How to support multi-entity accounting and manage corporate spend more efficiently

If you manage multiple entities, you need an enterprise-ready spend management solution to support you. With a solution like Payhawk in place, you can support accounting processes and get unparalleled real-time spend visibility. Get all the essential finance data you need at your fingertips in our comprehensive Group Dashboard and say goodbye to any mystery around upcoming expenditures or current funds again.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

Multi-entity accounting software helps you simplify how you manage and report on finances across various branches, subsidiaries, or distinct entities within your organisation by consolidating financial data, facilitating accurate reporting, managing intercompany transactions, and ensuring compliance with diverse regulations. It also lets you handle different currencies and regulatory requirements, ultimately providing a unified, comprehensive view of the organisation's financial landscape.

Managing finances for multiple entities can be complicated. Before even diving into multi-entity accounting software, you must ensure that you can accurately record expenses and categorise them for each venue, subsidiary, or entity. Every entity is unique, and collecting and maintaining accurate financial data can be challenging.

But with the right tech stack, including multi-entity accounting software and a complete spend management solution, you can streamline business processes by automating tasks, improving spend control and visibility with real-time data analytics, and tightly controlling cash flow by viewing upcoming transactions and current funds within the same dashboard.

This blog explores how our two new multi-entity management features will help you further improve enterprise spend management:

- Entity group creation: Create entity groups yourself instead of relying on customer support, giving you instant spend visibility across multiple entities.

- Add new entities to existing groups: Did you forget to add an entity or open a new one? No worries. You can easily add it to an existing group later.

Make multi-entity expense management efficient with Payhawk

Five big benefits of our enterprise expense management software

Our enterprise expense management software is always evolving. We regularly introduce new features to improve your multi-entity management experience, from streamlining processes to cash flow control. Here are a few benefits you get from our multi-entity software.

1. Single view over spend

View all upcoming spending and current funds in real time and filter your view by team, entity or individual to see who’s spending and on what. Our group dashboard gives you a single view of multi-entity spend and cash flow across all your entities in one place. You can spot spending patterns and make informed decisions based on accurate data to help further control your organisation's spending.

2. Cash flow control and real-time alerts

Get a comprehensive overview of entity spend through the Group Dashboard to improve cash flow control at a group level. Real-time alerts notify you when bank balances are low so you can top them up before they interrupt business operations.

3. Streamline the entire expense process

Standardise expense processes across all entities to streamline the entire reporting process. Create and implement group-level expense settings and workflows for multiple entities to simplify the tracking and management of all expenses at scale from within one system. You can also set up automated reports for efficient finance automation.

4. Enhance security and control

Add new employees or remove them promptly from the expense management system across multiple entities. This decreases the risk of leaving ex-employees on the system, creating potential security and data breaches. This and many other security features are constantly added to our spend management system.

5. Multi-entity support

Whether you’re having data synchronisation hiccups or employees need a refresher on submitting expenses digitally, we’ll be there to help.

Two new multi-entity management features to streamline your workflows

Our two latest features empower customers to take control of entity group creation, giving them complete control over multi-entity management.

How to manage entities and groups within the organisation in two simple steps

Customers can now create group entities instead of relying on our Customer Support Team. This makes group creation easier and quicker for finance managers.

Now, administrators can create/add/modify entities within groups themselves. This means you can gain financial visibility and break down your cash flows more efficiently without contacting the customer support team. This new feature also provides the visibility needed to allocate and use available funds and view upcoming expenses for every entity within your group.

Accessing all this information from one single Group Dashboard makes group-wide planning easier. Creating a new group is simple.

Follow the steps below:

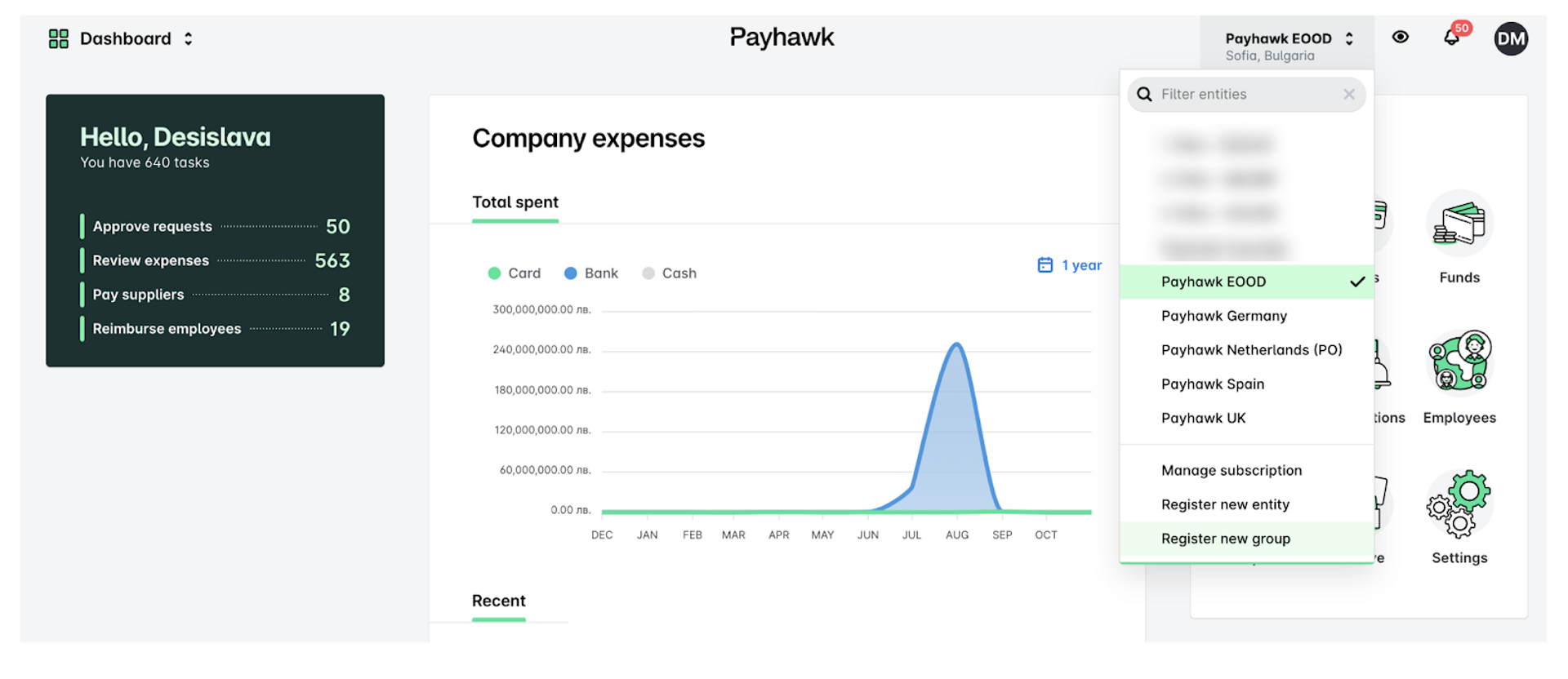

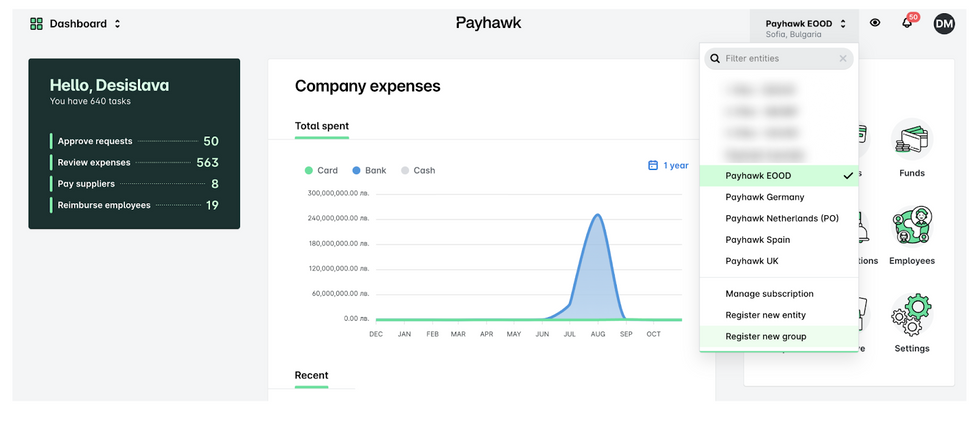

Step #1: Navigate to an entity overview page after logging into the Payhawk portal.

From here, select ‘register a new group’ from the dropdown:

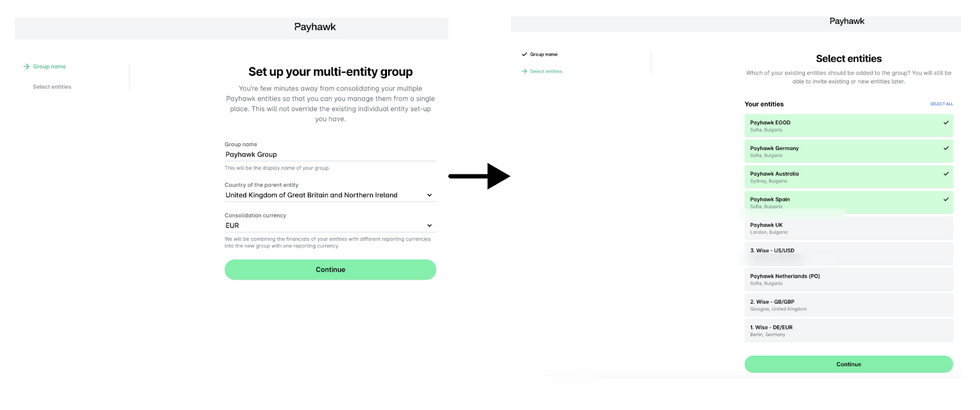

Step #2: Create/Modify a group

Name your new group, select the country of the parent entity and the consolidated currency, and hit “save”. Now, it’s just a case of selecting the entities you want to include in your new group:

That’s it! You can now view all selected entities within that single Group Dashboard.

Customers can now add existing entities to a group from the admin view

You might want to add existing entities to your new group — this is now possible with our latest feature. So, let’s say you create a new group to view all European entities, but you’ve forgotten to add your Italian branch. You can add entities retrospectively to your group whenever you want.

Adding existing entities to a group is easy:

- From your Group Settings, open your Entities page, where all the entities in your group are listed.

- After selecting ‘add entity,’ a small window will pop up listing all entities you’re part of but are not yet in this group.

- Simply select/deselect the entities you want to add to your group and click ‘add to group’.

Six things to consider when choosing spend management software to support multi-entity management

Choosing the right software can take time and effort. With many options on the market, how do you know which ones to shortlist? You need software with valuable multi-entity features to help you save time, cut costs where necessary, and elevate how you manage your operations’ finances.

1. Multi-entity currency support

At Payhawk, you can enhance cash flow management across various entities and multiple currencies using the Group Dashboard to visualise available funds versus projected spend. You also get timely alerts for low balances across all entities and currencies, enabling swift action when funds are nearing depletion.

2. Scalability and flexibility

As your organisation grows and you open new entities, you need software that grows with you and facilitates the addition of new entities quickly and easily. If you hire new team members at scale, your software needs to keep up, allowing you to build custom approval workflows around your complex organisational structures.

3. Spend visibility and control

It becomes difficult to competently manage multiple entities without a tight grip on company spending. What your team is spending, who's spending, and what becomes impossible to track. Look for a spend management solution that gives you control while empowering your employees to spend but with accountability.

4. Market-leading integrations

Data becomes siloed and unreliable if your corporate cards, expense management, and ERP or accounting software systems don't talk to each other. That's why you need a tech stack that integrates seamlessly, unifies data, and generates a single source of truth for everything financial.

5. Bulk add and remove employees

Managing finances across multiple entities can mean mistakes happen without the right software. For example, you forget to remove an ex-employee, and they continue to access sensitive financial data. There is no room for these kinds of errors. But with a bulk add and remove feature, you'll never slip up again (and you'll make onboarding easier, too).

6. Ability to standardise processes

Finding software that automates your sales invoice and purchase order creation processes minimises human error and helps you standardise them across your entities. This means employees know what's expected of them and which supplies they use for what. Standardising these processes also improves efficiency and accuracy while increasing vendor satisfaction.

Implementation and integration

Our software implementation is straightforward and includes initial onboarding and setup. Throughout the process, customers can access a dedicated support team member who answers questions and helps them get up and running with the new system, including comprehensive team training.

Part of the implementation process involves integrating current systems to ensure efficiency across all operations. Use our seamless accounting integrations, including Microsoft Dynamics 365 Business Central and NetSuite, to streamline the month-end closing process with the help of automation and real-time reconciliation.

It’s not just ERP systems you can integrate with. Seamlessly link other accounting software like QuickBooks and Xero and business travel solution TravelPerk to automate expense data and synchronise financial data.

Multi-entity management case study: State of Play Hospitality

A creator of technology-enhanced experiential leisure concepts, State of Play Hospitality is based in London and New York. With many venues and entities across both the US and the UK, it was important for the team to achieve a unified view of company spending.

Before using Payhawk, the team relied on systems that didn't integrate with NetSuite, and their accounts payable were disjointed, which meant switching back and forth between tools, hampering productivity.

Thanks to our single global platform, the company can now manage corporate cards, invoices, and reimbursable expenses across multiple entities quickly and easily.

David Watson, Group Financial Controller at State of Play, says:

"Taking corporate credit card transactions away from the traditional banks to a product that directly integrates with NetSuite was a game changer! Now we save time and make better decisions thanks to complete visibility over our multi-entity spend."

To sum up

Finding a tech stack that integrates seamlessly, supports multi-entity management, and makes business operations smoother and more visible is essential for any multi-entity organisation.

At Payhawk, we pride ourselves on offering a complete multi-entity spend management solution that improves efficiency and streamlines every process associated with company spending and spend management.

From ESG reporting to expense management and everything in between, we constantly strive to be the best digital finance partner for every multi-entity. Schedule a demo.

Trish Toovey works across the UK and US markets to craft content at Payhawk. Covering anything from ad copy to video scripting, Trish leans on a super varied background in copy and content creation for the finance, fashion, and travel industries.

Related Articles

Your finance function is eating your growth: The hidden multi-entity tax most CFOs don't realise they're paying