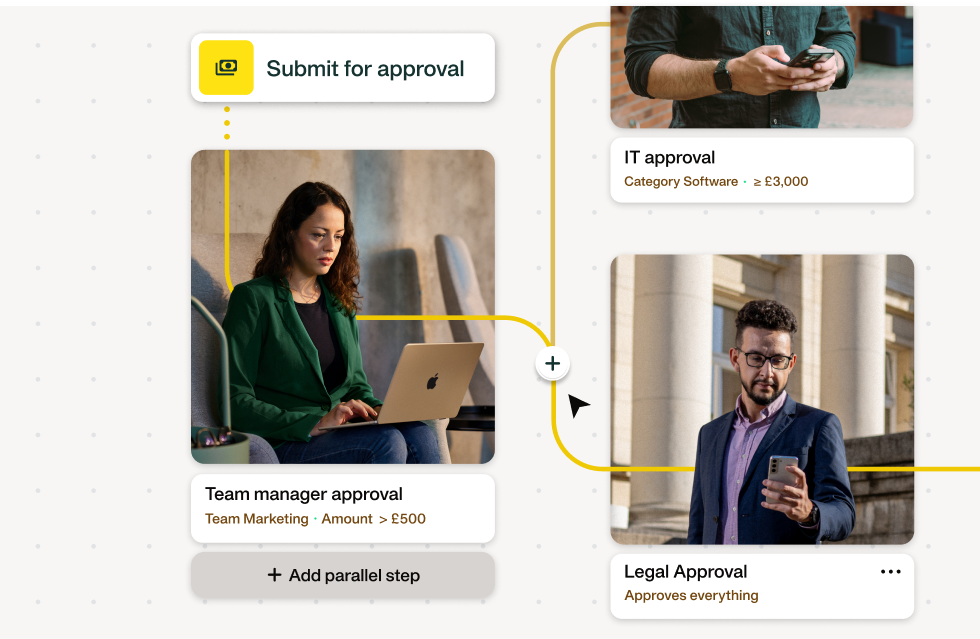

Use our new Workflow Designer for complex workflow needs

Our Workflow Designer allows companies to set up different approval flows for different types of company spend, so larger organisations can customise approval workflows to suit their needs perfectly. It can easily accommodate complex workflows, so where employee expenses might go through a simpler workflow, your invoice and purchase order approvals can go through a much more complex process, which Payhawk can easily automate.

Your approval can be as simple as a team manager's approval only or as complex as a purchase order request approval going through multiple teams and stages. Every approval process has three main events: a trigger — what would initiate the process — a condition, and an action.

For example:

- Trigger: Let's say an employee submits a purchase request

- Condition: The request, regardless of the amount, goes through the team manager for initial approval. If the request is for more than £5K, it's also sent to the department lead

- Condition: Once the team manager (and department lead) signs off the request, it's simultaneously routed to InfoSec and Legal for review

- Condition: As soon as InfoSec and Legal approve the request, it is routed to Procurement for final approval

- Action: Once approved, the request turns into a PO

- Action: PO sent to the supplier

Let's look at a different scenario now:

- Trigger: An invoice from the supplier is uploaded to Payhawk

- Condition: IF an invoice amount is under $100, no approval is needed

- Condition: IF an invoice amount is under $1K, the team manager will need to approve

- Condition: IF an invoice amount is between $1K and $5K, the finance director needs to approve the invoice

- Condition: IF an invoice amount is above $5K, the CFO needs to approve it

- Action: Once the invoice is approved, it's routed to be reviewed and paid

So whether you require a single person's approval or multiple people's approval, Payhawk's new Workflow Designer makes it all possible.

No matter how large your organisation is, how many entities you have, or how many different approval workflows you want to set up, you can easily manage it all from one place within the Payhawk portal. You can easily define a combination of both sequential and non-sequential steps and set up category approvers to support multiple levels of approvals, i.e. category manager, category L2 manager, and so on.

Set a specific approval process based on the amount

With our new Workflow Designer, you can set approval workflows based on the amount, by budget (routed to a cost centre or category), and by the department. And you can even set up purchase request workflows for purchase orders.

By leveraging the above approval flows, you can ensure that any will be approved by the right people and make the process as smooth and efficient as possible.

Here’s an example:

Within the Payhawk solution, you can define complex conditions for your expense controls with

steps based on the amount, the value of the customer field, and the value of the category.

So, if category = SaaS + amount > 10,000 X approves it.

This gives you granular control over how each expense type is approved and what workflow it follows.

You can even name approval steps and filter expenses based on the approval step that’s still pending.

The benefits of automating approval processes for expenses, invoices and purchase orders

There are so many benefits to automating your expense, invoice, and purchase order approvals, not least of which is helping support your business as it scales further. The larger your organisation gets, the more complex your processes become, the more people submit expenses, the more entities to manage, and the list goes on….

The answer to complex needs? Simple, automated processes - like our Workflow Designer, which gives you:

- Increased accuracy and efficiency. By getting tech to flag issues or extract data from receipts automatically, you’re streamlining the entire process from start to finish.

- Reduced manual errors and delays. With automated workflows, you’re not awaiting reimbursement for days or weeks. Instead, approvers are notified in real time about the submission and can take action immediately from their phone or desktop computer.

- Enhance compliance with expense policies. By building your expense policies into the software, it becomes difficult, nigh impossible, to approve expenses that aren’t correct or that don’t follow the expense policy.

Learn more about our Workflow Designer, how it works, and how it can help your organisation. Request a personalised demo.

Tsvetina is the creative force behind Payhawk's product marketing initiatives. She's dedicated to shaping our brand's image, refining messaging, and orchestrating our go-to-market strategy. Beyond her strategic role, she unwinds with a love for exquisite food, finds solace in yoga, and explores the world, fueled by a passion for live music experiences.

Related Articles

Best Spendesk alternatives for advanced spend management

.jpg)