Best budget tracking software for businesses: How and who to choose

Is your budget data a bit of a mystery? Is it siloed, fragmented, inaccurate, or perhaps you just don’t have the resources to budget properly? Either way, you may be in need of some technical assistance. Discover the best budget tracking software options available right now and how they can help you.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

When you’re looking for a budget tracking tool, you need one that adds real business value. It must enhance your financial control and management, of course, but also improve strategic decision-making by helping finance teams and budget owners unlock real-time analytics and insights into financial performance.

There are many options in the marketplace, and choosing the right tool for your organization can easily become overwhelming. So, here’s a quick rundown of some of the most popular tools on the market, plus what you should look for in budget-tracking software.

Budget tracking challenges

- Lack of real-time budget visibility: To make proactive spending decisions, you need access to real-time budget data. That means you can easily account for every penny and understand spending before committing to it.

- Inaccurate or incomplete budget data: Without accurate budget data, you can't make impactful business decisions. It's all guesswork, and there's no place for guesswork when it comes to managing corporate finances.

- Siloed and fragmented data: You're missing a trick if your system doesn't unify your spending data. You're unnecessarily exposing yourself to fragmented data, and it's challenging to track budgets when data spreads across multiple tools and departments.

- Too few resources to spend time budgeting: If you've already stretched your resources, you'll quickly find that proper budgeting has hit the bottom of your list. But ironically, it's the very thing that should guide every financial decision. The problem? Budgeting usually sits squarely with finance, making finance a bottleneck and leaving the people responsible for departmental spending in the dark (and without the real-time visibility they need to make smart, proactive decisions).

The solution? Intelligent budget tracking software. With tech on your side, you free up resources while making confident and informed budgeting decisions without having to (almost) lift a finger.

11 must-have budget tracking tool features

Whether you're battling fragmented data, inaccurate reports, or resource bottlenecks, the right budget-tracking software can make all the difference. Here are the top eleven must-have budget tracking features you should consider.

1. Real-time budget visibility

You need real-time budget visibility to make spending decisions in real time. Real-time means you can view budget utilisations instantly, so you won't have to wait around for month-end reports.

Look for a solution that lets you filter spending by department, category, period, employee, and more. Make sure it centralizes any and all useful data in a dashboard for ease and efficiency.

2. Budget impact during approvals

Most teams only realize they've blown the budget when it's too late (usually when an invoice hits Accounts Payable).

However, with real-time budget visibility at the approval stage, you can see exactly how a decision will affect the budget before the spend happens. That means smarter approvals, tighter controls, and no nasty surprises down the line. It's the same proactive discipline you get from our card controls, but applied to every expense.

3. Comprehensive spend tracking

Aligning spend with budgets is essential; it's how you stay informed about company-wide spending.

Look for a solution with an in-built spending tracker to easily check all types of expenditures, from card payments and reimbursements to purchase orders, invoices, subscriptions and fund requests — all in real time.

4. Unlimited budget dimensions

Customizing your budgets and breaking them down by multiple dimensions will help you run precise tracking and analysis.

Make sure your software lets you break down your budgets by categories, teams, suppliers, region, or any custom field — add as many dimensions as you want to gain granular insight into your budgets.

5. Custom budget hierarchies

Your organization's budget structure and reporting needs are unique, so you need a tool to help you create budget hierarchies that allow for complex financial frameworks. For example, if you want to create a company-wide budget that breaks down into project or departmental budgets.

6. Single-click budget imports

Make sure your chosen solution allows you to import all your budget data into the system using a simple Excel template.

The above streamlines the entire process. You can assign budget owners by including their emails in the template, and once uploaded, you will gain immediate visibility into budget utilization.

7. Multi-currency budgeting

Don't restrict your budgets to a single currency; instead, set each budget in different currencies (in any currency you choose) to enhance global financial management and visibility.

8. Extensive budget filtering

Pick a solution that lets you filter your budget by various fields, such as supplier, team, employee, projects, etc., so you can accurately understand where and how people are spending company money. By using filters, you not only gain visibility into budget spending but also increase team and individual accountability with assigned budgets.

9. Group budgets for multi-entity management

Managing multiple entity budgets in one place ensures consistency in financial management, regardless of the complexity of your organizational structure. Use software that helps you effortlessly manage and track budgets across the group from one dashboard.

10. Accrual tracking

Accrual accounting, i.e., when you incur expenses rather than when you make cash payments, gives you an accurate picture of your resource allocation and financial commitments.

Your budget monitoring solution should match your expenses with the period you incur them rather than pay them out to ensure accurate budget utilization calculations.

11. Unlimited forecasts

If you're dealing with frequently changing business conditions, you'll likely need to upload different iterations of your budget, which is essentially a forecast.

Make sure the software options you shortlist allow you to upload unlimited forecasts. This way, you can amend your forecasts to reflect numerous changes, such as budget owners or strategic direction. Track all changes made to the budget over time, with all past versions automatically saved in the system for easy access.

The 14 best budget tracking software for business

Whether you’re a fast-growing startup or a mature mid-size business, tracking budgets across multiple teams, entities, and regions is essential for making smart decisions.

But with so many software options out there, finding the right fit can be overwhelming. So to save you the time, we’ve done the legwork for you and put together a quick comparison of the top budget tracking tools on the market.

Payhawk

Let’s start with our offering. It’s proven and trusted by finance teams in more than 30 countries and has a very high review score, including across G2, TrustPilot, and more.

Our budget tracking tool gives you unmatched visibility and control over your company-wide budgets, including all your entities. It’s part of a much more substantial spend management tool that covers accounts payable, invoicing, vendor management, procurement, corporate cards, and more.

“One of my favorite things about Payhawk is that I can give each department a card in line with their budget and update funds as required. I like how it gives me control over different departments’ expenses in a matter of clicks.”

— Benoît Menardo, Payflow Co-founder.

Budgeting features include the following, which let you:

- View all budgets from one single dashboard

- Budget utilization in real-time

- Smarter spending decisions and budget accountability

- Let budget owners view and manage spend themselves, freeing up finance team resources

- Track every type of spend in your budget, including card payments, purchase orders, invoices and more

- Upload budgets in any currency

- Set unlimited dimensions and customize budget hierarchies

Plus, we integrate with some of the market-leading tools listed below to enable complete and seamless budget management for your company. (QuickBooks, Xero and NetSuite ERP.)

Quickbooks

As a leading accounting software, QuickBooks lets companies, from sole traders to limited companies, choose from a tiered subscription plan to help them manage VAT and income tax, prepare for self-assessment, and more.

Budgeting features include the following, which let you:

- Create budgets for profit and loss or assets and liabilities

- Set flexible time-bound budgets, e.g. annually or monthly

- Built-in cash flow projector

- Run ‘what-if’ scenarios to project profit and cash flow, e.g. if interest rates increase

- Financial modeling with their Business Plan Tool

NB: Payhawk integrates with QuickBooks, so together you’ll get a crystal clear full budget management tool.

Xero

A cloud-based accounting tool perfect for small and new businesses and scaling companies alike. Companies can automate menial accounting tasks to help improve operational efficiency and financial transparency.

- Budgeting features include the following, which let you:

- Create custom budgets to track by department or project

- Import budgets from Excel directly into Xero

- Consolidate multiple tracked budgets with the Xero Budget Consolidator app

- Create reports to track and analyse budget performance

- Compare actual financial data against your budget to determine business performance

P.S. Payhawk integrates with Xero, so together you’ll get the best of both tools to make budget management effortless.

FreshBooks

FreshBooks is an accounting software option primarily aimed at service-based businesses and freelancers. Customers can manage invoicing, track expenses, track billable hours, and more, but they don’t have many comprehensive budgeting features available.

- Budgeting features include the following, which let you:

- Track your time against projects to ensure you don’t go over project budgets

- Create spending summaries by category

- Create financial reports, including cash flow and profit and loss

Expensify

An expense management solution, Expensify helps small to mid-sized businesses manage and track expenses and budgets.

Budgeting features include the following, which let you:

- Set custom notifications to alert you when a certain amount of budget is spent

- Create a budget for anyone in the organization, by department or for individual employees

- Set budgets to plan spend for the month, year or quarter

- Expense category tracking

- Create unlimited custom reports

BILL Spend & Expense (formerly Divvy)

BILL is an automated expense management system (with real-time budgeting tools) for small to medium businesses looking to improve expense management efficiency.

Budgeting features include the following, which let you:

- Control budgets by enforcing spending limits and creating approval workflows

- Create single or multiple budgets by location, project, event, or other categories

- Allocate spend before money is spent

Ramp

A solution that combines accounts payable, vendor management, procurement, and expense management, helping you optimize corporate spending while gaining spend control and visibility.

Ramp's budgeting features include the following, which let you:

- Forecast integrations with accounting tools

- Ensure segregation of duties when managing spend

- Automate approval workflows to ensure the right people review budget changes

- Complete control over access, keeping budgeting data safe and in-depth spend insights for finance teams

- Make sure budget holders are held accountable with comprehensive audit trails

Airbase

Budget tracking, spend management and approval workflows all rolled into one solution.

Budgeting features include the following, which let you:

- Filter spending by team member, vendor or department to see where the budget is going

- Empower budget owners with real-time budget reporting

- Create budgets for every card, set limits or expiration dates to prevent unauthorized spending

- Closely control every penny with built-in requests and approvals

Coupa

Coupa is an enterprise-grade spend management solution with strong budgeting and procurement controls. It keeps spending tightly controlled and visible at all times.

Budgeting features include the following:

- Scenario analysis: Understand the impact of differing market conditions on your budget

- Integrations with various financial systems to ensure data accuracy and transparency

- User-friendly software to make budgeting as straightforward as possible

- Centralised budgeting, meaning everyone can get involved in the budgeting process

- Spend monitoring against budgets in real-time

Zoho Expense

Budget monitoring software and expense management for small to mid-sized businesses.

Budgeting features include the following, which let you:

- Create budgets for certain expense types or categories

- Keep track of individual spending by setting individual budgets

- Access a ‘budgets vs actuals’ analytic report from your Zoho Expense dashboard

- Auto-fill budget amounts and send automatic notifications when users almost reach their limit

Precoro

Precoro is a solution focused on procurement and budget control. It offers seamless integrations with accounting tools, including QuickBooks Online, Xero, and NetSuite.

Budgeting features include the following, which let you:

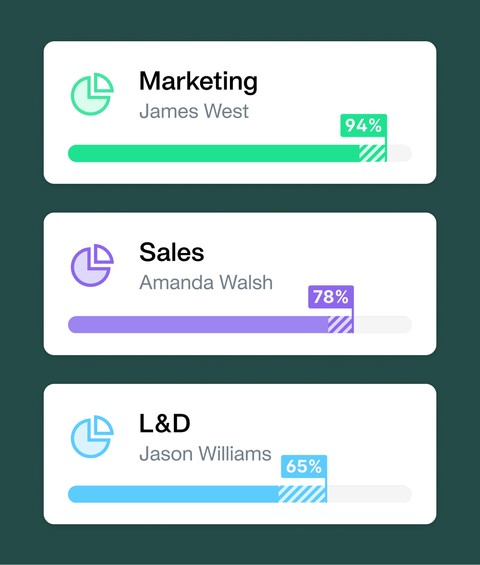

- Track budgets in real-time with useful pie charts and progress bars

- Set budget limits easily

- Use insightful budget data to report on finances and help plan resources

- Import and manage budgets in bulk

- Create budgets for projects, departments or custom fields and spanning custom time periods

Procurify

Control purchasing and spend in real-time with Procurify’s budget-friendly tool.

Budgeting features include the following, which let you:

- Clear budget breakdowns and spending forecasts

- Real-time budget visibility to curb overspending before it happens

- Customisable budget configuration options (i.e. custom budget categories)

NetSuite ERP (Oracle)

A robust enterprise solution for complex and scaling organisations with in-built budget modules to equip you with the best tools to budget, plan and manage finances.

Budgeting features include the following:

- ‘What-if’ scenario modeling and variance analysis

- Budget templates automatically populated with NetSuite’s general ledger

- Real-time forecasts in minutes

- Actual performance monitoring against business goals and tracking impact on cash flow

NB: We have a native integration with NetSuite ERP, so merging both pieces of tech gives you the best of both worlds.

SAP Concur

Enterprise-level expense management and budget tracking with integrations into ERP systems.

Budgeting features include the following, which let you:

- A holistic view of company spending, with an almost real-time view before and after spend happens

- Track budget spend on the move with the SAP Concur mobile app

- Create custom hierarchies and set visibility and approval permissions

- Access a constant view of your budget through intuitive dashboards

Best practices for implementing budget tracking software

Rolling out the right budget-tracking software will ultimately help set your business up for long-term success. From scoping your needs to getting buy-in from your team, a thoughtful approach can make all the difference between just another system and a real game-changer.

Assess your needs

Understand your budget reporting and tracking needs before even looking for a suitable software solution. That’s so you’re in the best position to choose a budgeting tool that will align with your business goals and deliver value from day one.

Pick the best software

Once you’ve defined your approach to budgeting, it’s time to assess your options. When you do, keep consolidation in mind, as it’s key to both visibility and efficiency.

Don’t add another tool without considering how it connects to your current (or future) tech stack. Instead, look for ways to consolidate budgeting with your broader spend management setup.

When everything lives in one place, you can instantly see how every expense — a card payment, invoice, or reimbursement — impacts your budgets in real time.

Train your teams properly

Choosing the right software is only half the battle; you must ensure your team knows how to get the most out of the tool. That means training teams before you even choose the software. Getting them ready to embrace your new tech can make transitioning to your new tool as smooth and straightforward as possible.

Take advantage of the tool’s help guides and resources center to use each feature to its full extent. For example, Payhawk’s help guides include step-by-step instructional guides to help you self-serve and troubleshoot where necessary.

Regularly review budgets and adjust as necessary

Business budget tracking software gives you an efficient way to take a proactive approach to budget management. If you notice you’re overspending in certain areas or need to increase resources in others, you can amend it in real time. Tech makes it quicker and more straightforward to manage 21st-century budget needs. Every organization’s needs are different, which is why finding a customizable and scalable solution is essential.

From static to dynamic budgeting

Budget tracking solutions help empower budget owners, finance team members, and employees to spend responsibly and be aware of their spend's impact. By assessing budget use in real-time, your organization can reduce overspending and redistribute finances dynamically before spend happens, helping drive and support strategic growth.

Want to see what that looks like in action? Discover how our all-in-one platform brings budgets to life with real-time visibility, automation, and control. Request a personalized product demo with one of our in-house experts today.

With extensive experience in finance, marketing, and digital strategy, Raphael combines quantitative insights with compelling storytelling to drive regional marketing success and customer-focused innovation in financial SaaS solutions.

Related Articles

Pennylane Integration: Why to connect with a spend management platform