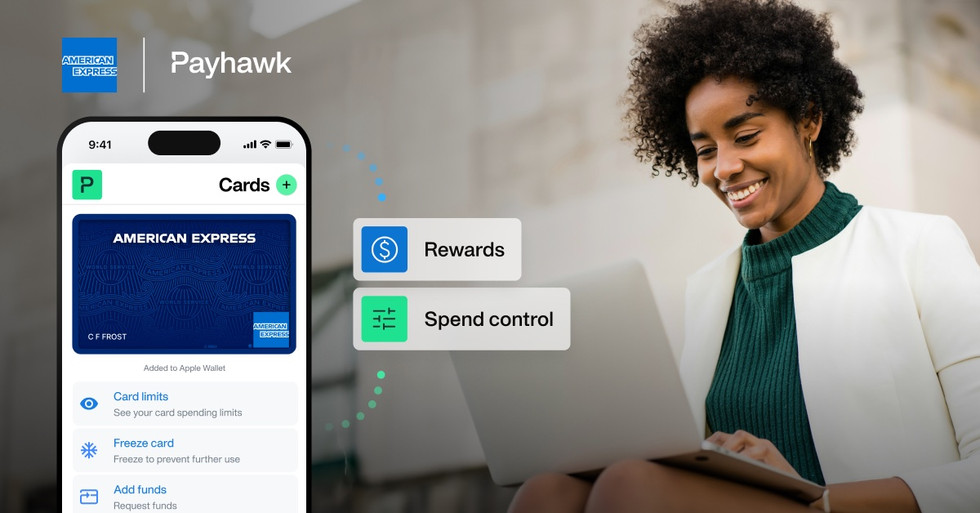

Payhawk Joins American Express SyncTM

New B2B payments collaboration provides Payhawk users even more ways to efficiently manage and process business spending globally - all while earning the rewards [1] of their eligible U.S. American Express® Business or Corporate Cards.

By submitting this form, you agree to receive emails about our products and services per our Privacy Policy.

This article first appeared as a Press release.

Payhawk, a global spend management solution for domestic and international businesses throughout the U.S., U.K., and Europe, today announced a new integration with American Express to offer U.S. Business and Corporate Card Members the ability to issue virtual cards with built-in spend controls and manage business spend globally — all while earning the rewards of their eligible American Express Card when making virtual Card payments. To achieve this integration, Payhawk is participating in the American Express SyncTM Commercial Partner Program.

Hristo Borisov, CEO of Payhawk, says:

We are teaming up with American Express to give our customers access to the control, enhanced security, and cash flow management that come with using an American Express virtual Card, alongside the ability to simplify and automate their finance operations with a single global spend management solution for cards, reimbursable expenses and Accounts Payable, natively integrated to their ERP of choice. The integration helps us provide an elevated user experience and more value to our customers.

Control your global business spend & earn American Express Card rewards

With the integration, Payhawk customers with eligible American Express Cards can:

- Control out-of-policy spend by issuing virtual Cards directly from Payhawk with built-in spend controls linked to their physical American Express Cards

- Earn the rewards of their eligible American Express Card when they use virtual Cards for business payments

- Save multiple days each month on manual accounting tasks with instant expense submissions and automatic receipt chasing on virtual cards

- Have greater visibility on the billing statement for their eligible American Express accounts enrolled in Payhawk, by seeing on-demand virtual Card transactions, helping to make reconciliation more efficient

- Speed up the month-end process by syncing all virtual card transaction data to their ERP in real-time

Enrolment is required and fees may apply. **Click here to learn more**.

[1] Not all Cards are eligible to get rewards. Terms and limitations vary by Card type.

The Payhawk Editorial Team consists seasoned finance professionals boasting years of experience in spend management, digital transformation, and the finance profession. We're dedicated to delivering insightful content to empower your financial journey.

Related Articles

10 key takeaways from SuiteWorld 2025: What they mean for system integrators