Manage SaaS subscriptions and track recurring payments

Payhawk's new subscription management feature addresses the growing need for businesses to control and monitor their SaaS subscriptions and recurring payments. This feature offers vital visibility and automation in the burgeoning subscription economy, aiding in cash flow management and forecasting. Find out how to use it in the blog.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

The popularity of software as a service (SaaS) has been rising rapidly over the last few years. And this growth in popularity has made the subscription economy one of the fastest-growing industries globally.

A study from UBS mentions that the subscription economy will be worth $1.5 trillion by 2025, implying an average annual growth rate of 18%. Subscription-based companies grow faster than unit price companies because they offer more predictable, stable cash flows.

Now a simple question. Do you know how much you're paying for your subscriptions annually? Not a single person could answer that question in a recent consumer survey. In the corporate world, it's even worse as each team has its own stack of SaaS. G2 calculates that around $40 billion is wasted by businesses on average on unused SaaS tools every year.

With so many subscription payments going out, businesses need better visibility and automation to control their recurring costs.

Subscription management helps customers to:

- Get more control and transparency over their cash flow

- Create clear forecasting when it comes to recurring payments

- Allow finance teams to spot duplicate or unused SaaS payments quickly

- Keep on top of payments: we’ll warn you if an upcoming payment looks set to fail due to lack of funds

“The subscription feature has enabled us to take immediate actions to avoid unnecessary spending. We were immediately able to identify which subscriptions are not required anymore and trigger cancellation on time.”

— Lenka Bartuskova, Finance Manager

Are you a Payhawk customer with three large SaaS payments going out next month? No problem, we've already highlighted them, so you and your budget owners will know the cost and what budget is left. We’ll also proactively calculate how much you are expected to spend on the card and then check whether you have enough available funds on your card

Track all your recurring business payments in one place

How do we do it?

It starts with automatic subscription detection. We use a variety of strategies to detect whether an expense is a potential subscription, including: supplier identification, payment frequency, and language processing. Essentially, we use all the information provided in the customer invoices, together with our supplier categorization algorithm — and no extra effort from the customer.

We search each expense that someone in your business uploads and either suggest it as a subscription or automatically map it to an existing subscription if relevant. From there, we prompt both the employee and the admin(s) in the expense tool. Here, they'll have a chance to either confirm or reject the suggestion as a subscription as well as add any additional details, like category and project, etc.

Types of recurring payment

We can track two different types of subscription payments. Number one includes any recurring payments that leave your associated business bank accounts via bank payment. This action is most relevant for your finance team and will let them keep an eye on cash flow and update relevant stakeholders as necessary.

Number two, we can track any subscriptions your employees have on their company cards. These recurring card payments, also known as 'continuous payment authorities' or 'future card payments,' will include any regular payments set up against a company card.

By tracking regular payments across your bank and card expenses, your finance team and budget owners can monitor cash flow and ensure there’s always enough for other necessary activities or upcoming spending. And, whether via bank or company card, payments can be tracked monthly, yearly, or by custom frequencies.

Subscription analytics

Your business subscriptions are regular, but they might not be static, so it's crucial to get a good view of any fluctuations or changes. By tracking your recurring payments with the new feature, you can get analytics on any increases or decreases since the last payment and estimate the future payment amount.

As your business grows and evolves, you can also use the feature to help assess which subscriptions are serving you best. Our customers can also see the total amount paid for a subscription by using the new feature as well as any payment trends for recent recurring expenses.

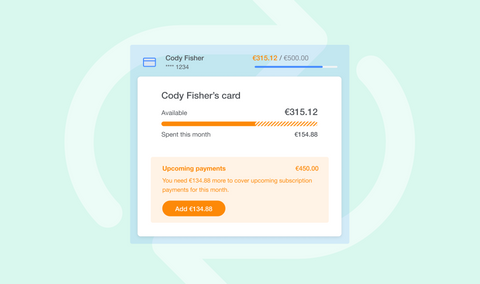

Card spend safety cushion

As part of the new subscription feature, each Payhawk customer admin can see the following at a company card user level:

- Safe to spend

- Upcoming payments

- Spent this month

Similarly, we'll let users know when their upcoming payments are due and how much they will cost. We'll also show them what's still available on their company card and how much is safe to spend.

Then, we'll let the users know if their current balance is too low when subscriptions are due. And, we'll display a pop-up with how much they need to add to their card in order to cover the recurring payment. This way, they won't inadvertently miss any critical subscriptions, something that's especially important when you consider that a whopping 73% of businesses plan to switch all their systems to SaaS in 2022.

Right now, the majority of companies are using multiple tools from SaaS providers to manage various business functions. If that includes your company, then our subscriptions feature is just one of our many features that could make managing your business finances easier.

Find out more, book a demo today.

Tsvetina is the creative force behind Payhawk's product marketing initiatives. She's dedicated to shaping our brand's image, refining messaging, and orchestrating our go-to-market strategy. Beyond her strategic role, she unwinds with a love for exquisite food, finds solace in yoga, and explores the world, fueled by a passion for live music experiences.

Related Articles

Smart money just got smarter: How AI is helping move money in 2026