Payhawk vs ExpensifyThe smarter, scalable Expensify alternative

Reconcile 99.7% of expenses automatically. Enforce spend policies with powerful card controls. Manage every type of spend—from bills to reimbursements—in one intuitive platform.

3 reasons to choose Payhawk over Expensify

Expensify automates expense reporting, but often creates "additional manual work in the process".*

Expense reporting made easy

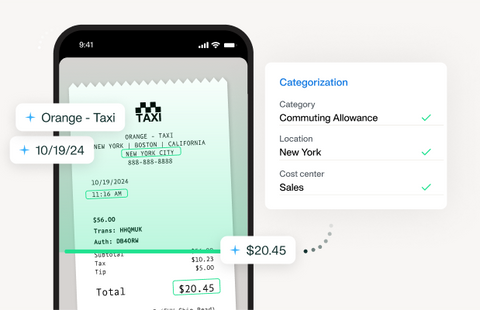

Say goodbye to complex and frustrating expense reconciliations. Employees submit receipts on the spot, while Payhawk automates the expense coding and matching, syncing expenses to your ERP in real-time.

Your cards – smarter control

Prevent out-of-policy spending before it happens. Set proactive spend rules by merchant, category, region, and more—with powerful card controls on your existing cards.

More than just expense management

Payhawk is an all-in-one spend management solution, combining direct credit card connectivity, expense management, accounts payable, purchase orders, budgets and multi-entity management in a single tool.

Compare Payhawk to Expensify

Expensify | ||

|---|---|---|

| Corporate cards | ||

Works with your existing corporate cards | ||

Card controls on linked cards | ||

American Express virtual cards | ||

Credit cards | ||

Card controls | ||

Virtual cards | ||

| Expense management | ||

Real-time card spend visibility across all cards | ||

Instant notifications for receipt submission | Only on Expensify cards | |

Zero-touch expense matching and coding | ||

Real-time automatic reconciliation with your ERP | ||

Automatic receipt chasing | ||

| Accounts payable and procurement | ||

Bill Pay | Yes, US, UK & EEA | US only |

Purchase orders | ||

3-way matching | ||

Vendor management | ||

| Platform | ||

AI-powered expense coding | ||

Advanced multi-dimensional budget tracking | ||

Highly customizable approval workflows per expense type | ||

Multi-entity management | ||

Lightning-fast, real human support team | ||

Effortless implementation | ||

Save with automation-powered spend management

Even more reasons you’ll love Payhawk

Payhawk unifies cards, accounts payable, budgets, travel, reimbursements, subscriptions, and procurement with automation giving you the power to track, control, and save on all business spending.

Manage all your corporate Visa, Mastercard and American Express cards from a single platform.

Automate expense processing and reconcile spend in real time — on your existing corporate credit cards.

Take back valuable time and strengthen bill payment controls with end-to-end accounts payable software.

Control spending from request to payment with procure-to-pay automation - custom request approvals, PO creation, 3-way matching and automated bill pay.

Automatically track card payments, reimbursements, purchase orders, and bill payments in real-time, all against your budgets.

Have all your data flow seamlessly between Payhawk and your ERP system without the need for manual uploads.

We’ve got your back—from day one

From fast onboarding to hands-on support, our expert team is here to help you hit the ground running.

Smooth onboarding and implementation

Our dedicated team guides you through the onboarding process, ensuring a smooth transition and setting you up for success from day one.

Lightning-fast, multilingual, real human support team

Whether you have questions, technical challenges, or need assistance, our in-house experts are just a message away.

Smooth onboarding and implementation

Our dedicated team guides you through the onboarding process, ensuring a smooth transition and setting you up for success from day one.

Lightning-fast, multilingual, real human support team

Whether you have questions, technical challenges, or need assistance, our in-house experts are just a message away.

Payhawk vs Expensify FAQ

Expensify automates expense reporting, but often creates additional manual work in the process. It also lacks a number of advanced product capabilities and cannot meet the needs of scaling companies.

With Payhawk you can reconcile 99.7% of all your expenses in real-time with zero manual effort, and manage all your company spending from a single platform - including bill payments, purchase orders and reimbursements.

Payhawk provides several key advantages over Expensify:

- Real-time transaction syncing: Payhawk connects directly to card networks, enabling real-time transaction syncing. This means that expenses are recorded instantly as they occur, providing immediate visibility and eliminating the delays associated with bank feeds or manual uploads that competitors often rely on.

- Card controls: Payhawk is the first provider on the market to offer powerful spend controls for 3rd party corporate cards. Set custom limits, enforce spending policies, and ensure compliance in real time—without micromanaging every transaction. With Payhawk, finance teams stay in control, employees get the flexibility they need, and businesses prevent overspending before it happens.

- Automatic receipt chasing: Our platform automatically prompts users to upload receipts immediately after a transaction occurs. If receipts are missing, Payhawk sends reminders to ensure that all necessary documentation is collected promptly, reducing the administrative burden on finance teams.

- Automation with OCR receipt scanning and expense reconciliation: Payhawk utilizes advanced Optical Character Recognition (OCR) technology to scan and extract data from receipts automatically. This automation simplifies the expense reconciliation process by categorizing expenses without manual data entry, allowing finance teams to save time and reduce errors. Finally, Payhawk offers native bi-directional real-time sync with your ERP or accounting software, streamlining the entire reconciliation process.

- Intuitive user experience: Based on G2 reviews, Payhawk consistently receives positive feedback for its user-friendly interface, while Expensify often faces criticism for complex workflows and usability issues. Our platform is designed to make expense management intuitive and efficient for all users.

- Fast and responsive support: Payhawk is committed to providing exceptional customer support. Third party reviews indicate that our support team is more responsive and helpful compared to those of Expensify, ensuring that our users receive timely assistance whenever needed.

- All-in-one spend management: Manage all your company spend from a single platform. Payhawk is an all-in-one spend management solution, combining direct credit card connectivity, expense management, accounts payable, purchase orders, budgets and multi-entity management in a single tool.

Absolutely! Switching to Payhawk is incredibly easy, primarily because our platform is card agnostic. This means you can continue using your existing corporate cards, such as Visa, Mastercard, or American Express, without having to change banks or card providers, while getting all the advantages of our spend management solution.

Once you sign up, our team provides comprehensive support to help you integrate Payhawk with your current systems. Implementing Payhawk happens in less than 72h, where you can rely on our implementation experts to guide you at every step of the way. With dedicated customer support available throughout the transition, you can feel confident that any questions or challenges will be addressed promptly.

Payhawk provides real-time transaction syncing by connecting directly to the card networks, such as Visa and Mastercard. This innovative approach allows us to capture transaction data as it occurs, enabling you to retain your existing corporate cards while benefiting from immediate visibility into your spending.

Unlike Expensify that relies on bank feeds or statement uploads—which can take 24 hours or more— we fetch transaction data in real-time by natively integrating to the card network, as opposed to setting up a bank feed.

No, at Payhawk, we prioritize transparency in our pricing structure, ensuring that there are no hidden fees or unexpected costs. We operate on a straightforward monthly subscription model with three distinct plans tailored to meet your business needs.

Unlike some competitors that may charge per expense report or impose transaction fees, Payhawk allows you to know exactly what you will pay at any given time. Our regular plans include unlimited transactions, users, and document processing, so you can manage your expenses without worrying about additional charges.

For more details, please visit our plans page.

Yes. In addition to our native integrations with Visa, Mastercard and American Express, you can integrate Payhawk with your ERP, accounting and HRIS systems.

Yes, Payhawk is well-equipped to accommodate multi-entity structures and global operations. Our platform offers a comprehensive spend management solution that supports businesses with complex organizational needs across different countries and currencies.

- Multi-entity dashboard and group controls: Payhawk allows companies to manage multiple entities from a single platform, providing centralized control over expenses while enabling local teams to operate independently. Configure settings at the group level and apply changes in one click.

- Dedicated IBANs in multiple currencies: Payhawk supports transactions in multiple currencies, including USD, EUR, GBP, BGN, PLN, and RON.

- Integration with global and regional ERP Systems: Payhawk integrates smoothly with major and regional ERP systems, ensuring that all financial data is synchronized accurately and in real-time, simplifying expense reconciliation and reporting across different entities.

- Fast payments & reimbursements: With Payhawk, you can make fast, low-cost payments to suppliers or employees directly from the platform.

At Payhawk, we are committed to protecting the confidentiality, integrity, and data availability of our information systems and our customers’ data. We are constantly improving our security controls and analyzing their effectiveness to give you confidence in our solution, knowing all your data is safe and secure.

Here is an overview of the security controls in place to protect your data.

The choice is clear—start with Payhawk today!

Get the spend management solution designed for modern finance leaders.

The information on this page is based on publicly available Expensify product features on their website and 3rd party product reviews on G2 as of December 2025.